WORKING PAPER — LEAN 94-05 Summary of Inventory Pilot Project

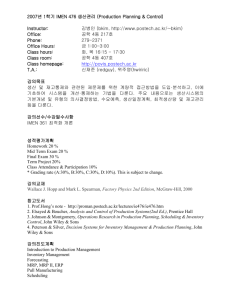

advertisement