Corporate Tax Segment 9 Corporate Divisions

advertisement

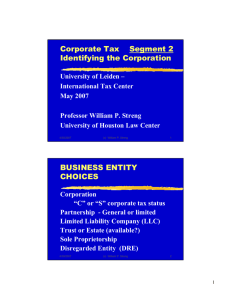

Corporate Tax Segment 9 Corporate Divisions University of Leiden – International Tax Center May 2007 Professor William P. Streng University of Houston Law Center 4/30/2007 (c) William P. Streng 1 Alternative Formats for Corporate Divisions 1. Spinoff Cf., § 301 dividend 2. Splitoff Cf., Redemption treatment §302 3. Split-up Cf., liquidation treatment §331 4/30/2007 (c) William P. Streng 2 1 Structure & Objectives Tax-free divisions may be: 1. Prorata or non prorata 2. Preceded by a drop-down into subsidiary 3. In exchange or not in exchange for parent stock Objectives 1. Increased market recognition. 2. Parts worth more than the whole 3. Option for tracking stock. 4/30/2007 (c) William P. Streng 3 Section 355 Requirements 1) Parent must control subsidiary before distribution (i.e., at least 80 percent §355(a)(1)(A) 2) Post-distribution active conduct of two or more businesses. §355(b)(2)(C) 3) Five year pre-distribution rule– Each trade or business must be been actively conducted during the five year period ending on the acquisition date and not acquired within the five year period. 4/30/2007 (c) William P. Streng 4 2 Section 355 Requirements, cont. 4) Distribution of all stock and securities of the controlled corporation. §355(a)(1)(D). 5) Not be a "device" for the distribution of earnings and profits. §355(a)(1)(B) 6) Judicial requirements: Business purpose, and Continuity of interest. 4/30/2007 (c) William P. Streng 5 Consequences to the Shareholders Receipt of the distribution--no gain or loss - §355(a)(1) Basis for stock allocated between two stocks based on relative fair market values. Tacked holding period. Treatment of "Boot"- not invalidating the basic transaction as tax-free. 4/30/2007 (c) William P. Streng 6 3 Consequences to Distributing and Controlled Corporations 1. Part of "D" reorganization plan: No recognition on distribution to shareholders of "qualified property" § 361(c)(1) & (2); i.e., no corporate level gain § 311(b) not applicable to a spinoff--since not a dividend § 336 not applicable to equivalent of a liquidating distribution when part of a taxfree reorganization. 4/30/2007 (c) William P. Streng 7 Consequences to Distributing and Controlled Corp., cont. 2. No preliminary "D" reorganization § 355(c) provides distributing corporation recognizes no gain or loss on the distribution of qualified property: stock or securities of distributing corporation. Gain recognized, however, on distribution of other than "qualified property" § 355(c)(2). Receipt of the distribution - no gain or loss §355(a)(1). 4/30/2007 (c) William P. Streng 8 4 Consequences to Distributing and Controlled Corp., cont. Basis for stock is allocated between two stocks based on relative fair market values. Tacked holding period. Treatment of "Boot“ - not invalidating the basic transaction as tax-free. 4/30/2007 (c) William P. Streng 9 5