Higher Power Tests for Bilateral Failure of PPP after 1973. Graham Elliott

advertisement

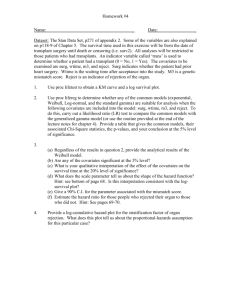

Higher Power Tests for Bilateral Failure of PPP after 1973. Graham Elliott University of California, San Diego Elena Pesavento Emory University December 2004 Abstract Whilst point estimates for mean reversion in real exchange rates suggest reasonable (but long) half lives to shocks, it still remains uncomfortable that models without any mean reversion at all are often compatible with individual country pair data from the floating period. Studies with data over longer periods find mean reversion, but at the cost of mixing in data from earlier exchange rate arrangements. Pooling the floating period data for a number of countries also finds evidence of mean reversion, but at the expense of potentially mixing in country pairs with and without mean reversion. We examine tests for mean reversion for individual country pairs where greater power against close alternatives is gained through modeling other economic variables with the real exchange rate. Our results are broadly consistent with other methods to improve the power of tests for unit roots in real exchange rates, finding support for the mean reversion hypothesis. Keywords: Unit roots, Purchasing Power Parity, Real Exchange Rates. JEL Classification: C32, C12, F40. Corresponding author: Elena Pesavento, Department of Economics, Emory University, Emory GA30322, USA. Phone: (404) 712 9297. Email: epesave@emory.edu. We thank Hisham Foad for excellent research assistance. 1 1 Introduction. The theory of purchasing power parity makes intuitive sense as a theory on the very long run real exchange rate. Whilst for small deviations in relative prices the theory may require some adjustment for transportation costs and other reasons for incomplete arbitrage, the idea that large deviations in relative prices between countries will mostly be traded away seems like a theory that is unlikely to be rejected in practice. Such a rejection would suggest that international competition is too weak to stop prices in different countries from diverging as much as they want forever. However it is the rejection of the idea that such divergences cannot occur that is implicated in the common failure to reject a unit root in the real exchange rate in univariate tests. In the face of such rejections, nearly all work has been directed not in devising new theories for the long run exchange rate but to attempt to improve the tests for unit roots in this application and to understand better what this is telling us - that infinite half lives are in the confidence interval for half lives and are not necessarily the only possibility consistent with the data. This seems a reasonable approach given that without trade barriers it is really difficult to imagine that relative prices for goods could become arbitrarily large in a world that allows trade in goods, labor and capital, even if in a restricted form. This paper also takes the direction of attempting to find empirical support for mean reversion in real exchange rates. The two main methods that have been pointed to recently in obtaining evidence of mean reversion are studies of the very long run and panel methods, which pool many currencies. Both of these methods make additional assumptions in order to obtain the increased power necessary to reject unit roots. An obvious criticism of the very long run data sets is that they combine periods of fixed and floating exchange rates. The rejection of a unit root by lengthening the dataset by adding a period of fixed exchange rates may not really tell us what we want to know - is there mean reversion under the current exchange rate regime? Similarly, panel methods by virtue of their pooling require additional assumptions and restrictions on the question being asked. These assumptions are often technical, such as restrictions on covariances between the real exchange rates and also on the estimation of the short run dynamics. Additionally by pooling the question is reduced often to asking whether all bilateral exchange rates mean revert or not. This paper takes an alternative route to improving power, one that does not involve the use of data outside the period we are particularly interested 2 in (i.e. the current set of exchange rate arrangements) and allows us to examine each bilateral real exchange rate independently (we do not require pooling). Instead, we use stationary economic variables in a multivariate framework to improve power, where the choice of covariates is justified by economic theory1 . 2 Power and Tests for a Unit Root in PPP. Given the basic implausibility that relative prices between goods in different countries could become arbitrarily large, especially in developed countries with fairly similar economies, it seems reasonable that the focus on the empirical failure to reject a unit root has been on the tests themselves. Tests for unit roots are commonly considered to have ’low’ power. The main contributions have been to improve power by examining longer spans of data or through the combining of many different real exchange rates in panels. The idea that unit root tests have ‘low’ power must be linked to the distances between the null and alternate models. The original literature, arguing that the tests have lower power, related to the ability to distinguish between roots of one and roots only slightly below one. However this is not really all that meaningful from an economic perspective - we would not be all that excited if we were able only to say the half life of a shock to the real exchange rate was 10000 years and not infinite. What we would really mean for any application of tests for a unit root is that the power is low against alternative models that are economically different from the null. In the PPP literature the low power argument has bite – actual estimates for such half-lives, whilst fairly long at 4-5 years (Froot and Rogoff (1995)), are in the range that we would consider reasonable. But against these alternatives, given the lengths of the data available post-Bretton Woods, typically applied tests for a unit root such as the Dickey Fuller test indeed have low ability to reject a unit root2 . The point can be shown directly by examining the 1 An extension of this paper to more countries and different covariates was simultanously done by Amara and Papell (2004) using programs and methods provided by us. 2 There is an alternate direction in which these and all other ‘higher power’ tests for a unit root have low power. As pointed out by Engel (2000) for the PPP case, tests for unit roots have low power against models that have a very small permanent component. Such models for all intents have identical properties as stationary ones, the permanent component in this case would not be apparent in the relative prices until the passing of thousands of years, far longer than the horizons of the models we are examining. 3 asymptotic power of tests for a unit root against the alternatives suggested by these point estimates3 . Assuming the half life of 4.5 years (18 quarters), then the point estimate of the autoregressive coefficient in an AR(1) model (denote this coefficient ρ) is roughly 0.9622. To compute an approximation to power of a test, we examine the local alternative given the sample size. With a sample size T of 121 quarters of data (from the start of 1973 through to the second quarter of 2003), the local alternative, given by T (ρ − 1) is a little under −4. Reading from estimates of local power of tests for a unit root in Elliott et al. (1996)4 , we see that the Dickey Fuller t-statistic, assuming a constant is included in the regression, has power below 12% for a test with size 5%. We would almost always fail to reject even though the alternative is true. This test does not use the information optimally, but from the same source, the most powerful univariate test against this alternative has asymptotic power less than 32% (Cheung and Lai (2000) use the more efficient tests in Elliott et al. (1996) and are able to reject more often, but only for a small subset of the countries examined). Because the need for better power is apparent, the approaches and results of the recent literature on unit root tests have been given central focus in the PPP debate. However the problem of increasing power is that it typically comes with additional assumptions on the model.5 Thus, even though these methods were able in most cases to reject unit roots in real exchange rates, the baggage of the additional assumptions has weighed the results down to some extent. One direction was to improve power by going back beyond the floating period and incorporating earlier data to lengthen the dataset. This is done rather than using higher frequency data, as it has been shown (Perron (1991)) that using more frequently sampled observations does not improve power6 (at least asymptotically, it is possible that more frequently observed data could allow the more precise estimation of nuisance parameters, po3 Froot and Rogoff (1995) go through a similar exercise, although they do not compare the alternative in terms of local power, which is more informative when examining these types of tests. 4 Numbers are from Table II, p828, and column labeled ‘Asymptotic Power’ 5 It was shown in Elliott, Rothenberg and Stock (1996) that additional power over the traditional tests for a unit root could be gained, however even these large gains in power did not result in universal overturning of the results (see Cheung and Lai (2000)). 6 A direct implication of this is that the values for asymptotic power we quote above for quarterly data are unchanged if one is to look at the power using yearly or monthly data with the same span. 4 tentially improving small sample power). The results of these tests are very encouraging. The results of Abauf and Jorion (1990), Lothian (1994), and Lothian and Taylor (1996) suggest mean reversion in the real exchange rates examined (with the need for a deterministic trend for the Japanese real exchange rate). However, the assumption that is required is that the behavior of mean reversion is similar across periods of large differences in exchange rate regime - from the Gold standard to the fixed exchange rates of the Bretton Woods period to the current floating exchange rates system (Rogoff (1996) makes this point). Thus it could well be that the increased power is nothing more than the recent non mean reverting floating period being overwhelmed in the test by the mean reverting periods of the Gold Standard and fixed exchange rates periods. This possibility is given further credence by the fact that studies of the Gold Standard period show great support for PPP (McCloskey and Zecher (1984), Diebold, Husted and Rush (1991)). The implication is that perhaps these studies have little or nothing to say about PPP in the current exchange rate regime, which of course is the important question at hand. A second approach that has become popular is to pool relative exchange rates across countries and test the null hypothesis that all fail to mean revert. This approach has also for the most part yielded results that are supportive of mean reversion in the real exchange rate. (Abuaf and Jorion (1990), Jorion and Sweeney (1996), Higgins and Zakrajsek (1999)). But this method too must make additional assumptions, rendering the rejection a joint test on the hypothesis of interest and these assumptions. Implicit in the power gain is that all countries must have mean reversion under the null. This means that even upon rejection we cannot tell if this rejection is because there is mean reversion for all countries or just an empirically important subset of countries. It is also possible that if many country pairs which do mean revert are mixed with a few that do not, the influence of the non mean reverting pair(s) is too small to induce rejection. Hence countries that do not truly mean revert could be found to mean revert. Hence for any application we cannot tell if a particular bilateral real exchange rate displays mean reversion. Other criticisms have revolved around the actual implementations of the methods. One particularly important criticism of the early applications was the assumption that each real exchange rate in the system was driven by shocks that are uncorrelated with the shocks for other countries. This assumption is not only at odds with the relevant economic theories (describing 5 the inter-linkage of economies) but is at odds with the actual construction of the real exchange rates, which have common base countries (using weighted averages of all countries weakens this latter criticism but does not remove it). O’Connell (1998) makes this complaint and adjusts the methods to take this into account, finding far weaker evidence for mean reversion in doing so (Engel, Hendrickson and Rogers (1997) also note this problem). However his method, estimating the cross correlations, requires that the time series dimension be large compared to the cross section dimension (he notes that T must be large enough for feasible estimation, however any asymptotic justification of the method will come from T getting large much faster than N , and for asymptotic results to be good approximations to the sampling distributions of the statistics used we would require T much larger than N in practice). Thus, in a sense, part of the power gain of going to cross section is lost due to this restriction on the number of currencies the method can handle. A second criticism of the implementation comes through the modeling of the dynamics. Typically, because of the size of the system there are an incredibly large number of parameterizations of the dynamic structure (number of lags for each real exchange rate, allowance for lags of one country to affect another, etc) that the typical route to choosing a model is to simply make an a-priori choice. There is little economic theory to guide us in this choice, especially when it comes to cross country effects. As with univariate tests for a unit root, specifying the dynamics incorrectly can lead to large problems (see Papell (1997) for the panel case). Another panel approach also involves a large T small N approach - only putting a few countries together and examining them using cointegration approaches which allow for cross correlations (although the comments on parameterizations of the dynamics still remains). Taylor and Sarno (1998) examine a panel of countries over the floating period in this way, finding mostly (but not completely) evidence of mean reversion. For one of their tests critical values are found through simulation, so rely heavily on the assumed dynamics and distributional assumptions. Also the method is notoriously poor at selecting the correct number of unit roots in the system. The method can be used to test the same null and alternative as the usual panel methods. Another problem that arises in the panel approach is that the results are found to depend on the base country. Rejections are fewer if Germany is 6 used as the base country compared to the US (Jorion and Sweeney (1996) and Papell (1997)). This points towards a difficulty in interpreting the results of the panel approach that is overcome by studies of bilateral exchange rates that do not have to rely on pooling7 . Other extensions have been in the direction of changing the relevant model away from the standard null and alternative being tested. In particular, threshold autoregressive models have been suggested as a more plausible alternative model (Obstfeld and Taylor (1997) argue that when the real price is ‘near’ its equilibrium then other factors are important, hence PPP only stops large deviations outside some bounds). Taylor (2001) has shown that estimates of the speed of mean reversion are biased upwards when linear autoregressive models are employed instead of the true threshold model in Monte Carlo simulations. Pippenger and Goering (1993) present evidence that tests for a unit root have lower power against these types of alternatives than usual . As we will not consider such models explicitly, any rejections we obtain could be considered to be in spite of these problems. Other nonlinear models have also been proposed. Our approach is along the lines of improving power in the context of linear models, however the additional information we require does not rely on examining data from other regimes, nor does it require abandoning the question of mean reversion for bilateral real exchange rates. We propose the following model for the real exchange rate (yt ) and a vector of stationary variables that co-vary with the exchange rate (xt ) (these are stacked into the vector zt ). Consider the model zt = β 0 + β 1 t + ut (1) and A (L) · (1 − ρL) uy,t ux,t ¸ = et (2) ¡ ¡ ¢0 ¢0 where zt = yt x0t , xt is a m×1 vector, yt is 1×1, β 0 = β y0 β 0x0 , ¢0 ¡ β 1 = β y1 β 0x1 , and A (L) is a finite polynomial of order k in the lag operator L which introduces stationary dynamics to the model. The test for a unit root in the real exchange rate is a test of the hypothesis that 7 The application of GLS estimates to panel renders the tests invariant to the currency chosen as numeraire (O’ Connell (1998)). 7 ρ = 1 versus the alternative that ρ < 1. Deterministic terms are handled in equation (1) where typically we allow for a constant only. This means that the null model is a random walk without drift against the alternative that the real exchange rate mean reverts. Often a time trend is allowed in the model if the real exchange rate is stationary, so the null in this case is a random walk with drift against the alternative of a deterministically trending real exchange rate with stationary dynamics around this deterministic trend. A time varying real exchange rate would be incompatible with the textbook PPP so we only consider test of a unit root against a mean reverting alternative. For each of the stationary covariates we allow an intercept term (β x0 is non zero) but not a time trend (β x1 = 0). The role of the stationary covariates is to soak up variation in the quasi difference of yt which enables the construction of tests for a unit root with higher power than tests that ignore this covariation. This direction for increasing the power of tests for a unit root was first pointed out by Hansen (1995), who developed a method to augment the Dickey Fuller test to exploit the information in covariates. The Hansen test, like the Dickey Fuller test, does not exploit the information optimally. Elliott and Jansson (2003) developed tests which do exploit this information in an asymptotically optimal way. It is these tests that will be applied8 . The stationary covariates, to be useful in improving power, need to be correlated with the quasi difference of the real exchange rate at the zero frequency. This means that the correlation may be contemporaneous, could be past variables predicting the quasi differenced real exchange rate, or the quasi-differenced exchange rate predicting stationary covariates. This leaves us not only quite free in choosing the covariates to use, but allows virtually any theory that involves the exchange rate (either theories of the exchange rate or theories relating to other variables that include the exchange rate as part of the story) to direct our attention to reasonable covariates. A consistently estimated nuisance parameter denoted R2 as it captures the extent of the correlation at zero frequency (i.e. in the long run, this parameter is between zero and one with zero being no correlation like a regular R2 ) indexes the value of the covariate in improving power. To the 8 Our model corresponds to case 3 in Elliott and Jansson (2003). As shown below we use first difference of macro variables as the stationary covariates. Given that xt is now in first difference, we cannot use the first observation as in Elliott and Jansson (2003) so we set the first observation equal to zero. (see also Elliott, Jansson and Pesavento (2002)). 8 extent that this parameter is large, very large power gains are to be had from the modeling of the real exchange rate with stationary covariates. Consider the example given above, where with 121 observations and a largest root in the real exchange rate of 0.9622. Using the DF statistic we have power in the unit root test around 12% however, if we are able to find covariates that yield an R2 of one half, we would have power against this alternative of over 40%. For larger correlations, the power is even greater. This provides a check on the conclusions of the literature that seeks to improve power by adding earlier regimes or averaging across different bilateral pairs of exchange rates. If we are able to find covariates that generate reasonable values for R2 , then a rejection of the null hypothesis provides evidence that it is indeed the low power of univariate tests that are driving the failure of the tests to reject and that the extra assumptions of the other approaches are not driving the rejections in this literature. On the other hand, if we construct tests with greater power and are still unable to reject then this should undermine the arguments that are made to support the other approaches. The assumption that we do require is that the covariates are stationary. If they had unit root or near unit root behavior then they will be spuriously correlated with the real exchange rate, explaining partly the long run properties of the real exchange rate and resulting in over rejection of the hypothesis that there is no mean reversion. For this reason we will restrict the potential covariates to ones which are unlikely to have even near unit root behavior even if they obviously do not have a unit root due to theoretical reasons (e.g. interest rates, which cannot be seriously thought of as being unbounded but nonetheless exhibit large degrees of serial correlation). 3 Choosing Stationary Covariates Our choices for covariates to improve the power of the tests are limited only to being sure that they are stationary. Thus potential covariates could come from a wide range of sources. In particular, we place no restrictions on the direction of causality; essentially we are exploiting properties of the reduced form vector autoregression. This means that potential covariates could be variables that drive the real exchange rate, or in turn variables that are driven by the real exchange rate. Economic theory gives good guide to the types of variables that are likely to be correlated in some way with the real exchange rate. Below we summarize the variables we employ and provide some theoretical or empirical justification for including them. 9 Nominal Exchange Rate, Inflation Since real exchange rates are computed as the log of the nominal exchange rates (st ) minus the log of the relative prices it seems natural to use the first difference of the nominal exchange rate or inflation in the US and the foreign country9 as the stationary covariate. In fact, we can think of the real exchange rate as a cointegration relation between nominal rates and the relative prices. Elliott, Jansson and Pesavento (2002) show that the tests and methods examined in Elliott and Jansson (2003) have optimality property in testing the null hypothesis of a unit root in the cointegration vector (in this case the real exchange rates). The extra exploitable information available is in the ’known’ stationarity of ∆st , ∆pt and ∆p∗t .10 Money Differentials A correlation between the real exchange rate and the money supply arises through the Dornbusch overshooting model extension of the usual monetary model of the exchange rate. In this model a permanent unanticipated shock to the money supply of one of the countries when prices are sticky results in an initial overreaction by the exchange rate. Thus the shock to money implies that the real exchange rate changes, generating a correlation between the variables that we can exploit for purposes of the test for a unit root. Rogers (1999), Eichenbaum and Evans (1995) among others ( see Obstfeld and Rogoff (1996) for a review), give corroborating empirical evidence that monetary shocks affect the real exchange rate. The model is typically in terms of shocks to one of the countries money supplies; hence we can examine the effects using the base countries money supply, the foreign country money supply, or the differential between them. Other models also generate correlations between monetary variables and the real exchange rate that would suggest there is a correlation to be exploited here. Beaudry and Devereux (1995) present a model with sticky prices and increasing returns, which causes money not to be neutral, leading to monetary shocks having effects on both the nominal and real exchange rates. 9 We report results only using the US inflation as stationary covariate. Results for foreign inflation or relative inflation are similar and are not reported. 10 The only difference between the tests here and those in Elliott and Jansson (2003) arises through the deterministic terms. Since to test for PPP we only allow for a mean in the real exchange rate, the difference between the test in Elliott, Jansson and Pesavento (2002) and Elliott and Jansson (2003) is not relevant for this application. 10 Income Differentials To the extent that these capture or reflect productivity differences, we may expect that income differentials be correlated in the long run with the real exchange rate. In most general equilibrium models there is at least a role for productivity effects on the current account, which could then influence the real exchange rate in the ways mentioned above (even though this second link is not a feature of the typical general equilibrium models). In the Obstfeld and Rogoff (1995) model, money is not neutral in the long run so we can expect these effects to result in correlations at the zero frequency (i.e. in the long run). Even in the cases where we expect neutrality, then we may find that there are short run correlations that are exploitable for the purposes of improving the power of the unit root tests. However this is in the end an empirical question, and one, which we can and will examine in the empirical section. Current Account Deficit Most general equilibrium models have no role for the exchange rate in current account determination (e.g. Glick and Rogoff (1995)), however as an empirical proposition there is some evidence. Krugman (1991) points out that traditional supply/demand type relations for trade with a role for the real exchange rate as the price, give a good description of the US experience in the 80’s. To the extent that there are wealth effects of a change in the real exchange rate, we also may expect real exchange rates to affect the current account (Krugman (1990),Obstfeld and Rogoff (1996)). Interest Rates Differentials Uncovered interest rate parity links movements of the nominal exchange rates to nominal interest rates differentials. If expected future spot rates can be regarded as a predictor of of the actual spot rates, uncovered interest parity implies that the change in nominal exchange rates is corrrelated with the interest reates differentials. Meese and Rogoff (1988) also show that monetary model and uncovered interst parity would lead to a link between real exchange rates and real interest rates differentials. We should then expect to find some correlation between interest rates and the real and nominal exchange rates11 . 11 In the empirical section we report results for the nominal interest rates differentials. Results for the real interest rates are similar and are not reported. Results are available upon request. 11 4 Empirical Results The data used are quarterly data from the IFS database for period from the first quarter of 1973 to the third quarter of 2003 when the data are available. The exchange rates are the end of the month value of the dollar in term of foreign currencies. The real exchange rate is constructed using CPI’s as the price indices. Finally, for money we use M2 taken directly from the IFS database or computed as M1 plus Quasi Money when M2 was not available. For some countries not all the data were available for some of the covariates so the sample period may be different in some cases. For the countries in the European Union the end of the sample is the last quarter of 1998. All the variables are in log with the exception of the interest rates. First, we review the results for testing for the lack of mean reversion in the real exchange rate using univariate tests. Table 1 gives the results for each of the countries using both the commonly applied Dickey and Fuller (1979) t-test, the PT and DF-GLS tests of Elliott et al. (1996), and the modified PT test of Ng and Perron (2001). The lag length is chosen with the Perron and Ng (2001) modified Akaike Information criterion (MAIC) with a maximum of 8 lags. In each case a constant is included in the specification. For none of the countries, regardless of the method of lag selection, we reject a unit root in the real exchange rate using the Dickey and Fuller (1979) test. None of the test statistics are even close to rejecting at the asymptotic 5% critical value of -2.86 and none of the statistics rejects at 10% level. This accords with typical findings, however it is well known that this test statistic has very low power, even amongst univariate tests. Also in agreement with past results12 , when the DF-GLS test is employed we are able to reject the null hypothesis of a unit root for a number of bilateral pairs of currencies. In particular, we reject unit roots in the real exchange rate for Belgium, Denmark, France, Germany, Italy, Norway, and Sweden. However we still cannot reject the hypothesis for many others of the country pairs - in particular for Japan, Canada and Australia the test statistics are far from rejection regions. Contrary to Cheung and Lai (2000), with data up to 2003, the DF-GLS test does not reject for the UK. Results for the PT and MPT tests are similar although they reject for a smaller number of countries. 12 Cheung and Lai (2000) use monthly data and also fail to reject using the Dickey and Fuller test but reject using the DF-GLS test for Germany, UK and France. 12 Each of the variables we have selected to include to improve power has been selected on theoretical grounds to be likely to be correlated with the real exchange rate and also be stationary13 . With the tests we will provide empirical evidence of the correlations. In table 2 we present evidence from tests of the stationarity of the variables. The test we employ is the Saikkonen and Luukonnen (1993) test for an MA unit root (the similarity between this hypothesis and the stationarity hypothesis as well as this test is reviewed in Stock (1994)) using an autoregressive estimate of the scaling variance (see Stock (1994) for details). The test allows for a mean in the data and tests the null of stationarity against the alternative of a unit root. The test also has power (or size divergence) against large autoregressive roots in small samples and also against breaks in the process (which means that the test rejects with frequency greater than stated size if these models are the true data generating processes). In most cases, the test fails to reject the null of stationarity (the value of the test statistic is given in the first line of each entry, the 5% critical value is 0.46). Apart from a few cases, all rejections are for the income variables. The change in the income growth rates differential with the US is rejected in about half the countries. Rejections here may seem strange, as it seems highly unlikely that these variables have unit roots. However this test has power in other directions as well - these rejections are more likely to be due to breaks in the process than unit root type non stationarity. Even so, whilst we report results using these variables below, in no case do we use these variables (that reject stationarity) in our conclusions over the mean reversion of real exchange rates. When the covariates are included, we are able to reject for each bilateral real exchange rate (Australia rejects only at 10% level while all other countries rejects at 5% level). The covariate that we find useful in improving power differs from country to country. The results of these tests are contained in Table 3, where each row of results accords with the use of the covariate noted in the first column. Each result gives the value for the statistic, the p-value for the test in brackets14 , and below each statistic we give an estimate of the R2 parameter that denotes the level of the long run relationship between the variables (see the discussion in Section II above - this parameter lies between zero and one with zero indicating no relationship and hence no power gain, and the larger the value the stronger 13 Amara and Papell (2004) use slightly different covariates and obtain similar results. The number of lags (not reported) is chosen by BIC on a VAR estimated under the null of ρ = 1. The maximum number of lags is set equal to 8. 14 13 the relationship and power gain). One way to interpret the information in relation to the R2 value is that for values near zero, we obtain little power gain and hence failure to reject would still be considered to have problems of low power. If the R2 is large and we fail to reject then the argument of low power has less force. The more powerful test of Elliott and Jansson (2003) leads to support of the PPP hypothesis even for Japan where traditionally it has been very hard to reject the null of a unit root in the real exchange rates against a mean reverting stationary alternative. The more striking result is obtained when we use the difference in the logarithm of the nominal exchange rate as the stationary covariate. The estimated R2 between the nominal and the real exchange rates is between 60% and 98% and we reject for all countries with the exception of Canada. Although for the Yen/Dollar real exchange rate a number of variables result in values of R2 in the 10 to 15 percent range, it is only in the case in which we use the change in the nominal exchange rate as covariate that we obtain a rejection. For each of the other covariates we are still unable to reject. For Belgium, Denmark, Finland, France, Germany, Italy, Norway and Sweden, where we rejected without covariates, we reject for nearly all combinations of the covariates at 10% level and for most of them at 5% level. The only failure to reject is using the relative interest rates for Norway. Notably for the case of Belgium, Denmark, France, Germany, Italy, Norway and Sweden the inclusion of nominal exchange rates result in R2 estimates of around 90%, while for Finland the correlation is around 60%, indicating that this covariate is strongly related to the real exchange rate in the long run. For most countries we also find a long run correlation between the real exchange rate and US inflation above 30%. For almost all seven countries the growth in income variables have very low correlations with the real exchange rate in the long run. For Netherlands, Spain, Switzerland and the UK, we also estimate R2 anywhere between 30% and 95% and we also have some strong rejections for nearly all combinations of covariates. This is contrary to the univariate results where none of the tests were able to reject the unit root hypothesis. The strong results across different covariates indicate that the failure to reject in an univariate settings may be from low power. Amara and Papell (2004) using the same test find evidence of mean reversion also for Austria, Greece, Ireland, Portugal and New Zealand. As noted above we have only two rejections in the case of Canada, of which only one is at 5% level. This is true despite one large estimates of R2 - including an estimated R2 of 93% for the nominal exchange rate- yet the 14 test statistic is far from the rejection region with a p-value of 0.26. Similar results occur when the income growth variables from both Canada and the US are combined. The implication here is that such rejections may not be from low power. Interestingly, and contrary to what has been found in the literature, we are able to reject the null hypothesis of a unit root when the current account share of income is used. The estimated R2 is 25% and the test rejects at 5% level. Contrary to our results, using data up to 1998, Amara and Papell (2004) are not able to find evidence against a unit root in the Canadian dollar for any of their covariates. The difference in our results is causes most likely by the appreciation of the Canadian dollar in the last year in our sample rather than by the use of different covariates. For Australia and Japan we also have only a few rejections. Although for the Yen/Dollar real exchange rate relative money growth and the current account share of income result in values for R2 in the 10 to 25 percent range, it is only in the case of using the nominal exchange rate that results in the rejection of the hypothesis that there is a unit root. For each of the other covariates we are still unable to reject. Australia show the weakest evidence in favour of PPP, with p-value above 0.05 for all covariates and only two cases in which we can reject at 10% level. The monetary variables do poorly for the Australian Dollar/US dollar real exchange rate, generating R2 a little above 10% but not generating rejections of the unit root. Although US inflation shows a weak correlation in the long run (R2 is 2%) leads to a rejection of the hypothesis. As mention, using the difference in the nominal exchange rates we also find some support with an estimated R2 of 0.73 and a p-value of 0.096. For comparison, we replicate the results in Table 4 for the nominal exchange rate, a variable for which theoretically we have little reason to conjecture whether or not it has a unit root. The general result is that we reject the unit root hypothesis far less often for the nominal compared to the real exchange rate. Indeed, we reject less often for ALL countries for which we had multiple rejections in Table 3, and we now have no rejections for Australia, Germany, Japan, Switzerland, and the UK whereas for the real exchange rate we had many rejections for these countries. For Norway and Sweden we only have rejections at 10% while p-value were extremely small for the real rates. The results for Belgium, Canada, and Denmark however, are quite similar to those for the real exchange rate. For Belgium and Denmark we find strong evidence against a unit root while we find a weak evidence of mean reversion for the Canadian dollar despite some high estimates for R2 . We can relate such findings to the properties of the tests themselves, as 15 well as the ’priors’ we might have from examining the time series plots in Figure 1. Firstly, for Australia, Germany, Japan, Norway, Sweden, Switzerland, and the UK the R2 values are similar comparing the same entries for the real exchange rate and the nominal exchange rate This similarity means that power against any mean reverting alternative is similar across the two tables, and so this is not the difference in the results. Of course, regardless of the magnitude of R2 , size is controlled by the tests, and so one possible explanation is that the roots of the nominal exchange rates are indeed one whilst those for the real exchange rate are less than one (or at least the roots for the nominal exchange rates are closer to one than those for the nominal exchange rate). If we look at the time series plots for these countries, it indeed does appear that the real exchange rates for these countries has less tendency to move away from its average with a difference between the two series mostly in the earlier part of the sample. For Belgium, Canada, and Denmark, we get qualitatively the same results in both tables and in fact the two series are very similar during the entire period. Overall, there appears to be plenty of evidence at the bilateral level for ruling out the possibility that the real exchange rate for these major countries have unit roots, and hence could become arbitrarily small or large. This is true without resorting to the inclusion of data from other exchange rate regimes, and backs up the long run studies in this sense (since the argument is one of lack of power in the shorter period). In addition, the covariates that are important for each of the countries are both informative and make sense. In the case of Canada, which has undergone a massive real depreciation in their exchange rate over the period of the study, it makes sense that income variables proxying for real variables are the important covariates in the long run. For the European countries, the important variables are monetary and current account variables. It certainly makes sense that the European countries should be somewhat alike. 5 Conclusion The concept of purchasing power parity is extremely important in linking economic models of different countries. Despite what clearly are at best relatively slow mean reversion rates for the real exchange rate, economists have modified rather than abandoned this theory - it is difficult to believe theoretically that it is not an important constraint at some time horizon. 16 At the same time, we obviously would like to rule out the possibility that it does not hold even in the very long run. To this end, unit root tests have been proposed with the null of no mean reversion in the real exchange rate. Early univariate tests fail to reject such a hypothesis. Such results were taken with a grain of salt, as it was known early on that such tests had low power against alternatives that fit with PPP. This created a search for higher power in testing. The two main approaches were the collecting of longer dataset and the pooling of real exchange rates across many bilateral pairs and conducting joint tests. Each has its own problems - notably the long run tests require including data from periods where the exchange rate arrangements were completely different to current ones, thus allowing the criticisms that it is the earlier periods that have mean reversion and the lack of mean reversion in the later period is unable to reverse the conclusion of the tests. In the pooling case, there is always the possibility that (if power is high) one country lack of mean reversion causes the pooled result to reject for all countries. The opposite possibility is more likely - that pooling allows the inclusion of a country without mean reversions with many that do and fails to reject for all. Here we exploit a different approach to improving power - we use other related data to improve the power of the tests. We are able in this way to retain a bilateral approach and ask the question for each country individually, but at the same time we do not need to incorporate data from previous exchange rate regimes. In the end, our results bolster the findings of the other approaches - by increasing the power of the tests we find much more evidence of mean reversion in real exchange rates. 17 6 References Abuaf, N. and P.Jorion (1990), "Purchasing Power Parity in the Long Run" Journal of Finance, 45, 157-74. Amara J. and D. Papell (2004), "Testing for Purchasin Power Parity Using Stationary Covariates" Mimeo, University of Houston. Beaudry, P. and M.B. Devereux (1995), "Money and the Real Exchange Rate with Sticky Prices and Increasing Returns", Carnegie-Rochester Conference Series on Public Policy, 43, 55-101. Cheung, Y-W, and K. Lai (2000), "On Cross Country Differences in the Persistence of Real Exchange Rates", Journal of International Economics, 50, 375-97. Dickey, D.A. and W.A. Fuller (1979), "Distribution of Estimators for Autoregressive Time Series with a Unit Root", Journal of the American Statistical Association, 74, pp427-431. Diebold, F.X., S. Husted and M. Rush (1991), "Real Exchange Rates under the Gold Standard", Journal of Political Economy, 99, 1252-71. Eichenbaum, M., and C, Evans (1995), “Some empirical evidence on the effects of monetary policy shocks on exchange rates”, Quarterly Journal of Economics 110, 975-1010. Elliott, G. and M. Jansson (2003), "Testing for Unit Roots with Covariates" Journal of Econometrics, 115, 75-89.. Elliott, G., M.Jansson, and E.Pesavento, (2002) "Optimal Power for Testing Potential Cointegrating Vectors with Known Parameters for Nonstationarity", mimeo. Elliott G., J.H. Stock and T.J. Rothenberg (1996), “Efficient Tests for an Autoregressive Unit Root”, Econometrica, 64, pp813-836, 1996. Engel (2000), “Long run PPP May not Hold After all", Journal of International Economics, 51, 243-73. Engel, C., M. Hendrickson and J. Rogers (1997), "Intranational, Intracontinenetal and Intraplanetary PPP", Japanese Journal of International Economics, 11, 480-501. 18 Froot, K. and K. Rogoff, (1991), "The EMS, the EMU, and the Transition to a Common Currency", in O. Blanchard and S. Fisher eds. NBER Macroeconomics Annual 1991, 269-317. Froot K.A. and Rogoff K. (1995), “ Perspectives on PPP and Long-Run Real Exchange Rates” Handbook of International Economics. Glick, R. and K. Rogoff, (1995) "Global versus Country Specific Productivity Shocks of the Current Account", Journal of Monetary Economics, 35, 159-92. Hansen, B. E. (1995), "Rethinking the Univariate Approach to Unit Root Testing: Using Covariates to Increase Power”, Econometric Theory, 11 (5) 1148-1172. Higgins, M. and E. Zakrajsek (1999), “Purchasing Power Parity: Three Stakes Through the Heart of the Unit Root Null”, Research Department, Federal Reserve Bank of New York (June). Jorion, P. and R. Sweeney (1996), "Mean Reversion in Real Exchange Rates: Evidence and Implications for Forecasting", Journal of International Money and Finance, 15, 535-50. Krugman, P. (1990), "Equilibrium Exchange Rates" in W.H. Branson, J.A.Frankel, and M.Goldstein eds. International Monetary Policy Coordination and exchange Rate Fluctuations, MIT Press: Cambridge, MA. Krugman, P. (1991), "has the Adjustment Process Worked?”, in C.F. Bergsten ed International Adjustment and Financing, Washington DC Institute for International Economics. Lothian, J.R. (1994), Multi-Country Evidence on the Behavior of Purchasing Power Parity under the recent Float”, Journal of International Money and Finance, 16, 19: . Lothian, J.R and M.P. Taylor, (1996), "Real Exchange Rate Behavior: The Recent Float from the Perspective of the Last Two Centuries", Journal of Political Economy.‘ ‘ Meese R. and K. Rogoff (1988), "Was it real? The Exchange RateInterest Differential Relation over the Modern Floating-Rate Period", Journal of Forecasting, 43,933-948. 19 McCloskey, D.N. and J.R. Zecher, (1984): "The Success of Purchasing Power Parity", in A Retrospective on the Classical Gold Standard, 18211931, M.Bordo and A. Schwartz eds. Chicago:U of Chicago, pp121-50. Ng, S. and P. Perron, (2001): "Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power", Econometrica, 69, 1519-1554. Obstfeld, M. (1993): "Model Trending Real Exchange Rates". Working paper C93-011, Center for International and Development Economics Research (February). Obstfeld, M. and K. Rogoff (1995): "Exchange Rate Dynamics Redux", Journal of Political Economy, 103, 624-60. Obstfeld, M. and K. Rogoff (1996): "Foundations of International Macroeconomics" The MIT Press, Cambridge. Obstfeld, M. and A. Taylor, (1997): “Nonlinear Aspects of GoodsMarket Arbitrage and Adjustment: Heckscher’s Commodity Points Revisited”, Journal of the Japanese and International Economies, 11, 441-79 O’Connell, P.G. (1998): "The Overvaluation of Purchasing Power Parity", Journal of International Economics, 44, 1-19. Papell, D.H. (1997): "Searching for Stationarity: Purchasing Power Parity Under the Current Float", Journal of International Economics, 43, 31332. Perron, P. (1991): “ Test Consistency with Varying Sampling Frequency”, Econometric Theory, 7(3), 341-68. Perron P. and S. Ng, (1995): “Unit Root Tests in ARMA Models with Data-Dependent Methods for the Selection of the Truncation Lag”, Journal of the American Statistical Association, 90, 268:281. Pippenger, M.K. and G.E. Goering (1993), "A Note on the Empirical Power of Unit Root Tests Under Thresholds", Oxford Bulletin of Economics and Statistics, 55, 473-81. Rogers, J. (1999), "Monetary Shocks and Real Exchange Rates", Journal of International Economics, 49, 269-88. 20 Rogoff, K. (1996), "The Purchasing Power Parity Puzzle", Journal of Economic Literature, 34, 647-68. Saikonnen P. and R. Luukonnen (1993), “Testing for Moving Average Unit Root in Autoregressive Integrated Moving Average Models”, Journal of the American Statistical Association, 88, 596-601. Stock J.H. (1994): “Unit Roots, Structural Breaks and Trends”, in McFadden and R.F. Engle eds. Handbook of Econometrics V4, North Holland, 2739-2841. Taylor, A.M. (2001): “Potential Pitfalls for the Purchasing Power Parity Puzzle? Sampling and Specification Biases in Mean-Reversion Tests of the Law of One Price” Econometrica, 69, 473-98. Taylor, M.P. and L. Sarno, (1998), "The Behavior of Real Exchange Rates During the Post-Bretton Woods Period", Journal of International Economics, 46, 281-312. 21 2.5 q s 2 1.5 1 0.5 0 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 1: Australia nominal and real exchange rates 70 q s 60 50 40 30 20 10 0 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 2: Belgium nominal and real exchange rates 1.8 q s 1.6 1.4 1.2 1 0.8 0.6 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 3: Canada nominal and real exchange rates 22 12 q 11 s 10 9 8 7 6 5 4 3 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 4: Denmark nominal and real exchange rates 7 q s 6.5 6 5.5 5 4.5 4 3.5 3 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 5: Finland nominal and real exchange rates 10 q s 9 8 7 6 5 4 3 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 6: France nominal and real exchange rates 23 3.5 q s 3 2.5 2 1.5 1 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 7: Germany nominal and real exchange rates 2500 q s 2000 1500 1000 500 0 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 8: Italy nominal and real exchange rates 350 q 300 s 250 200 150 100 50 0 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 9: Japan nominal and real exchange rates 24 4 q s 3.5 3 2.5 2 1.5 1 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 10: Netherlands nominal and real exchange rates 11 q s 10 9 8 7 6 5 4 3 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 11: Norway nominal and real exchange rates 250 q s 200 150 100 50 0 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 Figure 12: Spain nominal and real exchange rates 25 14 q s 12 10 8 6 4 2 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 13: Sweden nominal and real exchange rates 3.5 q 3 s 2.5 2 1.5 1 0.5 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 14: Switzerland nominal and real exchange rates 1.2 q 1 s 0.8 0.6 0.4 0.2 0 1973Q1 1976Q1 1979Q1 1982Q1 1985Q1 1988Q1 1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 Figure 15: UK nominal and real exchange rates 26 Table 1: ADF and DF-GLS test for the ADF PT DF-GLS AUS -1.729 9.539 -1.155 BEL -2.139 2.173* -2.133* CAN -1.297 23.538 -0.487 DEN -2.507 1.961* -2.318* FIN -2.377 3.079* -1.847 FRA -1.955 3.320 -1.965* GER -1.996 3.195 -2.006* ITA -1.966 3.290 -1.975* JAP -2.265 8.438 -1.208 NETH -1.755 4.378 -1.714 NOR -2.178 2.879* -2.135* SPAIN -1.928 6.204 -1.478 SWE -2.219 2.883* -1.997* SWI -2.499 6.530 -1.521 UK -2.363 3.986 -1.703 Number of lags is chosen by MAIC. 27 real exchange rate MPT lags 8.187 (0) 2.208* (3) 19.665 (0) 1.869* (3) 2.714* (5) 3.385 (0) 3.258 (0) 3.353 (0) 6.784 (3) 4.230 (2) 2.874* (0) 5.330 (1) 2.677* (3) 5.293 (0) 3.460 (5) AUS BEL CAN DEN FIN FRA GER ITA JAP NETH NOR SPAIN SWE SWI UK ∆st 0.146 0.089 0.161 0.093 0.050 0.134 0.076 0.238 0.078 0.074 0.063 0.202 0.093 0.114 0.147 Table 2: Stationary Test for covariates ∆(pt ) ∆ (mt − m∗t ) ∆ (yt − yt∗ ) ∆ (ca∗t /yt∗ ) 0.268 0.087 1.030* 0.240 0.394 0.193 1.677* 0.466 1.122* 0.194 0.267 0.631* . 0.310 0.352 0.104 0.389 0.439 0.170 0.501 0.830* 0.087 0.336 0.614* 0.109 0.299 2.242* 0.048 0.042 0.357 0.219 . 0.433 . 0.070 0.618* 0.116 0.121 0.120 0.087 0.125 0.367 0.150 0.084 1.009* 0.096 ∆ (it − i∗t ) 0.056 0.156 0.097 . 0.061 0.051 0.640* 0.030 0.058 0.235 0.018 0.017 0.066 0.182 0.027 The stationarity test is computed using BIC to estimate the number of lags in the estimation of the spectral density at frequency zero. The maximum lags for BIC is set equal to 8. The critical value for the test is 0.46 and we reject for large values. 28 Table 3: Unit root test with covariate for real exchange rates. ∆st ∆(pt ) ∆ (mt − m∗t ) ∆ (yt − yt∗ ) ∆ (ca∗t /yt∗ ) AUS 10.18(0.10)† 4.45(0.09)† 11.58(0.33) 10.04(0.30) 8.02(0.24) 0.73 0.02 0.10 0.02 0.01 BEL 5.73(0.00)* 2.00(0.02)* 3.18(0.04)* 2.55(0.02)* 1.20(0.00)* 0.93 0.30 0.08 0.00 0.00 CAN 56.97(0.26) 4.64(0.10)† 11.59(0.35) 14.19(0.39) 1.14(0.01)* 0.93 0.02 0.01 0.17 0.25 DEN 43.06(0.01)* 2.22(0.02)* 2.50(0.02)* 0.76(0.00)* . 0.98 0.20 0.02 0.03 . FIN 5.39(0.05)* 4.56(0.10)† 4.10(0.08)† 3.13(0.04)* 2.31(0.02)* 0.64 0.04 0.02 0.06 0.16 FRA 0.35(0.00)* 1.87(0.01)* 2.13(0.02)* 2.69(0.03)* 2.91(0.04)* 0.96 0.14 0.50 0.00 0.04 GER 5.13(0.00)* 1.51(0.01)* 1.47(0.00)* 2.37(0.02)* 1.85(0.01)* 0.96 0.43 0.02 0.01 0.00 ITA 0.05(0.00)* 1.60(0.01)* 1.79(0.01)* 2.68(0.03)* 1.87(0.01)* 0.87 0.07 0.00 0.07 0.01 JAP 20.22(0.00)* 8.60(0.26) 6.06(0.14) 7.86(0.23) 5.66(0.12) 0.97 0.01 0.15 0.00 0.23 NETH 5.89(0.00)* 2.75(0.03)* 2.37(0.02)* 2.64(0.03)* 2.35(0.02)* 0.95 0.32 0.00 0.08 0.37 NOR 0.01(0.00)* 2.38(0.02)* . 2.79(0.03)* . 0.91 0.12 . 0.13 . SPAIN 7.17(0.02)* 5.19(0.12) -1.39(0.00)* 5.82(0.14) 1.77(0.01)* 0.85 0.02 0.61 0.13 0.03 SWE 10.92(0.00)* 3.02(0.04)* 2.51(0.02)* 5.14(0.08)† 1.57(0.00)* 0.95 0.05 0.00 0.37 0.03 SWI 18.62(0.01)* 3.83(0.06)† 2.44(0.02)* 2.24(0.02)* 2.21(0.01)* 0.95 0.14 0.00 0.00 0.00 UK 2.09(0.01)* 5.37(0.13) 3.53(0.06)† 4.03(0.07)† 2.98(0.04)* 0.63 0.08 0.05 0.07 0.01 2 table has test, p-value in parenthesis and estimated R below. * denotes rejections at 5% † denotes rejections at 10% 29 ∆ (it − i∗t ) 9.33(0.26) 0.12 -7.43(0.00)* 0.35 15.00(0.44) 0.00 . . 2.35(0.02)* 0.05 3.76(0.07)† 0.05 3.26(0.05)* 0.07 1.96(0.01)* 0.00 5.09(0.12) 0.04 0.50(0.00)* 0.14 5.41(0.13) 0.00 3.25(0.05)* 0.01 1.67(0.01)* 0.01 1.05(0.00)* 0.01 3.28(0.05)* 0.07 Table 4: Unit root test with covariate for nominal exchange rates. ∆pt ∆ (mt − m∗t ) ∆ (yt − yt∗ ) ∆ (ca∗t /yt∗ ) ∆ (it − i∗t ) AUS 9.84(0.30) 38.15(0.73) 30.80(0.67) 16.72(0.46) 25.06(0.58) 0.01 0.04 0.02 0.09 0.20 BEL 3.21(0.04)* 3.43(0.05)† 2.43(0.02)* 1.42(0.00)* -8.78(0.00)* 0.19 0.08 0.00 0.00 0.09 CAN 6.90(0.19) 16.99(0.47) 17.76(0.47) 2.51(0.03)* 22.67(0.57) 0.01 0.04 0.16 0.32 0.00 DEN 1.91(0.02)* 2.72(0.03)* 0.71(0.00)* . . 0.26 0.01 0.03 . . FIN 3.60(0.06)† 3.71(0.06)† 4.63(0.10) 6.04(0.13) 2.38(0.02)* 0.11 0.01 0.00 0.24 0.14 FRA 3.79(0.06)† 3.76(0.04)* 4.05(0.08)† 5.32(0.13) 6.22(0.16) 0.23 0.55 0.00 0.04 0.04 GER 6.33(0.15) 7.06(0.20) 7.80(0.23) 4.60(0.10) 10.75(0.32) 0.18 0.01 0.00 0.00 0.07 ITA 13.65(0.35) 3.08(0.04)* 14.05(0.39) 3.11(0.04)* 12.58(0.38) 0.27 0.04 0.13 0.00 0.00 JAP 14.44(0.42) 12.17(0.35) 14.63(0.43) 16.06(0.43) 14.76(0.42) 0.00 0.10 0.01 0.17 0.07 NETH 5.52(0.12) 6.18(0.17) 2.56(0.03)* 3.32(0.04)* 1.67(0.01)* 0.19 0.00 0.05 0.33 0.20 NOR 3.95(0.07)† . 5.63(0.13) . 11.65(0.35) 0.06 . 0.13 . 0.00 SPAIN 11.11(0.31) 1.80(0.01)* 13.25(0.39) 7.65(0.20) 11.34(0.34) 0.15 0.57 0.04 0.17 0.00 SWE 8.54(0.24) 6.22(0.17) 6.97(0.16) 3.75(0.07)† 3.35(0.05)† 0.09 0.00 0.25 0.03 0.01 SWI 10.54(0.32) 11.92(0.36) 12.27(0.37) 8.89(0.26) 9.82(0.30) 0.01 0.01 0.00 0.04 0.02 UK 10.99(0.33) 10.36(0.30) 8.81(0.27) 5.90(0.15) 8.80(0.26) 0.05 0.10 0.00 0.03 0.00 2 table has test, p-value in parenthesis and estimated R below. * denotes rejections at 5% † denotes rejections at 10% 30 7 Appendix: Power of Tests for a Unit Root and Measures of Persistence. It is in general quite difficult to give a single summary statistic for the halflife of a shock to a variable. In general, we could write linear models of a variable yt as yt = C (L) εt where the εt are new shocks hitting the process (and are hence serially uncorrelated) and C(L) is a polynomial in the lag operator. The coefficients in C(L) summarize the effects of each shock, and can take many ’shapes’. The single summary statistic tries to reduce this to one parameter. Possibilities include simply the sum of the coefficients, denoted C(1). This however gives no idea as to the time dimension of the effect of the shocks - i.e. all of the effects may be over in very few periods or the effect may be strung out over a very long period. An alternate possibility is to report the time it takes for the effect of a shock to have only half the effect it did when it first hit - this is often referred to as the ’half-life’. An alternative to this is the time it takes for half the effect to have appeared (often also called the half-life). Apart from the total effect, it is hard to give closed form solutions for the measures as functions of the estimated parameters of an autoregressive model, which is the usual model actually estimated. A common approach in the PPP literature is to model the real exchange rate as an AR(1) process, i.e. yt = ρyt−1 + εt which inverts for|ρ| < 1 to the moving average process (omitting the initial effects) yt = Xt s=1 ρt−s εs showing that in the lag polynomial Ci = ρi−1 . If we are interested in the period k where the effect has diminished to half the initial effect, then this is the point where Ck = 0.5. This has a closed form solution, it is ln 12 k= ln ρ 31 (for the case of ρ > 0). From the point of view of testing for a unit root, a reasonable question to ask is if tests have good power against alternatives that represent ’reasonable’ half-lives in practice. To obtain asymptotic approximations of power functions for unit root tests, we examine local power. This method shrinks the alternative towards the null of a unit root at the rate at which the probability of a rejection under the alternative goes to one (any consistent test has asymptotic power 1 for all alternatives). In the unit root literature this means using the parameterization device ρ = 1 + c/T where c is the local alternative. The local power properties are in terms of power against various (negative) c, which can be related back to values for ρ given the sample size T using this relationship. If we apply this same parameterization to the half life, in order to get this also in terms of c, we have the result that ln 1 k ≈ 2 T c Power in terms of c can then be directly related to power in terms of the half-life k given T . Notice that this is very different in both approach and answer compared to Froot and Rogoff (1996), who use not local power but compute the power through considering ρ less than one, the asymptotic distribution for this, and then relating this to testing that one is in the confidence interval. This is problematic for a number of reasons. First, the asymptotic normal distribution is a very poor approximation to the sampling distribution for ρ when it is close to one. Second, it ignores the different asymptotic methods at ρ = 1, which invalidate the relationship between their results and the power of the unit root test. For their example of ρ = 0.981 where T = 216 months we have c = T (ρ − 1) = 216 ∗ (0.981 − 1) = −4.1, which indeed is a close alternative for the Dickey and Fuller (1979) test (as reported in the text power is around 11%). They compute that one would need 864 months to reject, however at this r this is c = −16.4 for which the test has power in the neighborhood of 80% (they note this is ’sufficient’ to reject, but it is hard to understand what this would mean other than power equal to one). The following table relates half lives to local power given 108 quarters of data (as we have in this study). For c = −5 (i.e. ρ just above 0.95 here) we have very little power in rejecting a unit root using the DF test, the test with covariates has much greater power. 32 c -5 -10 -15 -20 k 15 7.5 5 3.7 DF 0.12 0.31 0.85 DF − GLS 0.32 0.75 0.97 1.00 33 With Covariates = 0.2 0.4 0.6 0.42 0.53 0.69 0.88 0.94 0.99 0.98 1.00 1.00 1.00 1.00 1.00 R2