Ricardian Rent-Extraction by Royalties under Asymmetric Cost Information John R. Boyce and

advertisement

Ricardian Rent-Extraction by Royalties under

Asymmetric Cost Information

John R. Boyce∗

and

Jennifer L. Winter†

University of Calgary

May 2009

Abstract

This paper models exhaustible resource extraction in a principal-agent framework. The government

captures resource rents through license fees and taxes, with private information held by firms about

their extraction costs in a two-period, two-type model. We consider contracts consisting of license fees,

production levels and taxes offered by the government and determine the optimal incentive-compatible

contract which induces truthful revelation. In a full commitment solution, production of the least efficient,

high-cost type is distorted below the full information outcome because of the information asymmetry.

Production of the efficient, low-cost type is the same as in the full information equilibrium, and the

low-cost type earns positive information rents. The distortion on high-cost production and the positive

information rents are required to induce truthful revelation of cost by the low-cost type. When the

government cannot commit to future taxes, all rents are captured in the second period. The license fee

decreases by the amount of rent captured by the government in the second period. The information rents

earned by the low-cost type increase compared to the full commitment solution.

1

Introduction

Governments often collect tax revenue from the extraction of exhaustible resources, such as

oil, natural gas and minerals. In exhaustible resource economies, resource tax revenue is

“bonus” revenue above that from general tax revenues, compared to economies with little

or no endowment of exhaustible resources. When exhaustible resource producing firms and

the government have symmetric information about the costs of production, it is well known

∗ Professor of Economics, Department of Economics, University of Calgary, 2500 University Drive, N.W., Calgary, Alberta,

T2N 1N4, Canada. email: boyce@ucalgary.ca telephone: 403-220-5860.

† Ph.D. Candidate, Department of Economics, University of Calgary, 2500 University Drive, N.W., Calgary, Alberta, T2N

1N4, Canada. email: jlwinter@ucalgary.ca.

1

that a government who wishes to extract rents in the most efficient manner possible should

do so using either an ex ante auction or an ex post cash-flow, or rent, tax. Burness (1976),

Conrad and Hool (1981, 1984) and Fraser and Kingwell (1997) have shown the superiority

of a cash-flow tax over an ad valorem tax in terms of government revenues and efficiency.

However, governments typically use a combination of auctions and ad valorem royalty taxes,

where the latter are taxes on output, rather than a combination of auctions and rent taxes.1

Several articles have attempted to explain the presence of royalties for capturing resource

rents by introducing uncertainty. The forms of uncertainty considered are demand and cost

uncertainty, as well as asymmetric information between governments and firms.

We consider the case of private information held by firms about their extraction costs

in a two-period, two-type model. A government values it’s revenues and firm profits, and

maximizes a weighted social welfare function. We consider contracts consisting of license fees,

production levels and taxes offered by the government and determine the optimal incentivecompatible contract that induces truthful revelation. In a full commitment solution with

asymmetric information, production of the least efficient, high-cost type is distorted below

the full information outcome because of the information asymmetry. The high-cost type earns

zero economic profits, as the license fee is equal to its’ profits. Production of the efficient,

low-cost type is the same as in the full information equilibrium, and the low-cost type

earns positive information rents. The distortion on high-cost production and the positive

information rents are required to induce truthful revelation of cost by the low-cost type.

When the government cannot commit to future taxes, all rents are captured in the second

period. The license fee decreases by the amount of rent captured by the government in the

second period. Again, the high-cost type earns zero economic profits, but the information

rents earned by the low-cost type increase compared to the full commitment solution.

General models of principal-agent theory with asymmetric information have been developed by Myerson (1979), Myerson (1982), Baron and Myerson (1982), Maskin and Riley

(1984), Laffont and Tirole (1987) and Holstrom and Milgrom (1991). The optimal solution to these models involve prices (or quantities) and transfers as functions of reported

costs in order to induce truthful revelation. Fudenberg et al. (1990) and Rey and Salanié

(1996) have augmented the principal-agent literature by introducing no commitment on the

part of the principal. Fudenberg et al. (1990) determine the conditions under which no

commitment is necessary. Rey and Salanié (1996) note that long-term relationships can be

efficiently governed by short-term contracts, provided there is no asymmetric information at

the contracting date. However, they also find spot-contracting may fail to achieve long-run

efficiency because of intertemporal smoothing, ratchet effects and time inconsistency in the

optimal structure of information rents. They conclude limited commitment is a necessary

and sufficient condition for long-run efficiency.

Lund (2009) reviews the literature on the taxation of non-renewable resources. He surveys

works that examine how taxes affect equilibrium price and extraction paths; studies involving

policy reforms; the analysis of tax effects on firms’ decision process; and auctions as an

alternative to taxation. The most common way to introduce uncertainty in the exhaustible

resource literature is through risk rather than asymmetric information. Articles that consider

1 Copithorne et al. (1985) discuss instruments available to the government for capturing economic rent from natural resources.

They suggest an acceptable system for Canada could be provincial net royalties at moderate rates, a federal cash flow tax and

bonus bids.

2

asymmetric information between firms and government are Garnaut and Ross (1975), Gaudet

et al. (1995), and Osmundsen (1995, 1998).

Garnaut and Ross (1975) was one of the first articles to introduce asymmetric information

in models of resource extraction. They examine the problem of a government attempting to

capture resource rents while preserving investment in the resource when firms are risk averse

and have private information about the value of the resource. The authors argue government

revenues can be increased by switching from cash flow or royalty taxes to a resource rent

tax. Fraser and Kingwell (1997) find a similar result under symmetric and full information.

The resource rent tax is a cash flow tax that becomes positive when a threshold internal rate

of return have been reached. The tax rate then increases as further threshold rates of return

are reached.

Gaudet et al. (1995) examine optimal taxation in the presence of asymmetric information about costs. Gaudet et al. (1995) model a two period dynamic incentive problem from

repeated interaction between a government (principal) and firm (agent). They assume a

continuum of types and type-specific ad valorem taxes on production. They find the information asymmetry shifts production to the future compared to full information extraction

for all types. We consider the no-commitment problem with two periods and two cost types.

In contrast to ?, only production of the high-cost type is distorted, but because of the

information asymmetry rather than a positive tax rate.

Osmundsen (1995, 1998) models asymmetric information about costs when the government captures revenue from a type-specific license fee with a continuum of types. Only

production of the most efficient, least cost type is not distorted. ? concludes the distortion

is the result of an implicit royalty tax, as the output decision is distorted in the same way

(a decrease in initial production and an increase in future production).

It should be noted, however, that Slemrod et al. (1994), in a two-type model of income

tax with tax brackets find that the top marginal tax rate should be zero when there is a

finite and known upper bound to the distribution of wages. This suggests the resource rent

tax may not be optimal, as it introduces tax brackets. Livernois (1992) examines the effect

of tax brackets on non-renewable resource extraction. Livernois finds the presence of tax

brackets in a severance tax system and a profits tax system can induce the firm to choose

an extraction profile with constant extraction rates over some interval of time. This is in

contrast to the typical (optimal) declining extraction profile.

We consider type-specific taxes, and compare revenues and welfare under royalty and cash

flow taxes. However, we abstain from considering resource rent taxes, though type-specific

taxes could be considered to introduce tax brackets. Furthermore, firms and the government

do not face risk over costs or demand uncertainty. Uncertainty over the value of the resource

is analogous to cost uncertainty or asymmetric information about costs in the government’s

decision problem. Authors that have considered the effect of risk on firm decisions and tax

revenues are Campbell and Lindner (1983), Chavas (1993), Grafton (1994) and Fraser (1991,

1998b, 2000, 2002). The general result is the tax rate becomes dependent on the level of risk

aversion of the firm responsible for extracting the resource.

Campbell and Lindner (1983) develop a model of optimal resource taxation for maximizing

the expected revenue of a risk neutral government. The tax system consists of a competitive

bid and a resource rent tax, as in Garnaut and Ross (1975). They consider one firm with

3

the same prior information as the government that bids for the mineral lease when there is

uncertainty over the value of the lease. With a risk averse firm, the optimal tax rate depends

on the risk associated with exploration of the mineral reserves; a risk neutral firm results

in a tax rate of zero. This is in contrast to our result, where the tax rate depends on the

instruments available to the government in reducing the information externality. However,

the result is similar in when bids are not type-specific, there is a positive tax on the low-cost

type.

Chavas (1993) introduces risk and risk aversion into a Ricardian model of the pricing and

allocation of land. Revenue uncertainty decreases the rental price of land, making landowners

worse off, as well as reduces farm output and production per unit of land. Grafton (1994)

examines the effect of uncertainty on expected resource rent in an individual transferable

quota fishery. Grafton finds tradeable quotas will maximize expected short run rent only

if uncertainty does not affect quota demand. Furthermore, uncertainty reduces the rent

captured by the resource owner. Similarly, we find asymmetric cost information reduces

government revenues and distorts production compared to the full information outcome.

Fraser (1991, 2000) compares different revenue systems under uncertainty. Fraser argues

that bid systems give a government more information about the value of a lease to a firm.

However, he also finds a risk-sharing (ad valorem) tax will generate more revenue as a firm’s

risk aversion increases. In contrast, we assumed risk neutral firms and government, and

found the when both mechanisms can be used, different systems yield identical revenues and

welfare. Fraser (1998b) suggests that with an auction system of lease allocation, government

revenue can be maximized by setting the tax rate less than 100%. Fraser (2002) compares

the Australian and British resource rent tax systems. The systems involve a threshold rate

of return, below which the tax rate is zero. Above the threshold, there is a positive tax on

profits. Fraser finds a low rate of return and tax rate pair is preferable if profit margins and

riskiness are low, and a high pair is preferable if profit margins and riskiness are high.

More recent articles examining asymmetric information and resource extraction have attempted to offer further explanations for the presence of royalty taxes. Luchsinger and

Mueller (2003) present a generalized model to examine a resource rent extraction problem in

a principal-agent framework. They incorporate asymmetric information, risk aversion and

uncertainty in the model. The model provides an outline for a general solution, but without

assumptions about specific functional forms does not yield a closed-form solution. Lund

(2002) observes that resource rent taxes are applied in open economies, or in one sector of

a larger economy. This creates an incentive to transfer revenues out of, and costs into, a

high-tax sector. Lund models the government’s optimal tax decision when monitoring is

imperfect, and finds the combination of a rent and a royalty tax can be used to maximize

tax revenue. Lund argues this is an explanation for the frequent occurrence of royalties in

practice. We do not model a combination of rent and royalty taxes, but a cash flow tax of

100% is equivalent to a license fee. Our results are similar, though we find a royalty tax is

unnecessary when type-specific bids are available.

Muller (2004) uses a principal-agent model to compare the performance of profit-sharing,

revenue-sharing and fixed fee schemes in incentive regulation and rent-extraction plans.

Muller develops this model in the context of a government attempting to capture rents

when an exhaustible resource firm has private information about costs. He finds the fixed

4

fee performs best in inducing efficient behavior. In contrast, we find rent and royalty taxes

equivalent for inducing the optimal incentive-compatible outcome when used in conjunction

with a fixed fee.

Amacher et al. (2001) develop a dynamic model of government policy choice to compare

different royalty systems. They apply the model to forest concessions in Malaysia. The

authors are able to determine how different royalty systems impact harvesting, government

rent capture and concessionaire profits. They find flat and differentiated royalties have

similar effects on harvesting and profits. However, government revenues would be increased

by differentiating royalties according to species. This is similar to the results presented

below, as we find either type-specific bids or taxes are necessary to maximize welfare under

asymmetric information.

Osmundsen (1995, 1998) has argued that an explanation for royalty taxes lies in the assumption of asymmetric information. Osmundsen (1995) develops a static model of taxation

in the presence of private information held by firms. In the presence of asymmetric information, he argues it may be optimal to deviate from neutral taxation, as (efficient) firms enjoy

information rents, and so the government faces a trade off between maximizing total resource

rent and capturing a high fraction of the information rents. To reduce the information rent,

it is optimal to distort the level of extraction. Osmundsen (1998) develops optimal regulation

for type-dependent cost dynamics. In taxing the exploitation of a non-renewable resource,

a government faces the problem that firms have private information about the size of reserves. He finds optimal contracts in a two period framework distort the extent of and pace

of depletion. The optimal regulatory framework is generated by a menu of license fees and

royalties, or by an income tax system containing type-dependent depletion allowances and

tax-exempted income levels. Further, when the terminal time is endogenized, it is optimal

to distort the number of extraction periods.

When firms posses information over costs that is hidden to the government, Osmundsen

argues this is because royalties allow the government to capture a greater share of economic

rent. However, there are two inconsistencies with this argument and observed tax regimes.

First, the royalty tax in Osmundsen is an implicit rather than an explicit tax. That is, rents

in his model are collected using only a payment (license fee) to the government. There is no

actual royalty tax in the payment scheme. Indeed, if an explicit royalty tax were available in

Osmundsen’s model, we find that the government would not use it. What Osmundsen finds is

a distortion on the output of the inefficient (higher cost) types. Osmundsen (1998) interprets

this as being equivalent to a royalty tax, as the output decision is distorted in the same way

(a decrease in initial production and an increase in future production) as a royalty tax under

symmetric information. This leads to the second problem with Osmundsen’s interpretation.

In his model, the implicit royalty tax is highest on firms whose costs of production are high.

However, observed royalty regimes display a very different pattern of royalty taxation: The

royalty tax is higher for firms that produce at a higher level.2 Typically, higher production

rates, all else equal, correspond to lower production costs. Observed royalty rates appear to

be capturing Ricardian rents.

In this paper we show that the basic insight of Osmundsen, that royalty rates arise as

2 An example of this is the Alberta royalty regime, in which the royalty rate explicitly rises as production (measured in

barrels per day) rise.

5

a response to an asymmetric information problem, is correct, but that the mechanism he

employs is incapable of explaining either why royalties are explicitly used or why they are

Ricardian. The mechanism we consider differs from Osmundsen in a fundamental way. In

Osmundsen, auction bids differ by cost type, and there is no explicit royalty tax. In the

model we consider, auction bids do not vary by cost type, but the royalty tax is inversely

related to cost type. Thus, in our model, auctions serve to capture exhaustible resource

scarcity rents, while a royalty tax captures Ricardian rents. Our model also shows that

unlike in the case where information is symmetric, a royalty tax and a cash-flow (rent) tax

are actually equivalent. That is, both a rent tax and a royalty tax distort the intertemporal

choices by high cost firms in an identical manner.

The remainder of the paper is organized as follows. Section 2 describes the basic assumptions of the model. Section 3 considers the full and symmetric information equilibrium.

Section 4 modifies the mechanism design considered by Osmundsen (1998) to include explicit

royalty taxes in the context of a two-period two-type resource stock and shows (i ) that a

royalty tax is not used, and (ii ) that the implicit royalty tax contained in the optimal combinations of bids and quantity produced for each type is exactly the opposite of the Ricardian

royalty taxes that are observed. Section 5 considers the alternative mechanism design that

we propose. There, we show (i) that a royalty tax is used in combination with an auction

bidding format, (ii ) that the royalty tax is Ricardian, and (iii ) that welfare and profits are

identical to those in the Osmundsen model, though the method of payment is quite different.

In Section 6, we show that the royalty tax under asymmetric information is equivalent to a

cash-flow rent tax. From Sections 2 to 6 we assume the government can fully commit to a

future sequence of taxes; in Section 7, we consider the case where the government cannot

commit to a future tax structure. We assume that costs are perfectly correlated across periods. While this gives the government the ability to renege on previous arrangements, in a

rational expectations equilibrium we show that this has no effect upon the present value of

total welfare or on the present value of profits of the high-cost type. All that it does is reduce

the payments made in auctions by the amount by which the government can collect after it

reneges on the tax rate. One difference is the information rents earned by the low-cost type

are higher, because of the ability of the government to capture all rents in the second period.

2

Model Assumptions

Consider the simplest possible exhaustible resource model with Ricardian rents. In this

model, production of an exhaustible resource occurs over two periods, and there are two

types of resources, those with high costs and those with low costs of production, denoted

with subscripts ‘H ’ and ‘L’, respectively. The proportion of high cost types is 0 ≤ θ < 1,

and the proportion of low cost types is 1 − θ. For both types of reserves, let S denote the size

of the initial reserves. Letting qi denote the first period production implies second period

production is S − qi . The size of reserves is sufficiently small that no firm wishes to produce

in a third period.

Once a firm owns the rights to a lease, the present value of its gross variable profits is

6

given by

πi (q) = qp1 − ci (q) + β (S − q)p2 − ci (S − q) , i = H, L.

(1)

In (1), β = 1/(1 + r) is the present value of a dollar earned in the second period, where r is

the simple rate of interest; p1 and p2 are the prices in each period; and ci (q) is the variable

production costs of a firm of type i = H, L who produces at rate q in the first period.

Since the ci (q) are variable costs, cH (0) = cL (0) = 0, and for all q > 0, costs are higher

with the cH (q) functions than with the cL (q) functions:

cH (q) > cL (q) > 0, c0H (q) > c0L (q) > 0, and c00H (q) ≥ c00L (q) > 0.

(2)

Each of these properties is satisfied by a cost function of the form ci (q) = γi q 2 /2, where

γH > γL . Due to its simplicity, the results reported below use this cost function, although

Osmundsen (1998) has shown that it is possible to use only the assumptions in (2) to obtain

similar results.

In the contracts we study, a firm that produces at rate qj in period one pays a royalty

tax on revenues at rate τj . The royalty tax rates, τj , are chosen by the government to vary

according to the first period production rate, qj , j = H, L which reveal firm type. The first

period production rate is chosen by the firm. A firm of type i that faces a royalty tax, τj ,

earns profits in present value equal to πi (qj ) − τj R(qj ), where

R(qj ) = p1 qj + βp2 (S − qj )

(3)

is the present value of revenues when producing at rate qj in period one. Let bH and bL

denote the licensee fees or auction bids paid by firms for the right to lease a field of type

i = H, L. FH and FL are the fixed costs incurred to develop a field of type i = H, L. Thus

net profits in present value are

πi (qi ) − τi R(qi ) − Fi − bi , i = H, L

While it is possible that average costs of production of the low-type firm are higher than

costs of the high-type firm, we shall refer to firm type by variable costs, not average total

costs. However, a necessary condition for an incentive compatible solution is for firms of each

type of variable costs to choose the combination of output, auction bid, and royalty rates

associated with their own type. Therefore, we shall restrict the differences in fixed costs to

satisfy the following:

Assumption 1. The difference in fixed costs satisfies the following:

(1 + λ)(1 − θ)(γH − γL )

≥ FH − FL

(γH − γL ) γH +

(λ + µ)θ

This assumption implies that the difference in variable costs is higher than the difference

in fixed costs.

The government’s objective function is to maximize the weighted sum of government

7

revenues and firm profits:

n h

i

h

io

W = (1 + λ) θ bH + τH R(qH ) + (1 − θ) bL + τL R(qL )

n h

i

+ (1 − µ) θ πH (qH ) − τH R(qH ) − FH − bH

h

io

+ (1 − θ) πL (qL ) − τL R(qL ) − FL − bL

(4)

In (4), 1+λ is the weight the government places on government revenues earned from resource

rent collection and 1 − µ is the weight the government places on firm profits. Both λ and µ

are positive in value. Thus, the weight on revenues is given a higher weight than firm profits.

This is because resource rents allow the government to lower distortionary taxes elsewhere

in the economy (which has value λ per dollar of resource rents) and because the share µ of

profits are earned by foreign-owned firms, whose welfare is disregarded in domestic social

welfare.

Collecting the royalty tax and auction revenue terms in (4) yields

n h

i

h

io

W = (λ + µ) θ bH + τH R(qH ) + (1 − θ) bL + τL R(qL )

n h

i

h

io

+ (1 − µ) θ πH (qH ) − FH + (1 − θ) πL (qL ) − FL

(5)

This shows that the government effectively weights revenues at weight λ + µ and firms’ gross

profits at weight 1 − µ.

The government solves this asymmetric information problem by offering a menu of binding

contracts from which the firms may choose. These contracts are of the form {bi , qi , τi }, with

a separate menu item for each type i = H, L. The contract specifies the size of the bid a

firm must make, bi , the rate of first period production, qi , and the royalty rate, τi . The

government’s objective is to choose a menu contract that maximizes welfare subject to the

constraints that firms are both willing to participate and are willing to truthfully reveal their

cost type.

3

Incentive Contracts under Full and Symmetric Information

Let us begin by considering the case where the government and firms each have full and

symmetric information regarding the costs of extraction in each field. When costs are fully

observable by the government, a contract can directly specify production, taxes and bids

contingent on each realization of costs. A complete information contract consists of {qi , bi , τi }

for i = L, H. The government chooses these contracts to maximize welfare, given by (11),

subject to a participation constraint. The participation constraint under full information is

that expected profits of the firms are greater than or equal to zero:

θ [πH (qH ) − τH R(qH ) − FH − bH ] + (1 − θ) [πL (qL ) − τL R(qL ) − FL − bL ] ≥ 0

8

Intuitively, the reservation profits constraint must bind as otherwise the government could

lower firm expected profits and still have the firm accept the contract. A detailed proof is

provided in Appendix A.

The solution for qi∗ maximizes πi (q) − Fi . Let qi∗∗ ≡ argmax{πi (q) − Fi }, i = H, L denote

the profit maximizing output level of each type of firm. Notice that the royalty taxes do not

affect production.

Since θ > 0, and the participation constraint binds, this implies that πi (qi ) − τi R(qi ) −

Fi − bi = 0 for i = H, L. Otherwise, net profits of one cost type would be negative and the

other would be positive. Since the qi were chosen to maximize profits, negative profits imply

a bid greater than maximized profits net of costs and taxes. A bid greater than type-specific

profits is inconsistent with the participation decision of firms. Therefore,

πi (qi ) − τi R(qi ) − Fi − bi = 0

(6)

The bid by each type is equal to net of tax profits. Notice that the above equation is

overidentified in that we have two variables, bi and τi for type i = H, L with which to enforce

the optimal contract. Furthermore, we find ∂W

= 0, and is not a function of τi , so any

∂τi

value of τi satisfies the first order condition. Thus we can normalize royalty taxes to zero

without loss of generality. Then the optimal contract under full and symmetric information

∗∗

is for the government to offer a take-it-or-leave-it contract of the form {b∗∗

i , qi , 0}, where

∗∗

∗∗

bi = πi (qi ) − Fi to cost-type i = H, L.

This contract is efficient, since each firm produces at the profit maximizing level, qi∗∗ ,

and the government captures all of the surplus, since a firm of cost-type i is only offered a

contract of type i. Both types of firms are willing to accept the contract, as they receive a

normal rate of return (zero economic profits). Finally, the government can use either bids or

a royalty tax in this instance, as the tax does not affect production and hence is equivalent

to the bid in generating revenue.

4

Incentive Contracts of the form {bi , qi , τi }, i = H, L, under Asymmetric Information.

Here we consider the menu auction used in Osmundsen (1998) with the addition of explicit

royalty taxes. Firms know whether their production costs are cH (q) or cL (q). The government knows the proportions of firms, θ and 1 − θ, respectively, with high and low production

costs, and it knows the cost functions cH (q) and cL (q) as well as FH and FL . The government

can also observe the rate of production, but does not observe costs an individual firm incurs.

Hence, the government faces an asymmetric information problem. Suppose that the government uses a menu auction of the form {bi , qi , τi }, i = H, L to induce truthful revelation of

type.

Individual rationality requires that either type of firm must earn at least a normal rate

of return. This implies

πi (qi ) − τi R(qi ) − Fi − bi ≥ 0, i = H, L

9

(7)

Incentive compatibility requires that each type of firm must prefer correctly revealing its

own type. This implies

πi (qi ) − τi R(qi ) − Fi − bi ≥ πi (qj ) − τj R(qj ) − Fi − bj , i 6= j, i, j = H, L

(8)

The government maximizes welfare, given by (5), subject to individual rationality and

incentive compatibility constraints for both types. It is shown in Appendix B the individual

rationality constraint binds for the high cost type and the incentive compatibility constraint

binds for the low cost type. Then

bH = πH (qH ) − τH R(qH ) − FH

(9)

bL = πL (qL ) − τL R(qL ) − FL − [πL (qH ) − πH (qH ) + FH − FL ]

(10)

and

The expression πL (qH ) − πH (qH ) − FL + FH is the information rent earned by a low-cost firm.

This expression must be positive in sign to induce the low-cost firm to wish to reveal its

type.3 Note again that both (9) and (10) are overidentified in they are both functions of the

bids and tax rates. The government has four instruments to enforce the optimal contract.

Substituting the results of (9) and (10) into (5), and rearranging, yields

n h

i

h

io

W = (1 + λ) θ πH (qH ) − FH + (1 − θ) πL (qL ) − FL

h

i

− (λ + µ)(1 − θ) πL (qH ) − πH (qH ) + FL − FH (11)

The first thing to notice about (11) is firm profits are weighted by 1+λ, while the information

rent captured by the low-cost firm is weighted by −(λ + µ). Welfare is strictly decreasing in

the information rents earned by the low-cost type. The second thing to notice about (11) is

it depends only upon the production levels of each type of firm; neither royalty tax affects

welfare. This implies that the explicit choice of royalty taxes is completely arbitrary. For

this reason, we normalize them to zero.4

However, the choices of the output levels, qH and qL , are not arbitrary. These are chosen

by the government to maximize welfare. The optimal auction bids are thus given by (9) and

∗

(10), and welfare is given by (11), with qL∗ and qH

given implicitly by the solutions to (12)

and (13), respectively. The first-order conditions in the choice of output levels that maximize

welfare are

∂W

= (1 + λ)(1 − θ)πL0 (qL ) = 0

(12)

∂qL

and

i

h

∂W

0

0

0

= θ(1 + λ)πH (qH ) + (λ + µ)(1 − θ) πH (qH ) − πL (qH ) = 0

∂qH

(13)

3 The information rent reduces the bid paid by the low-cost type, giving it positive profits relative to the symmetric information

equilibrium.

4 Since they are arbitrary, it could be claimed that this could explain observed royalty rates, but this is a thin line on which to

weight such an argument. Osmundsen (1995, 1998), for example, is not making this argument. He uses the same normalization

as we do, although he does so implicitly, as no royalty taxes explicitly appear in his models.

10

From (12), qL∗ is chosen to maximize the low-cost type’s profits. However, (13) implies that

∗

qH

is chosen at a level less than the output level that maximizes the profits of the high cost

types. For example, when costs are of the form ci (q) = γi q 2 /2, the solution to (13) is of the

form

h

i

(1 + λ)(1 − θ)

(γH − γL ) qH − β(S − qH )

p1 − βp2 = γH +

(λ + µ)θ

The term in braces on the right-hand-side of this equation is positive in value. Therefore,

the expression qH − β(S − qH ) has the same sign as the expression p1 − βp2 , which is the net

present value of marginal revenue from first period production. If the second term in braces,

(1+λ)(1−θ

(γH − γL ), were zero, the right-hand-side of this expression would be the present

(λ+µ)θ

∗∗

value of net marginal costs from first period production. The solution (13) would be qH

, the

level of first period output that maximizes the present value of profits. However, the second

term is positive in sign. The solution to this equation is equivalent to having a higher net

∗

∗∗

marginal cost of first period production, which implies qH

< qH

.

Equation (13) can be rearranged to yield

0

πH

(qH ) =

1−θλ+µ 0

[C (qH ) − CL0 (qH )]

θ 1+λ H

where Ci0 (q) = c0 (q) − βc0 (S − q) is the present value of marginal costs. Totally differentiating

∗

is increasing in θ. That is, as the proportion of high

the above expression reveals that qH

cost types increases, the distortion on the optimal level of high-type production decreases.

∗

Furthermore, qH

is decreasing in both λ and µ. As the weight on government revenues

∗

increases. However,

increases or the weight on firm profits decreases, the distortion on qH

even with equal weight on government revenues and firm profits (µ = λ = 0) there would

∗

still be a distortion on qH

because of the information asymmetry.

High-cost firms earn zero economic rents in equilibrium, since they satisfy the individual

rationality constraint. Low-cost firms earn positive information rents in equilibrium. As a

consequence, social welfare is lower than what it would be in the symmetric information

case. The menu given to high cost firms results in inefficiently low first period production

in order to induce the low cost firms to choose the low-cost menu item. Additionally, the

low cost firms keep a positive share of the rents, compared to the symmetric information

equilibrium in Section 3. The pertinent results are summarized in the following proposition:

Proposition 4.1. The optimal incentive contract {bi , qi , τi }, i = H, L, has the following

properties:

i. Firms truthfully reveal their cost types.

ii. Royalty tax rates of zero are optimal: τH∗ = τL∗ = 0.

iii. The “effective” royalty rate for the most efficient type is zero (qL∗ = argmax{πL (qL ) −

∗

FL }), while the “effective” royalty rate for the least efficient type is positive (qH

<

argmax{πH (qH ) − FH }).

11

∗

iv. High-cost producers receive zero net surplus (b∗H = πH (qH

) − FH ), while low-cost pro-

ducers earn positive net surplus (b∗L < πL (qL∗ ) − FL ).

This proposition shows (i ) that royalties are not explicitly used, and (ii ) that the implicit

or effective royalty rises with the cost of extraction, rather than declining with the rate of

extraction as occurs under Ricardian rent taxation.

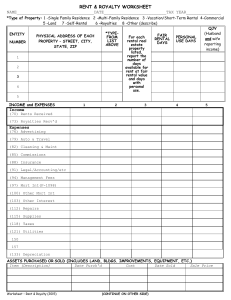

A graphical analysis will provide some intuition for the equilibrium results. Consider

Figures 1, 2 and 3. The dashed lines with short spaces are firm iso-profit and iso-welfare

for the high-cost type. The lines with longer spaces represent firm iso-profit and iso-welfare

for the low-cost type. Notice the high-type iso-profit curve is πH (q) − FH = 0 and the lowtype iso-profit curve is πL (q) = πL (qH ). Point L∗ defines the low-cost equilibrium bid and

production. Notice iso-profits and iso-welfare are tangent at production qL∗∗ and bid b∗L . So

both welfare and profits are maximized at the symmetric information production level for

the low-cost type.

$

WL*

b*L

b*H

WH*

H*

L*

ΠL Hq L L=ΠL Hq H L

H **

ΠH Hq H L-F H =0

q*H

È

q**

H

q**

L

q

Figure 1: Asymmetric Information Equilibrium

Point H ∗ defines the equilibrium production and bid for the high-cost type. This is where

iso-welfare under the high-type and iso-profits for the high type firm intersect. Notice that

∗

∗∗

qH

< qH

. The iso-profit curve for the low type intersects the πH (q) − FH = 0 and WH∗ curves

∗

at qH

as well. The low-type iso-cost curve is the locus of points where the low-cost type

∗

is indifferent between producing at qL∗∗ and producing at qH

. The high-type’s production is

distorted downwards because this is what is required to induce the low-cost type to reveal

it’s cost. This is demonstrated in Figure 2.

Consider the situation diagrammed in Figure 2. Welfare in the H -state of the world can

∗∗

clearly be increased by allowing high-type production to be qH

. This is represented by the

solid line in Figure 2, Panel a. The welfare improvement is the vertical distance between

the lines WH∗ and WH∗∗ . Welfare improves because the bid paid by the high-cost firm is now

∗

b∗∗

H > bH and because high-type production is no longer distorted. Firm profits are increasing

∗

as the bid paid decreases. The low-cost type is indifferent between producing at qL∗∗ and qH

,

12

∗∗

but can earn higher profits by producing at qH

. This situation is where the iso-profit curve

for the low-cost type intersects πH (q) − FH = 0 and WH∗∗ at H ∗∗ , shown in Figure 2, Panel b.

∗∗

When the low-cost type also produces at qH

, the iso-welfare curve in the L-state shifts down

∗∗

∗∗

to pass through H . Welfare decreases because the low-cost types now pay bid b∗∗

H < bL and

∗∗

produce at qH

< qL∗∗ . This change unambiguously lowers welfare as the increase in welfare

in state H is less than the decrease in welfare in state L.

b

b

WL*

b*L

b**

H

b*H

WH*

`

WH

L*

b*L

ΠL HqL L=ΠL HqH L

H **

WL*

ΠL HqL L=ΠL HqH L

b**

H

b*H

L*

`

WL

H **

ΠH HqH L-FH =0

q*H

q**

H

q**

L

ΠH HqH L-FH =0

q

(a) panel a

q*H

q**

H

q**

L

q

(b) panel b

∗∗

Figure 2: Equilibrium when H-type produces at qH

The difference between the full information solution and the asymmetric information

contract is demonstrated in Figure 3. The solid lines correspond to iso-profit and welfare

under the full information equilibrium. With full information, the iso-cost curve for the low

type is defined by πL (q) − FL = 0. L∗∗ denotes the full information equilibrium for the lowcost type. Notice that welfare is higher, but profits are lower, as the low-cost type pays bid

∗

b∗∗

L > bL . The information rent earned by the low-cost type is equal to the difference in bids

∗∗

∗

paid, b∗∗

L − bL . At H , the full information equilibrium for the high-cost type, profits are the

same but welfare is higher. Figure 3 shows the two reasons welfare is lower in the asymmetric

information equilibrium. The first is the low-cost type must be given information rents to

induce truthful revelation. The second reason is that high-cost type production must be

∗∗

to induce truthful revelation by the low-cost type.

distorted below qH

5

Incentive Contracts of the form {b, qi , τi }, i = H, L, under Asymmetric Information

In this section, we develop an alternative mechanism design in which the government collects

resource rents using both a license fee and an explicit royalty component. The crucial

difference between the incentive contract considered in this section and the one discussed in

Section 4 is we assume that the government does not distinguish between the auction bid

prices across the two cost types, that is, bH = bL ≡ b. This changes the welfare given in (5)

13

b

L**

b**

L

WL*

b*L

b*H

ΠL HqL L=ΠL HqH L

L*

WH*

H*

H **

ΠH HqH L-FH =0

q*H

È

q**

H

q**

L

q

Figure 3: Full Information versus Asymmetric Information Equilibria

to

W = (λ + µ) {b + θτH R(qH ) + (1 − θ)τL R(qL )}

n h

i

h

io

+ (1 − µ) θ πH (qH ) − FH + (1 − θ) πL (qL ) − FL

(14)

The individual rationality constraint becomes

πi (qi ) − τi R(qi ) − Fi − b ≥ 0, i = H, L

The incentive compatibility constraint is now

πi (qi ) − τi R(qi ) − Fi − b ≥ πi (qj ) − τj R(qj ) − Fi − b, i 6= j, i, j = H, L

It is shown in Appendix C the individual rationality constraint binds for the high cost

types and the incentive compatibility constraint binds for the low cost types. The individual

rationality constraint yields

b = πH (qH ) − τH R(qH ) − FH

(15)

Equation (15) is the same as (9), with the exception that the bid is now common to both

types. Incentive compatibility for the low-type yields

πL (qL ) − τL R(qL ) − FL − b = πL (qH ) − τH R(qH ) − FL − b

(16)

The incentive compatibility constraint now differs in a fundamental way. Since bL and bH

are identical, they drop out of each side of (16), which means the incentive compatibil-

14

ity constraint for the low-cost types can be solved for the royalty revenues from low-cost

production

τL R(qL ) = πL (qL ) − πL (qH ) + τH R(qH ).

(17)

This defines the royalty payments made by the low-cost type. Previously, the information

rent earned by the low cost types was πL (qH ) − πH (qH ) − FL + FH . Using (15) in (16), and

solving for b yields

b = πL (qL ) − τL R(qL ) − FL − [πL (qH ) − πH (qH ) − FL + FH ]

Note this exactly equal to (10). The information rent earned by the low cost types is the

same as with type-specific bids.

As in Section 4, we find that ∂W

= 0 and the first order condition is not a function of

∂τi

τi . Hence any value of the royalty taxes will satisfy the government’s welfare maximization.

Substituting (15) and (17) into (14), and collecting terms yields welfare exactly equal to the

welfare given above in (11). Thus, there are two important conclusions about the optimal

incentive contract when bH = bL ≡ b. First, we see that even though the royalty tax revenues

τH R(qH ) appear on the right-hand-side of both (15) and (17), the royalty rate τH has no

∗

effect upon welfare. Second, we find the values of qH

and qL∗ that maximize welfare are

identical to those found in Section 4.

Equations (15) and (17) jointly determine the optimal contract. The two equations are

overidentified as we have three instruments, b, τH and τL with which to capture resource

rents. As τH has no effect on welfare, it can be normalized to zero without loss of generality.

By (17), the same cannot be said of the royalty tax rate τL .5 That tax rate is positive so

long as there are information rents accruing to the low-cost type of firm. Hence, the royalty

tax is Ricardian in that τL∗ > τH∗ = 0.

These results are summarized as follows:

Proposition 5.1. The optimal incentive contract {b, qi , τi }, i = H, L, has the following

properties:

i. Firms truthfully reveal their cost types.

ii. The production rate for the low-cost type of firm is identical to the profit maximizing

rate (qL∗ = argmax{πL (qL ) − FL }), while the first period production for the high-cost

∗

type is less than the profit maximizing rate (qH

< argmax{πH (qH ) − FH }).

iii. Both high-cost and low-cost firms bid the scarcity rental price of the high-cost reserves,

∗

b∗ = πH (qH

) − FH , for the right to extract.

iv. Royalty tax rates are Ricardian: τL∗ > τH∗ = 0. The difference in total payments,

τL R(qL∗ ), is identical to the difference, b∗H − b∗L , given in Proposition 4.1.

5 If τ ∗ was chosen to be zero, we would have τ R(q ) = π (q ) − π (q ). Since q

H

H

L H

L L

H < qL , this is negative tax revenue, i.e.

L

a subsidy.

15

∗

v. High-cost producers receive zero net surplus (b∗ = πH (qH

)−FH ), while low-cost producers

earn positive net surplus (b∗ + τL R(qL∗ ) < πL (qL∗ ) − FL ).

Not surprisingly, the solution we identify is similar to the solution identified by Osmundsen

(1998). Output by each type of firm is identical; total payments to the government are

identical, welfare to the government is identical, and surplus earned by the firms is identical.

What differs is that our solution explicitly has royalty taxes which are Ricardian in nature,

while the “implicit” royalty tax rates in Osmundsen are higher for the high-cost types than

for the low cost types.

Osmundsen reaches his conclusions about the implicit royalty taxes by examining how

output changes relative to the profit maximizing level of output across types. What we have

shown is in the optimal incentive contract, the high cost types produce at an inefficiently low

level precisely because this is what is required to induce the low-cost types to not misrepresent

as a high-cost firm, even though the government is capturing additional revenues via the

royalty tax. Thus, the high-cost types underproduce not because they face a higher royalty

rate, but because if the government allowed high cost types to receive the lower royalty rate

and to produce at an efficient level, the low-cost types would not correctly reveal their cost

structure.

One interpretation of the result that high-cost types under-produce relative to the symmetric full information result is that it points towards the welfare cost of using royalties

to induce firms to reveal their true costs. However, as the model in Section 4 shows, this

need not be interpreted as a cost due to royalties, but rather a cost due to the information

asymmetry. These results suggest that the scarcity rental prices are themselves affected by

the information asymmetry, since the rental price b∗ is less than what it would be if there

were full and symmetric information. With full and symmetric information, the government

∗∗

could simply offer a contract of {b∗∗

L , qL } to the low-cost type of firms and a contract of

∗∗ ∗∗

∗∗

∗∗

{bH , qH } to the high-cost firms, where b∗∗

i ≡ πi (qi ) − Fi and qi ≡ argmax{πi (q) − Fi }.

∗

∗∗

∗

Note that b∗ < b∗∗

H because qH is inefficiently low, and b < bL because of the information

rents earned by the low-cost type.

6

The Equivalence of Rent Taxes and Royalties under Asymmetric Information

Now, let us consider an incentive contract in which the two instruments are an auction price

and a cash-flow (rent) tax. Let tH and tL denote the rent tax on each type of firm. Net

profits in present value are now

[πi (qi ) − Fi ] (1 − ti ) − b, i = H, L

16

Welfare in this case is given by

n

h

i

h

io

W = (λ + µ) b + θtH πH (qH ) − FH + (1 − θ)tL πL (qL ) − FL

n h

i

h

io

+ (1 − µ) θ πH (qH ) − FH + (1 − θ) πL (qL ) − FL

(18)

The individual rationality constraint becomes

[πi (qi ) − Fi ] (1 − ti ) − b ≥ 0, i = H, L

The incentive compatibility constraint is now

[πi (qi ) − Fi ] (1 − ti ) − b ≥ [πi (qj ) − Fi ] (1 − tj ) − b, i 6= j, i, j = H, L

The government objective is to maximize (18) subject to the individual rationality and incentive compatibility constraints for each type. We find the individual rationality constraint

binds for the high-cost type,6

b = [πH (qH ) − FH ] (1 − tH )

(19)

The government fully captures the scarcity rent of the high-cost type. Again, the incentive

compatibility constraint for the low cost types binds with equality.

[πL (qL ) − FL ] (1 − tL ) − b = [πL (qH ) − FL ] (1 − tH ) − b

(20)

As before, the incentive compatibility constraint for the low-cost type can be solved for the

royalty revenues from the low-cost type

h

i

tL πL (qL ) − FL = πL (qL ) − FL − [πL (qH ) − FL ] (1 − tH )

(21)

Equation (21) will be equivalent to (17) for tH = 0. Note we can substitute (19) into (20)

and solve for b, yielding

b = [πL (qL ) − FL ] (1 − tL ) − (1 − tH ) [πL (qH ) − πH (qH ) − FL + FH ]

In Sections 4 and 5, the bid paid by the low-cost type was

b = πL (qL ) − τL R(qL ) − FL − [πL (qH ) − πH (qH ) − FL + FH ]

and the information rent earned by the low-cost type was πL (qH ) − πH (qH ) − FL + FH . In

this case, for positive tH , the information rents are lower than with royalty taxes as they

are reduced by tH . However, the equilibrium bid is also lower with positive tH . Equations

(19) and (21) define the equilibrium bid and tax rates for the optimal incentive contract.

6 Details

are in Appendix D.

17

As before, we have three instruments for determining the optimal contract, so the system is

overidentified.

As in the previous sections, ∂W

= 0 and is not a function of ti , so any value of ti satisfies

∂ti

the maximization program. With a quadratic cost function of ci (q) = γi q 2 /2, the production

quantities that maximize welfare are

∗

=

qH

θ(1 + λ) [p1 − βp2 + βSγH ] + (1 − θ)(λ + µ)(1 − tH )βS[γH − γL ]

θ(1 + λ)(1 + β)γH + (1 − θ)(λ + µ)(1 − tH )(1 + β)[γH − γL ]

(22)

p1 − βp2 + βSγL

(1 + β)γL

(23)

qL∗ =

∗

Note that now qH

is a function of tH . A positive rent tax on the high cost firms further

distorts the first period production decision. However, for tH = 0, (22) is identical to the

∗

solution to qH

in Sections 4 and 5. Production of the low-cost types is not distorted, as

before.

Substituting equations (19) and (21) into (18) yields an expression for welfare that depends

∗

, qL∗ and tH .

on qH

n h

i

h

io

W = (1 + λ) θ πH (qH ) − FH (1 − θ) πL (qL ) − FL

nh

i h

io

+ (λ + µ)(1 − θ)(1 − tH ) πH (qH ) − FH − πL (qH ) − FL .

Notice that welfare is strictly decreasing in tH . This implies the optimal choice of tH is

zero. The above expression for welfare is now identical to (11). Equation (19) becomes

b∗ = πH (qH ) − FH , and the equilibrium bid is hidentical to that

in the previous optimal

i

incentive contracts. Equation (21) becomes tL πL (qL ) − FL = πL (qL ) − πL (qH ). This

expression is equivalent to equation (17), the tax revenues from the low types under royalty

taxes. Government revenues and welfare are the same as under the royalty tax system. Thus,

Proposition 6.1. The optimal incentive contract, {b, qi , ti }, i = H, L, has the following

properties:

i. Firms truthfully reveal their cost types.

ii. The production rate for the low-cost type of firm is identical to the profit maximizing

rate (qL∗ = argmax{πL (qL ) − FL }), while the first period production for the high-cost

∗

type is less than the profit maximizing rate (qH

< argmax{πH (qH ) − FH }).

iii. Both high-cost and low-cost firms bid the scarcity rental price of high-cost reserves,

∗

b∗ = πH (qH

) − FH , for the right to extract.

iv. The rental tax rates are Ricardian: t∗L > t∗H = 0. The difference in total payments,

18

tL [πH (qL∗ ) − FL ], is identical to the difference, b∗H − b∗L , given in Proposition 4.1, and

equal to the royalty tax revenues, τL R(qL∗ ), given in Proposition 5.1.

∗

v. High-cost producers receive zero net surplus (b∗ = πH (qH

)−FH ), while low-cost producers

earn positive net surplus (b∗ < (1 − t∗L ) [πL (qL∗ ) − FL ]).

This proposition suggests royalty taxes and cash-flow rent taxes are equally well suited

to rent extraction. Firm profits for both cost types and social welfare are identical, and the

production rate by high-cost and low-cost firms are identical no matter whether a royalty

tax or a cash-flow rent tax is used to extract rents when firms have private information.

Furthermore, in order to induce the low-cost firm to correctly reveal its type, the government

must leave rents on the table for the low-cost firms and it must force the high-cost types to

produce at an inefficient level relative to the full and symmetric information case.

7

The Optimal Incentive Contract when the Government Cannot

Commit to Future Taxes

In this section, we consider how the results from Section 5 change when the government

cannot commit to a tax structure. This topic was first considered by Gaudet et al. (1995) in

the context of resource extraction. In their model, the lack of commitment was implemented

through the assumption that costs in one period are uncorrelated with costs in a subsequent period. However, costs of extraction from a field depend upon characteristics such as

permeability and viscosity, which do not vary over time; or field pressure, which depends

upon remaining reserves, and varies in a systematic manner. Thus, it seems more realistic

to assume that costs are highly correlated across time. We implement this by assuming that

costs are perfectly correlated.

Since costs are perfectly correlated, learning costs in the first period means that the

government can use this information to capture all quasi-rents in subsequent periods. The

question is what effect does this have upon the equilibrium tax and auction bid structure,

as well as the optimal incentive contract?

Because costs are known, in the second period, the government can set the royalty rate to

extract all remaining quasi-rents. Let τi2 denote the royalty rate chosen by the government

in period two, and let τi1 denote the royalty rate chosen by the government in period 1 for

cost type i = H, L. Then welfare becomes

n h

i

W = (1 + λ) θ b + τH1 p1 qH + τH2 βp2 (S − qH )

h

io

+ (1 − θ) b + τL1 p1 qL + τL2 βp2 (S − qL )

i

n h

1

2

+ (1 − µ) θ πH (qH ) − τH p1 qH − τH βp2 (S − qH ) − FH − b

h

io

(24)

+ (1 − θ) πL (qL ) − τL1 p1 qL − τL2 βp2 (S − qL ) − FL − b

19

Combining all terms involving government revenues yields

n

h

i

W = (λ + µ) b + θ τH1 p1 qH + τH2 βp2 (S − qH )

h

io

2

1

+ (1 − θ) τL p1 qL + τL βp2 (S − qL )

n h

i

h

io

+ (1 − µ) θ πH (qH ) − FH + (1 − θ) πL (qL ) − FL

(25)

The individual rationality constraint for type i is now

πi (qi ) − p1 τi1 qi − βp2 τi2 (S − qi ) − Fi − b ≥ 0, i = H, L

and the incentive compatibility constraint for type i becomes

πi (qi )−p1 τi1 qi −βp2 τi2 (S−qi )−Fi −b ≥ πi (qj )−p1 τj1 qj −βp2 τj2 (S−qj )−Fi −b, i 6= j, i, j = H, L

In period 2, the government knows the costs of each type of firm by its’ choice of first

period production. Thus, it is able to choose any royalty rate τi2 so long as the individual

rationality constraint for production in period 2 is satisfied. Given that welfare in (25) is

increasing in τi2 , the government will set the royalty rates such that

τi2 (S − qi )p2 = (S − qi )p2 − ci (S − qi ), i = H, L

(26)

Now consider the problem in period one, given that the government will set the second

period royalty rates as in (26). The government’s objective is to maximize (25) by choice

of τH1 , τL1 and b, subject to the individual rationality and incentive compatibility constraints

for each type.

The optimal solution to the above yields ∂W

= 0, where the first order condition is not

∂τi1

∗

a function of τi1 (see Appendix E). Furthermore, qH

and qL∗ are equivalent to the solution

found in Section 4. The individual rationality constraint binds for the high-cost type of firm.

Then, this implies

b = πH (qH ) − τH1 p1 qH − τH2 βp2 (S − qH ) − FH

= πH (qH ) − τH1 p1 qH − β (S − qH )p2 − cH (S − qH ) − FH

(27)

where the second equality uses (26). The above can be simplified further using (1) to

substitute for πH (qH ), yielding

b = (1 − τH1 )p1 qH − cH (qH ) − FH

(28)

The equilibrium bid is equal to net of tax first period profits of the high cost type. Compare

this to equation (15), the equilibrium bid under full commitment. The bid is reduced by exactly the revenues captured by the government in the second period, [(S − qH )p2 − cH (S − qH )].

The incentive compatibility constraint binds for the low-cost types, which can be solved

20

to yield first period government revenues from the low cost types,

τL1 p1 qL = πL (qL ) − FL − τL2 (S − qL )βp2 − πL (qH ) + FL

+ τH1 p1 qH + τH2 (S − qH )βp2

h

i

= πL (qL ) − FL − β (S − qL )p2 − cL (S − qL ) + τH1 p1 qH

h

i

− πL (qH ) + FL + β (S − qH )p2 − cH (S − qH )

(29)

where the second equality uses (26). Alternatively, we can solve the incentive compatibility

constraint for b, using (27).

b = πL (qL ) − p1 τL1 qL − βp2 τL2 (S − qL ) − FL − [πL (qH ) − πH (qH ) − FH + FL ]

The expression πL (qH ) − πH (qH ) + FL − FH is the information rent earned by the low cost

type, and is the same as in previous sections.

Substituting (27) and (29) into (25) yields, after some simplification,

io

i

h

n h

W = (1 + λ) θ πH (qH ) − FH + (1 − θ) πL (qL ) − FL

n

h

io

+ (λ + µ)(1 − θ) πH (qH ) − FH − πL (qH ) − FL

(30)

Two things are apparent. First, the royalty tax rates τH1 and τL1 do not appear in (30).

Second, the expression in (30) is exactly the same as the expression in (11). Thus, welfare is

∗

maximized by choosing qH

and qL∗ in the same fashion as in (12) and (13). This implies that

no distortion in output is induced by the inability of the government to commit to future

royalty rates. All that happens is that firms recognize that the government will not be able

to restrain itself from extracting quasi-rents in period two, which means that the bid firms

are willing to pay for the rights to lease access to the field is reduced by exactly the amount

that the government takes from the high-cost lease in second period royalty payments.

Recall that equations (27) and (29) are overidentified in that there are three instruments,

1

τH , τL1 and b with which to determine the optimal incentive contract. For this reason, we

normalize τH1 to zero. In this case, (27) becomes

b∗ = p1 qH − cH (qH ) − FH

(31)

The equilibrium bid is simply the first period scarcity rental price of the high-cost type.

The royalty revenues the government earns in the first period are slightly different from the

solution in Section 5.

h

i

h

i

∗

∗

∗

∗

τL1∗ p1 qL∗ = p1 qL∗ − cL (qL∗ ) − FL − p1 qH

− cL (qH

) − FL − β cH (S − qH

) − cL (S − qH

) (32)

The equilibrium royalty revenues are equal to the difference in first period profits from the

∗

low-cost type choosing qL∗ rather than qH

, minus the present value of the difference in second

21

∗

period costs between types at qH

. This reflects the opportunity cost to the low-cost types

in period 2 of truthful revelation in period 1, which increases the information rents the

government must allow the low-cost types in order to induce it to truthfully reveal cost type.

Proposition 7.1. The optimal incentive contract {b, qi , τi1 }, i = H, L, when the government

cannot commit to a tax structure has following properties:

i. Firms truthfully reveal their cost types.

ii. The production rate for the low-cost type of firm is identical to the profit maximizing

rate (qL∗ = argmax{πL (qL ) − FL }), while the first period production for the high-cost

∗

type is less than the profit maximizing rate (qH

< argmax{πH (qH ) − FH }).

iii. Both high-cost and low-cost firms bid the first period scarcity rental price of high-cost

∗

∗

reserves, b∗ = p1 qH

− cH (qH

) − FH , for the right to extract.

iv. The second period tax rates capture all quasi-rents from both types: τi2 (S − qi∗ )p2 =

(S − qi∗ )p2 − ci (S − qi∗ ), i = H, L

v. The first period royalty tax rates are Ricardian: τL1∗ > τH1∗ = 0.

∗

∗

vi. High-cost producers receive zero net surplus (b∗ + τH2 (S − qH

)p2 = πH (qH

) − FH ), while

low-cost producers earn positive net surplus (b∗ +τL1 p1 qL∗ +τL2 (S −qL∗ )p2 < [πL (qL∗ ) − FL ]).

vii. The difference in total payments, p1 τL1∗ qL∗ , is lower than the difference, b∗H − b∗L , by

∗

) > 0. That is, the low-cost types earn higher information rents when the

βp2 (qL∗ − qH

government cannot commit to future tax rates.

8

Conclusions

In this paper, we have shown that royalty rent collection in exhaustible resources is a response

to asymmetric information. Auction bids are used to collect scarcity rents, while royalty rates

are used to collect Ricardian rents. With type-specific bids, Ricardian rents are captured by

the bid. When auction bids are the same for both types of costs, royalty taxes are used to

collect Ricardian rents from the low-cost type. This explains why royalty rates are Ricardian

in nature, i.e., are higher for lower cost producers, and why they are increasing in the output

rate of firms. Furthermore, when royalty rates are used in this fashion, we have shown that

like cash-flow rent taxes, they are non-distortionary. Finally, we have shown that the logic

of royalty taxes extends to the case where the government cannot commit to future royalty

rates. In that case, forward looking firms reduce the auction price they are willing to pay,

and the Ricardian royalty rates are used to extract first period rents. The information rent

captured by the low-cost firm increases because of the ability of the government to capture

all rents in the second period.

22

Future work would involve extending the model to allow for a continuum of agents, as in

Gaudet et al. (1995) and Osmundsen (1998). A continuum of cost types means type-specific

distortions and could affect the equilibrium contracts. A separate but related extension

would be to solve the three period problem. This would introduce two interesting questions.

With three periods, it is possible exhaustion does not occur for all types, which may affect

the equilibrium contracts. As well, three periods in a no commitment situation could result

in different Nash and subgame perfect Nash equilibria.

A

Derivation of Incentive Contract under Full and Symmetric

Information

Cost is observable to the government, so a contract directly specifies production, the bid

and tax rate for each cost type. A complete information contract consists of qi , bi , τi for

i = L, H. The government chooses these contracts to maximize welfare, given by (11),

subject to a participation constraint. The participation constraint under full information is

that expected profits of the firm are greater than or equal to zero:

θ [πH (qH ) − τH R(qH ) − FH − bH ] + (1 − θ) [πL (qL ) − τL R(qL ) − FL − bL ] ≥ 0

Intuitively, the reservation profits constraint must bind as otherwise the government could

lower firm expected profits and still have the firm accept the contract.

Letting η > 0 denote the multiplier on the participation constraint, the Kuhn-Tucker

conditions for the government’s maximization program are:

bH : (λ + µ)θ − θη = 0

(33)

bL : (λ + µ)(1 − θ) − (1 − θ)η = 0

(34)

0

qH : (λ + µ)θτH R0 (qH ) + (1 − µ)θπH

(qH )

0

+ η [πH

(qH ) − τH R0 (qH )] ≤ 0 as qH 1 0 (35)

qL : (λ + µ)(1 − θ)τL R0 (qL ) + (1 − µ)(1 − θ)πL0 (qL )

+ (1 − θ)η [πL0 (qL ) − τL R0 (qL )] ≤ 0 as qL 1 0 (36)

τH : [(λ + µ)θ − ηθ] R(qH ) ≤ 0

(37)

τL : [(λ + µ)(1 − θ) − (1 − θ)η] R(qL ) ≤ 0

(38)

Equations (35) and (36) can be interpreted as marginal welfare from type i must be

less than or equal to marginal profits multiplied by the shadow value of firm participation.

Equations (37) and (38) can be interpreted as the weight on revenues must be less than or

equal to the shadow value of firm participation.

23

Equations (33) and (34) can be added to yield η = λ + µ. This means the participation

constraint binds.

θ [πH (qH ) − τH R(qH ) − FH − bH ] + (1 − θ) [πL (qL ) − τL R(qL ) − FL − bL ] = 0

Evaluating (35) at qH = 0 yields

θ(1 + λ)[p1 − βp2 ] > 0

The above expression is true for p1 > βp2 , which must hold for profits to be positive when first

period production is positive. Therefore, since (35) is positive at qH = 0, the complementary

∗

slackness condition implies that qH

> 0. Similarly, evaluating (36) at qL = 0 yields

(1 − θ)(1 + λ)[p1 − βp2 ] > 0

So it is also the case that qL∗ > 0. Furthermore, the solution for qi∗ maximizes πi (q) − Fi .

qi∗∗ = argmax{πi (q) − Fi } =

p1 − βp2 + βγi S

(1 + β)γi

Using η = λ + µ, both equation (37) and (38) are equal to zero. This means ∂W

= 0 but is

∂τi

not a function of τi , so any value of τi satisfies the first order condition. Again considering

the participation constraint,

θ [πH (qH ) − τH R(qH ) − FH − bH ] + (1 − θ) [πL (qL ) − τL R(qL ) − FL − bL ] = 0

Since θ > 0, this implies that each term in square brackets is also equal to zero. Otherwise,

net profits of one cost type would be negative and the other would be positive. Since the

qi were chosen to maximize profits, this implies a bid greater than profits net of costs and

taxes. A bid greater than type-specific profits is inconsistent with the entry decision of firms.

Therefore,

πi (qi ) − τi R(qi ) − Fi − bi = 0

(39)

The bid by each type is equal to net of tax profits.

Welfare simplifies to being solely a function of government revenues,

W ∗∗ = (1 + λ) [θ [bH + τH R(qH )] + (1 − θ) [bL + τL R(qL )]]

Given the solution for bids, taxes fall out of the above equation. Again, we find the tax rate

is irrelevant to the government’s decision. However, an increase in τi has a negative effect

on bids bi received by the government. Despite this, the two revenue-generating mechanisms

are equivalent due to the relationship defined by (39). As any value of τi satisfies the first

order conditions (37) and (38), we can normalize τi = 0 without loss of generality.

24

B

Derivation of Incentive Contract {bi , qi , τi }, i=H,L under Asymmetric Information

The government maximization program is

max W =(λ + µ) [θ [bH + τH R(qH )] + (1 − θ) [bL + τL R(qL )]]

{bi ,qi ,τi }

+ (1 − µ) [θ [πH (qH ) − FH ] + (1 − θ) [πL (qL ) − FL ]]

s.t.

i. πH (qH ) − τH R(qH ) − FH − bH ≥ 0

ii. πL (qL ) − τL R(qL ) − FL − bL ≥ 0

iii. πL (qL ) − τL R(qL ) − FL − bL ≥ πL (qH ) − τH R(qH ) − FL − bH

iv. πH (qH ) − τH R(qH ) − FH − bH ≥ πH (qL ) − τL R(qL ) − FH − bL

Lemma B.1. Constraint (ii) can be ignored in the above maximization program.

Proof. Suppose that constraints (i) and (iii) are satisfied. Since by (3), cH (q) > cL (q), we

know that πH (q) < πL (q). By Assumption 1, the difference in variable costs is greater than

the difference in fixed costs. This means cH (q) − cL (q) > FH − FL , and this in turn implies

πL (qH ) − τH R(qH ) − FL − bH > πH (qH ) − τH R(qH ) − FH − bH

With the above, and that (i) and (iii) are satisfied, (ii) is satisfied as well.

Let η be the multiplier on constraint (i), and φL and φH be the multipliers on constraints

(iii) and (iv). The Kuhn-Tucker conditions are:

bH : (λ + µ)θ − η + φL − φH = 0

(40)

bL : (λ + µ)(1 − θ) − φL + φH = 0

(41)

0

0

qH : (λ + µ)θτH R0 (qH ) + (1 − µ)θπH

(qH ) + (η + φH ) [πH

(qH ) − τH R0 (qH )]

− φL [πL0 (qH ) − τH R0 (qH )] ≤ 0 as qH 1 0 (42)

qL : (λ + µ)(1 − θ)τL R0 (qL ) + (1 − µ)(1 − θ)πL0 (qL ) + φL [πL0 (qL ) − τL R0 (qL )]

0

− φH [πH

(qL ) − τL R0 (qL )] ≤ 0 as qL 1 0 (43)

τH : [(λ + µ)θ − η + φL − φH ] R(qH ) ≤ 0

(44)

τL : [(λ + µ)(1 − θ) − φL + φH ] R(qL ) ≤ 0

(45)

Adding equations (40) and (41) yields η = λ + µ. The multiplier on the individual

rationality constraint for the H type is positive, and so constraint (i) binds with equality.

25

This identifies the H -type equilibrium bid.

b∗H = πH (qH ) − τH R(qH ) − FH

(46)

The equilibrium bid for the high cost type is profits net of the royalty tax. The government

is able to capture all rents from the high cost firm.

Lemma B.2. The incentive compatibility constraint for the low-cost type binds with equality.

Proof. From (41), φL = (λ + µ)(1 − θ) + φH . Since λ > 0, µ > 0, 1 > θ > 0 and φH ≥ 0,

this implies φL > 0. So constraint (iii) binds with equality.

This yields a solution for b∗L :

b∗L = πL (qL ) − τL R(qL ) − FL − [πL (qH ) − τH R(qH ) − FL − bH ]

= πL (qL ) − τL R(qL ) − FL − [πL (qH ) − FL − πH (qH ) − FH ]

(47)

Lemma B.3. The optimal level of production for the high-cost type is positive.

Proof. Consider equation (42).

(λ + µ)θτH [p1 − βp2 ] + (1 − µ)θ [p1 − c0H (qH ) − β [p2 − c0H (S − qH )]]

+ (η + φH ) [p1 − c0H (qH ) − β [p2 − c0H (S − qH )] − τH (p1 − βp2 )]

− φL [[p1 − c0L (qH ) − β [p2 − c0L (S − qH )] − τH (p1 − βp2 )] ≤ 0

Evaluating at qH = 0 and substituting for η and φL yields the following:

(1 + λ)θ [p1 − βp2 ] + θβ(λ + µ)c0L (S) + [(λ + µ)β + φH ] [c0H (S) − c0L (S)]

∗

By (3), c0H (S) > c0L (S) so the above is positive. This means qH

> 0 and equation (42) is

satisfied with equality.

Lemma B.4. The optimal level of production for the low-cost type is positive.

Proof. Now consider (43).

(λ + µ)(1 − θ)τL [p1 − βp2 ] + (1 − µ)(1 − θ) [p1 − c0L (qL ) − β [p2 − c0L (S − qL )]]

+ φL [[p1 − c0L (qL ) − β [p2 − c0L (S − qL )] − τL (p1 − βp2 )]

− φH [p1 − c0H (qL ) − β [p2 − c0H (S − qL )] − τL (p1 − βp2 )] ≤ 0

26

Evaluating at qL = 0 and substituting for φL yields the following:

(1 + λ)(1 − θ) [p1 − βp2 ] + (1 + λ)(1 − θ)βc0L (S) − φH β [c0H (S) − c0L (S)]

The above equation will be negative for very large values of φH . However, if it is negative

at qL = 0, this implies that qL∗ = 0. At qL = 0 constraint (iii) is not satisfied, which

is a contradiction. Therefore it must be the case that qL∗ > 0 and (43) is satisfied with

equality.

Using (40) in (44), it is clear the first order condition with respect to τH is zero. Similarly,

using (41) in (45), we find the first order condition with respect to τL is zero. This implies

that any value of τi , i = H, L will satisfy the maximization program. The explicit choice of

royalty taxes is arbitrary.

Lemma B.5. The incentive compatibility constraint for the high-cost type does not bind

(φH = 0).

Proof. Suppose it is positive. Then constraint (iv) binds with equality:

πH (qH ) − τH R(qH ) − FH − bH = πH (qL ) − τL R(qL ) − FH − bL

Equation (42) simplifies to:

(1 + λ)θ [p1 − βp2 − c0L (qH ) + βc0L (S − qH )]

− [(1 − µ)θ + λ + µ + φH ] [c0H (qH ) − c0L (qH ) − β [c0H (S − qH ) − c0L (S − qH )]] = 0 (48)

In order for the above equation to be satisfied, it must be the case that p1 − βp2 − c0L (qH ) +

βc0L (S − qH ) > 0.

Equation (43) simplifies to:

(1 + λ)θ [p1 − βp2 − c0L (qL ) + βc0L (S − qL )]

+ φH [c0H (qL ) − c0L (qL ) − β [c0H (S − qL ) − c0L (S − qL )]] = 0 (49)

When φH > 0, the above equation is only satisfied if p1 − βp2 − c0L (qL ) + βc0L (S − qL ) < 0.

Equations (48) and (49) imply the following:

p1 − βp2 − c0L (qH ) + βc0L (S − qH ) > 0 > p1 − βp2 − c0L (qL ) + βc0L (S − qL )

The above inequality can be reduced to reveal that qL > qH . That is, production of the low

27

cost firm is higher than production of the high cost firm.

Since φL was shown to be positive, constraint (iii) binds with equality. The constraint

can be rewritten in the following way:

(1 − τL ) [p1 qL + βp2 (S − qL )] − bL

−(1 − τH ) [p1 qH + βp2 (S − qH )] + bH = cL (qL ) + βcL (S − qL ) − cH (qH ) − βcH (S − qH )

Z qL

Z qL

0

=

cL (q)dq + β

c0L (S − q)dq

qH

qH

By (3), c0H (q) > c0L (q) and above it was shown that qL > qH . This implies:

Z qL

Z qL

Z qL

Z qL

0

0

0

cL (q)dq + β

cL (S − q)dq <

cH (q)dq + β

c0H (S − q)dq

qH

qH

qH

qH

= cH (qL ) + βcH (S − qL ) − cH (qH ) − βcH (S − qH )

The above implies, with constraint (iii) that,

πH (qL ) − τL R(qL ) − bL < πH (qH ) − τH R(qH ) − bH

Note that the assumption that constraint (iv) binds implied that the above equation is

satisfied with equality. So we have a contradiction and it must be the case that φH = 0.

With the knowledge that η > 0, φL > 0 and φH = 0, equations (35) and (36) can be

∗

solved to yield qL∗ and qH

.

p1 − βp2 + βSγL

qL∗ =

(50)

(1 + β)γL

The equilibrium level of production by the low cost type is the same as in the first-best,

symmetric information case. There is no distortion on the efficient firm.

∗

qH

=

(1 + λ)θ [p1 − βp2 + βSγH ] + (λ + µ)(1 − θ)βS [γH − γL ]

θ(1 + λ)(1 + β)γH + (λ + µ)(1 − θ)(1 + β) [γH − γL ]

(51)

∗

It is clearly the case that qH

is not equal to the first-best outcome. It can be shown that

∗

∗∗

qH < qH . That is, production of the high cost types is distorted downwards. This is a

response to the asymmetric information, as the government must distort the production

profile of the high cost firm in order to induce the low cost type to truthfully reveal their

costs. As the low cost type earns information rents, social welfare is lower than in the first∗

best outcome. This is because qH

is lower, and because firm profits are valued at 1 − µ, while

government revenues have a weight of greater than unity.

28

C

Derivation of Incentive Contract {b, qi , τi }, i=H,L under Asymmetric Information

The government maximization program is

max W =(λ + µ) [b + θτH R(qH ) + (1 − θ)τL R(qL )]

{b,qi ,τi }

+ (1 − µ) [θ [πH (qH ) − FH ] + (1 − θ) [πL (qL ) − FL ]]

s.t.

i. πH (qH ) − τH R(qH ) − FH − b ≥ 0

ii. πL (qL ) − τL R(qL ) − FL − b ≥ 0

iii. πL (qL ) − τL R(qL ) − FL − b ≥ πL (qH ) − τH R(qH ) − FL − b

iv. πH (qH ) − τH R(qH ) − FH − b ≥ πH (qL ) − τL R(qL ) − FH − b

Lemma C.1. Constraint (ii) can be ignored in the maximization program.

Proof. Suppose that constraints (i) and (iii) are satisfied. Since by (3), cH (q) > cL (q), we

know that πH (q) < πL (q). By Assumption 1, the difference in variable costs is greater than

the difference in fixed costs. This means cH (q) − cL (q) > FH − FL , and this in turn implies