PASSING THE TEST, BUT MAKING THE GRADE? Milwaukee Public Schools’

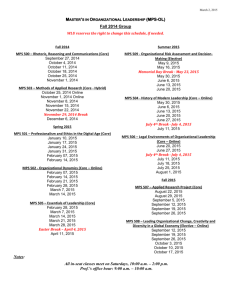

advertisement