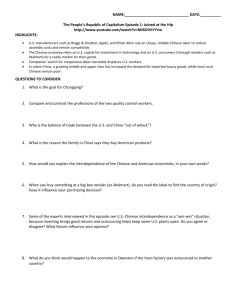

SECTION 4: CHINA’S AGRICULTURE POLICY, FOOD REGULATION, AND THE U.S.-CHINA AGRICULTURE TRADE

advertisement