THE DETERMINANTS OF CORPORATE LEVERAGE: A PANEL DATA ANALYSIS Research Discussion Paper

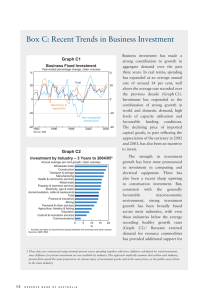

advertisement