Prejudice and Competitive Signaling Sue H. Mialon

advertisement

Prejudice and Competitive Signaling

Sue H. Mialon∗

First Draft: November 20, 2013, This Version: June 17, 2014

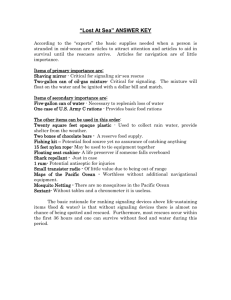

Abstract

In a signaling game between a receiver and senders, prejudice occurs if

senders are pre-judged based on an index such as race without reference to

their qualifying signals. This paper investigates what makes the receiver ignore

senders’ informative signals in favor of the uninformative index. Prejudice arises

when competition between senders erodes their signaling incentive and reduces

the quality of signaling significantly. To minimize the decrease in quality, the

receiver may pre-screen the senders using the index, removing the impact of

competition. We advocate policies that enhance the quality of signals to ensure

the effectiveness of competitive signaling systems.

JEL Classification Numbers: J71, J78, D82, K31

Keywords: Competitive Strategic Signaling, Prejudice, Discrimination.

∗

Sue H. Mialon, Department of Economics, Emory University, Atlanta, GA 30322 (e-mail: smialon@emory.edu, phone: 404-712-8169). I am grateful to Daniel S. Hamermesh, R. Preston McAfee,

Hugo Mialon, Kaz Miyagiwa, Malathi Velamuri, and Seung Han Yoo for their helpful comments.

1

1

Introduction

Prejudice is "a preconceived judgment or opinion, an adverse opinion or learning

formed without just grounds or before sufficient knowledge" (Merriam Webster dictionary). Hence, prejudice implies decision-making without all relevant information.

Typically, this requires a situation in which the relevant information is private and

not readily available. Signaling theory predicts that, in such a situation, a person (a

sender) who has valuable, private information would have an incentive to reveal the

hidden information through an investment in signaling methods. What has not received much attention, however, is that successful signaling also requires the receiver

of the information to have an incentive to utilize the signaled information. Although

all existing signaling models assume that the receiver always fully utilizes the signaled

information, the existence of prejudice implies that this may not be the case in reality.

In this context, this paper develops a model of prejudice as an outcome of failed

signaling not because of a lack of signaling incentives by the sender, but because

of a lack of interest by the receiver in utilizing signals. This paper investigates the

conditions under which the receiver becomes less interested in fully utilizing the information (henceforth, full information). We also offer new insights about the potential

inefficiency of signaling under full information and the implications of related policies

and their effectiveness.

The model builds on a simple signaling game between a receiver and two senders.

The senders’ quality is private information, whereas the two senders are easily distinguishable by an irrelevant, but observable, characteristic, such as race, gender, or

physical beauty, which is termed an index, following Spence (1973). The senders can

signal their hidden quality to the receiver by investing in an effort.

To understand the model, for example, suppose that two candidates (senders),

a male and a female, are being interviewed for a job. In order to discover whether

they are qualified, the recruiter must review their application files thoroughly and

pay attention to the details of their responses to questions while being interviewed.

That is, the recruiter needs to process their signals. However, instead of acquiring

all of the information and signals from each candidate for their decision, the recruiter may decide to pay more attention to the male candidate’s information and

skim through the female candidate’s information. In this case, prejudice occurs, not

because gender was a factor in decision, but because some useful information about

2

female candidate’s qualification was intentionally ignored in favor of gender-based

screening. Whether the female candidate was truly qualified, or even more qualified

than the male candidate, would never be known.

We distinguish prejudice from discrimination in that prejudice refers to differentiating the two candidates by gender before the recruiter gets to know anything about

them (even though more relevant information is available), whereas discrimination

refers to treating them differently by gender after the recruiter have investigated all

of the available information about them.

Why would the recruiter want to rely on uninformative gender (index) first instead

of acquiring full information? To the receiver, prejudice is preferable only if the index

is more effective in identifying high quality candidates than full information. Then,

when and why is full information less efficient than prejudice? In our benchmark case,

considering a typical model of signaling in which each type of sender independently

invests in signals, we show that such a framework is inadequate to explain prejudice.

In general, it is never optimal for the receiver to discard any valuable information

from the senders in favor of less informative index in that framework.

However, the entire dynamics of the signaling game change if there is a shortage

of return from successful signaling, which we consider in Section 4. In the example

above, the shortage occurs if there is only one position available for the two candidates.

Then, there is a chance that senders’ signaling efforts will be wasted even without

prejudice, because there is insufficient room for all of the qualified senders. As one

sender’s chance of being chosen depends on whether the other sender has a qualifying

signal, two senders’ signaling decisions become interdependent. Also, since receiving a

return from signaling effort becomes uncertain, senders’ incentive to signal decreases.

Even fair competition under full information can be as discouraging as prejudice. The

only difference is that under prejudice, the effort is wasted if they do not possess the

favorable characteristic, whereas under competition for limited positions, the effort

is to no avail if the sender does not win the competition. As the senders’ signaling

efforts decrease, the value of full information to the receiver diminishes.

Noisy and imperfect signals reduce the value further. For example, if all senders

have equally qualifying signals (pooling), or if their signals are too similar to differentiate their hidden qualities, the receiver would have to rely on the index when

making a selection. We call such an index-based decision comparative discrimina-

3

tion to distinguish it from prejudice.1 The possibility of comparative discrimination

decreases the senders’ signaling incentives and thus reduces the value of signals to

the receiver. Such a chain reaction from strategic interactions between senders as

well as with the receiver can easily destroy the value of competitive signaling under

full information. When the receiver expects that quality of information under full

signaling deteriorates substantially, the receiver chooses prejudice.

The main role of prejudice is to pre-screen the senders in order to decrease the

number of senders to consider and have less information to process. Since the selection

is independent of senders’ effort choices, it lessens the impact of value-destroying

competition for the insufficient return between the senders. Thus, when overheated

competition between the senders lessens their signaling incentives, prejudice becomes

an alternative in order to moderate the negative impact of competition.

The efficiency of competitive signaling comes from fairly distributing signaling

incentives among the senders. The distribution is fair in the sense that ex ante

identical senders make symmetric efforts, although the efforts can be asymmetric if

the senders are not identical. In contrast, prejudice always results in the most biased

selection that favors one of them. Anticipating this, even ex ante identical senders

will have asymmetric efforts. Prejudice is inefficient if a fair distribution of incentives

creates an overall greater value of signaling than a biased distribution under prejudice.

However, competitive signaling can be as inefficient as prejudice, if its "fair"

distribution of incentives is not so different from the distribution under prejudice.

This occurs if signals are more correlated with race or gender than with the senders’

quality. For example, if signaling is prohibitively costly for a minority, there is no

essential difference between competitive signaling and prejudice. In either system, a

minority with high quality will never have sufficient incentive to signal, due either

to prejudice or to economic hardship. Antonovics and Backes (2013) report that, if

the admission standard in the University of California system had not changed after

the affirmative action ban, the rate of under-representation would have been twice as

great under the previous system that emphasized grades and test scores. This raises

doubts as to whether competitive signals like test scores are more correlated with the

quality of the senders than with their race.

In order to maintain the efficiency of full signaling under competition, we em1

Comparative discrimination is different from statistical discrimination. For detailed explanation

on the differences, see Section 4.2.1.

4

phasize the importance of policies that make the signals closely correlated with the

hidden quality but not with the senders’ current economic status, race, or gender.

For instance, the Head Start program or the No Child Left Behind policy may help

to reduce the racial gap due to an unfavorable signaling environment for minorities.

If these policies can make signaling functions from both races more homogenous independently of their economic status, any difference in their signaling outcomes could be

attributed to a difference in the hidden quality. In that case, a competition-oriented

admission policy would work efficiently. As Aristotle argued, treating "like cases

alike" is required for equality and "identical treatment is not equal treatment,[..] if

individuals are not similarly situated."2

The remainder of this paper is organized as follows. Section 2 briefly summarizes the contributions of this paper to the literature. Section 3 presents our basic

framework of a costly process to decipher signaled information and a benchmark case

when there is no competition between senders. In Section 4, we introduce a strategic/interactive signaling model with a possible shortage of the return from signaling

efforts. Section 5 derives equilibrium. In Section 6, we discuss the policy implications

of the results. In Section 7, we present our conclusions.

2

Contributions to the Literature

The novelty of this paper is its original model of prejudice that differentiates prejudice

from discrimination. The model highlights the role of a shortage of the return from

signaling in leading to prejudice in equilibrium. We advocate the importance of

enhancing the quality of signals under competition because prejudice arises as a result

of inefficient competitive signaling.

There is an abundance of theoretical literature that is devoted to an explanation

of discrimination. While some theories, such as in Becker, (1957) describe it as a

matter of preference, many others spurred by the seminal papers of Phelps (1972) and

Arrow (1973) explain it as a result of statistical discrimination. Fang and Moro (2011)

provide an excellent survey of the literature that deals with statistical discrimination.

In the statistical discrimination literature, Coate and Loury (1993), Moro and

Norman (2004), and Mialon and Yoo (2014) are closely related to the present paper.3

2

3

"Minority Report," The Economist (Oct. 23, 2013)

There are many other studies with interesting approaches to explain discrimination, although

5

Coate and Loury (1993) explain statistical discrimination as a result of coordination

failure between players in a self-fulfilling equilibrium and emphasize the importance

of affirmative action in shaping the players’ beliefs about non-discriminatory equilibrium. Moro and Norman (2004) are the first to explicitly model discrimination

as a "relative" advantage that induces a greater payoff for one group at the expense

of the other. In their general equilibrium model, the production technology requires

two complementary inputs. The marginal product of each input adjusts accordingly

if relatively too many workers of the population invest in the skills for one. Thus,

discrimination is an outcome of two groups specializing in different tasks. The present

paper and Mialon and Yoo (2014) pioneer in modeling interdependent signaling decisions of senders. Mialon and Yoo (2014) show that employers prefer a discriminatory

outcome because it reduces the overall risks of hiring. They show how employers can

actively influence the discriminatory outcome and that discrimination is thus likely

to be persistent.

In contrast, the present paper models prejudice, a more fundamentally inefficient

discrimination of senders, as a purposeful act of ignoring potentially valuable information about senders in favor of a pre-judgment based on the uninformative index.

It is a shortage of the return from signaling that motivates prejudice. The shortage

intensifies competition and deteriorates the efficiency of competitive signaling. Thus,

prejudice is more likely to occur when competition is intense.

Although the statistical discrimination literature explains how ex ante identical

senders can be discriminated in equilibrium, the present paper finds that such discrimination is unlikely to occur if more effective discrimination is possible by means

of prejudice. Since prejudice works as a most effective way of discriminating senders,

the receiver chooses full information only if fair distribution of incentives is desirable. Thus, the receiver would never choose full information to discriminate ex ante

identical senders.

they are not closely related to this paper. For example, Mailath et al (2000) model discrimination

as an outcome of search frictions, Chaudhuri and Sethi (2008) discuss the relationship between

integration and discrimination, and Klumpp and Su (2013a) show how self-fulfilling beliefs about

a low variance in female human capital distribution induce a low representation of female workers

in high-end jobs. Blume (2005) considers a dynamic model of statistical discrimination to explain

how a discriminatory equilibrium is selected instead of a non-discriminatory one. He explains that a

discriminatory equilibrium may occur as a result of firms’ learning about worker investment decisions.

6

3

The Costly Process of Extracting Information

from Signals

Consider a game that involves a receiver and two senders.4 Each sender is characterized by his/her quality, high () or low (), and an index = 1 2. Although the

quality is the private information of senders, is observable to the receiver at no

cost. The two senders differ in . We assume that is not subject to choice. is

irrelevant in that ’s payoff depends only on the quality, = , of the sender and

not . The payoff from selecting a −type of sender is 0 whereas the payoff

from selecting a −type of sender is zero.

Let 0 be the probability that each sender has quality. When a sender makes

an effort , the sender receives 0 if selected, whereas the payoff for all other

cases are normalized to zero.5 Signaling is costly for senders. Let ∈ [0 ∞) be the

cost of choosing for a −type of sender, = 1 1 2 2. This cost is also

private information. The receiver has information only about the cost distribution

of each type. Let and be the cumulative distribution function (cdf) and

the probability distribution function (pdf) of type , respectively, on the support

[0 ∞). We assume that is twice-differentiable and that the ratio of the two pdfs

()

, satisfies the property of (1 ) ≥ (2 ) for 1 ≥ 2

for type = 1 2, () =

()

(MLRP). Signals are intrinsically noisy. However, the MLRP ensures that the signals

are more likely to be correct than not in predicting an −type. The MLRP implies

that () first order stochastically dominates (FOSD) (). Thus, on average,

it is more costly for an −type to signal than it is for an −type, ceteris paribus.

The receiver must incur a cost of 0 to extract information from signals

4

The model considers two senders only for simplicity. This game is equivalent to one in which

(i) there are many identical receivers and two types () of a continuum of senders of mass 1 on an

interval of [0 ] for , and (ii) each receiver is randomly matched to the senders from each type.

Introducing 2 possible types of makes the signaling decision of each type senders depend on

that of the remaining − 1 types. Except for the increased dimension of strategic interactions, the

same qualitative results are expected to hold for 2 possible types of .

5

We assume that 0 is given exogenously for several reasons. First, in many cases, there is

prejudice in a non-market situation and the payoff from acquiring the scarce position is often

a non-market price. For example, in the case of college admissions, there is no flexible market

price. Second, even if the payoff of competitive signaling is determined in the market, the outcomes

under prejudice are not determined by the market. For example, if represents a wage differential

resulted from prejudice, it cannot be a completely market-determined price because, by definition,

a prejudiced group’s wage is not a competitive, market-clearing wage.

7

whereas the index is costlessly observable.6 In some cases, may wish to first make

a decision based on the observed only. In that case, observes signals only from

the selected type . In the benchmark case below, we first examine the role of the

cost in determining prejudice in a model without competition between two types of

. Then, in Section 4, we introduce a shortage of returns from signaling that results

in an interaction between the senders.

Throughout the paper, regardless of whether or not there is an interaction between

the senders, the timing of the game between the receiver and the senders is as follows.

At stage 0, nature chooses type and quality for each sender. At stage 1, each

sender determines whether to make a signaling effort or not. At stage 2, the

receiver observes the index of each sender and decides whether to make a decision

based on the index () first or to pursue full information from the signaling () of

each sender. If is chosen, at stage 3, observes all senders’ choice of effort. If is

chosen instead, selects type with some probability, and only the selected sender’s

signals can be observed. After or , how the signals are used for a decision differs

depending on whether or not the senders are competing.

3.1

Benchmark

For this benchmark case, we assume that there are unlimited positions as in the

statistical discrimination literature. Thus, there is no need for competition between

the senders, which makes each sender of type signal independently. This feature

allows us to identify the effect of competition as we introduce limited positions in the

next section.

Given unlimited positions, as long as the signals are valuable, is willing to

hire as many senders as possible upon observing the qualifying signal for all .

Let e ∈ [0 1] be the probability that the receiver chooses and e ∈ [0 1] be the

probability of observing type 0 signal if is chosen. Since e and e are chosen

to reflect how much values the signals in equilibrium, we assume that, if a sender

under consideration at stage 3 has a signal , the sender is selected and receives ,

6

For example, when hiring, recruiters must decipher the information that indicates candidates’

quality by examining the details of signals, such as academic records and evaluation letters. According to The Society for Human Resource Management (SHRM), in 2011, the estimated average

cost-per-hire for organizations with 1000 or more employees was $4,285 and $3,079 for organizations

with fewer than 1000 employees.

8

or nothing.7 Then, a sender of type decides to invest in signaling effort ( ) if

and only if ( | ) = [e + (1 − e )e ] − ( | ) = 0 or

[e + (1 − e )e ] = e .

(1)

e = ( − ) − (1 − )

(2)

Thus, type makes a signaling effort with a probability of = (e ).

For given and , the receiver’s payoffs from and are () = e − ,

and () = e (e − ), respectively, where

for = 1 2. Thus, as long as () 0 ⇔ e , prefers and fully utilizes the

signals. e shows the value of signals from type . If e e 0, a higher incentive

e induces a higher signaling effort , and increases ’s incentive to utilize signals.

Specifically,

( − )

e

T0⇔

− (e ) R 0

(3)

e

(1 − )

where (e ) =

. By the MLRP, (e ) is increasing in e . Thus, there exists

at which = 0, 0 for e and 0 for e , where =

³

´

(− )

−1

, from (3). Thus, e is concave and maximized at . Assumption

(1− )

1 ensures that is not so high that, at least in some cases, it is worthwhile to use all

of signaled information.

Assumption 1 (1) , where = e ( ). (2) , where is the lowest

that satisfies = e ( ).

To ensure that all signaling efforts are intrinsically valuable to the receiver, we

also assume that is high enough to satisfy the following condition.

7

This is a behavioral assumption that we make in order to simplify the analysis. However, even

without this assumption, the same behavior is expected to arise in equilibrium. Given the MLRP,

any observed is more likely from an −type than from an −type and thus, is informative.

Then, for a given , using improves 0 payoff. If will not be used for selection, it is not

necessary to acquire all signals in the first place. Note that acquiring is costly. must incur

0 to reach the information of even if it is not used, whereas the cost can be avoided if

acquires only the information to be used. Thus, the receiver strictly prefers to reduce the set of

information to process rather than not use . This implies that the receiver would never want to

waste once the information has been obtained by costly efforts. Our assumption simply reflects

the nature of predicted equilibrium behavior of who wants to prioritize the decision of in

determining the value of .

9

Assumption 2 ≥

When ≥ , greater signaling efforts by senders increase the value of signals

for , 0 Then, prejudice means ignoring intrinsically valuable information.

As we intend to explain prejudice as a decision to not pursue potentially valuable

information, we require this property of Assumption 2.8 Lemma 1 summarizes the

Perfect Bayesian Nash equilibria (PBE) in this benchmark case.

Lemma 1 If e is not too low, the unique equilibrium is that the receiver acquires all

of the signaled information (e = 1).

Proof. Proofs are provided in the Appendix.

As long as the senders expect that e is not too low, there is sufficient signaling,

and no information is wasted (e = 1). However, if senders make no effort at all as

a result of a self-fulfilling belief about a very low e , will not acquire any signaling

f1 = 1 f

2 = 0, for instance,

information as it would be worthless. In particular, if

the equilibrium outcome is discriminatory against type 2. This results in Lemma 1

resembles statistical discrimination in the literature.

However, like statistical discrimination models, this model does not explain prejudice. It does not explain why one group should expect a particularly lower e than

the other. Prejudice (like discrimination) is always a relative concept. Offering a

type 1 sender an opportunity to prove his qualification becomes prejudice because

the same opportunity is not available to a type 2 sender for no proper reason. That

is, prejudice is 0 s choice for an asymmetric distribution of the opportunities between

the two types of senders. This benchmark framework is inadequate to explain prejudice, because the framework treats a decision for one type in isolation from a decision

for the other. In the next section, we build a model in which the receiver considers

both types simultaneously in comparison.

4

Model of Strategic Signaling

For , the value of senders’ signals depends on the need. Let be the parameter

that incorporates the need for signaled information. Roughly speaking, represents

f, 0, and a higher incentive to signal e lowers

If , for a high enough level of

the value of signals. Then, is not always better off with greater signaling efforts. In this case,

ignoring information is not necessarily inefficient because signaling itself is ineffective and cannot be

considered to be prejudice.

8

10

the likelihood of an available return from successful signaling for senders, or the

available positions that needs to fill with quality senders. Given that we have

two candidates, we assume that ≤ 2. If = 2, is willing to hire all senders

as long as they are qualified and, thus, there is no competition between the senders.

However, when 2, needs to compare two senders to select the best candidate. To

be selected, a sender must have not only a qualifying signal, but also a better signal

than the competitor’s. Thus, senders’ signaling decisions become interdependent.

Below, we show that as declines, the competition between senders intensifies and

prejudice is more likely to occur.

In this paper, prejudice differs from discrimination in the level of information

that has, although in both situations, refers to the index in selecting senders.

There is prejudice when decides to refuse an opportunity to learn more about the

quality of senders of one type, while being receptive to the information from senders

of the other type. Discrimination, on the other hand, is treating senders of two types

differently after acquiring all available information about them.

Let denote the probability that chooses and acquires all of the signals from

all = 1 2 in this new game of strategic signaling. Prejudice requires first that

chooses ( = 0). In that case, also must decide what fraction of the acquired

information should be from each . Suppose that acquires the information from

types 1 and 2 with probabilities b1 = ∈ [0 1] and b2 = (1−) ∈ [0 1] respectively.

Prejudice occurs when = 0 and b1 6= b2 .

may need to use in selection even after acquiring all of the signaling information ( = 1). If both senders have qualifying signals,( , ), given that 2, the

receiver will have to use to choose between the two qualified candidates to fit . Let

b1 = ∈ [0 1] (b2 = (1 − ) ∈ [0 1], respectively) be the probability that type 1

(2) sender is selected in this case. When b1 12 we say that there is comparative

discrimination in favor of type 1. Comparative discrimination occurs when = 1

and b1 6= b2 .

If is chosen and both senders have , chooses type with a b probability at

stage 3. If only one of them has , selects the sender with with a probability

of 0 = min{ 1}, 0 ≤ 1. If no sender has a qualifying signal, no one is selected. If

chooses instead, selects type with a probability of b . Only senders with

qualifying signals are selected for the position.9

9

For the same reason explained in Footnote 5, we make this behavioral assumption to simplify

11

4.1

Sender’s problem

Let Ψ2 be the probability that a type 2 sender invests in signaling. Then, for given

, b and b , a type 1 sender decides to make an effort to signal if and only if

( | ) = Ψ2 [ (b1 ) + (1 − ) (b1 )] + (1 − Ψ2 )[0 + (1 − )b1 ] − 1

( | ) = 0, or

(4)

1 b1 = [1 + (1 − )b1 ]

where 1 = 0 − Ψ2 (0 − b1 ), and Ψ2 = (2 + (1 − )2 ). Similarly, a type 2

sender decides to choose if and only if 2 b2 = [2 + (1 − )b2 ] , where

2 = 0 − Ψ1 (0 − b2 ), and Ψ1 = (1 + (1 − )1 ). Then, a type sender makes

a signaling effort with probability, where

= (b ) = ([ + (1 − )b ] )

(5)

b1 = , and b2 = (1 − ). (5) shows how the competition between the two senders

affects each sender’s best response function. From (1), when senders choose signaling

efforts independently, the cut-off for signaling incentive was e = [e + (1 − e )e ] .

To compare e and b , suppose that e = b , and e = 0. Since b ≤ 0 , and

0 ≤ 1, we find that b ≤ e always, with a strict inequality for at least one if 2.

Therefore, other things being equal, the senders’ incentive to signal is lower for all

in interactive signaling.

Proposition 1 (Strategic effect of competitive signaling) Other things being equal, if

2, interaction between two senders reduces their incentives to signal.

When 2, one sender’s signaling effort imposes a negative externality on the

other sender. For a type 1 sender with a signal, the selection is guaranteed if type

2 does not signal. However, if type 2 does, the return from signaling is available

only with b1 ≤ 1 probability. As declines, it becomes more difficult to expect a

return from their signaling effort (i.e., a lower ). Thus, senders’ incentive to signal

decreases. If is too small, no signaling would be worthwhile. To avoid such a case,

we assume that has a lower bound , ∈ (, 2]. 10

the analysis.

10

Let be the level of at which = , where satisfies = e ( ) and . Since

b = [ + (1 − )b ] , when = 0, b1 = b1 = . In this case, even if = 1, if ,

b1 = and the signal is too costly for to use. Thus, we assume that is greater than

this level.

12

On the other hand, (5) shows that the interaction occurs only if chooses . If

is chosen ( = 0), b = b , a sender’s best response becomes independent of the

other, eliminating the effect of strategic interaction. This implies that one of the most

important roles of prejudice is to remove the impact of interaction and competition

between the two types. Thus, when the interaction between two types lowers the

value of signaling significantly, has a greater incentive to choose and to remove

the impact of interaction. We discuss this issue in detail in Section 5.2.

4.2

4.2.1

Receiver’s problem

Optimal Comparative Discrimination

First, consider ’s decision on the optimal when is chosen and observes ( , )

from both types of senders. Upon observing ( , ), favors a type 1 sender if and

[1 (b1 )2 (b2 ) − 2 (b2 )1 (b1 )] 0, where ∆ = 2 1 2 + (1 −

only if (1−)

∆

2 (2 )

1 (1 )

1

⇔

)(1 2 + 2 1 ) + (1 − )2 1 2 . This condition holds iff 2

(2 )

(1 )

()

Φ2 (b2 ) Φ1 (b1 ), where Φ () = () is the ratio of the probabilities that the two

types signal, = . Then, the optimal is characterized as follows.

⎧

⎪

⎨

max

=

[ ]

⎪ min max

⎩

min

if Φ2 (b2 ) Φ1 (b1 )

if Φ2 (b2 ) = Φ1 (b1 )

if Φ2 (b2 ) Φ1 (b1 )

(6)

where max = min{1 1 } and min = max{0 1 − 1 }.

This shows that sets the optimal so as to minimize prediction errors. The

1 (1 )

increases as the signaling function becomes noisier

probability ratio Φ1 (b1 ) = 1

(1 )

and thus the size of prediction error for type 1 increases. Thus, if Φ2 (b2 ) Φ1 (b1 ),

it implies that type 2 has a greater prediction error, given the observation that the

two types had equally qualifying efforts. Thus, the optimal is to favor type 1 with

a lower prediction error, = max .

Comparative discrimination differs from statistical discrimination in several aspects. First, comparative discrimination requires competing senders who are compared in their "relative" strength, whereas in determining statistical discrimination,

senders are not compared. Second, comparative discrimination is required only when

the senders have equally qualifying signals, whereas statistical discrimination does

not require such a condition. When senders are in competition, since a sender with

13

a relatively stronger signal has an advantage, there is no need to use the index to

discriminate unless the senders’ signals are not differentiable. On the other hand, in

the case of statistical discrimination, what gives rise to discrimination is self-fulfilling

beliefs about each sender’s qualification, instead of a comparison based on signals.

At stage 2, the receiver ’s expected payoff from acquiring all the information is

( ) = e1 1 ( ) + e2 2 ( ) − 2

(7)

where e is defined in (2), 1 = 0 − Ψ2 (0 − 0 ), 2 = 0 − Ψ1 (0 − (1 − )), and

Ψ = ( + (1 − ) ). (7) shows how competition affects the value of signals

for . Without competition, () = e − . Now, the value of a signal from type 1

e1 is weighted by 1 which depends on type 2’s signaling effort Ψ2 . The weight 1

decreases if type 2’s signaling Ψ2 increases, and vice versa.

4.2.2

Optimal Level of Prejudice

The receiver’s payoff from is

() = [e1 + (1 − )e2 − ]

(8)

From (8), for a given , () is merely a convex combination of signaling values

from the two senders, e1 and e2 . The weight of the signaling from type 1 (type

2, respectively) is ((1 − )). optimizes the weight considering whether type 1

is expected to generate a greater signaling value than type 2. If expects that

e1 e2 , it is best to favor type 1, = max , and vice versa. Thus, the optimal is

characterized as follows.

⎧

⎪

max

if e1 e2

⎨

=

(9)

[min max ] if e1 = e2

⎪

⎩

if e1 e2

min

where max = min{1 1 } and min = max{0 1 − 1 }. Note that if = 2, = 12, and

as declines, diverges from 12.

14

5

5.1

Equilibrium

Comparative Discrimination

To understand how the equilibrium is determined under full information, , suppose

) Φ2 (b

). In this

that signaling is much easier for type 1 for any given b

, i.e., Φ1 (b

situation, if ( , ) is observed after , rationally infers that the type 2 sender

is more likely to have quality given that signaling was more difficult for type 2 to

do. Thus, favors type 2 to minimize the prediction error. Expecting this, senders

adjust their signaling incentives accordingly. Expecting a favorable treatment (a low

) upon ( , ), type 2’s incentive to signal b2 increases, whereas b1 decreases. The

() is increasing in (Eeckhoudt and Gollier [1995]).

MLRP implies that Φ () =

That is, the quality of signals deteriorates as it becomes easier to signal. As a result,

Φ2 (b2 ) increases, whereas Φ1 (b1 ) decreases, which reduces ’s incentive to favor type

2. Proposition 2 describes the equilibrium .

Proposition 2 Suppose there exists a ∗ ∈ [0 1] at which Φ2 (b2 ( ∗ )) = Φ1 (b1 ( ∗ ))

and ∗ ∈ [0 1]. Then, in equilibrium, if acquires all of the signaled information

and ( , ) is observed, the optimal comparative discrimination is ∗ . If such a ∗

does not exist, the equilibrium is min or max .

) 6= Φ2 (b

), ∗ 6= 12. Thus, in general, optimal comparative discrimination

If Φ1 (b

) Φ2 (b

) at any

is discriminatory. In particular, Proposition 2 implies that, if Φ1 (b

b

, the condition Φ1 (b1 ) = Φ2 (b2 ) requires b1 b2 . Then, it must be that 1 − .

Therefore, the optimal is set to counterbalance the effect of unequal signaling

conditions for the two senders.

) Φ2 (b

) for a given b

. Then, ∗ 1 − ∗ .

Corollary 1 Suppose Φ1 (b

Suppose that it is particularly difficult for minority students to pursue higher

education because of the high costs and that many of them are discouraged by the

large income disparity between minority and non-minority groups. Corollary 1 implies

that, in this case, if both a minority student and a non-minority student have the

same standardized test scores, it is optimal for college admission offices to favor the

minority student, as the probability that the student has quality is higher than

that of the non-minority student. However, if the senders are ex ante identical, the

optimal is to treat the two types equally.

15

Corollary 2 If the two senders are ex ante identical and they have equally qualifying

signals, ∗ = 12 is optimal.

Since comparative discrimination counter-balances the effect of initial signaling

conditions for each sender, it reduces discriminatory outcomes in equilibrium.

5.2

Prejudice

Under the expectation of = 0, b1 = and b2 = (1 − ) . As long as a sender

is selected in the first round (with a or (1 − ) probability), the return from

signaling is guaranteed. Since is independent of senders’ signaling decisions, their

only objective is to optimize their own signaling efforts independently for a given

or (1 − ).

Proposition 3 For 2, if an index-based pre-screening takes place ( = 0) in

equilibrium, the equilibrium ∗ is either ∗ = min or ∗ = max .

Proposition 3 states that if 2, 0 decision to use to pre-screen ( = 0)

always leads to prejudice, b∗1 = max b∗2 = min (or b∗1 b∗2 ). For the rest of our

analysis, we assume that type 1 is favored if prejudice occurs, ∗ = max , without loss

of generality.

5.3

Equilibrium

At stage 2, the receiver’s expected payoffs are ( ) = e1 1 ( ) + e2 2 ( ) − 2

and ( ) = [ e1 + (1 − )e2 − ] 0. chooses if and only if ( ) ≤

( ), or

(1 − Ψ2 )(0 − )e1 + (1 − Ψ1 )(0 − (1 − ))e2 + Γ( − ) (2 − ) (10)

|

|

|

{z

}

{z

}

{z

}

1

2

3

where Γ = (1 − ) [1 2 − 1 2 ] and and are given in (6) and (9).

The term e shows the net gains in type ’s signal from switching to full information () if separating occurs (i.e., type chooses but the other type − does

not), whereas 3 shows the net gains from when pooling occurs (i.e., both types

choose ). To understand equilibrium conditions, suppose expects e1 ≥ e2 and

thus plans to implement = max if is chosen. This results in (0 − max ) = 0, and

16

1 = 0, which implies that never gains more from type 1’s signaling by switching

from to . What matters to is how much he gains from offering a type 2 sender

more opportunity to signal, 2 and 3 . The extra gain from type 2’s signal is not

large enough if

(1 − Ψ1 )(0 − min )e2 + Γ( − max ) (2 − ) = .

|

|

{z

}

{z

}

2

(11)

3

Thus, if 2 e2 + 3 is very small, prejudice occurs ( = 0, = max ) in equilibrium.

Proposition 4 summarizes the PBE when the two senders are ex ante identical.

Proposition 4 Suppose Φ1 = Φ2 = Φ. When there is prejudice, = 0, and the

equilibrium signaling incentives are

b1 = max b2 = min

(12)

Under full information ( = 1), ∗ = 12, and the equilibrium incentives are b∗1 =

b∗2 = b∗ , where

b∗ = ∗ ( ∗ ) and

∗ ( ∗ ) = 0 − Ψ ( ∗ )(0 − ∗ ).

(13)

(14)

Let ∗ and ∗ be the value of 2 e2 + 3 evaluated at (b∗ b∗ ) and (b1 b2 ), respectively.

1. If ∗ , and ∗ , the unique equilibrium involves full information and no

discrimination ( = 1, ∗ = 12, = max ).

2. If ∗ , and ∗ , the unique equilibrium involves prejudice. ( = 0,

= min , = max ).

3. If ∗ ∗ , there are multiple equilibria at ( = 1 ∗ = 12, = max )

and ( = 0, = min , ∗ = max ).

4. If ∗ ∗ , there is a unique mixed strategy equilibrium at (0 =

1, 12, = max ).

+(2 −1 )

From Proposition 4, we can identify the source of prejudice. Prejudice arises in

equilibrium when competitive signaling cannot create a sufficiently high signaling

17

value and induce ∗ or ∗ . Corollary 3 shows when the conditions are likely

to be satisfied.

Corollary 3 Other things being equal, prejudice is likely to arise if or is low, or

Φ = is high.

That is, has a greater incentive to pre-judge senders without sufficient information if the added value of finding another −quality sender is not too high (a low )

or −quality is difficult to distinguish because it is too easy for any sender to signal

(a high Φ ). For the same reason, is more likely to choose prejudice when is low.

As declines, signals become less valuable to . This reduces the senders’ incentive

to signal, b∗ or b2 , which in turn, lowers the value of full information and, thus, is

more likely to choose prejudice.

6

Policy Implications

In this section, we discuss the implications of the main findings in this paper in the

context of affirmative action policies and the No-Child-Left-Behind policy. First, we

discuss the implication of Color-Blind affirmative action that bans any race-based

choice. Then, we discuss the implication of a purely competition-oriented college

admission policy when minorities face a severe disadvantage in signaling and the role

of the No-Child-Left-Behind policy in this case.

6.1

Color-Blind Affirmative Action

In the context of college admissions, color-sighted affirmative action means that the

admissions office is allowed to consider race as a factor when making a decision. In

contrast, affirmative action bans, or color-blind affirmative action, in contrast, denies

any race-based decision on the basis of a non-discriminatory principle, advocating

purely merit-based selection. The system of purely-merit based selection corresponds

to the competitive signaling under full information with no comparative discrimination ( = 12) in the current framework. Although there is merit in competitive

signaling given the inefficiency in disregarding informative signals under prejudice,

our findings concerning optimal comparative discrimination indicate that a purely

non-discriminatory policy is not always optimal.

18

From Proposition 2 and Corollary 1, we find that, if the senders are not ex ante

identical, the optimal level of comparative discrimination is to favor a disadvantaged

sender. This is because signaling efforts observed from senders facing greater difficulty

in signaling indicate a greater probability of high quality. In the context of college

admissions, this implies that, if two applicants have equally qualifying credentials,

allowing race-based decisions (color-sighted affirmative action) to favor minority indeed can be optimal.11 In this case, insisting on a purely non-discriminatory policy,

= 12 6= ∗ , would lower the value of signals under a competitive signaling system,

∗ , which would increase the receiver’s incentive to move to a more intensive indexbased decision, prejudice. Thus, such a purely non-discriminatory policy may indeed

backfire and promote prejudice.

In this paper, the need for an index-based decision exists even under competitive

signaling because both senders may have equally qualifying signals. Similarly, in

reality, even under a purely-merit based system, there may be a situation in which

the senders are not clearly distinguishable by their signals because the signals are

intrinsically imperfect. For example, highly qualified students can obtain a score of

88 and less qualified students can obtain 89 on a test. Because senders’ signals may

not be perfect in revealing their hidden quality, there is a need for another proxy

in decision-making. This paper finds that for that reason, even under a merit-based

system, allowing an index-based decision to improve the incentives of a disadvantaged

group can indeed improve the soundness of the merit-based system.

As a result of affirmative action bans for higher education, in California, Michigan,

and Texas, any race-based decision is now prohibited in the college admission process.

There have been some doubts that color-blind affirmative action actually promotes

efficiency. Chan and Eyster (2003) and Fryer et al (2008) argue that a color-blind

policy can be inefficient because strict enforcement of such a policy is impossible and

admissions offices may still use other race-related variables in deciding admissions

instead of race. Prior to the ban, although race could be a factor, the schools relied

primarily on standardized test scores and GPAs for admission. New admission policies

now give more weight to other traits, such as the student’s standing in his/her high

school as well as leadership and extra-curricular activities.12 Hence, in practice, color11

Fu (2006) makes a similar argument in a model of contest. He shows that affirmative action

favoring minorities improves the efficiency of a contest.

12

For example, in California and Texas, graduating high school seniors who are in the top 4% and

10%, respectively, of their class are guaranteed admission to the state’s university system.

19

blind affirmative action may simply replace race with other indices that are closely

related to race for admission criteria. The new admission criteria are often viewed as

more inefficient than race. This confirms the prediction in this paper that a purely

non-discriminatory policy may indeed promote more inefficiency.

6.2

The Effectiveness of Competitive Signaling

From the investigation on what promotes the receiver’s incentive to discard potentially valuable information, we find that the gist of the question lies in whether a

competition-oriented system is efficient. The immediate implication of Proposition 1

and Corollary 3 is that a competitive signaling mechanism may not always be efficient

if excessive competition among the senders destroys their signaling incentive.

However, Case 2 of Proposition 4 (or (11)) indicates that there is a more serious

issue when competitive outcomes are no different than that from prejudice, i.e., 2 e2 +

3 is very small. For example, suppose economic hardship significantly limits the

possibility of a high quality minority (type 2) to signal, e.g., Ψ2 ≈ 0, Φ1 Φ2 , and

even under competitive signaling, at b∗2 , 2 (b∗2 ) ≈ 0 In this case, e2 ≈ 0. Hence,

there is no essential difference between prejudice and competitive signaling in the

outcomes. In both cases, the signaling effort from a minority is substantially lower

than that from a majority. For the minority, there is no incentive to signal under

prejudice, and signaling is not affordable under competitive signaling. In this case,

there is no real gain from a competitive signaling system.

A competitive system is effective if competitive signaling can offer a meaningful

difference in signaling incentives for minority senders who would not have the same

opportunity under prejudice. This requires that signals are closely correlated with

the hidden quality, rather than an irrelevant factor like economic hardship. In an

effort to ensure that the signals are free from the influence of other irrelevant factors,

the Head Start program or the No-Child-Left-Behind policy can play an important

role. As the policies make the signaling environment more homogenous for both races,

any observed signaling outcomes would be correlated more with the hidden quality

for either race than the economic hardship. Thus, the policies enhance the value of

signaling under competition.

20

7

Conclusion

This paper models prejudice in a signaling game between a receiver and two senders

who differ in one irrelevant, but observable, index. Prejudice occurs when the receiver

chooses to (partially) ignore more informative signals from the senders in favor of less

informative indices from the senders. In equilibrium, prejudice is likely to arise if

competitive signaling is inefficient. Acquiring all of the signaled information under

competitive signaling may be too costly for the receiver if competition reduces senders’

signaling incentives substantially and worsens the quality of overall signals. In such

a case, prejudice removes the impact of competition by pre-screening senders on the

basis of their observable index. If signaling does not reveal enough information even

under competitive signaling, another index-based decision may be necessary. In such

a case, the optimal level of comparative discrimination will favor a disadvantaged

sender to minimize prediction errors.

The analysis of policy implications based on these results indicates that colorblind affirmative action is not always optimal and can actually increase the likelihood

of prejudice. We point out the importance of the Head Start program and the No

Child Left Behind policy in improving the quality of a signal itself. This is because

competitive equilibrium may not be effective if the signals are not better proxies for

the hidden quality than an index.

8

Appendix

1. Proof of Lemma 1

For any given ∈ [0 1], if = 1, b = , = ( ), and e (b ) ,

confirming that = 1 is an equilibrium, for = 1 2and = 1 1 2 2. For

= 0, it must be that () (), i.e., e (b ) , at equilibrium b . When

= 0, b = . Thus, if is low enough, e ( ) . Let be the level of

b that satisfies e ( ) = in the range where b . For e ( ) , needs

to be low enough that . Let be the level of that satisfies = .

Then, for , equilibrium involves = 0. In this case, since () ≤ 0 for all

∈ [0 1], the optimal = 0.

2. Proof of Proposition 2

21

Suppose 0. By construction, in equilibrium, for given and ,

Φ (b∗ ) = Φ ( [ (0 − Ψ− (0 − b )) + (1 − )b ])

⇔ b∗1 = [ (0 − Ψ2 (0 − )) + (1 − )] = Ω1 (b∗2 (b∗1 ))

⇔ b∗2 = [ (0 − Ψ1 (0 − (1 − ))) + (1 − )(1 − )] = Ω2 (b∗1 (b∗2 )).

At min b2 = 0, b1 0 is at its maximum, and at max b2 , b1 0 is at its minimum.

Since Ω is continuous and monotone decreasing in the element, by Fixed Point

Theorem, such a b∗ exists and is unique. The stability condition requires that the

slope of the best response function for type 1 to be greater than that for type 2, i.e.,

¯

µ

¯

¯−Ψ−10

2

¯

¶¯

¯

1

¯ |−Ψ01 (0 − (1 − ))|

(0 − ∗ ) ¯

⇔ 1 2 Ψ01 Ψ−10

2 (0 − )(0 − (1 − ))

If all the signaled information is acquired in equilibrium ( = 1), at b∗ , ∗ 1 since

0 = min{ 1} ≤ 1, (0 − ) 0, Φ 0, and b∗ .

(1) An increase in increases b1 but decreases b2 . When b is differentiable,

2

1

2

1

2

1

=

=

,

= Ψ2 − Ψ2 (0 − ) = Ψ2 − 2

(0 − ),

Ψ2

1

2

and = −Ψ1 − (0 − (1 − )) = −Ψ1 − 1 (0 − (1 − )) where

1 = 1 + (1 − )1 and 2 = 2 + (1 − )2 . Thus, by collecting terms, we

get

(Ψ2 + 2 Ψ1 (0 − ))

b1

=

≥0

b2

(Ψ1 + 1 Ψ2 (0 − (1 − )))

= −

≤0

(15)

(16)

where = 1 − 2 2 1 2 (0 − )(0 − (1 − )) 0 by stability condition.

2

1

0,

0 from (15) and

(2) Then, given that Φ is increasing in b , and

∗

(16), Φ2 (b2 ) − Φ1 (b1 ) is decreasing in . Thus, for , Φ2 (b2 ) Φ1 (b1 ), and thus

is inclined to lower , and for ∗ , Φ2 (b2 ) Φ1 (b1 ), and thus, is inclined

to increase . Therefore, in equilibrium, the receiver randomizes at ∗ such that

Φ2 (b2 ( ∗ )) = Φ1 (b1 ( ∗ )).

(3) Since Φ2 (b2 )−Φ1 (b1 ) is decreasing in , ∗ exists if Φ2 (b2 ( min ))−Φ1 (b1 ( min ))

0 and Φ2 (b2 ( max )) − Φ1 (b1 ( max )) 0. Thus, if Φ2 (b2 ( min )) − Φ1 (b1 ( min )) 0 or

22

Φ2 (b2 ( max )) − Φ1 (b1 ( max )) 0, ∗ does not exist. In the former case, = min ,

and in the latter case, = max . Both cases are trivial.

3. Proof of Corollary 2

When = 1, if there is no difference in the distributions, Φ1 = Φ2 = Φ, in

equilibrium, it must be that Φ(b2 ) = Φ(b1 ), which occurs only if b2 (∗ ) = b1 ( ∗ ) ⇔

1 = 0 − Ψ (0 − ∗ ) = 0 − Ψ (0 − (1 − ∗ )) = 2 . This requires that (0 − ∗ ) =

(0 − (1 − ∗ )), i.e., ∗ = 12. Thus, Φ(b2 ) = Φ(b1 ) if and only if ∗ = 12.

4. Proof of Proposition 3

A favorable treatment of type 1 ( = max ) based on the belief e1 e2 (from

(9)) actually results in e1 e2 because it gives greater incentives for type 1 to signal,

i.e., b1 b2 . Since e1 0 0, this confirms e1 e2 . Similarly, when = min , this

confirms e1 e2 . If e1 = e2 , any is optimal for . However, since e 0 0, for any

∈ (min max ),

e1 (max ) = e1 (max ) + (1 − )e2 (max ) e1 ( ) + (1 − )e2 ((1 − ) )

Thus, ∗ = max (or ∗ = min respectively) is always a weakly dominant strategy if

e1 ≥ e2 (e1 ≤ e2 ) is expected.

5. Proof of Proposition 4

A. 3 ≥ 0.

If = min , max , Γ 0, and thus, 3 0. If = max , − max = 0,

and thus, 3 = 0. If = ∗ , Γ = 0, and thus, 3 = 0.

B. General thresholds and

From Proposition 2, when 0, Φ1 (b1 ) = Φ2 (b2 ) in equilibrium. Plugging

= ∗ from (6), we obtain 3 = 0 since Γ = 0 at ∗ . Thus, (11) reduces

= 2 e2 = (1 − Ψ1 )e2 (2 − )

(17)

where = if ≤ 1 or (2 − ) if 1. On the other hand, will not acquire full

information ( = 0) in equilibrium if and only if 2 and 3 are small around the

23

equilibrium signaling efforts. Evaluating (11) at = 0, we obtain

= 2 e2 + 3 (2 − ),

(18)

C. When Φ1 = Φ2 = Φ (ex ante identical senders)

In this case, any difference in signaling error or signaling value is due to different

incentives, b . Throughout the proof, without loss of generality, we assume that type

1 is the favored type. Then since = max is a weakly dominant strategy, other things

being equal, plans to favor type 1 with a max probability, if is ever chosen.

1. Suppose expects Φ1 (b ) Φ2 (b ). (The argument is symmetric for the

case when( Φ1 Φ2 .) From (6), = min . At min , 1 = 0 − Ψ2 (0 −

if ≤ 1

(1 − Ψ2 )

min ) =

, and 2 = 0 − Ψ1 (0 − (1 − min )) =

1 − Ψ2 (2 − ) if 1

(

if ≤ 1

. Thus, 1 2 .

1 if 1

(

(1 − Ψ2 )

(a) Suppose ( min ) ( max ). In this case, = 1, b1 =

(1 − Ψ2 (2 − ))

(

, and thus, Φ1 Φ2 , which contradicts.

b2 =

b

(b) Suppose

( min

(

( ) ( max ) and thus, = 0. In this case, 1 =

0

b2 =

, and thus, Φ1 Φ2 . Equilibrium occurs at

( − 1)

= 0 if (11) is satisfied at the equilibrium incentives. Evaluating (11) at

b1 and b2 , we get ∗ = (1 − Ψ1 )e2 + 3 = (e2 (b2 ) − e1 (b1 )Ψ2 (b2 ))

(2 − ).

(

[(1 − Ψ2 ) + (1 − )]

(c) Suppose ( min ) = ( max ) . In this case, b1 =

[(1 − Ψ2 (2 − )) + (1 − )]

(

and b2 =

. Thus, to have Φ1 Φ2 , it is required

( + (1 − )( − 1))

that b1 b2 , which holds if and only if 1 and 1+Ψ1 2 . When 1,

2 (−1)

), which is

however, in the range where ∈ [0 1+Ψ1 2 ), b1 ∈ [1 1+Ψ

1+Ψ2

1

out of the range of consideration (where 1 0 by definition). Thus,

there is no mixed strategy equilibrium if Φ1 Φ2 .

24

2. Suppose expects Φ1 = Φ2 . This requires that b1 = b2 = b∗ .

(a) Suppose ( ) ( max ). Given that = 0, b1 = = b2 =

(1 − ) can occur if and only if ∗ = 12, which is a weakly dominated

strategy by ∗ = max . When ∗ = max , b1 b2 , which contradicts.

(b) Suppose ( ) ( max ). When = 1, b1 = b2 can occur only if at

∗ = 12. In this case, 1 = 0 − Ψ2 (0 − ∗ ) = 2 = 0 − Ψ1 (0 − (1 −

∗ )) = ∗ . Let b1 = b2 = b∗ = ∗ . Equilibrium occurs at = 1 if (17)

is satisfied at b∗ . That is,

∗ = (1 − Ψ1 (b∗ ))e2 (b∗ ) (2 − ),

(19)

where = if ≤ 1, or (2 − ) if 1.

(c) Suppose ( ) = ( max ). Since b1 = [1 + (1 − )max ] =

b2 = [2 + (1 − )min ] = b . Then, for ∈ [0 1] and 1, by

construction of b , we get

=

.

+ (2 − 1 )

(20)

Such a exists if 2 1 , which requires that ∗ = 12. In

equilibrium, and ( ) must satisfy (20) and the following.

∗ = (1 − Ψ1 ( ))e2 ( ) = (2 − ).

From (19) and (21),

∗

(2 − ) =

∗

and b =

(

2

if

+(2 −1 )

2 −(−1)1

if

(2−)+(2 −1 )

(21)

≤1

.

1

Also, for the randomization strategy , it must be that (2 − ) and

(2 − ).

3. Then, the PBE are summarized as follows: Let ∗ = (1 − Ψ1 (b∗ ))e2 (b∗ )

and ∗ = (1 − Ψ1 (b ))e2 (b ) be the values of evaluated at (b∗ b∗ ) and

(b b ), respectively. Similarly, ∗ = (e2 (b2 ) − e1 (b1 )Ψ2 (b2 )) is the value of

evaluated at (b1 b2 ).

(

(

0

b2 =

, = max , = min .

1. If ∗ (2 − ), = 0, b1 =

( − 1)

25

2. If ∗ (2 − ), = 1, b1 = b2 = b∗ = ∗ , = max , = 12.

3. If ∗ ∗ = (2 − ) ∗ , the unique mixed strategy is =

b1 = b2 = b , = max , = 12.

,

+(2 −1 )

6. Proof of Corollary 3

When 0, from Proposition 2, is optimally chosen to make Γ = 0, and thus,

3 = 0. Thus, ∗ is determined by 2 e2 = (1 − Ψ1 )(0 − min )e2 . By construction

from (2), e2 is lower if is low or Φ2 = 2 2 is high, ceteris paribus. An increase

in directly increases 2 e2 since (0 − min ) is always an increasing function of . It

also, indirectly increases 2 e2 by increasing the senders’ incentive to signal. Around

b∗ = [0 − Ψ (0 − )], the effect

h of a marginal increase

i in on the incentive is

∗

1

∗

= . Since = −(0 − 2 ) (2 + (1 − )2 ) + 12 Ψ , collecting terms,

we obtain

1

Ψ

b∗

2

0.

=

1

1 + (0 − 2 ) [2 + (1 − )2 ]

References

[1] Antonovics, K. and B. Backes (2014), "The Effect of Banning Affirmative Action on College Admissions Policies and Student Quality," Journal of Human

Resources, 49(2).

[2] Arrow, K.J. (1973), The Theory of Discrimination, Discrimination in Labor

Markets, edited by Ashenfelter, O. and A. Rees, Princeton University Press, pp.

3—33.

[3] Becker, G.S. (1957), The Economics of Discrimination, Chicago: The University

of Chicago Press.

[4] Bowles, S., G. Loury, and R. Sethi (2013), "Group Inequality," Forthcoming,

Journal of European Economic Association.

[5] Blume, L. (2005), "Learning and statistical discrimination," American Economic

Review, 95 (2), 118-121.

26

[6] Chan, J. and E. Eyster (2003), "Does Banning Affirmative Action Lower College

Student Quality?" American Economic Review, 93(3), 858-872.

[7] Chaudhuri, S. and R. Sethi (2008), "Statistical Discrimination with Peer Effects:

Can Integration Eliminate Negative Stereotypes?" Review of Economic Studies,

75, 579-596.

[8] Coate, S. and G.C. Loury (1993), "Will affirmative-action policies eliminate

negative stereo-types?" American Economic Review, 83, 1220-1240.

[9] Eeckhoudt, L. and C. Gollier (1995), “Demand for risky assets and the monotone

probability ratio order”, Journal of Risk and Uncertainty, 11, 113-122.

[10] Fang, H. and A. Moro (2011), "Theories of Statistical Discrimination and Affirmative Action: A Survey," Handbook of Social Economics, Vol. 1A, edited by

Jess Benhabib, Matthew O. Jackson and Alberto Bisin, North-Holland, 133-200.

[11] Fryer, R.G., G.C. Loury, and T. Yuret (2008), "An Economic Analysis of ColorBlind Affirmative Action," Journal of Law, Economics, and Organization, 24(2),

319-355.

[12] Fu, Q. (2006), "A Theory of Affirmative Action in College Admissions," Economic Inquiry, 44 (3), 420-428.

[13] Klumpp, T. and X. Su (2013), "Second-Order Statistical Discrimination," Journal of Public Economics, 97(1), 108-116.

[14] Mailath, G., Samuelson, L., and A. Shaked (2000), "Endogenous Inequality in

Integrated Labor Markets with Two-sided Search," American Economic Review,

90(1), 46-72.

[15] Mialon, S. and S.H. Yoo (2014), "Employers’ Preference for Discrimination,"

Emory University Economics Working Paper Series 14-02.

[16] Moro, A., and P. Norman (2003), "Affirmative Action in a Competitive Economy," Journal of Public Economics, 87, 567—594.

[17] Moro, A., and P. Norman (2004), "A General Equilibrium Model of Statistical

Discrimination," Journal of Economic Theory, 114 (1), 1—30.

27

[18] Phelps, E. (1972), "The Statistical Theory of Racism and Sexism," American

Economic Review, 62, 659-661.

[19] Spence, M. (1974), "Job Market Signaling," Quarterly Journal of Economics,

87, 355—374.

[20] The Society for Human Resource Management (SHRM) (2011), "Executive Brief:

What Factors Influence Cost-Per-Hire?" www.shrm.org/research/benchmarks/.

28