40 - University of Idaho

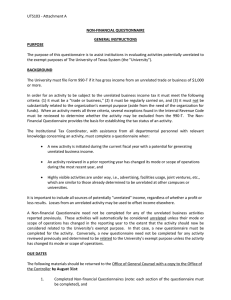

advertisement

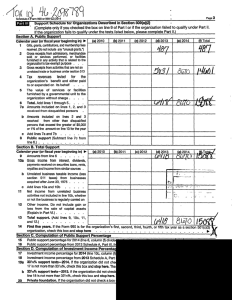

ATTORNEY-CLIENT PRIVILEGE – ATTORNEY WORK PRODUCT Counsel Markup Draft – re-write of earlier draft from General Accounting 10.60 -- Unrelated Business Income (Tax) Created/updated: May 1, 2009 September 29, 2009 Preamble: Some university revenue producing activities may result in unrelated business income as defined by the Internal Revenue Service (IRS). Generally this will involve funds derived from a university business activity that is not substantially related to the university’s exempt purposes of instruction, research and extension. B. Policy: The University is required to file an annual tax return to the IRS and the State of Idaho reporting all unrelated business income, and thus an annual review of all revenue generated by University Units must be done in order to ensure accurate reporting. To the extent an activity results in tax to the University, the Units generating taxable revenue are responsible for the payment of any tax due. C. Process/Procedure: General Accounting has a questionnaire that is used to make a determination as to the status of income derived from each activity. Prior to engaging in any new income producing activity, Units are required to complete the questionnaire. General Accounting may also require Units to update the questionnaire information for existing activities. The questionnaire is provided by General Accounting located at: http://www.uihome.uidaho.edu/default.aspx?pid=79447 . A spreadsheet will be sent out annually to all Units requiring them to review all revenue to determine if it is related or not to the exempt purpose of the university. The spreadsheet is to be filled out by department personnel and returned to general accounting by the stated deadline. D. Contact Information: Questions regarding unrelated business income should be directed to General Accounting gnrlacctg@uidaho.edu.