Tax on Unrelated Contents Publication 598

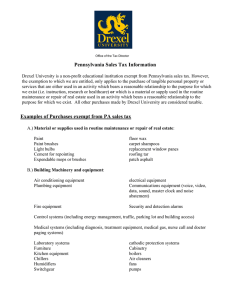

advertisement