ARTICLE RENEWABLE RESOURCES AND THE DORMANT COMMERCE CLAUSE

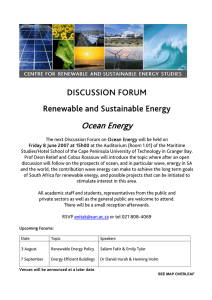

advertisement