Abstract Rüdiger Fahlenbrach, Angie Low, and René M. Stulz* July 2008

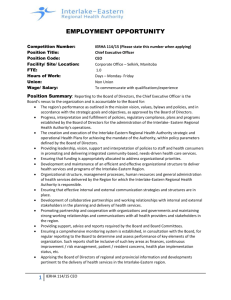

advertisement