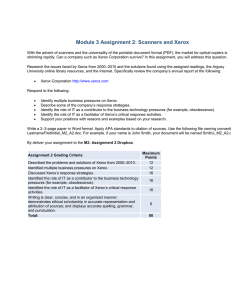

Revolution or Evolution? Managing the Traditional Firm e-transition

advertisement