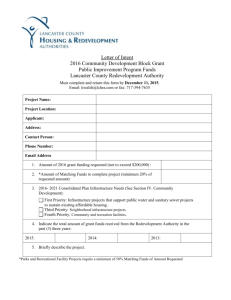

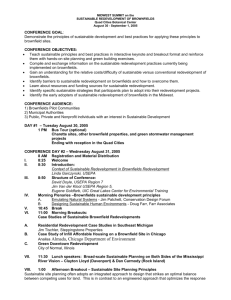

R G :

advertisement