Nelson and Plosser Revisited: A Re-Examination using OECD Panel Data Christophe Hurlin

advertisement

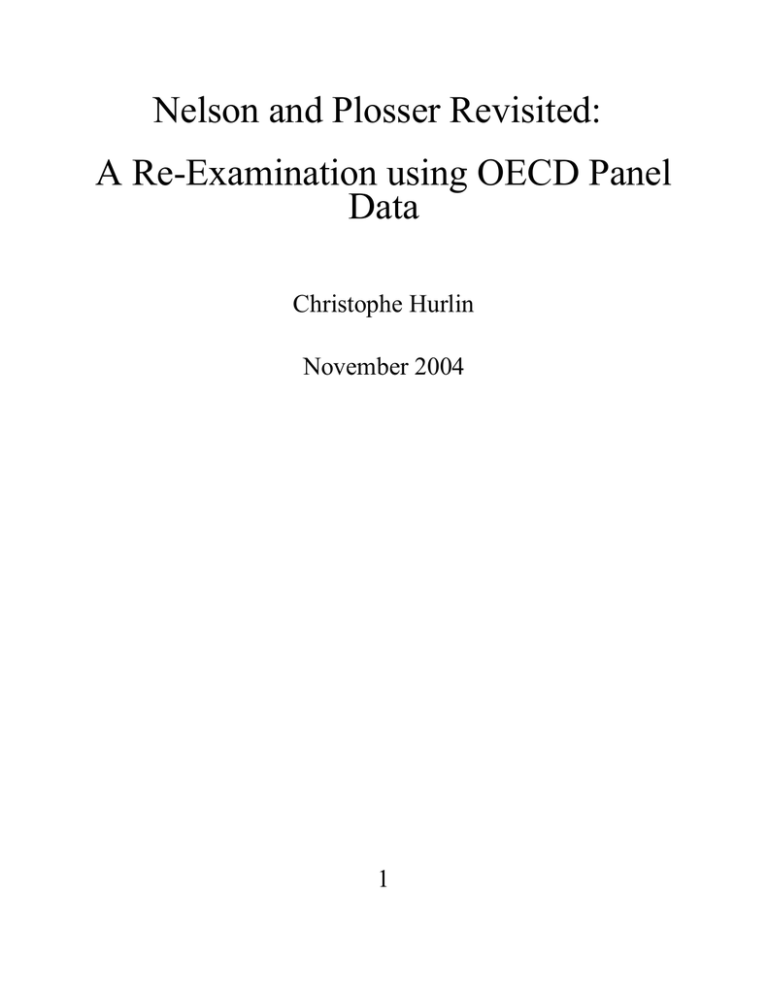

Nelson and Plosser Revisited: A Re-Examination using OECD Panel Data Christophe Hurlin November 2004 1 1 MOTIVATIONS Twenty two years after the seminal paper by Nelson and Plosser (1982), why testing the presence of a unit root in the same macroeconomic series by using a panel of OECD countries? • Testing the homogeneity of the unit root result in an international panel framework • Technical reason: the power deficiencies of pure time series-based tests for unit roots and cointegration, even for the ’’new generation’’ of powerful procedures of test (ADF-GLS in Elliott, Rothenberg and Stock, 1996, MaxADF in Leybourne, 1995). • A new generation of panel unit root tests allows to take into account the genuine international dimension of a panel. – These tests relax the restrictive assumption of crosssectional independence. – The international, sectoral or regional co-movements of the economic series, largely documented since for instance Backus and Kehoe (1992). 2 The cross-sectional independence assumption in panel unit root tests • Two generations of panel unit root tests can now be distinguished (Hurlin et Mignon, 2004) • The common feature of first generation tests is the restriction that all cross-sections are independent. • Under this independence assumption the Lindberg-Levy central limit theorem or other central limit theorems can be applied to derive the asymptotic normality of panel test statistics. • Levin and Lin (1992, 1993); Levin, Lin and Chu (2002); Choi (2001); Im, Pesaran and Shin (1997, 2003). • However, this cross-sectional independence assumption is quite restrictive in many empirical applications. =⇒ More generally, this assumption raises the issue of the validity of the panel approach in macroeconomic, finance or international finance. 3 MESSAGES =⇒ Testing the unit root in a panel with international shocks or international dependences is not economically equivalent to a collection of individual time series tests or to test unit root in panel under the cross-sectional independence assumption. =⇒ Parallel between the dichotomy cross-sectional independence versus correlations in panel unit root tests and the dichotomy general versus partial equilibriums in macroeconomics. =⇒ So, it is not only a technical problem of power and size to know if (i) the unit root must be tested in panel or in time series and (ii) if it is necessary to consider crosssectional dependent processes. This a genuine economic issue linked to the importance of international, regional, sectorial or individual dependencies in the dynamics. For these reasons, we propose here a re-examination of the seminal work of Nelson and Plosser for the OECD, based on panel unit root tests without and with cross-sectional dependencies. 4 A second generation of panel unit root tests • The second generation panel unit root tests relax the cross-sectional independence assumption. • The first issue is to specify the cross-sectional dependencies, since as pointed out by Quah (1994), individual observations in a cross-section have no natural ordering. • The second problem is that the usual t-statistics unit root tests have limit distributions that are dependent in a very complicated way upon various nuisance parameters defining correlations across individual units. • We distinguish two groups of tests: the first group tests are based on a dynamic factor model or an error-component model . The cross-sectional dependency is then due to the presence of one or more common factors or to a random time effect. • The tests of the second group are defined by opposition to these specifications based on common factor or time effects. In this group, some specific or more general specifications of the cross-sectional correlations are proposed. 5 =⇒ In this paper, these various panel unit root tests are applied to OECD panel databases for the same 14 macroeconomic and financial variables as those considered in Nelson and Plosser (1982). =⇒ The period considered is 1950-2000 : the issue of breakpoint =⇒ Our results highlight the importance of (i) the heterogeneous specification of the model and (ii) the crosssectional independence assumption. =⇒ For some macroeconomic variables generally considered as non-stationary, such as the real GDP for instance, the null of unit root is strongly rejected for our OECD sample with first generation tests. On the contrary, when the international cross-correlations are taken into account in the dynamic analysis, the results are clearly more in favour of the unit root for all the considered variables, including the unemployment rate. 6 2 2.1 FIRST GENERATION UNIT ROOT TESTS Im, Pesaran and Shin unit root tests • The well-known IPS test (1997, 2003) is now avalaible under usual software (Eviews 5.0) Their model with individual effects and no time trend is: pi [ ∆yit = αi + ρiyi,t−1 + β i,z ∆yi,t−z + εit (1) z=1 • The null hypothesis is defined as H0 : ρi = 0 for all i = 1, ..N and the alternative hypothesis is H1 : ρi < 0 for i = 1, ..N1 and ρi = 0 for i = N1 + 1, .., N, with 0 < N1 ≤ N . • Their test is based on the (augmented) Dickey-Fuller statistics averaged across groups. Let tiT (pi, β i) with β i = β i,1, .., β i,pi denote the t-statistic for testing unit root in the ith country, the IPS statistic is: N 1 [ t barNT = tiT (pi, β i) (2) N i=1 7 • Under the crucial assumption of cross-sectional independence, the statistic t barN T is shown to sequentially converge to a normal distribution when T tends to infinity, followed by N . A similar result is conjectured when N and T tend to infinity while the ratio N/T tends to a finite non-negative constant. • In order to propose a standardization of the t-bar statistic, IPS have to compute the values of E [tiT (pi, β i)] and V ar [tiT (pi, β i)]. • Two solutions can be considered: the first one is based on the asymptotic moments E (η) and V ar (η). The corresponding standardized t-bar statistic is denoted Zt bar . • The second solution is to carry out the standardization of the t-bar statistic using the means and variances of tiT (pi, 0) evaluated by simulations under the null ρi = 0. l k √ SN −1 N t barNT − N i=1 E [tiT (pi , 0)| ρi = 0] t Wtbar = SN −1 N i=1 V ar [tiT (pi , 0)| ρi = 0] d −→ N (0, 1) T,N→∞ • Although the tests Ztbar and Wtbar are asymptotically equivalent, simulations show that the Wtbar statistic performs much better in small samples. 8 RESULTATS • If we consider the standardized statistic Wtbar , the unit root hypothesis is not rejected for 8 macroeconomic variables out of 14 at a 5% significance level: nominal GDP, real per capita GDP, employment GDP deflator, consumer prices, velocity, bond yield and common stock prices. • Except for the nominal GDP, the results are robust to the use the standardized statistic Ztbar based on asymptotic moments instead of Wtbar . • More surprising, except for the nominal GDP and the unemployment rate, the results are also robust when we consider the statistic ZtDF bar based on the average of Dickey Fuller individuals statistics. • The results are globally robust to the specification of deterministic component. • Special care need to be exercised when interpreting the results of the 6 variables for which the null hypothesis is rejected. Due to the heterogeneous nature of the alternative, rejection of the null hypothesis does not necessarily imply that the non stationarity is rejected for all countries. 9 2.2 Fisher type unit root tests • Idea: testing strategy based on combining the observed significant levels from the individual tests (p-values) =⇒ Fisher (1932) type tests • Choi (2001) and Maddala and Wu (1999). • Let us consider pure time series unit root test statistics (ADF, ERS, Max-ADF etc.). If these statistics are continuous, the corresponding p-values, denoted pi, are uniform (0, 1) variables. Consequently, under the assumption of cross-sectional independence, the statistic proposed by Maddala and Wu (1999) and defined as: N [ PM W = −2 log (pi) (3) i=1 has a chi-square distribution with 2N degrees of freedom, when T tends to infinity and N is fixed. • For large N samples, Choi (2001) proposes a similar standardized √statistic: −1 SN N N PMW − E [−2 log (pi)] log (pi) + s ZM W = = − i=1 √ N V ar [−2 log (pi)] (4) 10 RESULTATS TESTS DE FISHER • The results confirm our previous conclusions. If we consider the PM W test at a 5% significant level, we do not reject the unit root for 7 out of 14 variables. • The only difference with the IPS results is for the nominal GDP, for which we reject the null here. This is precisely the only variable for which the two IPS standardized statistics, Wtbar and Ztbar , do not give the same conclusions. • Except for the real per capita GDP, the conclusions are identical with the Choi’s standardized statistic. • The results are globally robust to the specification of the deterministic component, except for industrial production, nominal GNP and money. • Contrary to the IPS tests, the Fisher tests lead to the rejection of the null for unemployment rate in a model with time trends. This point clearly indicates the ambiguity of the non stationarity analysis for this variable. 11 CONCLUSION PART I • With the panel unit root tests based on the cross-sectional independence assumption, the conclusions on the non stationarity of OECD macroeconomic variables are no clear-cut. • The unit root hypothesis is strongly rejected for 4 macroeconomic variables (real GDP, wages, real wages and money stocks), which are generally considered as non stationary for the most of OECD countries. • The non stationarity is also rejected for the unemployment rate, but in this case, it is not surprising given the times series results (Nelson and Plosser, 1982). • The non stationarity is robust to the choice of the test and the choice of the standardization only for 6 variables (employment, GDP deflator, consumer prices, velocity, bond yield and common stock prices). ⇒ So, we are far from the general results obtained by Nelson and Plosser. • Are these surprising results due to the restrictive assumption of cross-sectional independence used to derive the asymptotic normality of the test statistics? 12 • Obviously, these first generation tests are likely to yield biased results if applied to panels with a cross-sectional dependency. • First intuition: Maddala and Wu (1999) =⇒ important size distortions. size = Pr [H1/H0 true] (5) • Two solutions: – Adaptation of first generation unit root tests (Maddala and Wu, 1999) – Development of new tests • How to specify these cross-sectional dependencies? – Metric of economic distance (Conley, GMM 1999) – With a factor structure – Others approaches 13 3 3.1 A SECOND GENERATION UNIT ROOT TESTS Tests based on factor structure • For all these tests, the idea is to shift data into two unobserved components: one with the characteristic that is strongly cross-sectionally correlated and one with the characteristic that is largely unit specific. • The testing procedure is always the same and consists in two main steps: in a first one, data are de-factored, and in a second step, panel unit root test statistics based on defactored data and/or common factors are then proposed. • These statistics do not suffer from size distortions as those which affect the standard tests based the cross-sectional independence assumption when common factors exist in the panel. 14 • In this context, the unit root tests by Bai and Ng (2001, 2004) provide a complete procedure to test the degree of integration of series. • yit = a deterministic component + common component expressed as a factor structure + error idiosyncratic. • Instead of testing for the presence of a unit root directly in yit, Bai and Ng propose to test the common factors and the idiosyncratic components separately. • For that, Bai and Ng have to use a decomposition method of the data which is robust to the degree of integration of the common or idiosyncratic components. • Bai and Ng accomplish this by estimating factors on firstdifferenced data and cumulating these estimated factors. 15 • Let us consider a model with individual effects and no time trend: yit = αi + λiFt + eit (6) where Ft is a r × 1 vector of common factors and λi is a vector of factor loadings. • The corresponding model in first differences is: ∆yit = λi ft + zit where zit = ∆eit and ft = ∆Ft with E (ft) = 0. (7) • The common factors in ∆yit are estimated by the principal component method. Let us denote fet these estimates, ei the corresponding loading factors and zeit the estimated λ residuals. • Then, the ’differencing and re-cumulating’ estimation procedure is based on the cumulated variables defined as: t t [ [ fˆms êit = zeis (8) F̂mt = s=2 s=2 for t = 2, .., T, m = 1, .., r and i = 1, .., N. • Bai and Ng test the unit root hypothesis in the idiosyncratic component eit and in the common factors Ft with the estimated variables F̂m t and êi t. 16 • To test the non stationarity of the idiosyncratic component ∆êit = δ i,0êi, t−1 + δ i,1∆êi, t−1 + .. + δ i,p∆êi,t−p + µit (9) Let ADFeec (i) be the ADF t-statistic for the idiosyncratic component of the ith country. • The asymptotic distribution of ADFeec (i) coincides with the Dickey Fuller distribution for the case of no constant. =⇒ Therefore, a unit root test can be done for each idiosyncratic component of the panel. =⇒ The great difference with unit root tests based on the pure time series is that the common factors, as global international trends or international business cycles for instance, have been withdrawn from data. • Example : real GDP (table ??). For 12 countries, the conclusions of both tests are opposite at a 5% significant level: for 8 countries, the ADF tests on the initial series lead to reject the null, whereas the idiosyncratic component is founded to be non-stationary. 17 • Individual time series tests have the same low power as those based on initial series =⇒ pooled tests are also proposed. • These tests are similar to the first generation ones. However, the great difference is that the estimated idiosyncratic components êi,t are asymptotically independent across units • Let denote pcee (i) the p-value of the ADFeec (i) test, this statistic is:S N c − (i)] − N d c i=1 log [pe √ e Zee = −→ N (0, 1) (10) T,N→∞ N • RESULTATS (1) At a 5% significant level, the non stationarity of idiosyncratic components is not rejected only for 6 out of 14 variables (industrial production, employment, consumer prices, real wages, velocity and common stock prices). (2) It implies that if the macroeconomic series are nonstationary, this property seems to be more due to the common factors, as international business cycles or growth trends, than to the idiosyncratic components. 18 Testing the non-stationarity of the common factors • Bai and Ng (2004) distinguish two cases1. • When there is only one common factor among the N variables (r = 1), they use a standard ADF test in a model with an intercept. ∆F̂1t = c + γ i,0 F̂1,t−1 + γ i,1∆F̂1,t−1 + .. + γ i,p∆F̂1,t−p + vit (11) The corresponding ADF t-statistic, denoted ADFFec , has the same limiting distribution as the Dickey Fuller test for the constant only case. • If there are more than one common factors (r > 1), Bai and Ng test the number of common independent stochastic trends in these common factors, denoted r1. • If r1 = 0 it implies that there are N cointegrating vectors for N common factors, and that all factors are I(0). • Bai and Ng(2004) propose two statistics based on the r demeaned estimated factors F̂m t for m = 1, .., m. These statistics are similar to those proposed by Stock and Watson (1988). 1 In the first working paper (Bai and Ng, 2001), the procedure was the same whatever the number of common factors and was only based on ADF tests. 19 RESULTATS • There is only one common factor in real GDP and in real per capita GDP, which can be analyzed as an international stochastic growth factor. For both variables, this common factor is found to be non stationary. • For all the others variables, the estimated number of common factors ranges from 2 to 4. Whatever the test used, MQc or MQf , the number of common stochastic trends is always equal to the number of common factors, as reported on tables ?? and ??. • These results are robust to the choice of the number of common factors. =⇒ All the macroeconomic series are I(1) as in NP (1982) 20 3.2 Other Approaches: Chang nonlinear IV unit root tests • There is a second approach to model the cross-sectional dependencies, which is more general than those based on dynamic factors models or error component models. • It consists in imposing few or none restrictions on the covariance matrix of residuals. O’Connell (1998), Maddala and Wu (1999), Taylor and Sarno (1998), Chang (2002, 2004). • Such an approach raises some important technical problems. With cross-sectional dependencies, the usual Wald type unit root tests based on standard estimators have limit distributions that are dependent in a very complicated way upon various nuisance parameters defining correlations across individual units. There does not exist any simple way to eliminate these nuisance parameters. 21 One solution consists in using the instrumental variable (IV thereafter) to solve the nuisance parameter problem due to cross-sectional dependency. =⇒ Chang (2002). Her testing procedure is as follows. (1) In a first step, for each cross-section unit, she estimates the autoregressive coefficient from an usual ADF regression using the instruments generated by an integrable transformation of the lagged values of the endogenous variable. (2) She then constructs N individual t-statistic for testing the unit root based on these N nonlinear IV estimators. For each unit, this t-statistic has limiting standard normal distribution under the null hypothesis. (3) In a second step, a cross-sectional average of these individual unit test statistics is considered, as in IPS. 22 Let us consider the following ADF model: pi [ ∆yit = αi + ρiyi,t−1 + β i,j ∆yi,t−j + εit (12) 2 j=1 where εit are i.i.d. 0, σ εi across time periods, but are allowed to be cross-sectionally dependent. • To deal with this dependency, Chang uses the instrument generated by a nonlinear function F (yi,t−1) of the lagged values yi,t−1. • This function F (.) is called the Instrument Generating Function (IGF thereafter). ItU must be a regularly ∞ integrable function which satisfies −∞ xF (x) dx = 0. • This assumption can be interpreted as the fact that the nonlinear instrument F (.) must be correlated with the regressor yi,t−1. • Under the null, the nonlinear IV estimator of the parameter ρi, denoted e ρi, is defined as: l−1 k −1 e ρi = F (yl,i) yl,i − F (yl,i) Xi (Xi Xi) Xi yl,i k l −1 F (yl,i) εi − F (yl,i) Xi (Xi Xi) Xi εi (13) 23 =⇒ Chang shows that the t-ratio used to test the unit root hypothesis, denoted Zi , asymptotically converges to a standard normal distribution if a regularly integrable function is used as an IGF. e ρ d Zi = i −→ N (0, 1) for i = 1, ..N (14) T →∞ σ eeρi =⇒ This asymptotic Gaussian result is very unusual and entirely due to the nonlinearity of the IV. • Chang provides several examples of regularly integrable IGFs. In our application, we consider three functions in order to assess the sensitivity of the results to the choice of the IGF. IGF1(x) = x exp (−ci |x|) where ci ∈ R is determined by ci = 3 T −1/2s−1 (∆yit) where s2 (∆yit) is the sample standard error of ∆yit. IGF2(x) = I(|x| < K) IGF3(x) = I(|x| < K) ∗ x The IV estimator constructed from the IGF2 function is simply the trimmed OLS estimator based on observations in the interval [−K, K] . 24 RESULTATS • The results are clear. The SN statistics based on the instrument generating functions IGF2 and IGF3 provide strong evidence in favor of the unit root. The null is not rejected for all the considered variables and the corresponding p-values are always very close to one. • When the first instrument generating function IGF1 is used, the results are also in favor of the unit root hypothesis for 10 variables: the only exceptions are nominal GDP, GDP deflator, consumer prices, wages. • However, it is important to note that Im and Pesaran (2003) found very large size distortions with this test. • The non-stationarity appears to be a general property of the main macroeconomic and financial indicators. 25 1.Panel Unit Root Tests First Generation Cross-sectional independence 1. Nonstationarity tests Levin and Lin (1992, 1993) Levin, Lin and Chu (2002) Harris and Tzavalis (1999) Im, Pesaran and Shin (1997, 2002, 200 Maddala and Wu (1999) Choi (1999, 2001) 2- Stationarity tests Hadri (2000) Second Generation Cross-sectional dependencies 1- Factor structure Bai and Ng (2001, 2004) 2- Other approaches Moon and Perron (2004a) Phillips and Sul (2003a) Pesaran (2003) Choi (2002) O’Connell (1998) Chang (2002, 2004) 26