Tearfund Partner Organisational Assessment - Financial Management

advertisement

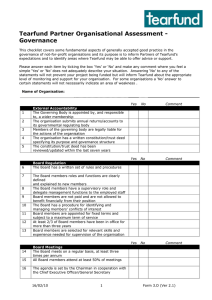

Tearfund Partner Organisational Assessment Financial Management This checklist covers some fundamental aspects of financial management and its purpose is to inform Partners of Tearfund’s expectations and to identify areas where Tearfund may be able to offer advice or support. Please answer each item by ticking the box ‘Yes’ or ‘No’ and make any comment where you feel a simple ‘Yes’ or ‘No’ does not adequately describe your situation. Answering ‘No’ to any of the statements will not prevent your project being funded but will inform Tearfund about the appropriate level of monitoring and support for your organisation. Name of Organisation: Section 1: Basic Systems 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 Yes No Comment Yes No Comment Supporting Documents A valid supporting document is kept for each income and expenditure transaction Supporting documents are filed and referenced, so that it is easy to trace any document from the accounting records The bank statements for each bank account are filed and form a complete sequence Supporting documents and bank statements are kept secure for the previous five years Cashbooks The date, description and amount of every transaction are recorded systematically in a cashbook or appropriate ledger A separate cashbook is kept for each bank and cash account. Accounts Codes A standard Chart of Accounts is used consistently to prepare financial records, budgets and reports Transactions are also classified by project or activity using a standard list of ‘cost centres’ or department codes Section 2: Planning 2.1 2.2 2.3 2.4 Budgets A Budget is prepared for every project before the project starts, showing sources of income as well as costs A Budget is prepared annually for the core costs of running the organisation and the expected sources of income. Where more than one donor is involved the budgeted project costs are allocated to each donor in a funding plan. A cash flow forecast is prepared for the organisation and updated regularly through the year. 16/02/10 1 Form 3.C (Ver.2.1) Section 3: Reporting 3.1 3.2 3.3 Yes No Comment Yes No Comment Reporting All Project Managers receive accurate budget monitoring reports promptly after the end of each month/quarter Accounts are produced each month/quarter to monitor the organisational administration budget, and Balance Sheet Variances on each budget monitoring report are reviewed by a manager and appropriate action is agreed Section 4: Internal Controls 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 4.9 4.10 4.11 4.12 4.13 4.14 4.15 Controls over money and assets All cash kept in the office is in a locked cash box or safe with access restricted to a specific keyholder. All bank accounts are held in the name of the organisation, not in the name of individuals. There is a written policy setting out which members of staff or the Board can sign cheques, and their authority limits Each transaction is authorised by the appropriate member(s) of staff (budget holders) Staff check that goods and services bought by the NGO have been received before bills are paid. Cheques are only signed after details of payee and amount are written in and supporting documents have been checked Staff salaries (including advances and loans) are checked by a senior manager or Board member every month. All assets owned by the organisation are recorded in an Asset Register. Financial duties are segregated so that no one person can both carry out and record a financial transaction. Checks and reconciliations Petty cash records are checked and balances physically verified every month by a manager or director. All cash book balances are reconciled to the bank statement every month and checked by a manager or director. All other balances, debts due or payable, are reviewed every three months by a director. Computer accounting systems The computer system maintains an audit trail of all data entries and changes. Access to the computer system is restricted to specific staff with the use of passwords. The computer system is backed up frequently onto disks or tapes which are kept secure from fire or other loss. Please use a separate sheet if there is insufficient space for your comments 16/02/10 2 Form 3.C (Ver.2.1) The information presented in this checklist is, to the best of my knowledge, complete and accurate. Completed by: Position: Signed: 16/02/10 Date: 3 Form 3.C (Ver.2.1)