Bank Lending Channels During the Great Recession

advertisement

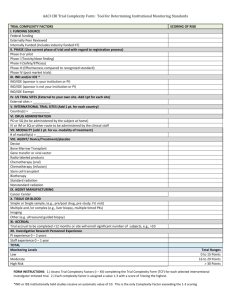

Bank Lending Channels During the Great Recession Samuel Haltenhof, Seung Jung Lee, and Viktors Stebunovs Federal Reserve Board The Role of Financial Intermediaries in Monetary Policy Transmission June 19-20, 2013 The views expressed are those of the authors and do not reflect those of the Federal Reserve System Introduction The bank’s lending channels for MFG industries: do they exist? are they significant? Which margin explains MFG employment: firm or household access to credit? the extensive or intensive margin? How to interpret MFG employment losses over the crisis? The bank lending channels Commercial and Industrial (C&I) loans not collateralized with real estate Consumer installment loans (CIL) are not collateralized Home equity lines of credit (HELOC) collateralized with real estate Data sources and breakdown LHS: Quarterly Survey of Employment and Wages data on employment and number of establishments for 21 MFG industries at the state level We focus intentionally on MFG industries RHS: Proxies for credit access at the state or nation level Senior Loan Officers Opinion Survey C&I loan standards to small firms at the state level (TS ) Willingness to originate CIL at the nation level (W) Z.1, CoreLogic, and TranUnion Home equity at the state and nation levels (HES and HE) Panel data index by industry, state, year over 1991 - 2011 Variation, Exogeneity, and Identification Geographic exogeneity assumption State-industry level employment affected by broader aggregates (Peek and Rosengren, 2000) Use difference-in-difference approach based on industry type C&I loans (EF × TA = 1): The degree of external finance dependence for physical capital investment (Rajan and Zingales, 1998) and asset tangibility (Braun 2008; Claessens and Laeven, 2003) HELOC (EF = 1): The degree of external finance dependence for physical capital investment (Rajan and Zingales, 1998) CIL and HELOC (DG = 1): The sensitivity of output to consumer credit (U.S. Census’ durable/nondurable goods industries) The total employment The results: The total employment Model EF x TA x state-lev. C&I loan tightness (TS ) EF x state-lev. home equity (HES ) DG x nation-lev. CIL willingness (W) DG x nation-lev. home equity (HE) Additional controls Fixed effects Error clustering 1 2 -0.02** -0.02 -2.03 -1.39 -0.07** -0.07 -2.07 -1.50 0.06*** 0.06** 7.70 2.51 0.19 0.19 6.07*** 4.44*** Nation/state vars. Nation/state vars. levels of TS , HES , W, HE Ind. x State Ind. x State Ind. x State Ind. x State Year R-square 0.18 0.29 Observ. 9500 Note: If significant at the 10% level, ** at the 5% level, and *** at the 1% level. t-statistics are reported below the coefficients. 3 -0.02** -2.08 -0.07** -2.08 0.06*** 7.78 0.19 6.09*** State vars. Ind. x State Year Ind. x State 0.22 The number of establishments: the last margin to adjust? The results: The number of establishments Model EF x TA x state-lev. C&I loan tightness (TS ) EF x state-lev. home equity (HES ) DG x nation-lev. CIL willingness (W) DG x nation-lev. home equity (HE) Additional controls Fixed effects Error clustering 1 2 0.01 0.01 1.51 0.67 -0.03* -0.03 -1.67 -0.72 0.01** 0.01 2.48 1.56 0.03 0.03 1.14 0.73 Nation/state vars. Nation/state vars. levels of TS , HES , W, HE Ind. x State Ind. x State Ind. x State Ind. x State Year R-square 0.04 0.16 Observ. 9500 Note: If significant at the 10% level, ** at the 5% level, and *** at the 1% level. t-statistics are reported below the coefficients. 3 0.01 1.56 -0.03* -1.69 0.01** 2.50 0.03 1.13 State vars. Ind. x State Year Ind. x State 0.07 The average establ. size: one of the margins to adjust? The results: The average establishment size Model EF x TA x state-lev. C&I loan tightness (TS ) EF x state-lev. home equity (HES ) DG x nation-lev. CIL willingness (W) DG x nation-lev. home equity (HE) Additional controls Fixed effects Error clustering 1 2 -0.03*** -0.03*** -3.15 -2.67 -0.03 -0.03 -1.06 -0.77 0.05*** 0.05** 6.97 2.21 0.17*** 0.17** 4.70 3.06 Nation/state vars. Nation/state vars. levels of TS , HES , W, HE Ind. x State Ind. x State Ind. x State Ind. x State Year R-square 0.11 0.17 Observ. 9500 Note: If significant * at the 10% level, ** at the 5% level, and *** at the 1% level. t-statistics are reported below the coefficients. 3 -0.03*** -3.16 -0.03 -1.03 0.05*** 6.96 0.17*** 4.71 State vars. Ind. x State Year Ind. x State 0.13 Robustness checks Exclusion of bank-friendly states or large states Different definitions of C&I Tightness and CIL Willingness measures Different definitions of home equity Different fixed effects and clustering International variables (the exchange rate index works) Sample to 1991-2007 (are the results driven by the crisis?) Robustness checks: Coefficient stability in Model 1 Dependent variable EF x TA x state-lev. C&I loan tightness (TS ) EF x state-lev. home equity (HES ) DG x nation-lev. CIL willingness (W) DG x nation-lev. home equity (HE) Additional controls Fixed effects Error clustering R-square Observ. Total employment -0.01 -0.73 0.01 0.13 0.05*** 3.74*** 0.25*** 5.71 Number of establ. Average size of establ. 0.03*** -0.04*** -3.31 -3.17 0.01 0.01 0.27 0.20 -0.02** 0.07*** -1.86** 4.83*** 0.03 0.22*** 0.75 4.67 Nation/state vars. levels of TS , HES , W, HE Ind. x State Ind. x State 0.13 0.07 7000 7000 Note: If significant at the 10% level, ** at the 5% level, and *** at the 1% level. t-statistics are reported below the coefficients. 0.05 7000 No structural break in the bank lending channels? A large shock to supply of loans? If there was a structural break in the economy, it apparently lied somewhere else. Back-of-the-envelope macro effects Consider actual declines in MFG employment from 2007 to 2010 Assume about 33 percent of banks tightened C&I loan standards per year Assume about 27 percent of banks decreased willingness to originate consumer installment loans per year ”Goodness of fit” (predicted change/actual change) Percent EF x TA = 0 EF x TA = 1 DG = 0 0.0 11.9 0.8 DG = 1 19.6 44.8 23.1 14.3 40.1 17.4 About 6 percent per year decline in HELOC access proxy explains an additional 10 percent of employment drop in DG industries, ”the overall explanatory power” is 25 percent Conclusions, caveat, and further work Access to credit affects employment mostly through changes in the average size of establishments Household access to finance matters more than that of firms The results do not appear to be driven just by the recent recession developments Both bank credit channels appear to have been economically significant in the Great Recession (”the overall explanatory power” is 25 percent) No insights into how employment losses in MFG industries are absorbed by other sectors (leave it for future work) Sectoral output, small vs large establishment, and more structural changes analysis? MFG industries’ gross output