–11 U.S. Intl. Corporate Tax U.S. International Tax Law

advertisement

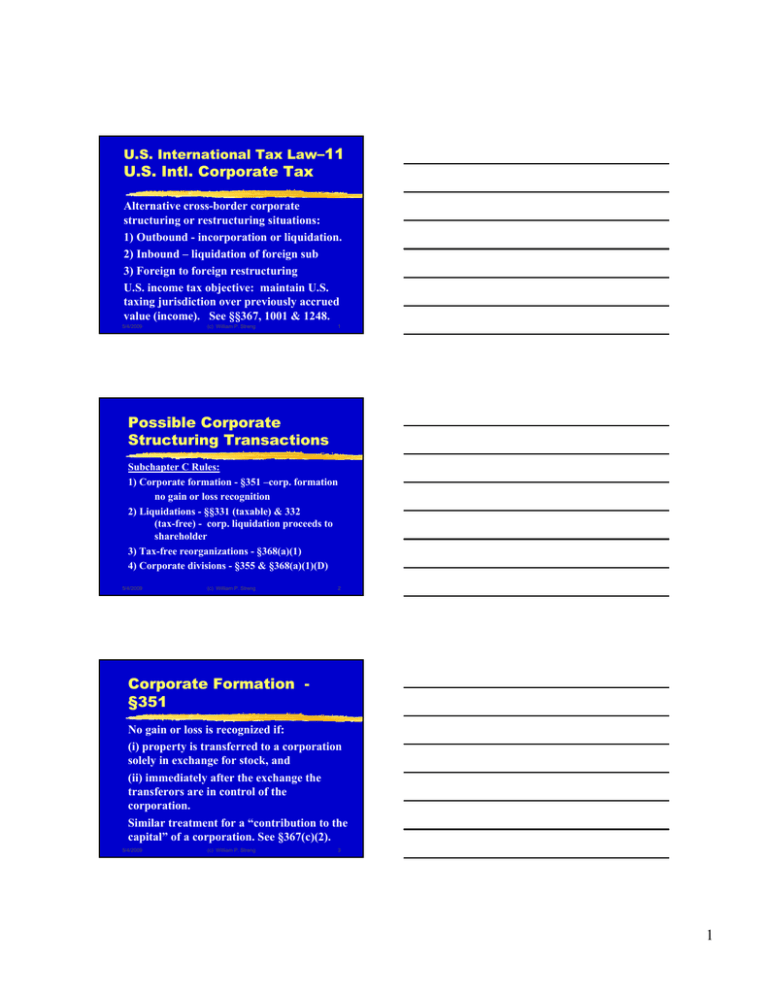

U.S. International Tax Law–11 U.S. Intl. Corporate Tax Alternative cross-border corporate structuring or restructuring situations: 1) Outbound - incorporation or liquidation. 2) Inbound – liquidation of foreign sub 3) Foreign to foreign restructuring U.S. income tax objective: maintain U.S. taxing jurisdiction over previously accrued value (income). See §§367, 1001 & 1248. 5/4/2009 (c) William P. Streng 1 Possible Corporate Structuring Transactions Subchapter C Rules: 1) Corporate formation - §351 –corp. formation no gain or loss recognition 2) Liquidations - §§331 (taxable) & 332 (tax-free) - corp. liquidation proceeds to shareholder 3) Tax-free reorganizations - §368(a)(1) 4) Corporate divisions - §355 & §368(a)(1)(D) 5/4/2009 (c) William P. Streng 2 Corporate Formation §351 No gain or loss is recognized if: (i) property is transferred to a corporation solely in exchange for stock, and (ii) immediately after the exchange the transferors are in control of the corporation. Similar treatment for a “contribution to the capital” of a corporation. See §367(c)(2). 5/4/2009 (c) William P. Streng 3 1 Taxable Corporate Liquidations- Shareholders 1) §331(a) - complete corp. liquidation to shareholders is treated as a distribution in exchange for stock. §331(a). 2) If foreign corp. (CFC) proceeds are received by a greater than 10% U.S. shareholder, the gain may be treated as ordinary income under §1248. 5/4/2009 (c) William P. Streng 4 Tax-free Corporate Liquidations - §332 Liquidation of U.S. sub into U.S. parent: 1) no gain is recognized to the distributing corporation - §337(a); and, 2) no gain is recognized to the recipient parent corporation under §332. Cross-border options in this context: 1) Foreign sub into U.S. parent (inbound) 2) U.S. sub into (c)foreign parent (outbound).5 5/4/2009 William P. Streng Corporate Tax-free Acquisitive Reorganizations Tax-free exchanges of corporate stock if a proprietary interest is maintained in corporate form. IRC §368 provides the definition of “reorganization” types. U.S. tax common law requirements: 1) Business purpose; 2) Continued proprietary interest; and, 3) Continuity of business enterprise. 5/4/2009 (c) William P. Streng 6 2 Types of Acquisitive Corporate Reorganizations §368(a)(1)(A) - statutory merger or consolidation - the surviving corporation must be a U.S. corporation to effect a merger under U.S. laws (or foreign?). B reorg. - “stock for stock” exchange. C reorg. - stock for assets exchange. Plus: triangular reorganizations (forward & reverse triangular mergers). 5/4/2009 (c) William P. Streng 7 Corporate Divisions §355 1) Spin-off - distribution of stock of a controlled corporation - cf., dividend. 2) Split-off - shareholders give up a portion of their stock in exchange for the stock of the controlled subsidiary - cf., redemption. 3) Split-up - stock of two or more subs distributed in liquidation of corporation cf., liquidation. 5/4/2009 (c) William P. Streng 8 Code §355 Requirements 1) Control of stock of subsidiary to be distributed. 2) Both corps engaged in business immediately after the distribution. 3) All (or most) of stock of sub to be distributed to shareholders. 4) Transaction not used principally as a “device” for the distribution of earnings. 5/4/2009 (c) William P. Streng 9 3 Anti-Importation of Loss Rules §362(e) limits tax basis upon the corporate acquisition of loss property. Total adjusted bases of the transferred properties must exceed the FMV of transferred properties immediately after the transaction for this limitation to apply. §362(e)(2)(A)(ii). 5/4/2009 (c) William P. Streng 10 Outbound exchange situations - §367(a) 1) Transfer of appreciated assets to a foreign corp. in an incorporation. 2) U.S. corporation is liquidated and assets are distributed to foreign shareholders. 3) Reorg. - Stock (or assets) of a U.S. corporation are acquired by foreign corp. for foreign corp. stock. 5/4/2009 (c) William P. Streng 11 Outbound Triangular Reorganizations 1) Forward triangular merger. 2) Reverse triangular merger. 3) “B” reorganizations - stock of foreign corporation is received for domestic stock. 4) “C” reorganization - stock of foreign corporation is received by domestic sub for domestic assets. 5/4/2009 (c) William P. Streng 12 4 “Other” Transfers §367(b) 1) Inbound liquidation of foreign corporation into U.S. corporation. 2) Stock of foreign corporation owned by U.S. shareholders acquired for stock of U.S. corporation (i.e., inbound). 3) U.S. shareholder of foreign corporation exchanges stock for other foreign corporation stock. 5/4/2009 (c) William P. Streng 13 Alternative tax treatments for cross-border transfers Outbound transfers: 1) Tax all appreciation when (a) all or (b) certain assets are transferred outbound. 2) No tax when appreciated assets are transferred outbound. 3) Obtain a ruling in advance - tollcharges imposed on transfers of certain assets. 4) Ruling request within 183 days after the 5/4/2009 (c) William P. Streng transaction - with anticipated tollcharges.14 §367(a) - Treatment for a §351 Transaction Code §351 eligibility is permitted based on the current inclusion in the U.S. income tax base of the accrued appreciation attributable to certain assets transferred to the foreign corporation. Code §367(a)(1) – is the recipient corporation treated as a “corporation” for federal tax purposes? Otherwise, no Subchapter C treatment. 5/4/2009 (c) William P. Streng 15 5 Transfers to Other Foreign Entities 1) §§1491-1494 excise tax provisions for outbound transfers. Repealed in 1997. 2) §367(d)(3) and §721(c) permit regulations on transfers to foreign partnerships. Cf., §704(c). 3) §684 concerning required gain recognition on transfers of appreciated property to foreign trusts. 5/4/2009 (c) William P. Streng 16 §367(a) Requirements for Outbound Transfers A foreign corporation is not treated as a "corporation". §367(a)(1). What is the effect of this treatment for §351 purposes? Possible taxation of asset transfers: consider tax character and source. And, then, tax basis adjustment. Exception is available for property transferred for use in the “active conduct” of foreign trade (c) orWilliam business. §367(a)(3)(A). 5/4/2009 P. Streng 17 Other §367(a) Outbound Transfers 1) Outbound liquidation. 2) Outbound corporate reorganization. Consider also: - Transfer of partnership interest to foreign corporation - §367(a)(4). - Change in tax classification of the entity from (e.g., partnership) to corporation. 5/4/2009 (c) William P. Streng 18 6 Defining an “Active Trade or Business” §367(a)(3)(B) applicability. 1) What is the “trade or business”? 2) “Active conduct” of business necessary. Substantial managerial and operational activities (not merely holding stock). 3) Conducted outside the United States. 4) Property is used in the trade or business (not listed stocks and bonds). 5/4/2009 (c) William P. Streng 19 Automatically Tainted Assets §367(a)(3)(B) 1) Inventory. 2) Installment obligations and accounts receivable. 3) Foreign currency and property denominated in foreign currency. 4) Where transferor is a lessor, unless transferee was the lessee (or, next slide). 5) Depreciable property - to the extent tax 5/4/2009 (c) William P. Streng depreciation claimed against U.S. income.20 Property to be Leased by the Transferee Treated as active conduct of trade or business property if: 1) Leasing of property constitutes active conduct of a leasing business; 2) Property is not used in the United States; 3) Need exists for substantial investment in the assets of the type transferred. Must be substantial marketing and customer service. 5/4/2009 (c) William P. Streng 21 7 Outbound Transfer of Corporate Stock Ordinarily outbound corporate reorganizations, rather than §351 incorporations. General rule of taxability upon the transfer of stock or securities of foreign corporations. Possible “GRA” alternative. “Limited interest in transferee” exceptions. (next slides) 5/4/2009 (c) William P. Streng 22 Transfer of Foreign Corporation Stock 1) U.S. transferor owning less than 5 percent of the stock of the transferee - no current U.S. income tax effect. 2) U.S. transferor owns more than 5 percent, then a five year gain recognition agreement (GRA) to avoid gain recognition. 3) If foreign corporation moves from CFC to non-CFC status - §1248 pickup. 5/4/2009 (c) William P. Streng 23 Transfer of U.S. Corporate Shares to Foreign Corp. No gain recognition if: 1) U.S. transferors with less than 50% ownership of the transferee (next slide). 2) Transferee is engaged in active conduct of a trade or business for 36 months prior to the transfer (and no sale anticipated). 3) U.S. transferor (i) owns less than 5% or (ii) if a 5% or greater U.S. transferor, has a gain recognition(c)agreement (GRA). 5/4/2009 William P. Streng 24 8 U.S. Corp. - U.S. Shareholder Status? As relevant for the tax-free exception for U.S. transferors with less than 50 percent ownership of transferee (p. 753): 1. Presumption that transferors are U.S. persons. 2. Obtain ownership statements from foreigners to show the 50 percent U.S. ownership threshold is not exceeded. 5/4/2009 (c) William P. Streng 25 Corporate Inversions U.S. corporation transformed into a foreign corporation. Future avoidance of U.S. income tax. No CFC status. Treatment of the shareholders? Tax recognition on transformation of entity. Transfer pricing/earnings stripping opportunities? 5/4/2009 (c) William P. Streng 26 2004 JOBS Act Corporate Inversion Rules §7874 - two different types of inversion transactions: 1) 80%+ stock identity – former shareholders own at least 80%. Foreign corp. deemed to be domestic. 2) 60-80% stock identity – corporate level gain recognized on stock & asset transfers. Plus, §4985 excise tax on stock options. Plus, §6043A IRS information reporting. 5/4/2009 (c) William P. Streng 27 9 Outbound Transfers of Intangibles Prior objective: (1) incur costs and deduct under §174 against U.S. source income and then (2) transfer the (zero basis) asset to a foreign subsidiary. Subsequent foreign income from using the intangible is immune from U.S. tax (possibly subject to Subpart F rules). Under §367(d) - treated as selling property in a licensing transaction. (next slide) 5/4/2009 (c) William P. Streng 28 Outbound Transfers of Intangibles, continued Amounts to reflect a reasonable royalty or disposition proceeds if a disposition by the foreign subsidiary occurs. §367(d)(2)(B) specifies a reduction of the E&P of the foreign corporation for the deemed royalty payments. §367(d)(2)(C) - ordinary income from sources without United States. Prior sourcing rule changed in 1997. (next slide)29 5/4/2009 (c) William P. Streng Outbound Transfer of Intangibles, continued Super-royalty provision applicable §367(d)(2)(A). Exception for foreign based goodwill which is transferred. Planning option: use a licensing agreement to transfer intangibles - then the pricing is determined under §482. 5/4/2009 (c) William P. Streng 30 10 §367(d), continued e) until TRA-97, also treated as U.S. source income. Now treated as foreign source. f) exception for foreign goodwill or going concern value. g) valuation problems – super-royalty provision, i.e., amount treated as received must be “commensurate with income”. h) Foreign corp. E&P reduction §367(d)(2)(B) cont. 5/4/2009 (c) William P. Streng 31 §367(d), continued Other §367(d) considerations: - Use a sale/license rather than §351 transfer? - Royalty is treated as an account receivable under §367(d). - Elect sale treatment? U.S. source ordinary income; Reg. §1.367(d)-1T(g)(2). -Transfer to a partnership – see §367(d)(3) (note partnership tax rule in a Subchap. C §). 5/4/2009 (c) William P. Streng 32 “Property” Requirement a Code §351 Element Rev. Rul. 64-56 - does “know-how” constitute “property” for §351? Or services? To be “know-how” the country where the transferee operates must afford the transferor substantial legal protection against the unauthorized disclosure and use of the process, formula, or other secret information involved. See Rev. Proc. 69-19. 5/4/2009 (c) William P. Streng 33 11 “Property” Transfer Requirement - §351 Transfer must be made of "all substantial rights" for a property transfer to occur for §351 purposes. Ordinarily, the transfer of economic rights for intangibles is accomplished by an exclusive license, rather than by a legal assignment. Retention of certain controls and rights of recapture may be acceptable for this purpose. 5/4/2009 (c) William P. Streng 34 Dupont case Non-Exclusive License Royalty-free non-exclusive license to sub to make, use and sell the product in France. Holding: §351 does not embody the same concepts as the capital gains provisions. Capital gains contemplate completeness of disposition, but §351 is based on control over the transferred rights. Held: Non-exclusive license to the subsidiary was a transfer of "property" for §351. 5/4/2009 (c) William P. Streng 35 Transfer as a “Contribution to Capital” §367(c)(2) - contribution to corporation treated as a constructive exchange for §367 purposes. If the transfer is made of an appreciated “intangible” - then subject to the further provisions of §367(d). 5/4/2009 (c) William P. Streng 36 12 Outbound Transfer of Intangibles, continued Disposition of transferred intangible accelerating transferor’s gain recognition. §367(d)(2)(A)(ii)(II). Option to elect to treat transfer of intangible as a deemed sale at fair market value. Ordinary gross income in the year of transfer, but probably U.S. source. 5/4/2009 (c) William P. Streng 37 Foreign Branch Loss Recapture Rules U.S. taxpayer operates foreign branch at a loss. These losses reduce U.S. taxable income. Then, transfers of foreign branch assets to foreign corporation. Foreign profits are then immune from current U.S. income tax (assuming Subpart F is not applicable). Branch loss recapture rules are applicable under §367(a)(3)(C). (next slide) 5/4/2009 (c) William P. Streng 38 Foreign Branch Loss Recapture, continued. Recapture the gain to the extent of previously unrecaptured losses of the branch. Type of recapture depends upon whether previously deducted as (1) an ordinary loss or (2) a capital loss. Note: Foreign tax credit provision (§904(f)(3)) takes precedence in determining recapture. 5/4/2009 (c) William P. Streng 39 13 Liquidation of U.S. Corp. into Foreign Parent §367(e)(2) denies nonrecognition of gain to a U.S. corporation making a liquidating distribution to a foreign parent corporation (80 percent or more). Cf. §§332 & 337. Exceptions (in regs): (1) when distributed assets are used in a U.S. trade or business; or, (2) if a U.S. real property interest. 5/4/2009 (c) William P. Streng 40 Liquidation of Foreign Corp into Foreign Parent No gain recognition on a “foreign to foreign” liquidation. §332. But, gain recognition is required if U.S. trade or business assets are transferred, unless the ten year gain recognition rule is applicable. Why? Exception from gain recognition when U.S. real property. 5/4/2009 (c) William P. Streng 41 Outbound Spinoffs §367(e)(1) Distribution of stock of sub by a U.S. corporation to a foreign person. If U.S. corporation distributes stock or securities of a U.S. or foreign subsidiary to a foreign person in a §355(a) transaction the distributing corporation recognizes gain under §367(e)(1). (exceptions, next slide) 5/4/2009 (c) William P. Streng 42 14 Outbound Spinoffs, cont. Exceptions: 1) After distribution both distributing and distributed controlled corps are U.S. real property holding corps. 2) 80% or more of stock of the U.S. corp is to distributees holding 5% or less of the distributing corp's stock, i.e., publicly held. 3) Distributing corp agrees to file an amended return if foreign distributee of 5/4/2009 (c) William Streng stock. 43 U.S. stock disposes ofP.that Outbound Transfers to Partnerships and Trusts Excise tax - §1491; repealed in TRA-97. §684 - gain recognition on transfers of appreciated property to foreign trusts and estates. §721(c) regulatory authority re contributions of appreciated property to partnerships. 5/4/2009 (c) William P. Streng 44 §367(b) Objectives Nonoutbound Transfers 1. Implement §1248 treatment - require recognition where §1248 gain would slip out of U.S. tax base or retain §1248 treatment for the future if postponement currently permitted. 2. E&P of foreign corporation moves up the ownership chain for corporations. 3. U.S. shareholder status – CFC? 5/4/2009 (c) William P. Streng 45 15 §367(b) - Foreign Sub into U.S. Parent Complete Liquidation of Foreign Sub into U.S. Parent Corporation: Pickup of the “all earnings and profits amount” by the U.S. shareholder. Reg. §7.367(b)-5(b). 5/4/2009 (c) William P. Streng 46 §367(b) - Foreign Sub into Foreign Parent Liquidation of Foreign Subsidiary into Foreign Parent Not a gain recognition event. E&P moves up. Reg. §7.367(b)-5(c). 5/4/2009 (c) William P. Streng 47 Share Exchanges 1. CFC to non-CFC §1248 pickup. Indirect FTC to corporate shareholder. 2. Exchange of second tier CFC stock by CFC for foreign corp. stock where not CFC status – §1248 move-up. 5/4/2009 (c) William P. Streng 48 16