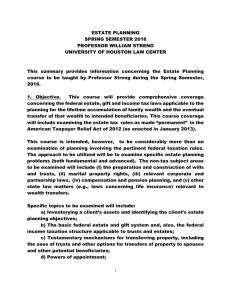

U.S. Real Property U.S. International Tax Law - 7

U.S. International Tax Law - 7

U.S. Real Property

Concerning foreign investment in U.S. real estate, consider:

1) U.S. income tax on operating profits from the real estate investment

2) U.S. income tax on disposition gain

(noting capital gains usually protected from tax)

5/4/2009 (c) William P. Streng 1

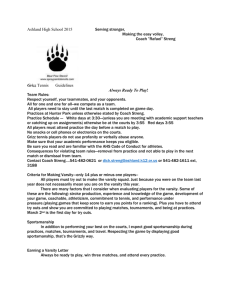

Management of Real Property

ETBUS – Gross or Net Taxation?

1) Continuous activities (by agent) and

ETBUS?

2) Rev. Rul. 73-522 cf., long-term “net leases” and not ETBUS.

3) Election available to enable ETBUS status a) §§871(d) & 882(d) (& tax treaty).

b) When make this election? c) Limitations on this election? Binding &

5/4/2009

Rev. Rul. 91-7 – gross income required.

(c) William P. Streng 2

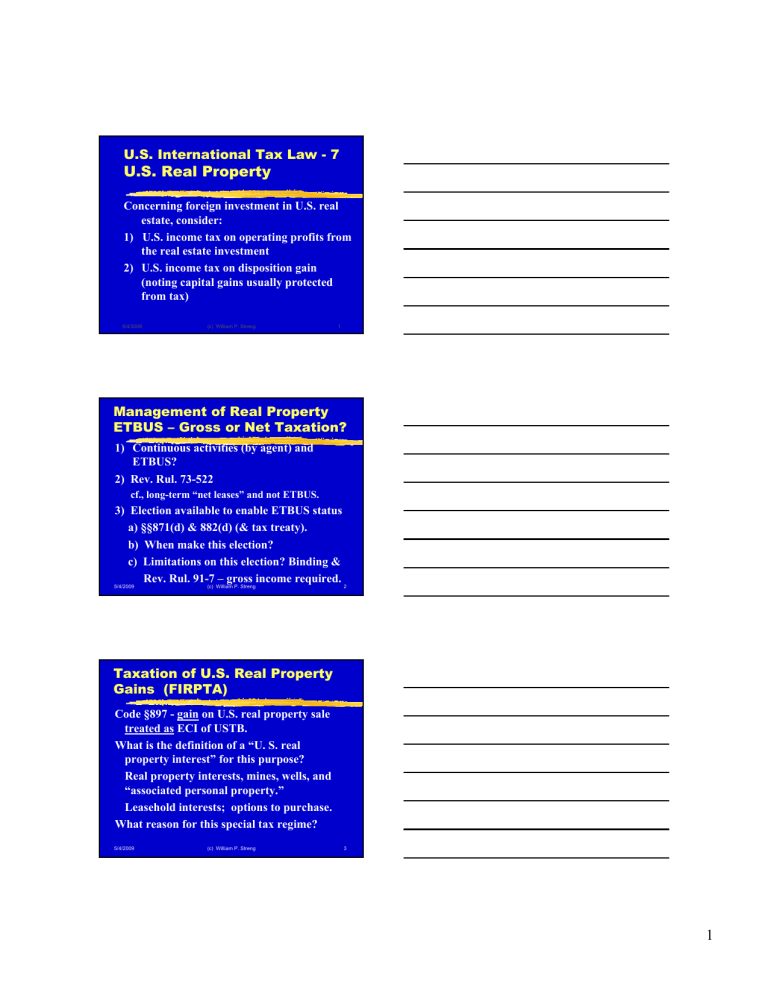

Taxation of U.S. Real Property

Gains (FIRPTA)

Code §897 - gain on U.S. real property sale treated as ECI of USTB.

What is the definition of a “U. S. real property interest” for this purpose?

Real property interests, mines, wells, and

“associated personal property.”

Leasehold interests; options to purchase.

What reason for this special tax regime?

5/4/2009 (c) William P. Streng 3

1

Further Definition of US Real

Property Interest

Consider:

(1) Loans, but an equity kicker loan?

(2) Sale of stock of a “United States real property holding corporation” (all gain subject to tax, not only U.S. %). cf., sale of stock of foreign corporation.

Not including publicly traded stock (except for 5%+ shareholder).

5/4/2009 (c) William P. Streng 4

Definition of U.S. Real

Property Holding Corp.

Holds U.S. real property greater than

50% of (1) real property and (2) trade or business assets of the corporation.

Note: comparative asset values (& currency fluctuations) could cause constant changing of above or below the 50% level.

Why exclude liquid assets from this

(c) William P. Streng 5

Treatment of the Foreign

Corporation - Special Rules

1) Sale of shares of foreign corporation; but, liquidation & redemption distribution?

2) Distribution by foreign corporation of its appreciated U.S. real property triggers gain recognition. Code §897(d)(1).

3) Possible applicability of tax nonrecognition provisions. E.g., Rev. Rul.

84-160 & Code §351 dropdown of assets into a U.S. holding corp. Code §897(e).

5/4/2009 (c) William P. Streng 6

2

Code §1445 FIRPTA

Withholding at Source

Transferee must withhold 10 percent of the gross amount realized from the disposition transaction.

Applies to the proceeds (including debt) and not to the gain realized from the real estate sales transaction.

U.S. income tax return is required from the seller (to determine net gain/loss).

5/4/2009 (c) William P. Streng 7

Code §1445 Exceptions to

Withholding at Source

Exceptions to the withholding requirements - Code §1445(b):

1) not a foreign seller - individual.

2) Corporation not a USRPHCo.

3) IRS “qualifying statement” received.

4) future use for residence purposes.

5) regularly traded shares (+/- 5%).

5/4/2009 (c) William P. Streng 8

Code §1445 &

Entity Distributions

Foreign corporate distributions withhold 35% of the gain amount.

Tax applies to the corporation which knows its tax basis for distributed asset. §1445(e)(2). U.S. corp.?

Partnership & trust distributions – withhold 35% of the gain realized to extent allocable to a foreign partner/

5/4/2009 foreign trust beneficiary. §1445(e)(1).

9

3

FIRPTA & Tax Treaties

Any immunity provided under an applicable bilateral income tax treaty? No.

See U.S. Model Treaty, Article 13, re jurisdiction to tax real estate income – including disposition gain - in the country of situs (including stock of a

USRPHCo.).

5/4/2009 (c) William P. Streng 10

Example

USRPHCo Status? 50%+ Test

NRA invested in wholly owned U.S. corporation:

1) NYC apartment for $2 million

2) stock (publicly traded): $2 million

3) art gallery: $2 million (rented space; annual lease & no renewal right)

Consider (for FIRPTA purposes) the various alternatives concerning the relative fair market values of the several properties.

5/4/2009 (c) William P. Streng 11

Example

Foreign Corp. Stock Sale

NRA invested in wholly owned foreign corporation owning U.S. property.

The interest in a foreign corporation is not a U.S. real property interest.

Sale of this stock would not be taxed under FIRPTA, but the stock value should be reduced by the purchaser by the potential internal federal income

(c) William P. Streng 12

4