Developing a Unified Manufacturing and Sourcing Strategy

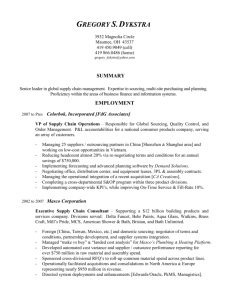

advertisement