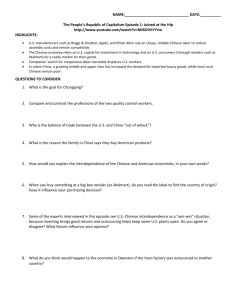

Technology Development in the New Millenium: China in Search of

advertisement