Congruence Among the Voters and Contributions to Political Campaigns. ∗ Elena Panova

advertisement

Congruence Among the Voters and

Contributions to Political Campaigns.∗

Elena Panova†

February 28, 2006

Abstract

This paper builds a theory of political campaign contributions.

Interest groups can engage in non-directly informative political advertising in order to signal their private information on the valence of

candidates. The paper’s key insights are: (a) campaign contributions

can be rationalized by interest groups signalling benefits; (b) political campaigns are cheaper, the more congruent the voters; (c) higher

campaign receipts by incumbents can be explained by better information available to interest groups that seek re-election; (d) campaign

contributions increase the voters welfare.

Key words: campaign contributions, voter information, incumbency advantage, electorate diversity.

JEL codes: D72, D82, M37.

1

Introduction.

Political campaign contributions play an important role in elections.1 While

this role varies across democracies, some patterns are common: political ad∗

This paper is based on the first chapter of my Ph.D. dissertation. I am extremely

grateful to my supervisor Jean Tirole for his guidance. I thank Mattias Dewatripont

and Andrea Prat who refereed my dissertation, and made many useful suggestions. I am

also grateful to David Dreyer Lassen, Nicolas Marceau, Louis Phaneuf, Cristian Shultz,

Peter Norman Sørensen, Julia Shvetz, John Sutton, and Etienne Wasmer for their helpful

comments.

†

GREMAQ, Université des Toulouse-1, CORE at UCL, and UQAM.

1

See surveys by Morton and Cameron (1992), Prat (1999, 2004), and Stratmann (2005).

1

vertising is expensive (although these expenses are small compared to stakes

of public policies); the vast majority of campaign contributions comes from

private sources, winners of elections (mostly incumbents) receive more contributions than losers.

These patterns clearly appear in US Congressional races (see our review

in the Appendix). During the last two decades, US Congressional candidates

raised and spent on average more than a billion of 2003 US dollars per election cycle. Around 80% of these contributions came from Political Action

Committees or directly from individuals. An incumbent candidate received

on average about 6 times more contributions than a challenger candidate.

Incumbents won on average more than 90% of House races and about 80%

of Senate races.

Given that private campaign financiers may pursue different objectives,

these observations raise the following inter-related issues: what are the incentives to contribute to electoral campaigns, and why does political advertising

influence the election? Furthermore, why do campaign contributions disproportionately benefit incumbent candidates?

In order to address these issues, we build a model where interest groups

signal private information they hold about the valence of candidates for office

by financing political advertising. Specifically, there are two interest groups.

Each interest group is a uniform constituency of voters who benefit from

group-specific public policy. There are two candidates competing for office:

the incumbent and the challenger.

Each candidate has a type that depends on her valence with different

interest groups. We make an important distinction between an unbiased

candidate, whose valence with differen interest groups is the same, and a

biased candidate, who is valent with one interest group but nonvalent with

the other. When there is a positive correlation between the valence of a

candidate with different interest groups, more weight is put on the event

that a candidate is unbiased. This correlation the most important parameter

in our model. It measures the congruence between the interest groups in

their preferences regarding the candidates.

The interest groups do not observe a candidate’s type when they vote.

However, before the election each interest group receives private signal on

whether the incumbent is valent with it or not. This signal depends on benefits by this interest group from group-specific public policy. These benefits

are either high, or moderate, or else null. Positive benefits signal that the

incumbent is valent, while no benefits signal that the incumbent is nonvalent.

2

Hence, in isolation the beneficiaries vote for the incumbent, while nonbeneficiaries vote for the challenger.

The quality of private information that is relevant to the vote may differ

between the interest groups. More precisely, private signal on the incumbent’s type held by an interest group is stronger, the higher its benefits from

group-specific public policy. Therefore, when the incumbent delivers policy

benefits to only one interest group, information about these benefits encourages nonbeneficiaries to vote for her if sufficiently high prior weight is put on

the event that a candidate is unbiased.2 Hence, both interest groups potentially benefit from information sharing before the election: nonbeneficiaries

may increase the efficiency of their vote, while the beneficiaries may increase

the probability of re-election.

The interest groups can share information in two ways. The first way is

cheap-talk: the interest groups can endorse the candidate for re-election. The

second way is costly signalling: the interest groups can contribute money

to electoral campaigns. Political advertising is not directly informative.3

However, its intrinsic costs create an opportunity for the interest groups to

burn money in public. We consider when and how the voters share their

private information depending on the congruence between them.

An opportunity to finance political advertising is useless for the interest

groups in two extreme cases. Specifically, if the prior weight of the event

2

In other words, better informed beneficiaries convince “swing” nonbeneficiaries to vote

for the incumbent. Lupia (1994) shows that indeed preferences by better informed voters

can be an important information for the vote by less informed citizens. He analyses survey

data on voting behavior in insurance reform initiatives of 1998 in California, and finds that

poorly informed voters “used their knowledge of insurance industry preferences to emulate

the behavioral of those respondents who had relatively high level of factual knowledge.”

3

There are three reasons for this assumption. The first reason is that lying during

electoral campaigns is feasible. In the United States legal system does not punish lie in

political advertising (in contrast with commercial advertising). Also, selective reporting

(“slanting”) allows to reshape information without lying directly, as described in the literature on communications. The second reason is that according to experimental evidence

by Ansolabehere and Iyengar 1996, political advertising is effective even if it contains no

direct information. The third reason is that alternative assumption generates the following

contradiction. Suppose that political advertising directly provides information about candidates to voters. Then, political advertising expenditures as well as the election outcomes

depend on the advertising prices. The largest item of expenditures on electoral campaigns

is television advertising (Prat 1999). However, Ansolabehere, Gerber, and Snyder 2001,

find that higher prices of television advertising have no effect on total campaign spending

levels or vote margins in Congressional elections.

3

that a candidate is unbiased lies below a lower congruence threshold, benefits

received by one interest group is useless information for the other interest

group. Hence, political advertising is ineffective, and the interest groups do

not spend money on it. If the prior weight of the event that a candidate is

unbiased lies above an upper congruence threshold, the vote is coherent if the

interest group share their private information: if nonbeneficiaries learn that

the incumbent has delivered some policy benefits to the other interest group,

they vote for her. Therefore, the beneficiaries have no incentives to lie about

the size of their benefits. Hence, cheap-talk is an available option for credible

communication between the interest groups.

The focus of our paper is the case where the prior weight of the event

that a candidate is unbiased lies between the thresholds.4 In this case, the

vote is not perfectly coherent if the voters honestly disclose policy benefits

delivered to them by the incumbent. Indeed, nonbeneficiaries vote for the

incumbent if and only if they learn that she has delivered high benefits to

the other interest group, because the signal on her type generated by this

information is sufficiently strong. Hence, when an interest group receives

moderate benefits, it wants to claim that its benefits are high in order to

avoid tie in the election. At the same time, when an interest group indeed

receives high benefits, it seeks to overcome the suspicions, and to signal in

a credible way its high eagerness to re-elect the incumbent. To that goal, it

contributes to electoral campaigns a sum that it would not have contributed

if its benefits were moderate. Hence, we rationalize campaign contributions

by interest groups signalling benefits.5 This is the main insight of our paper.

Notice, that more prior weight is put on the event that a candidate is

unbiased, less money the beneficiariaries need to burn in public in order to

credibly signal private information they hold about the incumbent’s valence.

Hence, we predict that electoral campaigns are cheaper, the more congruent

the voters.

Furthermore, our model allows to explain why do incumbents receive

more contributions. When the interest groups signal their private information by financing campaign of a candidate they seek to elect,6 one candidate

4

The upper congruence threshold lies above the lower congruence threshold, because

moderate policy benefits generate a weaker signal on the incumbent’s type than high policy

benefits.

5

We explain the novelty of our argument in the next section.

6

The interest groups can signal their benefits by financing campaign of either candidate.

Hence, we do not rule out split contributions.

4

(promoted by better-informed interest groups) receives more contributions.

Hence, we explain higher campaign receipts by incumbents with better information available to interest groups that seek re-election (in our model, the

beneficiaries from public policies).

Intensive debate about social costs and benefits from campaign contributions that takes place both in the academic literature and in press, encourages us to adress these issues in our paper. We compare the sum of campaign

contributions to the informational benefit that they generate - a higher coherence of the vote. Because contributions are smaller than policies at stake,

we find that campaign contibutions increase the voters welfare. This increase

is larger, more congruent the interest groups.

We suggest, however, to interpret this insight cautiously as far as regulation issues are concerned, at least because we do not consider how does

information sharing between the interest groups affect the incentives by the

incumbent. We make, however, two general remarks. First, if the voters lack

an opportunity to signal their private information by contributing to electoral

campaigns, they might search other ways for credible communication. This

may lead to even larger inefficiencies than the waste of money on political

advertising. Second, this waste could be diminished by reducing a voter’s

uncertainty regarding the preferences by the rest of the electorate.

The paper is organized as follows. The next section discusses our contribution to the literature. Section 3 presents the model. Section 4 considers

a “thought experiment” in which all information about the candidates available to the voters is public, and forms thereby the basis for Section 5, that

describes how do campaign contributions and the vote depend on the congruence between the interest groups. Section 6 considers the impact of campaign

contributions on the efficiency of the election. Section 7 summarizes the main

insights, and suggests some directions for future research.

2

Related literature.

A sizeable literature in economics views campaign contributions as a payment

for policy favor from informed lobbies to candidates, and explicitly assumes

that uninformed voters are more eager to elect a candidate who raises more

contributions. These papers do not explain why politicians get away with

corruption, because they do not model the asymmetry of information that

generates a signal-extraction problem for the voters or judges.

5

Starting with Austen-Smith 1987, a growing number of studies points at

this drawback, and builds models where political campaigns provide information about the quality of candidates to rational voters. Although these

models keep assuming that political advertising is financed by informed lobbies that promote candidates who would bias future policies towards their

interests, in equilibrium candidates who run more expensive campaigns are

more suitable for the voters.

The reason for that result depends on whether it is assumed that political

advertising provides direct information to the voters or not. Some theories

(including Ashworth 2003, and Coate 2003) assume that political campaigns

directly inform the voters about the quality of candidates. Therefore, the

candidates whose policy platforms better fit the voter’s preferences advertise

more, because they generate higher returns from campaign advertising.7 In

other papers (Prat 1999, 2002a, 2002b, 2004; and Potters, Sloof, and van

Winden 1997), political advertising is not directly informative. Expensive

campaigns signal high quality of a candidate, because lobbies have stronger

incentives to give money to valent candidates. The argument by Potters,

Sloof, and van Winden is reminiscent of Milgrom and Roberts 1986, except

that candidates outsource financing for political advertising.

For three reasons already discussed in introduction, we assume that political campaigns convey no direct information to the voters. Our theory of

campaign contributions is the most closely related to Prat’s paper 2004. In

his paper, the voters benefit from electing a valent candidate. An interest

group with no electoral weight holds private information about the valence

of candidates. It proposes to a candidate a contribution to her electoral campaign. If the candidate accepts this offer, she credibly promises in exchange

a future policy favour. High-quality candidates receive more contributions,

because they have higher chances to win the election. The reason is that with

a small probability voters themselves learn the valence of the candidates for

office. Hence, in equilibrium expensive campaign of a candidate signals high

7

In Coate’s model political parties with preferences at the extremes of one-dimensional

political spectrum compete by proposing their candidates to swing voters with “moderate”

ideology. Interest groups observe the candidate’s platforms, and support campaigns of

like-minded candidates. Their contributions help the swing voters to learn the candidates’

platforms. Because “moderate” platforms attract more votes, campaign contributions

encourage the parties to pick the candidates whose ideology is more centrist than that of

the median party member.

6

valence of this candidate to the voters.8 Notice, that the lobbyist cannot

endorse a candidate.

In our model information transmission takes place between the interest

groups that vote. We assume that interest groups can simultaneously use

two ways of communication: cheap-talk and costly signalling via campaign

finance, and describe circumstances where costly signalling is the only way

for credible communication. Hence, we view campaign contributions as a way

of information transmission from better- to less informed voters, and not as

a payment for a future policy favour (although, we find that in equilibrium

with campaign contributions there is a higher probability to elect a politician who is biased towards interest of groups that contribute more, than in

equilbrium without contributions).9 This view may allow us to consider a

game with multiple interest groups without making additional assumptions

on the nature of bargaining between lobbies and candidates.

This is reminicent of Battaglini and Bénabou 2003, where several agents

lobby the politician who can take an action that benefits them. The politician’s decision depends on the state of nature that she does not observe. The

lobbyists hold imperfect private information about the state. Battaglini and

Bénabou find that if the expected degree of policy disagreement between the

principal and the agents is low, lobbying activity by each agent is high. The

reason is that an agent anticipates confirmation provided by other agent’s

lobbying.

In our model, well-informed interest group “lobbies” the other interest

group in campaign financing stage in attempt to avoid tie in the election.

In contrast with Battaglini and Bénabou, the stakes of such lobbying are

endogenous. As a result, when the voters are more congruent, an individual

interest group has weaker (and not stronger) incentives to lobby. Indeed,

when more prior weight put on the event that a candidate is unbiased, this

generates two coherent effects. First, it decreases the probability of the event

that there is tie in the election with independent vote. Second, it decreases

the expected benefits by one interest group from changing the vote by the

other interest group in case of such a tie.

8

This informational benefit may be lower than costs of the future policy bias.

Ansolabehere, de Figueiredo, and Snyder 2002, provide a range of facts to illustrate

that campaign contributions are not a form of policy-buying.

9

7

3

The model.

Consider a two-period economy led by an elected official - the politician.

The election takes place at the end of the first period.10 There are two

candidates competing for office: the incumbent and the challenger. The

electorate is constituted by two interest groups. Each interest group is a

uniform constituency of voters. If there is a tie in the election, either interest

groups is equally likely to be pivotal.

There are two public projects indexed by i (i = 1, 2). Project i is specific

to interest group i. That is, interest group i receives return ri from project

i, while costs of the project normalized to 1 are split equally between the

interest groups.

Return from project i is stochastic: it can be null, moderate, or high:

ri ∈ {0, r, R} , where 0 < r < R.

It depends on the politician’s valence with interest group i, that is measured

by random variable

v, with probability 12

vi =

0, with probability 12

We say that the politician is valent with interest group i if vi = v, and

nonvalent with interest group i if vi = 0. When the politician is valent with

interest group i, more weight is put on more successful outcomes of project

i:

R, with probability vi ,

r, with probability vi + l,

(1)

ri =

0, with probability 1 − l − 2vi ,

where variable l is a positive constant (l stands for “luck”). Since l is positive,

the politician may generate moderate returns from project i even if she is

nonvalent with interest group i. Notice however, that the politician need to be

valent with interest group i in order to be able to generate high returns from

project i. Furthermore, we assume that the politician might fail project i

(that is, deliver no returns from the project) even if she is valent with interest

group i: l + 2v < 1.

Hence, the politician has type (v1 , v2 ) that depends on her valence with

different interest groups, as illustrated by Table 1. We make an important

10

Timing of the game is summarized at the end of this section.

8

distinction between an unbiased politician, who is either valent with both

interest groups or nonvalent with both interest groups; and a biased candidate, who is valent with one interest group but nonvalent with the other

interest group.

Table 1: The politician’s type.

v2 = v

v2 = 0

biased

(towards interest group 1)

v1 = v

valent

v1 = 0

biased

(towards interest group 2)

nonvalent

We denote by ρ correlation between the politician’s valence with different

interest groups:

Pr (vi = v | v−i = v) = Pr (vi = 0 | v−i = 0) = ρ,

where index −i denotes a number from {1, 2} that is distinct from i. In

these notations, the distribution of the politician’s type is as follows. With

probability ρ the politician is unbiased (this weight is split equally between

the event that the she is a valent type and the event that she is a nonvalent

type). With probability 1 − ρ the politician is biased (again, this weight is

split equally between the two cells that lie on the main diagonal of table 1).

Correlation ρ is the most important parameter in our model. When it

is positive, more weight is put on the event that the politician is unbiased.

Hence, parameter ρ measures the congruence between the interest groups in

their preferences regarding the candidates competing for office. We focus on

cases where there is some congruence between the interest groups, that is

1

< ρ 1. Later, it will become clear why the complementary cases are out

2

of our interest.

The distribution of the politician’s type is a common knowledge. However, the type itself is known by the politician, but not by the constituencies.

This informational asymmetry is important for the following reason. At the

beginning of each period, a project can be either undertaken, or shut down.

This choice is nontrivial, because the projects are costly, and their outcome

is stochastic (in particular, there is a positive probability of a project failure). We assume that if the only information available for that choice is the

9

distribution of the politician’s type, it is efficient to undertake the projects:

lr +

v

(r + R) > 1.

2

(2)

However, if it is known that the politician is nonvalent with an interest group,

it is efficient to shut down the group-specific project: lr < 1. Trivially,

assumption (2) implies that if the politician is valent with an interest group,

it is efficient to undertake the group-specific project.

The decision whether to undertake the projects or not is made by the

politician. Her objectives are two-fold. First, she receives benefits per period in office. Second, she attaches infinitely small value to picking efficient

policies. The first objective creates re-election concerns. We focus on perfect

Bayesian equilibrium in which these concerns encourage the politician to undertake both projects in the first period regardless of her type (we explain

in section A.2 of the appendix why such equilibrium exist). In the second

period, however, the politician has no re-election concerns. Therefore, she

picks efficient policies, in line with her second objective. Specifically, she undertakes project i if and only if she is valent with interest group i.11 Hence,

in the election each interest group has strict preferences regarding the type

of the winner.

The information available to the voters is as follows. An interest group

holds private signal on the incumbent’s type. This signal is generated by

the first period return that the interest group receives from group-specific

project. In order to illustrate the main insights in the most transparent way,

we assume that the signal is stronger, the higher the return:12

3l + 2v < 1.

(3)

Hereafter, we say that an interest group is a beneficiary if it receives a positive return from group-specific policy. Otherwise, we say that an interest

11

Delegation of the decision about whether or not to undertake the projects to the

politician in office does not affect the efficiency of the first period policies (as implied by

assumption (2)), and increases the efficiency of the second period policies.

12

Assumption (3) is equivalent to inequality

Pr (vi = v | ri = r) −

1

1

> − Pr (vi = 0 | ri = 0) .

2

2

That is, moderate returns generate a stronger signal than no returns. High returns generate

stronger signal than moderate returns according to the system of equations (1).

10

group is a nonbeneficiary.13 Hence, the beneficiaries hold more precise private

information than nonbeneficiaries.

The interest group can exchange the information they hold in two ways.

The first way is cheap-talk: an interest group can simply endorse the candidate for re-election. The second way is costly signalling. An interest group

may contribute any positive sum to the incumbent’s campaign or/and to the

challenger’s campaign. A contribution strategy by interest group i is a pair

of contributions (cC (ri ), cI (ri )) for each outcome ri , where cI (ri ) are interest

group’s i contributions to the incumbent’s campaign, and cC (ri ) are interest

group’s i contributions to the challenger’s campaign. Political advertising

is not directly informative. However, campaign contributions become public

before the election. This allows the interest groups to revise their beliefs

about the incumbent’s type.

The timing of the game is as follows.

Date 1.

a. Random state of nature determines the type (v1 , v2 ) of the politician.

This type is unobserved by constituencies.

b. The incumbent undertakes both projects.

c. The first-period returns from the projects realize. Interest group i

privately observes return ri from group-specific project i, and updates its

beliefs about the incumbent’s type.

d. Interest groups may exchange the information they hold. There are two

ways available for this exchange: cheap-talk and costly signalling: an interest

group may contribute any positive sum to the incumbent’s campaign or/and

to the challenger’s campaign.

e. Campaign contributions become public, and the interest groups revise

their beliefs about the incumbent’s type (political advertising is not directly

informative).

f. The election takes place.

Date 2.

The winner of the election undertakes the projects or not depending on

her type.

13

The first period benefits by interest group i are equal to ri −1. Assumption (2) implies

that r > 1.

11

4

The vote with fully shared information.

In order to understand how do the interest groups exchange information at

date 1.d, we have to find how do they vote when this exchange has already

taken place. To this goal, we consider in this section a “thought experiment”

in which the first period returns from both projects are public. We start by

describing the interest group’s posterior beliefs about the incumbent’s type.

4.1

Posteriors.

Recall, that we focus on perfect Bayesian equilibrium in which at date 1.b the

incumbent undertakes both projects regardless of her type. In this equilibrium, the voters update their beliefs about the incumbent’s type depending

on the first-period returns from the projects. We denote by

prri−i (ρ) = Pr (vi = v | r1 , r2 )

the posterior probability which the voters assign to the event that the incumbent is valent with interest group i.

If project i has high return, the interest groups infer that the incumbent

is valent with interest group i regardless of the outcome of project −i:

pR

r−i (ρ) = 1 for any r−i .

Trivially, posetrior pR

r−i (ρ) does not depend on correlation ρ:

∂ pR

r−i (ρ)

= 0.

∂ρ

(4)

(5)

If project i has moderate return or no return at all, some uncertainty is

left about the valence of the incumbent with interest group i. Specifically,

if both projects fail, then the posterior probability of the event that the

incumbent is valent with interest group i is equal to

p00 (ρ) =

Pr (ri = 0, r−i

Pr (ri = 0, r−i = 0 | vi = v)

,

= 0 | vi = v) + Pr (ri = 0, r−i = 0 | vi = 0)

according to standard Bayesian updating. By full probability rule we find

Pr (ri = 0, r−i = 0 | vi = v) =

1

(1 − l − 2v) (1 − l − 2vρ) ,

2

12

and

Pr (ri = 0, r−i = 0 | vi = 0) =

1

(1 − l) (1 − l − 2v (1 − ρ)) .

2

Hence,

p00 (ρ) =

(1 − l − 2v) (1 − l − 2vρ)

.

2 (1 − l)2 − 2v (1 − l) + 2ρv 2

(6)

In a similar way, we find the posteriors

p0r (ρ) =

(1 − l − 2v) (l + vρ)

,

2l (1 − l − v) + v (1 − l − 2ρv)

ρ (1 − l − 2v)

,

1 − l − 2ρv

(l + v) (1 − l − 2vρ)

pr0 (ρ) =

,

2l (1 − l − v) + v (1 − l − 2ρv)

p0R (ρ) =

and

prr (ρ) =

(l + v) (l + vρ)

,

2l (l + v) + ρv 2

(7)

(8)

(9)

(10)

ρ (l + v)

.

(11)

l + ρv

Because a priori more weight is put on the event that the incumbent

is unbiased, a positive return from a project signals not only her valence

with the beneficiaries from that project, but also her valence with the other

voters. Similarly, no return from a project generates negative signals on the

incumbent’s valence with both interest groups. An outcome of a project’s

affects the posterior beliefs about the incumbent’s valence with the voters

who do not benefit from this project more, the stronger correlation ρ, that

is, the more congruent the interest groups. Hence, when return from project

−i is positive, the posterior probability of the event that the incumbent is

valent with interest group i monotonically increases with ρ. Otherwise, this

probability decreases with ρ (see section A.3 of the appendix):

prR (ρ) =

∂

pri (ρ)

∂ pri (ρ)

∂ pr0i (ρ)

<0< r

< R

for any ri < R.

∂ρ

∂ρ

∂ρ

(12)

Inequalities (5) and (12) imply

Lemma 1 (congruence among the voters and posteriors) Suppose

that outcomes of both projects become public before the election. Then, the

13

posterior probability prri−i (ρ) of the event that the incumbent is valent with

interest group i is nondecreasing with ρ if return from project −i is positive,

and nonincreasing with ρ otherwise.

An important implication of Lemma 1 for the remaining is monotonicity

of the posteriors in ρ.

4.2

The vote.

We are now prepared to describe how do the interest groups vote when they

share information about their first-period benefits.

Recall, that in the second period the politician in office picks efficient

policies because she has no re-election concerns. That is, she undertakes

project i if and only if she is valent with interest group i. Therefore, in the

election an interest group has the following preferences regarding the type of

the winner. It prefers a candidate who is valent with itself to a candidate

who is nonvalent with itself, regardless of her valence with the other interest

group. The reason is that the stakes of public policies are sufficiently high,

see assumption (2). Between two candidates who have the same valence

with itself, an interest group prefers the one who is nonvalent with the other

interest group, because an interest group shares the costs of both projects.

However, the voters cannot just pick a candidate who better fits their

preferences, because they hold imperfect information about the valence of

the candidates. More precisely, they know the distribution from which both

candidates’ type is drawn. This is the only information available to the

voters about the challenger’s type. They receive additional signal about the

incumbent’s type from the first-period outcomes r1 and r2 of the projects

(this signal depends on correlation ρ).

The vote by interest group i depends on this signal. We introduce notai

i

tion Irr−i

(ρ) to describe this vote: if Irr−i

(ρ) > 0 interest group i votes for the

incumbent, otherwise it votes for the challenger. In order to see how does the

i

(ρ) in terms

vote depend on the posteriors, it is convenient to express Irr−i

of the expected future return from project i if the winner of the election is

valent with interest group i:

S = (l + v) r + vR,

where “S” stands for the future stakes of public policies. In these terms,

the expected future payoff by interest group i if the challenger picks policies

14

at date 2 is equal to S−1

. Hence, its expected benefits when the incumbent

2

rather than the challenger picks policies at date 2 are equal to

r

i

Irr−i

(ρ) =

S prri−i

prri−i (ρ) + pr−i

S−1

i (ρ)

−

.

(ρ) −

2

2

(13)

Equation (13) describes how do the posteriors influence the vote. The

i

(ρ) increase in the

expected benefits by interest group i from re-election Irr−i

r

−i

ri

posterior pr−i (ρ), and decrease in the posterior pri (ρ). That is, re-election

is more attractive outcome for interest group 1, the more posterior weight is

put on the event that the incumbent’s type belongs to upper cells of table

1, and the less weight is put on the event that it belongs to the left cells

of the table (the first consideration being more important than the second).

Similarly, interest group 2 is more eager to vote for the incumbent, the more

skewed the posterior distribution of the her type towards the left and down

in table 1.

Because we already have established how do the posteriors depend on the

congruence ρ between the interest groups (see lemma 1), we can find how

does the vote depends on ρ. We will achieve this goal in two steps. On

the first step, we will describe the vote in two extreme cases: in case where

there is no correlation between the politician’s valence with different interest

groups, that is, ρ = 12 (independent vote), and in case where the politician’s

valence with different interest groups is the same, that is, ρ = 1 (coherent

vote). On the second step, we will consider cases where there is a positive but

imperfect correlation between the politician’s valence with different interest

groups, that is, 12 < ρ < 1. In order to describe the vote in these case, we will

refer to the vote in two extreme cases, and use the following monotonicity

argument, that is implied by lemma 1 and equation (13):14

Lemma 2 (monotonicity of the vote in congruence among the

i

(ρ) by interest group i is monotonous in ρ for any r1 ,

voters) The vote Irr−i

r2 .

In section A.4 of the appendix we describe precisely how does the vote

depend on the congruence between the interest groups.

14

When the outcomes of both projects become public before the election, lemma 2 is

impled by lemma 1 that establishes monotonicity of posteriors prri−i , and equation (13),

accrding to which the expected benefits from re-elction are a linear combination of thses

posteriors. Trivially, lemma 2 also holds when the first-period outcomes of the projects

are private (then, the posteriors do not depend on ρ).

15

Independent vote. Suppose that the prior beliefs about the politician’s type are fully diffused, that is, ρ = 12 . In particular, the same weight

is put on the event that the politician is biased as on the event that she is

unbiased. Then, the posterior beliefs about the incumbent’s valence with

interest group i do not depend on the outcome of project −i. Specifically,

if project i fails, the interest groups assign a higher posterior probability to

the event that the incumbent is valent with interest group i than the prior:

1

1 − l − 2v

1

0

pr−i

=

< for any r−i ,

(14)

2

2 (1 − l − v)

2

while if project i has a positive return, the voters increase their expectations

of that event more, the higher the return:

l+v

1 R

1

1

r

=

= 1 for any r−i .

> , pr−i

(15)

pr−i

2

2l + v

2

2

We now use equation (13) to describe the vote. We start with the vote by

nonbeneficiaries. If both projects fail, everyone votes for the challenger:

v (S − 1)

1

0

I0

< 0.

=−

2

2 (1 − v − l)

Nonbeneficiaries have even stronger incentives to vote for the challenger when

the other interest group receives benefits, because in this case the expected

future costs

1 of 0public

1 projects that nonbeneficiaries will pay are higher. That

0

is, Ir−i 2 < I0 2 for any r−i > 0. To summarize, nonbeneficiaries vote for

the challenger regardless of the benefits that the incumbent delivers to other

voters:

1

1

1

0

0

0

IR

< Ir

< I0

< 0.

(16)

2

2

2

We now describe the vote by the beneficiaries. If both project have the

same positive return, both interest groups vote for the incumbent (see equations (2) and (13)):

1

v (S − 1)

r

=

> 0,

(17)

Ir

2

2 (2l + v)

S −1

1

R

> 0,

(18)

=

IR

2

2

16

The beneficiaries have even stronger incentives to vote for the incumbent

when she delivers lower benefits to the other interest group then to themselves, because in this case the expected future costs of public projects that

they pay are lower:

1

1

r

r

0 < Ir

< I0

,

(19)

2

2

1

1

1

R

R

R

< Ir

< I0

.

(20)

0 < IR

2

2

2

However, when the beneficiaries receive return r that is smaller than return

R held by the other interest group, their vote depends on how strong is the

signal on the incumbent’s type generated by moderate return from a project.

If and only if this signal is sufficiently strong, an interest group that holds

moderate benefits votes for the incumbent despite it knows (from the fact

that she has delivered high return to the other voters) that in the future she

will charge it the costs of the project that is not group-specific:

1

r

IR

>0

(21)

2

if and only if

v (S − 1) > l.

(22)

In order to illustrate the main insights in the most transparent way, we

assume hereafter that parameters of the model satisfy inequality (22). Then,

inequalities (16)-(20) imply

Lemma 3 (independent vote) Suppose that there is no correlation

between the politician’s valence with different interest groups, that is, ρ = 12 .

Then, the beneficiaries vote for the incumbent, while nonbeneficiaries vote

for the challenger.

Trivially, the insight of lemma 3 holds regardless of whether the voters

share information before the election or not. We will use this insight in

section 6 where we compare the efficiency of the election with and without

contributions.

Coherent vote. Suppose that the politician is unbiased, that is, ρ = 1.

Then, the interest groups vote coherently. Specifically, if the incumbent

17

delivers high return from at least one project, the interest groups infer that

she is a valent type, and vote for her:

S −1

(23)

> 0 for any r1 , r2 .

2

Suppose now, that none of the projects has high return. Then, some

uncertainty is left about whether the incumbent is a valent type or she is a

nonvalent type. If both projects have moderate return r, the voters assign a

higher posterior probability prr (1) to the event that the incumbent is a valent

type then the prior (see inequalities (12) and (15)), and vote for her:

1

r

r

Ir (1) = pr (1) −

(S − 1) > 0.

(24)

2

IRri (1) = IrR−i (1) =

while if both projects fail, they assign a lower posterior probability p00 (1) to

that event (see inequalities (12) and (14)), and vote for the challenger:

1

0

0

I0 (1) = p0 (1) −

(S − 1) < 0.

(25)

2

When one project has high return, while the other project fails, the voters

assign a higher posterior probability to the event that the incumbent is a

valent type than the prior:

pr0 (1) =

(l + v) (1 − l − 2v)

1

> ,

2l (1 − l − v) + v (1 − l − 2v)

2

and vote for her:

1 S−1

r

> 0.

(26)

(1) = p0 (1) −

2

2

The reason is that according to assumption (3), moderate return from a

project generates a stronger signal on the politician’s type than the failure

of a project.

To summarize inequalities (23), (24), and (26), if at least one project has

a positive return, the interest groups vote for the incumbent:

I0r

i

(1) > 0 for any ri > 0 and any r−i .

Irr−i

(27)

Lemma 4 (coherent vote) Suppose that outcomes of the projects become public before the election, and the politician has the same valence with

different interest groups. Then, the vote is coherent. Both interest groups

vote for the incumbent if at least one project has a positive return. Otherwise, they vote for the challenger.

18

Congruence between the interest groups and the vote. We now

describe the vote in cases where there is a positive but imperfect correlation

between the politician’s valence with different interest groups, that is, 12 <

ρ < 1. In these cases, the politician a priori may be biased. However, more

weight is put on the event that she is unbiased.

If both interest groups receive coherent signals on the incumbent’s type

(that is, they both receive some benefits, or both receive no benefits), then

the posterior distributional weight is further reallocated towards the event

that the politician is unbiased as compared to the prior. Hence, the vote

when the interest groups share information is the same as their independent

vote described by lemma 3.

Specifically, when both interest groups benefit before the election, they

shift the posterior distributional weight towards the event that the incumbent

is a valent type as compared to the prior. Similarly, when both interest groups

receive no return from public projects before the election, they reallocate the

distributional weight towards the event that the incumbent is a nonvalent

type, and vote for the challenger. More precisely, lemmas 2-4 imply that if

i

(ρ) > 0 for any ρ; and I00 (ρ) < 0 for any ρ,

both ri > 0 and r−i > 0 then Irr−i

as depicted on Figure 1. (see section A.4 of the appendix).

From now on, we focus on more interesting cases where one interest group

benefits before the election while the other does not. Recall, that according to

assumption (3), the beneficiaries hold more precise signal on the incumbent’s

type than nonbeneficiaries. Hence, the beneficiaries vote fore the incumbent.15 In contrast, nonbeneficiaries informed about the benefits received by

the other interest group may decide to vote for the incumbent.

To be more precise, suppose that at date 1.c the incumbent delivers benefits to interest group 1, but not to interest group 2. Then, the posterior

distributional weight is shifted towards upper cells of table 1 as compared to

the prior. Hence, the impact of information about benefits received by interest group 1 on the vote by interest group 2 is controversial. On one hand,

these benefits signal that the incumbent is a valent type, and thereby encourage interest group 2 to vote for re-election. On the other hand, however, they

also signal that the incumbent is biased towards interest group 1, and hence,

provide the incentives for interest group 2 to vote for the challenger. Hence,

interest group 1 votes for the incumbent if and only if the first consideration

15

Our model can be easily extended for more general case where the signal on the

incumbent’s type held by nonbeneficiaries is useful for the beneficiaries.

19

I rr−i i (1 / 2 )

I 0R (1 / 2 )

1

money burned

I (1 / 2 )

I (1 / 2 )

I (1 / 2 )

R

r

R

R

r

0

r

r

r

R

0.75

0.5

I (1 / 2 )

ρ = ρ R0

I (1 / 2 )

I

ri

r−i

0.25

(1 / 2 ) = 0

0.5

0.6

0.7

0.8

I rr (1)

I 0r (1)

ρ

0.9

I (1 / 2 )

-0.25

I r0 (1 / 2 )

-0.5

0

0

I rR−i (1) =

= I Rri (1)

I 00 (1)

I R0 (1 / 2 )

ρ = 1/ 2

ρ = ρ R0

ρ = ρ r0

ρ =1

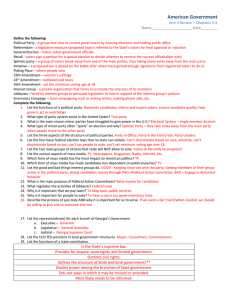

Figure 1: Congruence among the voters and benefits from re-election.

is more important than the second, that is, if and only if the prior weight ρ

of the event that the politician is unbiased is sufficiently high.

Indeed, if the prior distribution of the politician’s type is diffused, that

is ρ = 12 , interest group 2 votes for the challenger (lemma 3), while if the

incumbent is unbiased, that is ρ = 1, interest group 2 votes for re-election

(lemma 4). Lemma 2 implies that the expected benefits by interest group

i from the re-election increase with ρ. Thick red curve, and dashed green

curve on Figure 1 illustrate this dynamics. Thick red curve corresponds to

the case where project 1 has high return, while dashed green curve depicts

the case where project 1 has moderate return. High return from a project

generates a stronger signal on the politician’s type than moderate return.

Therefore, thick red curve is steeper than dashed green curve. For each

return from project 1 there exist a threshold, such that nonbeneficiaries vote

for the incumbent if and only if correlation ρ between the politician’s valence

with different interest groups lies above this threshold.

Specifically, there exist a lower congruence threshold ρ0R , such high return

from project 1 convinces interest group 2 to vote for the incumbent despite

the failure of project 1, if and only if the prior weight ρ of the event that

the politician is unbiased lies above this threshold. That is, IR0 (ρ) > 0 if and

20

only if ρ > ρ0R , where

ρ0R =

(1 − l) S

.

2(1 − v − l)S − (1 − 2v − l)

(28)

Similarly, there exist an upper congruence threshold ρ0r , such that any positive

return from project 1 convinces interest group 2 to vote for the incumbent if

and only if correlation ρ lies above that threshold. That is, Ir0 (ρ) > 0 if and

only if ρ > ρ0r , where

ρ0r =

(1 + l) S

.

2(1 − v − l)S − (1 − 2v − 3l)

(29)

Because high return from a project generates a stronger signal on the

politician’s type than moderate return, the upper congruence threshold ρ0r

exceeds the lower congruence threshold ρ0R (see equations (28) and (29)).

These considerations are summarized by the following

Lemma 5 Suppose that outcomes of the projects become public before

the election. Then, the vote is as follows.

1. The beneficiaries vote for the incumbent.

2. Nonbeneficiaries vote for the incumbent in one of the following two

circumstances.

a. If she delivers high return R to the other voters, and the prior weight

ρ of the event that the politician is unbiased lies above the lower congruence

threshold ρ0R given by equation (28).

b. If she delivers moderate return r to the other voters, the other voters

receives moderate return r , and the prior weight ρ of the event that the

politician is unbiased lies above the upper congruence threshold ρ0r given by

equation (29).

Hence, the vote depends on the prior weight ρ of the event that the

politician is unbiased. If ρ lies below the lower congruence threshold ρ0R ,

the vote by the interest groups is independent; if it lies above the upper

congruence threshold ρ0r , the vote is coherent. Otherwise (that is, if ρ lies

between the thresholds), there is a tie in the election if and only if one interest

group receives moderate return while the other interest group receives no

return. This motivates the following

Definition The congruence between the interest groups is low, if ρ < ρ0R .

21

The congruence between the interest groups is moderate, if ρ0R < ρ < ρ0r .

The congruence between the interest groups is high, if ρ > ρ0r .

Stakes of public policies, the voters’ information and the congruence between the interest groups. As we already have discussed,

an interest group is more eager to vote for a candidate, the higher probabilily is assigns to the event that the candidate is valent with itself, and the

lower probability it assigns to the event that she is valent with the other

voters. The higher the stakes of public projects as compared to their costs,

more important is the first consideration as compared to the second. Hence,

the congruence among the voters is nondecreasing in the efficiency of public

projects. That is, both thresholds ρ0R and ρ0r decrease in S.

Another factor that is important for the coherence of the vote is the

precision of information held by the interest groups. While the signal on

the incumbent’s type generated by high return from a project has a given

precision, the strength of signals generated by two other possible outcomes

of a project depends on variables v and l (see equations (1)).

Indeed, variable v measures how important is valence of the politician

with an interest group for avoiding the failure of the group-specific project.

Hence, higher v, stronger is the signal on the incumbent’s type generated

by the failure of a project. Consequently, more difficult it is to convince

nonbeneficiaries to vote for the incumbent. Hence, threshold ρ0R increases

with v. The impact of variable v on threshold ρ0r is two-fold, because the

signal on the incumbent’s type generated by moderate return from a project

is stronger at higher values of v. However, this effect is minor as compared

to the effect that variable v has on the precision of the signal generated by

the failure. The reason is that the incumbent can succeed a project in two

ways: by delivering high returns from the project and by delivering moderate

returns. At the same time, there is only one way in which she fails a project.

Hence, threshold ρ0r also increases with v though slower than threshold ρ0R .

Moderate return from a project generates stronger signal on the incumbent’s type, the lower the probability that the politician who is nonvalent

with an interest group delivers moderate return from group-specific project

by luck. This luck is measures by variable l. Hence, the higher l, weaker

is the signal on the incumbent’s type generated by moderate return from a

project. At the same time, stronger is the signal generated by the failure.

Hence, both thresholds ρ0R and ρ0r increase in l (threshold ρ0r increases faster

22

than threshold ρ0R ).

These considerations are summarized by the following.

Remark 1 Both thresholds ρ0R and ρ0r decrease in S, increase in v, and

increase in l.

The formal proof of this statement is moved to section A.5 of the Appndix.

5

Campaign contributions and the vote.

In this section we use the insights of lemma 5 to describe when and in which

way do the voters exchange information before the election when the firstperiod return from a project is privately known by the interest group that

holds this return.

Recall, that there are two ways available to the interest groups for this

exchange: cheap-talk and costly signalling via electoral campaign finance. A

contribution strategy by interest group i is a pair of contributions (cC (ri ), cI (ri ))

to the candidate’s campaigns for each outcome ri , where cI (ri ) denote interest group’s i contributions to the incumbent’s campaign, and cC (ri ) stand

for interest group’s i contributions to the challenger’s campaign.

We focus on symmetric Perfect Bayesian Equilibria in pure strategies in

which first, an interest group contributes to electoral campaign of a candidate

whom it is eager to elect (that is, contributions are promotional), second, political advertising is the least expensive. We call equilibria that satisfy these

refinements CPAPC equilibria, where CPAPC stands for “cheapest political

advertising with promotional contributions”.

We consider separately the cases of low-, moderate-, and high congruence

between the interest groups as defined in the previous section. In order to

decribe contributions and the vote in each of these cases, we use the fact that

in equilibrium an interest group’s campaign contributions strategies shall be:

- first, informative (since they are costly);

- second, incentive compatible;

- third, individually rational with respect to the vote they generate.

5.1

Low congruence between the interest groups.

When the prior weight ρ of the event that the politician is unbiased lies below

the lower congruence threshold ρ0R , return ri is a sufficient statistics for the

23

vote of interest group i (lemma 5). Because contributions have no impact

on the election outcome, no positive contributions are individually rational.

The vote is independent.

Proposition 1 When the prior weight ρ of the event that the politician is

unbiased lies below the lower congruence threshold ρ0R , the interest groups do

not contribute to electoral campaigns. Their vote is independent: the benefciaries vote for the incumbent, while nonbeneficiries vote for the challenger.

5.2

High congruence between the interest groups.

When the prior weight ρ of the event that the politician is unbiased lies

above the upper congruence threshold ρ0r , the vote is coherent. Specifically,

the interest group vote for the incumbent if and only if she deliveres positive

return from at least one project (lemma 5). Therefore, it suffices for the

beneficiaries to simply announce their benefits, in order to convince nonbeneficiaries to re-elect the incumbent. Hence, there is an equilibrium in which

the voterst exchange information at date 1.d via cheap-talk. Obviously, this

is the unique CPAPC equilibrium.16

Proposition 2 When the prior weight ρ of the event that the politician is

unbiased lies above the upper congruence threshold ρ0r , there is the unique

CPAPC equilibrium in which an interest group truthfully announces its firstperiod benefits before the election, and the vote is coherent: the interest group

vote for the incumbent if she has delivered a positive return from at least one

project, and for the challenger otherwise.

5.3

Moderate congruence between the interest groups.

We now consider more intersting case where the prior weight ρ of the event

that the politician is unbiased lies between the lower congruence threshold

ρ0R and the upper congruence threshold ρ0r . In this casen, when the interest

groups honestly disclose their first-period benefits there is a tie in the election

16

Other symmetric Perfect Bayesian Equilibria in pure strategies are associated with

positive costs of political advertising. Any contrbutions that satisfy informativeness constraint that requires either cC (ri ) = cC (0) or cI (ri ) = cI (0), and individual rationality

constraints that require cI (ri ) + cC (ri ) 12 Pr (r−i = 0 | ri ) I0ri for any ri , constitute a

symmetric Perfect Bayesian Equilibria in pure strategies. Incentive compatibility does not

impose any additional constraints.

24

if and only if one interest group receives moderate return while the other

interest group receives no return (see lemma 5). This creates moral hazard

in the campaign finance stage (at date 1.d). Indeed, if an interest group

receives moderate return r, it has the incentives to claim that it has received

high return R in order to convince nonbeneficiaries to vote for the incumbent.

The expected gains from such a lie are equal to

1

c = I0r (ρ) Pr (r−i = 0 | ri = r) =

2

=

v (S (l + 1) − ρ (2S (v + 2l) + 1 − 2v − 3l))

4 (v + 2l)

(30)

Because there is a hazard of this lie, cheap-talk is not credible.

At the same time, if an interest group holds high return, it is eager to

credibly communicate this information to the other voters. It may achieve

this goal by costly signalling. We now assume that interest group i receives

high return at date 1.c, and describe its campaign contribution strategy

that satisfy three constraints: informativeness, incentive compatibility, and

individual rationality.

Informativeness constraint requires that campaign contributions signal

high return:

for any ri < R either cC (R) = cC (ri ) or cI (R) = cI (ri ).

(31)

When campaign contributions are informative, the interest groups vote

as described by lemma 5. That is, the beneficiaries vote for the incumbent,

while nonbeneficiaries vote for the incumbent if campaign contributions signal that she delivered high return to other voters, and vote for the challenger

otherwise. Hence, incentive compatibility requires that interest group i contibutes the sum that it would have contrubuted that the beneficiries who

hold moderate return do not contribute so as if the return they hold was

high:

C

(32)

c (R) + cI (R) − cC (r) + cI (r) c,

where threshold c is given by equation (30).

Individual rationality requires that contributions by an interest group to

political advertising do not exceed the expected benefits from contributing.

These benefits come from the impact that they have on the election outcome.

Hence, an interest group may benefit from contributing if and only if it holds

25

Suppose that project i has high return. At date 1.f, interest group i

assigns a positive probability to the event that project −i fails. In this case,

by signalling big success of project i, interest group i convinces interest group

−i to vote for the incumbent. This provides interest group i with expected

future benefits equal to

1

S (1 − l) − ρ (2v (S − 1) + 1 − l)

c = I0R (ρ) Pr (r−i = 0 | ri = R) =

. (33)

2

2

Individual rationality requires:

cC (R) + cI (R) c,

(34)

where threshold c is given by equation (33), and

cC (ri ) + cI (ri ) 0 for any ri < R.

(35)

The latter inequality implies that an interest group that receives less than

high return does not finance political advertising. Hence, the informativeness

constraint (31) is equivalent to

cC (R) + cI (R) > 0,

(36)

while the incentive constraint (32) is equivalent to

cC (R) + cI (R) c.

(37)

Recall, that we pick an equilibrium in which electoral campaigns are the

least expensive, and contributions to a candidate’s campaigns help her to win

the election. Minimization of campaign expenditures cC (R) + cI (R) subject

to constraints (34), (36) and (37) implies that constraint (37) is satisfied as an

equality. The beneficiaries contribute so as to help the incumbent candidate

to win the election, which implies that cC (R) = 0. Hence,

Proposition 3 When the prior weight ρ of the event that the politician is

unbiased lies between the lower congruence threshold ρ0R and the upper congruence threshold ρ0r , there is the unique CPAPC equilibrium in which campaign

contributions and the vote are the following.

1. An interest group contributes to the incumbent’s campaign sum c that

is given by equation (30) if it receives high return. Challenger receives no

contributions.

26

2. The beneficiaries vote for the incumbent regardless of total contributions received by the candidates. nonbeneficiaries vote for the incumbent

candidate if the sum contributed to her electoral campaign is at least as big

as threshold c. Otherwise, they vote for the challenger.

Proposition 3 tells that political advertising by the incumbent has to

be sufficiently expensive to be credible. Hence, we rationalize campaign

contributions by the interest groups signalling benefits.

Money burned in electoral campaigns and congruence among

the voters. Proposition 3 implies that the lower limit of expected contributions to the incumbent’s campaign is equal to

M B = v(1 − l − vρ)c =

=

v 2 (1 − l − vρ) (S (l + 1) − ρ (2S (v + 2l) + 1 − 2v − 3l))

,

4 (v + 2l)

(38)

where “MB” stands for money burned in political advertising. This sum

decreases with correlation ρ. The reason that the higher prior weight of

the event that a candidate is unbiased, lower probability the beneficiaries

assign to the event that the other interest group receives no benefits, and

also lower is their expected gain from convincing nonbeneficiaries to vote for

the incumbent.

At the same time, the sum given by equation (38) increases with policy

stakes S: the higher the stakes, larger the expected gain by the beneficiaries from avoiding tie in the election, hence, stronger are their incentives to

exaggerate the size of their benefits. We summarize these considerations as

Corollary When the prior weight ρ of the event that the politician is

unbiased lies between the lower congruence threshold ρ0R and the upper congruence threshold ρ0r , the lower campaign spending thershold is given by equation (38). This threshold increases with policy stakes S and decreases with

the congruence between the interest groups ρ.

Incumbency advantage. Propositions 3 predicts that campaign contributions are skewed towards the incumbent. The reason is the beneficiaries

hold more precise private information than nonbeneficiaries. Of course, the

prediction of the proposition that the challenger receives no contributions

27

is not realistic. The reason is that in our model the strength of a signal

on the incumbent’s type generated by a policy failure is given, and this signal is weak (and therefore, useless for the beneficiaries). In a more general

version of our model, the challenger receives contributions to her campaign.

However, as long as more precise private information is available to the beneficiaries than to nonbeneficiaries, challenger receives less contributions than

the incumbent.17

6

Campaign contributions and voter welfare.

The election is more efficient when the expected valence by the official in

office at date 2 with an interest group is higher, and the costs of political

advertising are lower. Campaign contributions have no impact on the efficiency of the election when the congruence between the interets groups is

low (see propositions 1), and increase this efficiency when that congruence

is high (see proposition 2). We consider now how does the efficiency of the

election depend on the congruence between the interest groups, when the

congruence between the interets groups is moderate. Recall, that we focus

on the upper limit of this efficiency. That is, we assume that costs of creadible

communication are given by equation (38).

Efficiency of the vote. We start by considering how does the expected

future welfare depend on the probability to screen in a certain type of the

politician during the election. The expected future welfare is equal to 2(S−1),

if a valent candidate wins the election; to S − 1, if a biased candidate is in

office at date 2; and to 0, if nonvalent candidate occupies the office in period

2.

When a biased candidate is in office at date 2, the expected second period welfare is equal to S − 1. This is precisely the same as the expected

17

Only if we assume, contrary to what is done in the model, that nonbeneficiaries hold

more precise private information than the beneficiaries, we find that the challenger’s campaign is more expensive. Consider the mirror image of our model where a project has

high return with probability 1 − l − 2v + 2vi , moderate return with probability l + v − vi ,

and no return with probability v − vi . Then, moderate return from project generates a

negative signal on the incumbent’s valence. However, this signal is not as strong as the

one generated by the failure of a project. Hence, the incumbent receives no contributions,

while the lower limits of the challenger’s campaign expenditures are given by equation

(38).

28

future welfare when the incumbent is replaced with the challenger. Hence,

for the parameters that we consider there are no costs of re-electing a biased

incumbent. The election is more efficient the higher the probability to reelect a valent incumbent and the lower the probability to re-elect a nonvalent

incumbent.

We denote by zV the probability to re-elect a valent incumbent, by zS

the probability to re-elect a biased incumbent, and by zI the probability to

re-elect nonvalent incumbent. In this notation, the expected future welfare

is equal to

ρ

(39)

W2 (zV , zS , zI ) = (S − 1) 1 + (zV − zI ) .

2

No contributions benchmark. As a benchmark, we consider the case

where campaign contributions are prohibited. In this case, the interest groups

vote for the incumbent if and only if they benefit before the election. Therefore,

zV = 2v2 + lv + l + v, zS = l + v, zL = l.

(40)

Hence, according to equation (26), the expected second period welfare is

equal to

vρ

W2NC = W2 2v2 + lv + l + v, l + v, l = (S − 1) 1 +

(2v + l + 1) .

2

(41)

Note, that the efficiency of the election without campaign contributions

given by equation (41) increases with vρ and with S. The reason is the

following. Each interest group screens in a candidate with higher expected

valence with itself. The less noisy the voters signals on the incumbent’s type,

more efficient is this screening. Since more prior weight is put on the event

that a candidate is unbiased, the vote by one interest group creates a positive

externality on the future expected utility of the other interest group. These

externality is stronger, the stronger correlation ρ, and more important the

higher the policy stakes S.

W2N C

Welfare benefits from campaign contributions. We now compare

the efficiency of the election with and without campaign contributions.

According to proposition 3, when at least one project has high return at

date 1.c, the incumbent stays in office. She also stays in office if both projects

29

have moderate return. When one project has moderate return, while the

other project fails, she wins the election with probability 12 . Finally, if both

projects fail she has no chance to be re-elected. Hence,

zV = l + 2v, zS = l +

3v lv

− , zI = l.

2

2

(42)

Hence, the expected informational gain from campaign contributions is equal

to

vρ

(1 − 2v − l) .

(43)

IS M C = (S − 1)

2

According to proposition 3, this gain is achieved at the expense of money

burned in electoral campaigns. The lower campaign spending thershold is

given by equation (38). We subtract it from the informational gain given by

equation (43), and find that

Proposition 4 When the prior weight ρ of the event that the politician is

unbiased lies between the lower congruence threshold ρ0R and the upper congruence threshold ρ0r , campaign contributions increase the voters welfare.

The reason is that contributions are of a smaller value than the policies

at stake.

Remark 2 The more congruent the voters, larger their benefits from

campaign contributions.

Indeed, there are two coherent effects. First, the more congruent the

voters, more important is the externality that individual vote imposes on

the future utilities by the other voters. Hence, larger are the benefits from

informaion sharing that increases the extent to which a voter internalizes that

externality. Second, the more congruent the voters, cheaper it is for them

to signal their private information, hence, less money is burned in campaign

advertising.

7

Conclusion.

The paper builds a model of political campaign contributions where the interest groups finance political advertising in order to share their private information about the valence of candidates. The main insights of the model

can be summarized as follows.

30

1. Campaign contributions can be rationalized by interest group’s signalling benefits.

2. One of the candidates (the incumbent) receives more contributions.

3. Political advertising is less expensive when the interest groups are more

congruent.

4. Campaign contributions increase the voter welfare.

The model could be extended to study the policy-costs created by campaign finance. Assume that the information held by the interest groups depends on the politician’s effort. Campaign finance allows the interest groups

to exchange information about the candidate for re-election. This communication may weaken the incumbent’s incentives to exert an additional unit of

effort in order to signal its valence to the voters.1819

The model also allows to investigate how the total amount of money

spent on political advertising depends on diversity of the electorate. On

the one hand, the number of contributing interest groups increases. On the

other hand, however, each interest group is less likely to be influential in the

election. These questions are open for further research.

References

[1] Anderson, J. E. and Prusa, T. J. (2001), “Political Market Structure,”

NBER Working Paper No. W8371.

[2] Ansolabehere, S., de Figueiredo, J. M., and J. M. Snyder, Jr. (2003),

“Why Is There so Little Money in Politics?” The Journal of Economic Perspectives, 17(1):105-130.

[3] Ansolabehere, S. and S. Iyengar, (1996) “Going Negative: How Political

Advertisements Shrink and Polarize the Electorate,” The Free Press,

New York.

18

Along the lines of Holmström 1999.

For instance, if the politician in office can at some costs exert an effort that increases

the probabilty of a policy success, information sharing among the voters may weaken

her incentives to exert an additional unit of effort. This consideration is reminicent of

Holmström 1999.

19

31

[4] Ansolabehere, S., Gerber, A. S., and J. M. Snyder, Jr. (2001), “Does TV

Advertising Explain the Rise of Campaign Spending? A Study of

Campaign Spending and Broadcast Advertising Prices in US House

Elections the 1990s and the 1970s,” Working paper, Massachusetts

Institute of Technology.

[5] Ashworth, S. (2003), “Campaign Finance and Voter Welfare with Entrenched incumbents,” Working paper, Harvard University.

[6] Austen-Smith, D. (1987), “Interest Groups, Campaign Contributions

and Probabilistic Voting,” Public Choice, 54:123-139.

[7] Bailey, M. (2002), “Money and Representation: An Exploration in

Multiple Dimensions with Informative Campaigns,” Working paper,

Georgetown University.

[8] Baron, D. (1994), “Electoral Competition with Informed and Uninformed Voters,” American Political Science Review, 88:33-47.

[9] Battaglini, M., and Bénabou R. (2003), “Trust, Coordination, and The

Industrial organization of Political Activism,” Journal of the European Economic Association, 1(4):851-889(39).

[10] Besley, T. (2004), “The New Political Economy,” Working paper, London School of Economics.

[11] Coate, S. (2003), “Political Competition with Campaign Contributions

and Informative Advertising,” Working paper, Department of Economics, Cornell University.

[12] Grossman, G. M. and E. Helpman, (2001), “Special Interest Politics,”

MIT Press.

[13] Holmström, B. (1999), “Managerial Incentive Problems: A Dynamic

Perspective,” Review of Economic Studies, Blackwell Publishing,

66(3), pages 169-82.

[14] Holmström, B. and P. Milgrom (1991), “Multi-Task Principal Agent

Analyses,” Journal of Law, Economics and Organization, 7, Special

Issue.

[15] Holmström, B. and J. Ricart i Costa (1986), “Managerial Incentives and

Capital Management,” The Quarterly Journal of Economics, 4:835860.

32

[16] Laffont, J.-J. (2000), Incentives and Political Economy, Clarendon Lecture, Oxford University Press.

[17] Laffont , J.-J. and J. Tirole (1993), “A Theory of Incentives in Procurement and Regulation,” MIT Press.

[18] Levitt, S. (1995), “Policy Watch: Congressional Campaign Finance Reform,” Journal of Economic Perspectives, 9(3):183-93.

[19] Milgrom, P. and J. Roberts (1986), “Price and Advertising Signals on

Product Quality,” Journal of Political Economy, 94:796-821.

[20] Morton, R. and C. Cameron, (1992), “Elections and the Theory of Campaign Contributions: A Survey and Critical Analysis,” Economics

and Politics, 4:79-108.

[21] Moon, Woojin (2001), “The Calculus of Campaign Contributions and

the Resource Constrained Electoral Competition Model,” mimeo,

University of California, Los Angeles.

[22] Poole Keith T., and Romer, Thomas (1985), “Patterns of Political Action Committee Contributions to the 1980 Campaign for the United

States House of Representatives,” Public Choice 47:63-111.

[23] Potters, J., Sloof, R. and van Winden, F. (1997), “Campaign Expenditures, Contributions, and Direct Endorsements: The Strategic Use

of Information and Money to Influence Voter Behavior,” European

Journal of Political Economy, 13(2):1-31.

[24] Prat, A. (1999), “An Economic Analysis of Campaign Finance,” World

Economics, NTC Economic & Financial Publishing, Oxfordshire,

United Kingdom, 1(2).

[25] Prat, A. (2002a), “Campaign Advertising and Voter Welfare,” Review

of Economic Studies 69(4):997-1017.

[26] Prat, A. (2002b), “Campaign Spending with Office-Seeking Politicians,

Rational Voters, and Multiple Lobbies,” Journal of Economic Theory, 103(3):162-189.

[27] Prat, A. (2004), “Rational Voters and Political Advertising,” Working

paper, London School of Economics and Poitical Science.

[28] Schultz, C. (2003), “Strategic Campaigns and Redistributive Politics,”

Working paper, University of Copenhagen.

33

[29] Stratmann, T. (2005), “Some talk: Money in politics. A (partial) review

of the literature,” Public Choice, Springer, 124(3):135-156.

[30] Tirole J. (1999), The Theory of Industrial Organization, The MIT Press.

[31] Tullock, G. (1972), “The Purchase of Politicians,” Western Economic

Journal, 10:354-355.

[32] Wittman, D. (2005), “Candidate Quality, Pressure Group Endorsements, and the Nature of political Advertising,” Working paper,

University of California, Santa Cruz.

A

A.1

Appendix.

US Congressional Campaigns.

Costs of political advertising. Figure 2 illustrates the US Congressional campaign receipts from 1981-1982 election cycle to 2001-2002 election

cycle in millions of 2003 US dollars.20 On average, this figure stood at 1069