Document 10790202

advertisement

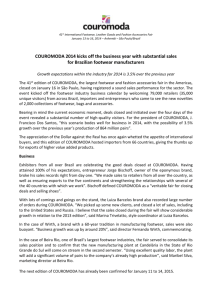

Practical Example of Base Source Optimization - Footwear Profiling at Nike, Inc. by David G. Jacobs, P.E. B.S. Civil Engineering United States Military Academy - West Point, 2008 Submitted to the MIT Sloan School of Management and the Engineering Systems Division in Partial Fulfillment of the Requirements for the Degrees of Master of Business Administration and Master of Science in Engineering Systems in conjunction with the Leaders for Global Operations Program at the Massachusetts Institute of Technology June 2015 ARCHWES MAS 3ACHUSETTS INSTITUTE OF rECHNOLOLGY JUN 24 2015 LIBRARIES 2015 David G. Jacobs, P.E. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Author Signature redacted )MWTS'loan School of Management, Engineering Systems Division Certified by Signature redacted May 8,2015 David Simchi-Levi, Thesis Supervisor Professor of Engineering Systems, Engineering Systems Division Certified by Signature redacted_Stephen C. Graves, Thesis Supervisor Abraham J. Siegel Professor of Management Science, MIT Sloan School of Management Accepted by Signature redacted Munther A. Dahleh William A. Coolidge Professor of Electrical Engineering and Computer Science Chair, Engineering Systems Division Education Committee Accepted by Signature redacted N'faukfHerson, Director of MIT Sloan MBA Program MIT Sloan School of Management MfTLibraries 77 Massachusetts Avenue Cambridge, MA 02139 http://Iibraries.mit.edu/ask DISCLAIMER NOTICE Due to the condition of the original material, there are unavoidable flaws in this reproduction. We have made every effort possible to provide you with the best copy available. Thank you. The images contained in this document are of the best quality available. Practical Example of Base Source Optimization - Footwear Profiling at Nike, Inc. by David G. Jacobs, P.E. Submitted to the MIT Sloan School of Management and the Engineering Systems Division on May 8, 2015 in partial fulfillment of the requirements for the degrees of Master of Business Administration and Master of Science in Engineering Systems. ABSTRACT The long term sourcing for footwear development, or "profiling," at Nike, Inc. has grown with the company and become significantly complex. It is no longer possible for a single person, no matter the level of experience, to optimize the company's profiling plan without computational assistance. Optimization methods, specifically mixed-integer linear programing, present an opportunity to save between 6.7 and 9.7% of combined labor and duty costs to the company. The model proposed by this research is responsible for justifying that potential but is merely a starting point for Nike, Inc. Further application and research into the company's manufacturing processes including transportation costs, technology groupings, and the Manufacturing Index (MI) could wield results that far surpass the levels obtained by this research. Implementation of an algorithmic approach is challenging for an organization that values "storytelling," collaboration, and narrative. However, in time I believe that this model, or something similar, will find a place, and deliver results, for Nike, Inc. Thesis Supervisor: Stephen Graves Title: Abraham J. Siegel Professor of Management Science, Professor of Mechanical Engineering and Engineering Systems Thesis Supervisor: David Simchi-Levi Title: Professor of Civil and Environmental Engineering and Engineering Systems, LGO Co-Director 3 This page intentionally left blank. 4 ACKNOWLEDGEMENTS I would like to thank Nike's Sourcing and Manufacturing division for sponsoring this project and for their candid support for the Leaders for Global Operations program. I would also like to thank the Global Footwear Planning team for supporting me with open minds, enthusiasm, and wisdom. Thank you to Jon McCracken (whose profile adorns the model's user interface), to Roger Sklar (who now has the esteemed privilege of using the model), to Scott Powell for his leadership of the Supply Chain Innovation Team, and to Carlo Quinonez, who provided his perspective, friendship, and wisdom. Most importantly, I am indebted to Ryan Warr, who designed the project and mentored me throughout. I could not have come to any meaningful result, much less one this successful, without his collaboration. Finally, I'd like to thank my fellow interns from MIT: Yalu Wu, John Kang, Ryan Jacobs, Jonathan Dobberstein, and Alessandra Mak. I probably would have made it without you all, but it wouldn't have been nearly as fun. 5 This page intentionally left blank. 6 TABLE OF CONTENTS T able of Contents ..................................................................................................................................................................... 7 1. 2. Introduction ...................................................................................................................................................................10 1.1. Purp ose of Project ..............................................................................................................................................10 1.2. Profiling Description .........................................................................................................................................10 1.3. Prob lem Statem ent ............................................................................................................................................10 1.4. H ypothesis .............................................................................................................................................................10 1.5. Project G oals .........................................................................................................................................................11 1.6. Project A pproach ................................................................................................................................................11 1.7. Confi dentiality .....................................................................................................................................................11 Background of Profiling in Global Footw ear Planning ................................................................................. 11 2.1. B ackground of Com pany ................................................................................................................................. 11 2.2. Footwear Planning at N ike ............................................................................................................................. 12 2.2.1. G lobal Footw ear Planning Team ........................................................................................................ 12 2.2.2. Footwear Categories ............................................................................................................................... 12 2.2.3. Footw ear Planning Process .................................................................................................................. 12 2.3. 3. 4. Literature Review ........................................................................................................................................................14 3.1. Prior Research in N ike Global Footw ear Planning ............................................................................... 14 3.2. Research in Retail M anufacturing ............................................................................................................... 14 3.3. Research in Im plem enting Softw are Solutions ......................................................................................is M ethodology ..................................................................................................................................................................15 4.1. Current State A nalysis ......................................................................................................................................15 4.1.1. Interview s ....................................................................................................................................................16 4.1.2. Process M apping Across Stakeholders ............................................................................................ 16 4.2. 5. Current Profiling Process ................................................................................................................................ 13 Prototyping ...........................................................................................................................................................17 4.2.1. In itial Prototype ........................................................................................................................................17 4.2.2. Second Prototype ......................................................................................................................................18 4.2.3. Final Prototype ..........................................................................................................................................19 4.3. V alidation of the M odel ....................................................................................................................................21 4.4. R obustness of M odel .........................................................................................................................................22 M odel Form ulation ......................................................................................................................................................22 7 5.1. Form ulation and D efinitions ......................................................................................................................... 22 5.2. O bjective Function ............................................................................................................................................. 22 5.2.1. 6. 7. Grouping Constraint ................................................................................................................................ 23 5.3. Constraints ............................................................................................................................................................23 5.4. U ser Interface D evelopm ent .......................................................................................................................... 26 S.S. O utput Pages ........................................................................................................................................................26 R esults ..............................................................................................................................................................................27 6.1. Q uantitative A nalysis ........................................................................................................................................27 6.2. Com parison versus current state ................................................................................................................27 6.3. R ecom mendations and K ey Findings .........................................................................................................28 6.4. Business Problem and Change Im plem entation ................................................................................... 28 A reas for Future Research ........................................................................................................................................29 7.1. T echnology Groupings .....................................................................................................................................29 7.2. T ransportation Costs ........................................................................................................................................29 7.3. M anufacturing Index Im pact .........................................................................................................................29 8. Conclusions .....................................................................................................................................................................30 9. References .......................................................................................................................................................................31 8 TABLE OF FIGURES Figure 1. Footw ear Planning Timeline.............................................................................................................................12 Figure 2. Profiling Stakeholders.........................................................................................................................................16 Figure 3. Solver Progression................................................................................................................................................17 Figure 4. Open Solver Interface..........................................................................................................................................18 Figure 5. Solver studio user interface ........................................................................................................................... 19 Figure 6. A IMM S Profiling Optimization Tool....................................................................................................... 20 Figure 7. Changes in M odel Performance with Minimum Fill Level.....................................................................28 9 1. INTRODUCTION 1.1. Purpose of Project The purpose of this project is to evaluate footwear "profiling" at Nike and to suggest improvements, specifically to apply mixed-integer linear programming optimization techniques as a means of cost reduction. The project was designed by leadership within Nike Inc.'s Global Footwear Planning team in concert with the Leaders for Global Operations (LGO) program at MIT. 1.2. Profiling Description Profiling is a method of advanced sourcing used by Nike, Inc. The goal of profiling is to incorporate demand forecasts and production capability into the product development cycle. Approximately two years before product delivery to retailers, footwear products go into the development cycle. The development cycle occurs as a product evolves from design concept, to prototype, to a model offering. The footwear concept created by a Nike design team is developed under the guidance of a Footwear Development Director (FDD) who arranges a partnership with a factory group. Once in partnership with a factory the FDD directs the coordination of the designers with production engineers in the factory. Steps taken to design for manufacturing and technological limitations of the factory are taken into account. During the process of creating a prototype specific machinery and tooling is developed to accommodate the footwear model line production. By the end of the process (approximately 9 months from product delivery) the model is ready to be released for full production supported by an updated design, performance requirements, and an "engineering tech kit" that specifies production standard work. Consequently, it is preferable that products be developed with factories (or at least factory groups) by whom they will eventually be produced. Moving a product or product line requires transferring intellectual property, machinery (called tooling), and personal skills between contracted manufacturers. Profiling is done to minimize the need for these transfers but still allocate future factory capacity and enable footwear development directors to form partnerships with factories. 1.3. Problem Statement Describe, assess, and improve (if possible) the footwear profiling process at Nike, Inc. using algorithmic methods. 1.4. Hypothesis The Nike, Inc. profiling procedure can be quantitatively improved (assessed using net dollar expenditure) using mixed integer linear programming techniques. 10 1.5. Project Goals At the outset of the project I had three main goals: 1. Build a decision support tool capable of being implemented by Nike, Inc. 2. Conduct a proof-of-concept to validate that the tool is valuable to the problem. 3. Build-out the tool and lead the effort to begin implementation for Nike, Inc. 1.6. Project Approach This research is broken into phases: Diagnosis, which includes interviewing employees and diagramming the current process flow; Initial Prototyping, developing a simple prototype as a proof-of-concept; Expansion of Prototype, iteratively improving and growing the prototype into a usable model; and Implementation, the socialization of the model leading to adoption. 1.7. Confidentiality As part of this research only publicly available data has been used without modification. All proprietary information has been avoided wherever possible, or at a minimum disguised, so as not to violate terms of non-disclosure with Nike, Inc. The merit of this research is in the approach and solution, not in the proprietary data from Nike, Inc. 2. BACKGROUND OF PROFILING IN GLOBAL FOOTWEAR PLANNING This chapter provides the reader with necessary information about Nike, Global Footwear Planning, and the profiling process. 2.1. Background of Company Nike, Inc. (NKE) is a "global marketer of athletic footwear, apparel, and equipment that is unrivaled in the world" (Nike 2014 "Investor Relations). The company was founded as Blue Ribbon Sports in 1964 and in 1968 by Bill Bowerman (deceased) and Phil Knight (chairman of the board). In the last company annual report (May 2013 - May 2014) the company reported $27.7B in revenue, of which, $16.2B is attributable to aggregated footwear product lines (Nike 2014 10-k). Nike manufactures under the Nike (SwooshTM), Jordan, Nike Golf, Hurley, and Converse brand names. These brands are proliferated across six "Geographies": North America, Western Europe, Central and Eastern Europe, Greater China, Japan, and Emerging Markets. The North America Geography accounts for $7.4B in footwear revenue or roughly 45.6% of company-wide footwear revenues (Nike 2014 10k). 11 Three countries compose the majority of the source base for footwear manufacturing for Nike footwear products with Vietnam, China, and Indonesia comprising 43%, 28%, and 23% of all footwear manufacturing. Within these countries there are approximately 40 factories that primarily manufacture footwear (not including sandals). Nike, Inc. is headquartered in Beaverton, Oregon and staffed by over 56,000 employees worldwide (as of 31 May 2014). The President and Chief Executive Officer is Mark Parker who has held that role since 2006. 2.2. Footwear Planning at Nike 2.2.1. Global Footwear Planning Team Strategic planning and high-level (above Geography) production planning at Nike, Inc. are conducted by the Global Footwear Planning (GFP) team. Within GFP, there is demand management, supply management, and a supply chain innovation section (the sponsor for this research). Generally, demand management is responsible for generating reports that indicate the anticipated demand in future seasons, supply management is responsible for allocating that demand against factory capacity, and supply chain innovation is expected to continually implement process improvement and analytics. 2.2.2. Footwear Categories GFP works in concert with 16 Footwear Categories, which are the functional footwear product lines (i.e. running, basketball, etc.). The footwear categories are concerned chiefly with the quality of their product and the cost to produce. The categories hold significant power in the organization as the product line managers and design/implementation shops. Sourcing plans are the result of negotiated outcomes between GFP and footwear categories. 2.2.3. Footwear Planning Process FIGURE 1. FOOTWEAR PLANNING TIMELINE The footwear planning process at Nike starts with a 10-year horizon for capacity management. Using growth projections, factory improvement projections, and demand forecasts as inputs, Global Footwear Planning uses the Strategic Capacity Optimization Tool (SCOT) as a decision support tool for expanding or acquiring additional capacity to support demand. The tool optimizes 12 around total cost under the constraint that all projected demand is able to be met at an internallydetermined level of service. Meanwhile, product concepts and footwear technologies are constantly being innovated in Nike "Innovation Kitchens" by footwear design teams, chemical engineers, performance scientists, and the athletes themselves, The "Innovation Kitchens" are the life-blood of Nike's technological advancements in footwear. New product concepts and technologies that are available two-years from product delivery are eligible to be programmed into footwear profiling. It should be noted, that not all shoes use "new" technology from the "Innovation Kitchens" in any given season. Many products are fusions or new applications of existing technologies to the company or are planned revisions of existing products. I merely mean to highly the cycle of innovation at the company is a continual process that affects capacity planning. Two years from product delivery, footwear profiles are developed that pair footwear categories with factory capacity (expanded in the next section). The goal of footwear profiling at Nike, Inc. is to assign the appropriate capacity and technological capability mix to footwear categories so that they are able to translate products from design to production without incurring unnecessary costs or variability in their source base. Between profiling and 9 months from production, the company continually updates profiles in a process called "relative sourcing" that iteratively updates the profile to include more details as products become finalized. For example, a specific running shoe may finish ahead of others and be locked into production at one or two factories 15 months from the production start date. The company is still not able to guarantee the production plan for every model in the target season but can begin to form a more complete picture. The final step in footwear production planning at Nike, Inc. is called "product alignment." Product alignment assigns specific models, styles, sizes, and color against capacity in a specific factory. Guertin (2014) developed an optimization technique for this process for Nike sandals and Quinonez (LGO 2013) is currently expanding the technique to incorporate all of Nike footwear into a product alignment optimization. After product alignment, the footwear models in a specific season are fully allocated and begin heavy production. 2.3. Current Profiling Process The profiling process as it stands is executed through compromise and heuristics. The Director of Sourcing within the Supply Management division of GFP is responsible for producing a "factory profile." The profile assigns factory space to footwear categories by percentages of factory capacity in a given season (i.e. running has 33% of the capacity at factory XY in season mm). The profile at any given time runs two years out, or 8 footwear seasons. Profiles are reviewed seasonally and updated after meetings between Global Footwear Planning and Footwear Category directors. To create a new profile the Director of Sourcing would first look at the allocation for the season prior (in, for "in" in seasons). Then incorporating demand forecasts for footwear categories in the 13 next (m+1) season look to see if the current profile could support the new demand without exceeding capacity constraints. Changes would then be made iteratively until all business rules were satisfied. Some of the business rules are not obvious. For example, certain footwear categories' development directors had strong relationships with certain factories but not others. Additionally, not every factory could support every product category due to equipment, specialization, etc. These business rules were not always codified - they were simply known by the Director of Sourcing from their experience. Finally, once the profile satisfies internal constraints, it must pass through a sourcing meeting for approval. The sourcing meeting would be attended by GFP Directors, Footwear Development Directors, and executives. 3. LITERATURE REVIEW 3.1. Prior Research in Nike Global Footwear Planning This project builds on work done by Guertin, 2014 that examined the use of optimization techniques in sourcing sandal production. Guertin found that algorithmic optimization could produce between 4-11% total landed cost savings for Nike, Inc. Sandal production. The formulation for that optimization considered "total landed cost" in its objective function. "Total Landed Cost" is comprised of manufacturing, transportation, tooling, holding, and duty costs. A key difference between Guertin's research and this project is the timeline and level of information on the product. Guertin was directly sourcing sandals where factory capabilities and design specifications are fully known while this project is two years from delivery and is more uncertain. Quinonez (2013) conducted significant research into "risk-adjusted total landed cost" (RATLC). RATLC is a single measurement for both quantifiable costs as well as factory risks derived from the Nike Manufacturing Index (MI). The goal was to derive a single cost metric to describe the total impact of strategic sourcing decisions. 3.2. Research in Retail Manufacturing Mercier and Battle (2012) highlight the importance of collaboration between retailers and suppliers in eliminating waste in a supply chain. Particular recommendations include: choose partners carefully, commit for the long-term, build cross-functional teams, and turn pilots into business as usual. This study highlights much of what Nike, Inc.'s operations team does very well. The footwear development process, particularly, is an example of partnering for the long term and graduating from pilot to 'business as usual.' Diaz-Madronero, Mula, and Peidro (2014) identify trends in optimization-based sourcing decisions. They find that mixed-integer/linear programs solved by commercial solvers are the most common in the manufacturing industry. They find that constraints are prioritized by limited 14 resources which correspond to productive resources (i.e. factory capacity). This research indicates a useful starting point in testing the hypothesis of this project. Xia, Zu, and Shi (2015), discuss optimizing for profit in a socially responsible supply chain. They experiment with closed-form optimal solutions for social responsibility and then expand to include profit-driven sensitivity analysis for the supply chain. This work holds relevance to a suggested expansion of the Manufacturing Index (MI) later in this research and is in line with Nike, Inc.'s core manufacturing values. Larson and Odoni (1981) primarily derive algorithmic and heuristic approaches to solving urban transportation and optimization problems. However, their work is also seminal in queuing theory and can be applied to sourcing. Of importance is the concept of wait times increasing exponentially for queues above 90 percent utilization. This affects sourcing for Nike, Inc. as a business rule. Factories should generally not be permitted to take on greater than 90 percent of their absolute capacity if capacity is fixed and on-time-performance (OTP) is an objective. 3.3. Research in Implementing Software Solutions Sonenstein (2014) discusses the importance of management in implementing new corporate strategies. In multi-year studies, the efficacy of outcomes in retailers attempting to implement manufacturing changes was highly dependent on the collaboration and approach taken by management. From Guertin (2014), Giesler and Rubenstein (1987) discuss the importance of management in implementing software solutions. They observe that the number of interactions between user and developer as well as strong support from management before, during, and after implementation is essential in the success of a software pilot. These principles are consistent with challenges encountered during this research. 4. METHODOLOGY The purpose of this chapter is to explain the current process for Profiling at Nike and to explain the approach taken. 4.1. Current State Analysis Profiling at Nike is the process by which anticipated factory capacity is allocated to footwear categories (i.e. running, basketball, etc.). The Global Footwear Planning division (organized under the umbrella of Sourcing and Manufacturing) is responsible for allocating footwear factory space. Within the Global Footwear Planning division, the Sourcing Director creates the factory "profile" containing the percentage of each footwear factory's capacity dedicated to each footwear category over the next eight retail seasons. The profile is a constantly iterated document 15 that is updated incrementally following meetings with Footwear Development Directors within each footwear category. The process for testing the hypothesis that an optimization based profiling strategy could be effective for the Nike Global Footwear Planning Division includes the following steps: 1) Identify Stakeholders 2) Interview Stakeholders 3) Process Map Activities Across Stakeholders 4) Begin Prototyping. 4.1.1. Interviews Interviews were conducted to determine stakeholder amenability to an optimization based profiling strategy and to understand the organizational priorities of each stakeholder. I interviewed managers and directors of the Global Footwear Planning division and Footwear Development Directors from 10 of the 16 footwear categories. These interviews took place during the month of February as part of the "scoping" portion of the research project. 4.1.2. Process Mapping Across Stakeholders The final result is very much a compromise of interests indicated in Figure 2 below. Uw Key Concems: 1) On-Time Perf. 2) Utilizatiorw 3) Cost Key Concerns: 1) Quality 2) On-Time Perf. 3) Global Margin I Categories Assigns Sources (16) Key Concerns: 1) Quality/Performance 2) Margns* 3) On-Time Perf. Production A DVs: 1) Cost 2) Demand 3) Capacity 4) Technology Matching 5) Factory Matching Key Concerns: 1) Margins* 2) Capacity 3) InvestmentOpp. FIGURE 2.PROFILING STAKEHOLDERS. To understand the figure, the orange "Swoosh" represents the overall company, Nike Inc. GFP is the Global Footwear Planning Division. "Categories" are the footwear categories and "Factory Groups" are the contracted factory partners. The company as a whole prioritizes the quality of the product (delivering on performance specifications without defects), and the value of the Nike brand, above all other concerns. The next most valued aspect is meeting the orders of retail partners and finally maintaining the highest "global margin" possible. By this I mean aggregate margin combining the margins of all footwear categories. This is worth noting because footwear categories must manage individual "margin 16 targets" which are heavily influenced by the factories to which they are assigned (remember that each factory has different labor costs). Consequently, each footwear category is motivated to optimize their individual margin (and therefore be assigned to capable, lower cost factories). The Factory Groups also are concerned with margin but in this case, they receive higher fees per unit by making higher value products. The Factory Groups are all interested in making the most expensive products by estimated Free-On-Board costs in order to maximize their own revenues. 4.2. Prototyping This section will discuss the prototyping process for developing the Profiling Optimization Tool for Global Footwear Planning at Nike, Inc. .p. Solver Studio for Excel FIGURE 3. SOLVER PROGRESSION 4.2.1. Initial Prototype The initial profiling prototype was a simple proof-of-concept done in Excel using an Add-In called "Open Solver". This first version of the prototype considered only a single period (one season) and matched supply with demand. The objective was a cost minimization but only considering the Labor and Overhead (LOH) of each factory. It did not consider technology matching, supplier-destination country connections, multiple seasons, or user controls to alter factory-category connections. The initial prototype was restricted to using the existing profile "gateways". Mathematically, this means that only existing arcs could be used between categories (i) and factories (j) according to the current profile. Even this simplified model showed the potential for significant cost savings over the current method of conducting profiling (see methodology for a more thorough explanation of arcs in the model). However, it relied on Excel cell objects and could not support more complex problems than the one described above. It was primarily useful as a short, quick, proof-of-concept that provided more power than the simple Solver provided with Excel. An example of the "Open Solver" interface is shown below: 17 FIGURE 4. OPEN SOLVER INTERFACE 4.2.2. Second Prototype With the first model producing simple, but reasonable results, the program was expanded in a different suite called "Solver Studio" (also an Excel add-in). Solver Studio runs using named ranges in Excel to identify data sets and runs a simplified version of Python (called PuLP) in its execution prompt. This platform allowed for more constraints to be added to the formulation and even decisions about what factory arcs to open or close. The two main shortcomings of "Solver Studio" are processing time and the user interface (limited to Visual Basic macros or the PuLP script). "Solver Studio" enabled the research to expand the model to incorporate taxes, technology groupings, and mixed-integer decisions for factory category arcs (instead of relying on the status quo). "Solver Studio" could not incorporate multiple seasons as the number of decision variables (approximately 123k for one season) increased run times past one half hour. Additionally, the "Solver Studio" interface was not user-friendly for the intended customer. Coding PuLP and altering individual cells in Excel was required to make the model run effectively.Nevertheless, it was a building block in the step to the final model and validated the usefulness of the model for a single season 18 Levelling Controls & Factory Button Grouping Percentages (User Input) FIGURE 5. SOLVER STUDIO USER INTERFACE 4.2.3. Final Prototype The final housing for the model was proprietary software called AIMMS. AIMMS is capable of running multiple solver engines (i.e. CPLEX, GUROBI, XA, etc.) and supports a user interface. Additionally, the programming in AIMMS allows for database query and automated data uploads from master documents. This streamlines the data entry for the user (not necessarily an individual familiar with writing queries) and allows the solver to run separate from EXCEL. The improved engines combined with a more streamlined process allowed the prototype to be expanded into multi-season and allowed for the development of a user interface. This prototype could process a model that has over 600,000 linear variables and decisions (both linear and mixed-integer) in less than 30 seconds on average. Additionally, the user has a simple way to control most of the constraints in the model. They can formulate the optimization easily to their precise business problem. For the final user interface, an image of the Director of Sourcing (who was retiring) was added in homage. 19 Embedded User Pages Optimization O o Engine The improved user interface linked the user to easily-understood input pages and had friendly buttons that allowed for running the model and viewing/exporting results. In this final state it was reasonable that a user untrained in optimization could fully source a profile using only demand inputs. The program also allows for easy changes to the factory landscape by adding new factories or changing their capabilities (along with any constraints). However, some training in AIMMS would be required to handle those structural changes in the code and I left with a recommendation that the model be maintained by Global Footwear Planning's Supply Chain Innovation group for changes to the base of the model. 4.2.4. Customization The final model is a customized solution rather than an out-of-the-box optimization package. There are tradeoffs in taking this approach. For customization, there is an increased responsibility on the developer to maintain the package - there are no consultants coming in to fix errors that occur. Additionally, the user typically must have a higher level of understanding than they would for a supported software package. The company also undertakes an adoption risk if the knowledgeable users of the system leave the group and new users cannot easily transfer the skills. On the positive side, this model is capable of greater flexibility than the other commercial options the company explored. With the use of AIMMS, the problem can be modeled more precisely and the run time is faster. The main benefit to run time is the lack of a requirement for translating data or functions between mediums or languages. Everything from database queries to solver runs to output is done in the same language. Run time is a major advantage for a problem of this size and the output can be directed into any data visualization package the developer or user desires. Additionally, the AIMMS software 20 allowed for a custom user interface that alleviated much of the training concerns associated with a custom software solution. The developer still maintains more responsibility than they would for a commercial solution but the user is relatively unaffected. In fact, the user is advantaged by the quicker run time and flexibility to alter constraints easily. Finally, the custom solution offers a major improvement for the user interface. The other software packages available in the company simply did not compare with the ability to interact with a non-expert user. Overall, the custom solution was necessary for this highly unique business problem. Traditional network design packages (the most common that were considered for alternatives) simply did not provide the flexibility or user interface to justify the investment. The custom solution was far more likely to develop a feasible and implementable outcome and consequently became the most desirable option for this project. 4.3. Validation of the Model To validate the applicability of the model it was run with the same constraints used by the current Director of Sourcing on past seasons to see how it performed. Data existed for each profiled season through FY 2013 including duties paid by the company and total labor spending. For past seasons these numbers were used as the benchmark for comparison. To validate the model, past forecasting data (from FY 2013) was used and two different "runs" were done: 1) A run where the model could not alter the factory-category arcs that existed in the season - it could only alter volumes; and 2) A run where the model could alter factory-category arcs but subject to a deviation constraint. The "past data" allowed the researcher to compare the model's logic to what actually happened as a benchmark and to determine if the constraints worked to simulate the business problem. Fortunately, the company maintained data sets that dated back over five years and included both "forecasted" as well as "actual" data for demand and production. The results of the validation runs were promising. The model generated "feasible" results given the constraints programmed (i.e. no results were generated that violated the bounds set by the user) and validated that the multi-season model was able to incorporate the seasonality of the product array. This had been the largest concern of the stakeholders - that the model would view each season individually and not be able to handle the complexity of deviations between seasons. In the first run, where no new factories could be established for any category, the model was highly constrained but generated savings from improved duty spend (data on the actual amount spent on duties in FY 2013 was accessible) and from labor rate improvement (essentially moving product whenever possible to lower labor-rate factories). During this scenario savings of 3% were achievable. In the second run, the constraints were relaxed to allow for 1 new factory to open for a category between seasons and for a 20% deviation in product allocation for any category in any factory. In this scenario the model outperformed (up to 9% improvement on cost savings with the relaxed constraints). 21 These results both validated the multi-season model as a concept and generated benchmarks for the savings that could reasonably be anticipated for applying to the next profiling season (which was larger in volume due to company demand growth). The ability to control deviations proved critical in generating adoption of the product as did the user having the option to use the current set of factory arcs and only deviate with production volumes (this was due mostly to simple apprehension of changing too much too fast as an organization, not due to the rejection of the utility of the model). 4.4. Robustness of Model Forecasted demand can change significantly for individual products between seasons but is more stable for aggregated categories. Rather than expand the scope of this project further to include simulating and modeling demand forecasting error (a separate internship the same year), the model was made to incorporate business rules that the user could adjust as constraints. For example, both the contract manufacturers and the company carry risks if too few product lines are sourced to a single factory. The user has the ability to dictate minimum and maximum categories assigned to a factory and vice versa. These controls are really just heuristics but work for the company. I advise using simulation to justify these heuristics in future research. 5. MODEL FORMULATION 5.1. Formulation and Definitions The primary objective for the model is to minimize cost with respect to constraints for quality and seasonal volume deviation. Other formulations are possible, including optimizations that seek to minimize the number of arcs between categories and factories (something that may be desirable from a work-flow perspective). However, the most directly applicable is the traditional cost minimization described below because of its bottom-line impact. 5.2. Objective Function i i Min I I i=1 j=1 k I m III Xi,j,k,,m * (LOHj,m + ti,j,k,m + Fj,k,m) k=1 1=1 m=1 Decision Variables: Xi,j,k,,m: The number of units of product in category, i, sourced to factory j, destined for country k, in product grouping 1, for season m i E I: for i in the set of available categories "I"(Called SSCategories in model) 22 j E J: forj in the set of available factories "J" (Called SSFactories in the model) k E K: for k in the set of available destination countries "K" (Called SSCountries in the model) 1 E L: for 1in the set of available groupings "L" (Called SSConstruction in the model). 5.2.1. Grouping Constraint A grouping is an aggregation of technology capabilities that creates distinct factory technological capabilities. It indicates the ability of a factory to meet the production requirements of a potential category in a season. This constraint was developed as the result of a business problem facing the company where developers would say "we can't make that product in that factory." I found that this was due to technological constraints that were undocumented for a model-level of aggregation. For example, the technologies at a factory were documented (i.e. the factory can produce Nike Free' products). However, one product may have 15 different technologies designed for a single model. Many factories would not be able to support that hypothetical product. The "Groupings" constraint is an attempt to aggregate technology pairings into meaningful sets that categories can plan against. See Section 7.1 for recommendation about improving this concept. m E M: for m in the set of seasons involved in the model "M" (Called SSSeason in the model) Cost Drivers: L OHj,m: Labor and overhead rate (per each pair of shoes, X) at factory j in season m tij,k,m: variable duty rate for category i from factory j to country k in season m Fjkm: flat duty rate from factory j to country k in season m. Some countries charge a set rate regardless of the value of a product for imports. Summary: This function minimizes cost for sourcing subject to the constraints below. Constraints Demand Constraint i * 5.3. ~ Xii ~kim * FactoryCapabilityMatrixi,j,m) Dji,k,m 1=1 1=1 23 Di,k,m: Demand for category i in country k in season m FactoryCapabilityMatrixij,m: Binary table (0,1) opening and closing category i to factory j. Accounts for sourcing relationships and factory capabilities. Can change or remain the same between seasons. Changing a grid square in the matrix would close a factory-category combination. For example at the intersection of Factory "A" and "Running" a I indicates that Factory "A" can produce running shoes where a 0 would prevent sourcing Running to Facotry A. In the optimization logic, the model will never source product to a factory with a "0" because it would increase costs without helping to meet constraints. The demand constraint simply requires that the product allocation must be greater than the anticipated demand for a category in a country. This does not fall into a "level of service," or traditional newsvendor, inventory consideration because this decision does not necessitate production - only capability to produce. Loading Constraints i k I I I Z Xi,j,k,l,m 5 Cj,m * MaxLoadingj; i=1 k=1 1=1 Cm: capacity of a factory j, in a season m MaxLoadingj: factory maximum percentage loading s.t. 0 i 1 k MaxLoading 1 1 YZ Y. Xi,j,k,l,m : Cpm * MinLoadingjm i=1 k=1 1=1 MinLoadingj,: factory maximum percentage loading s.t. 0 MinLoading 1; MinLoading MaxLoading Loading constraints are quite simply the maximum and minimum levels of capacity that can be allocated to any factory. It is a user-driven control with the default values set by company rules of thumb or contractual obligation. It is worth noting that removing the minimum loading constraint risks long term damage to the supply base (i.e. if 0 loading is permitted the factory in question may either shut down or leave Nike to stay in business). The maximum loading constraint allows for building in buffers for the system without forcing prioritization of product. Grouping Constraint 1k E Xi,j,k,,m * Techno1ogyCapabilityMatrixjj, Dim * Pim, j=1 k=1 24 TechnologyCapabilityMatrixj,,m:Binary matrix [0,1] associating construction groupings, 1, to factories j, during season m. A factory with 1 in a grouping can manufacture products of that technology set in a season, factories with 0 in a grouping matrix could not. For example, a category that has demand for "Autoclave" could not be sourced to a factory with a "0" in its matrix for "Autoclave." Dim: Demand for category i (aggregate, not broken out by country) in season m Pi,,m: Percentage of category i, that falls into grouping 1, in season m s.t. =im = 1 This is the most difficult constraint to understand intuitively. Essentially, it works in the same way as the factory category capability matrix. It has a binary matrix of arcs available between factories and groupings. Groupings are combinations of technological capabilities. . Although mentioned briefly above, the grouping constraint serves to control for technology gaps between factories. This is a key challenge because the attribute set for individual products is not known at the time profiling occurs. That requires that these "groupings" be more category-specific. Consequently, they are an aggregation of individual technologies into category specific combinations. For example a set of unique technologies required on every basketball shoe would comprise a "Basketball" grouping. A factory possessing that production capability would have a "I" in the Technology Capability Matrix in its box for "Basketball." Any factory that could not produce those technologies should not be sourced Basketball product and would have a "0." The matrix works by multiplying the coefficient from the matrix against decision variables which are constraint to meet demand. Improvement opportunities for this constraint are mentioned in section 7.1. Seasonality Constraint - General |Xi,j,k,I,m, - Xi,j,kl,mn+ I< sm sm: volume deviation allowed for product combinations between seasons The seasonality constraint was added to make implementation more suitable. This constraint controls for the amount of any category (i) changing from a given factory (j) in a following season. This makes the transition to a more optimal solution gradual and avoids "shocking" the system. Nike, as a publicly traded company, would be uncomfortable makin g drastic changes to the supply chain and incurring short-term revenue risk. However, this absolute value function is not linear. To implement as a linear program mixed integers were introduced. 25 Ni,j,m: A new pathway between a category i and a factory j, in month m; Binary[0,1] Seasonality Linear Conversion Part 1 Z Ni,j,m ; AllowableFactoryDeviationsim j=1 AllowableFactoryDeviationsim:The new arcs permitted to be formed for a category i, in month m. Seasonality Linear Conversion Part 2 Ni,j,m > PathwayDeviationi,m PathwayDeviationim= FactoryPathwaysi,j,m+j- FactoryPathwaysijm FactoryPathwaysij,m:The arcs (binary) available between categories i and factories j in month m. These constraints create two new binary variables (New Pathways and Factory Pathways) that help account for the absolute value constraint needed for deviation control. FactoryPathwaysi,j,mcan be user controlled or the engine can program the arcs for each month (dramatically increases run time because of integrating a matrix of mixed integer variables). Typically, the matrix for FactoryPathwaysij,mwill be pre-determined and the program is deviating only for the FactoryPathwaysi,jm,+ month which includes all the arcs from FactoryPathwaysi,j,mplus the Nij,m arcs that are added. In this way, the program is dynamically updating over seasons. The goal of writing this constraint is to control for deviations between seasons. The company is very sensitive to moving large quantities of product too quickly from one factory to another and also to opening new factories to categories for the first time. This constraint allows the user to control the number of new factories and the rate at which changes are made. However, it dramatically increases the run time due to the introduction of two binary variables. 5.4. User Interface Development The user interface was developed to allow the user to manually change settings for individual factory-category arcs in each season, minimum/maximum fill percentages for factories in each season, the allowable deviation for a category in a factory in a season, labor and duty rates for each country and factory in each season, and could even cap the source base capacity coming from individual factory groups or countries. These alterations are available from drop down menus and tables. The "default" settings are either the current rate (for duties or labor) or the "optimal" value in an unconstrained scenario. Each model run by the user can be saved as a different scenario and run incrementally. 5.5. Output Pages 26 The output pages from the model give both graphic and tabular outputs. Key outputs are the total cost of production, cost per pair of footwear produced, loading at individual factories, duty costs, labor costs, and margin percentages at the global and category level. Shipping costs, or even better, Total Landed Cost (from Quinonez 2013) would add detail to the model and are proposed in Section 7.2. The scope of this project did not include transportation costs but much of that research exists and could be implemented quickly. Eventually, it would be preferable to output each model run into a data visualization dashboard suite in a program like Tableau or similar but AIMMS allows for relatively simple output dashboards organically. 6. RESULTS 6.1. Quantitative Analysis The results of the optimization are very promising. With a model size comprised of 1,628,000 decision and mixed-integer variables, and a run time under 3 minutes on average, the model generates a potential improvement of up to 4.9% savings on labor and overhead costs in the next fiscal year if implemented immediately. Additionally, the potential tax savings produced by the model may be as high as 3.6% annually over the current baseline. 6.2. Comparison versus current state To conduct this comparison, I used FY 13 data and ran the model and then compared its solution versus the baseline of actual spend during that year. I then used the demand data for the next profiling season and compared only labor and overhead (since future duty payments are much more difficult for which to account) model projections against what current rates would imply. As mentioned above, the combined effect of tax savings and labor ranged between 5.7-9.7% depending on year and assumptions made. A key driver of savings over baseline is the minimum fill level required of individual factories. By that I mean Factory X must be filled above XY% of its stated capacity. Hence the key decision made at this time is to decide at which factory or factories will a new product be planned to be made. By maintaining every factory at differing minimum fill levels the savings over baseline erodes gradually. It eventually becomes negative simply because more footwear is being produced by the source base than is needed in the market (Figure 7). However, even at relatively high minimum fill levels of 70%, and a constant maximum fill level of 90%, the model produces savings over baseline. The graphic indicating this relationship is shown below. For the current state comparison I used company business rules as the assumption for both fill levels. The source of the savings is deviating from where product is currently source to realize lower labor rates (5-7% savings) and optimizing for the lowest possible duty rate for source-destination combinations (2-3% savings). The model adjusts the quantity of product sourced to factories with 27 lower labor rates higher whenever it can based on the constraints, and takes product out of factories with higher labor rates. The user has control over most of the constraints in the model and can craft scenario plans. It was intentional to give the user significant control over the inputs of the model to prevent a "black box" solution and create a product that would be viable for quick implementation. %Improvement Over Baseline (Generated Profile FYI5) FIURE 7.CAGE4A24% EC70 RFO 000 6.3. ecom nd endaions Ky Fiding FIGURE 7. CHANGES IN MODEL PERFORMANCE WITH MINIMUM FILL LEVEL 6.3. Recommendations and Key Findings Applying this model to design future footwear profiles presents a significant opportunity for Nike, Inc. The company anticipates growing revenue to $37 billion by 2017 (Nike Press Release, 10/09/2013). The rapid annual growth of the company incentivizes implementing the model quickly (which was the impetus behind sponsoring the project). The opportunity cost of delaying implementation of the model grows every year. 6.4. Business Problem and Change Implementation Significantly more difficult than achieving results is getting those results implemented. Nike employs a "matrix" structure, and as described in the "Current Profiling Process" section, the profiling process involves many stakeholders and is not an algorithm. Many of the individuals involved are experts in developing and manufacturing footwear but not in understanding optimization scripts. Leading the adoption of the model proved to be the most difficult part of this project. One of the reasons for the difficulty lies in a lack of authority. The matrix structure incentivizes collaboration and works best with consensus. The incentives for footwear categories are to maximize their category margins and to design great footwear. Any category that suffers a decrease in their margins as a result of the model is not likely to support consensus. This means that unless incentives are changed to allow some categories to take lower-margins the optimal solution will struggle to gain their support. Additionally, constraints could be included to preserve minimum category margins, but that outcome would come at the cost of the company as a whole. 28 I believe top-down direction would greatly speed the rate at which optimization is adopted in manufacturing decision making at Nike. Otherwise, incentives are not present to generate consensus and the status quo could persist longer than is necessary or beneficial from a financial perspective. Another challenge is the familiarity of stakeholders with operations research and optimization software. While the user interface is meant to be intuitive, maintaining and updating the model logic is not. The Supply Chain Innovation team in GFP is meant to be the subject matter experts but they only have the ability to affect footwear planning. If the approach is expanded to apparel, equipment, or to the entire Nike operations practice a centralized center of excellence may be required. Nevertheless, the product allows for the user to manipulate the scenarios in ways that make only minor structural deviations from the status quo (for example, preventing decisions that would change any category into a new factory). Even in a resistant adoptive environment, the model can product 1-2% savings by optimizing for labor and duty rates in the current matrix. This simplified scenario can be implemented immediately (and had internal support). 7. AREAS FOR FUTURE RESEARCH Despite the impact I believe the model can have immediately, there are opportunities to expand the research and potentially improve on the results. 7.1. Technology Groupings The technology groupings used in the model are only a start. Nike, Inc. has not needed this level of aggregation for footwear technology before and will be able to find a more robust set of grouping parameters with more research. At present, I created the capability for the groupings to be incorporated in the model, and gave a first shot at what I thought they could be. However, what is really needed is the lowest level of aggregation for manufacturing technology packages that do not have interactions. I am not confident that the groupings I developed are completely homogenous from one another. The impact of this is that the outcome may be sub-optimal with respect to flexibility. If there are more "true" groupings than I identified, the model should be more constrained. If there are fewer, the model would be less constrained on how factories and categories can be assigned. 7.2. Transportation Costs As mentioned in the Literature Review, Quinonez (2013) examined the "Total Landed Cost" for manufacturing footwear for Nike, Inc. This model uses averages for footwear component costs (the footwear products are still in development at the time of profiling) and does not use transportation costs despite having country of origin and country of destination arcs. Adding this to the model would be an easy input and help incorporate transportation in addition to duties. 7.3. Manufacturing Index Impact 29 Nike, Inc. internally maintains a rating system of all contracted manufacturers. This rating system combines both qualitative and quantitative evaluation for: lean manufacturing, labor and health, safety and environment, country risk, leadership planning and development, and transparency. Factories are then rated at red, yellow, bronze, silver, or gold status (Nike Corporate Responsibility). Factories that consistently fail to achieve bronze status or above are gradually culled from the sourcing pool but there are no hard-wired incentives in sourcing decisions for manufacturing index ratings. Evaluating the value for the company in having factories of each rating reflected in sourcing decisions could give real financial incentives to Nike, Inc.'s sustainability and manufacturing efforts. These incentives could be written into the model and produce an outcome that is optimizing for more than simply objective cost. This essentially, would be an expansion into footwear of the research done by Quinonez, 2013. 8. CONCLUSIONS The hypothesis for this research, that an algorithmic approach to profiling could produce improved results, is found to be correct. The model produced by this research is promising but significant opportunities for improvement and expansion remain. Additionally, organizational structures to support implementation are not ideal. The matrix structure that incentivizes collaboration for design and marketing inhibits the ability of traditionally back-office functions, like operations, to standardize and improve. In addition to researching the impact of transportation costs, technology groupings, and the MI on the cost to the company an assessment on the operations organizational structure should be examined (probably by the corporate strategy team in Nike's headquarters). 30 9. REFERENCES Guertin, J. (2014). PracticalExample of Implementing an Optimization and ScenarioPlanning Tool. Massachusetts Institute of Technology, Sloan School of Management. Quinonez, C. (2013). Development of a criteriabased strategicsourcing model. Massachusetts Institute of Technology, Sloan School of Management. Simchi-Levi, D., Kaminsky, P., & Simchi-Levi, E. (2008). Designing and managing the supply chain: concepts, strategies, and case studies. Mcgraw-Hill/irwinseries operationsand decision sciences. 3rd. Nike, Inc. (2013). "Investor Day Press Release." October 9, 2013. Nike, Inc.(2014). Annual Report on Form 10-k. Nike, Inc. (2014). "About Nike, Inc." from http://nikeinc.com/pages/about-nike-inc Larson, Richard & Odoni, Amadeo (1981). Urban Operations Research. Prentice-Hall.NJ. AIMMS Reference Manual (2014). Binns, Jessica. For UnderArmour, Supply Chain is Key to becoming a $10-Billion Brand. Supply Chain Case Study, Apparel Magazine. June 2014. YIldIrIm, I., Tan, B., & Karaesmen, F. (2006). A multiperiod stochasticproductionplanning and sourcingproblem with service level constraintsRetrieved from www.scopus.com Geisler, E., & Rubenstein, A. H. (1987). "Successful Implementation of Application Software in New Production Systems." Interfaces, 17(3), 18-24. Xia, Yu, Shi (2014). "A Profit Driven Approach to Building a 'People:Responsible' Supply Chain." European Journalof Operations Research. Volume 241. Issue 2. Diaz-Madronero, Mula, Peidro (2014). "A review of discrete-time optimization models for tactical production planning." InternationalJournalof ProductionResearch. Volume 52. Issue 17. Shonenstein, S. (2014). "How Organizations Foster the Creative Use of Resources." Academy of Management Journal. Volume 57. Issue 3. Mercier, Peter and Battle, Stuart (2012). "Retailer-Supplier Collaboration in the Supply Chain." From products-retailer_supplier-c https://www.bcgperspectives.com/content/articles/retailconsumer ollaborationinthe-supply-chain/ 31