Homework: Airline Operating Costs and Airline Productivity April 9,2012 Maryam Zavareh

advertisement

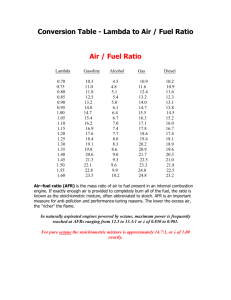

Homework: Airline Operating Costs and Airline Productivity April 9,2012 Maryam Zavareh Q1: Frontier Airline • • • • • • US Low Cost Carrier Airline Headquarter: Denver, Colorado Founded: 1994 Fleet Size: 91 Flies to 76 destination Parent Company: Republic Airways Holding Assumption and Notes • The data range was assumed to be started from Q1,2001 to Q3,2009. • In years 2001 and 2002, some of the data is missing. Q2: • RPMs: Revenue Passenger Mile Number of Passengers X Distance Flown • ASMs: Available Seat Mile Number of Seats X Distance Flown • RASM: Unit Revenue Revenue/ASM • CASM: Unit Cost Operating Expense / ASM • Yield: Average fare paid by passenger, per mile flown Revenue / RPM • PRASM: Passenger Revenue per available seat mile Passenger revenue/ASM Q2 (Cont.): • Fuel Consumed: Fuel Consumed (by airline,..) • Fuel Costs per ASM: cost of fuel consumed per ASM Cost of fuel / ASM • Non-Fuel Costs per ASM: Wages and Salaries, Other rentals and landing fees, Depreciation and Amortization, Maintenance materials, and repairs, Commissions…, Rentals…, and Other The sum of above/ ASM Chart 1 Transition of ASM-RPM- LF vs Years 4000 1 0.9 3500 0.8 0.7 2500 0.6 2000 0.5 0.4 1500 0.3 1000 0.2 500 0.1 0 0 1 2 3 2001 4 1 2 3 2002 4 1 2 3 2003 4 1 2 3 2004 4 1 2 3 4 1 2005 Years by Quarters 2 3 2006 4 1 2 3 2007 4 1 2 3 2008 4 1 2 3 4 2009 RPM ASM Load Factor Load Factor Millage Flown in Millions 3000 Chart 1 • This graph shows ASM,RPM and Load Factor which is RPM/ASM. • The ASM was overall gone up and so the RPM. However, the highest ASM and RPM for each year happen in third and fourth quarter. • The ASM was increased 31% from Q4,2008 to Q1,2009, but the RPM was just increased 23% and made the LF drop 6%. • The ASM and RPM were decreased 80% from Q2 to Q3 in 2009. • The lowest ASM ad RPM belongs to Q3, 2009 however the load factor is still high. (As discussed in class, LF by itself can not be a good indicator for airlines performance). • The Max LF which is 0.84 belongs to Q3,2008. • The min LF which is 0.52 belongs to Q4,2001. Chart 1 Year Average Average System System RPM ASM Average System LF Year Max LF 2003 1167.70 1692.89 0.69 2003 Q3 2004 1691.88 2367.40 0.71 2004 Q3 2005 1945.18 2592.37 0.75 2005 Q2 2006 2233.07 2941.21 0.76 2006 Q2 2007 2633.00 3368.12 0.78 2007 Q3 2008 2631.10 3245.40 0.81 2008 Q3 2009 1839.88 2363.27 0.78 2009 Q2 Chart 2 Transition of Income Before Tax-Total Operating Expense-Total Operating Revenue vs Years 450 400 350 Million Dollars 300 250 200 150 100 50 0 Income (Loss) Before Taxes -50 -100 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2001 2002 2003 2004 2005 2006 Years by Quarters 2007 2008 2009 Total Operating Expenses Total Operating Revnues Chart 2 • The operation expense and revenue was fairly gone up until Q4,2006. The Total Op Revenue was dropped 14%, however the Total Op Expense dropped 6%. • The Total Op Revenue was dropped again at Q4,2007, and so the Total Op Exp. • The drop between Q4,2008 and Q1,2009 was very significant. • The max Total Op Revenue is 373.2 million dollar Q3,2007. • The max Total Op Expense is 401.97 million dollar Q2,2008. • 2009 was the only year that had positive income. Chart 2 Year Average of Total Average of Total Average of Income Operating Operating (Loss) Before Taxes Revenues Expenses 2003 147.52 143.48 2.22 2004 196.81 204.47 -9.99 2005 240.09 240.59 -3.45 2006 283.34 286.45 -6.62 2007 333.59 335.38 -7.29 2008 343.12 362.03 -26.25 2009 299.72 268.16 17.39 Chart 3 Transition of RASM, CASM, Yield per RPM, and PRASM vs Years 70 60 Revenue in Cents 50 40 30 20 10 RASM (¢) 0 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2001 2002 2003 2004 2005 2006 Years by Quarters 2007 2008 2009 CASM (¢) Yield per RPM (¢) PRASM (¢) Chart 3 • In the Q1, 2009 the ASM was hugely increased (the highest value over the years), but the RPM did not increased as much, so the RASM decreased 33%. • The same trend happened for CASM. In the next graphs, we will see the expense went down at the same time period. • The yield per RPM was decreased because of the lost in the revenue and spike in ASM. Chart 3 • The RASM and CASM were increased very significantly at Q3, 2009. • These are because of sudden decreased in ASM at the same time. • Also, the Revenue and Cost has increased at Q3,2009 in comparison to Q2,2009, so the Yield per RPM was increased as well. • The PRASM was increased at the same time period because of the same reasons. (ASM ) Chart 4 Transition of AC Operating Expence, Non Fuel Operating Expenses, Fuel Consumed vs Years 300 50 Expense in Million Dollars 250 40 35 200 30 150 25 20 100 15 10 50 Fuel Consumed in Million Gallons 45 5 0 0 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2001 2002 2003 2004 2005 Years by Quarters 2006 2007 2008 2009 Aircraft Fuel Operating Expense Non-Fuel Operating Expenses Fuel Gallons Consumed Chart 4 50 90% 45 80% 40 70% 35 60% 30 50% 25 40% 20 30% 15 20% 10 10% 5 Expenxe Percentage 100% 0% 0 1 2 3 2001 4 1 2 3 2002 4 1 2 3 2003 4 1 2 3 2004 4 1 2 3 4 1 2005 Years by Quarters 2 3 2006 4 1 2 3 2007 4 1 2 3 2008 4 1 2 3 4 2009 Non-Fuel Operating Expenses Aircraft Fuel Operating Expense Fuel Gallons Consumed Fuel Consumed in Million Gallons Transition of AC Operating Expence, Non Fuel Operating Expenses, Fuel Consumed vs Years Chart 4 • Overall, the AC fuel Op Exp was increased over the years. Although, it dropped at the first quarter of each year. • Unfortunately there is not enough fuel consumption data for analysis. • The ASM was decreased slightly from Q3,2007 to Q3,2008. Also, the fuel consumption was decreased for the same time period. • However, the AC fuel Op Exp increased 20% for the same time period. Chart 5 Transition of AC Fuel Op Exp per ASM, None-Fuel Op Exp per ASM, and Jet Fuel Price vs Years 0.60 4 Expence in Million Dollars 3 0.40 2.5 0.30 2 1.5 0.20 1 0.10 Jet Fuel Price Dollar Per Gallon 3.5 0.50 0.5 0.00 0 1 2 3 2001 4 1 2 3 2002 4 1 2 3 2003 4 1 2 3 2004 4 1 2 3 4 1 2005 Years by Quarters 2 3 2006 4 1 2 3 2007 4 1 2 3 4 1 2 3 4 2008 2009 Non-Fuel Operating Expenses/ASM Aircraft Fuel Operating Expense/ASM Jet Fuel Price Chart 5 • The Non-Fuel Op Exp per ASM has been increased over the years until Q2, 2008. After this point, it dropped significantly. • Reasons: “The depreciation and amortization cost decreased due to impairment charge in 2008.” (from the website) “The Commissions, booking fees and credit card expense decreased in conjunction with the 15.1 percent decrease in company’s revenue. ” (from the website) Chart 5 • Overall, AC fuel Op Expense per ASM increased until Q4,2008. • However, the AC Op Exp decreased at the first quarter of each year and it decreased at Q1,2009. Then it gone up dramatically at Q3,2009 because the ASM decreased by 80%. • The jet fuel price has an impact on the AC fuel Op expense. • The Jet Fuel Price has the lowest amont at Q1,2009 for the last four years. That could be the reason why we see a huge increase in ASM. • The highest jet fuel price belongs to Q2, 2008 which shows the highest AC Op Exp at chart 4. Q4: • describe the effect of Fuel Prices on: a. Expenses (Chart 5, 4, 3) It seems that the fuel price has a significant impact on AC fuel and even non fuel Op Exp per ASM. For example, at Q2, 2008 when the fuel cost was the highest over the study time period, the AC fuel and even non fuel Op Exp per ASM went up. Also, at Q1, 2009 when the jet fuel price went down, the fuel and non fuel Op Exp per ASM decreased as well. The same trend happened for chart4. However, Chart 3 did not show any significant impact from jet fuel cost. Chart 3 with Fuel Price 70 4 60 3.5 3 Revenue in Cents 50 2.5 40 2 30 1.5 20 1 10 Jet Fuel Expense dollar per Gallon Transition of RASM, CASM, Yield per RPM, and PRASM and fuel price vs Years 0.5 0 0 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2001 2002 2003 2004 2005 2006 Years by Quarters 2007 2008 2009 RASM (¢) CASM (¢) Yield per RPM (¢) PRASM (¢) Jet Fuel Price Chart 4 with Fuel Price Transition of AC Operating Expence, Non Fuel Operating Expenses, Fuel Cost vs Years 300 4 Expense in Million Dollars 3 200 2.5 150 2 1.5 100 1 50 Fuel Cost Dollar per Gallon 3.5 250 0.5 0 0 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2001 2002 2003 2004 2005 Years by Quarters 2006 2007 2008 2009 Aircraft Fuel Operating Expense Non-Fuel Operating Expenses Jet Fuel Price Q4: • describe the effect of Fuel Prices on: b. Airline Finance (Chart 2) The jet fuel cost has significant impact on the airline financing. Whenever the fuel cost went up (Q2 2008), the airline has lost income (the highest lost was Q2, 2008 due to highest fuel price. Likewise, when the fuel cost went down (Q1,2009), the airline gain income (+ income). Chart 2 with Fuel Price Transition of Income Before Tax-Total Operating Expense-Total Operating Revenue vs Years 450 4 400 3.5 3 Million Dollars 300 250 2.5 200 2 150 1.5 100 50 1 Jet Fuel Price Dollar Per Gallon 350 0 0.5 -50 -100 0 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2001 2002 2003 2004 2005 2006 Years by Quarters 2007 2008 Total Operating Revnues 2009 Total Operating Expenses Q4: • describe the effect of Fuel Prices on: c. Airline Network Structure (Chart 1) – The jet fuel did not have a huge impact on the network (on the max and min fuel cost-Q2 2008 and Q1,2009), however, it is shown that at Q3, 2009, when the jet fuel cost was rising, the ASM decreased very significantly. Chart 1 with Fuel Price 4 3500 3.5 3000 3 2500 2.5 2000 2 1500 1.5 1000 1 500 0.5 0 0 1 2 3 2001 4 1 2 3 2002 4 1 2 3 2003 4 1 2 3 2004 4 1 2 3 4 1 2005 Years by Quarters 2 3 2006 4 1 2 3 2007 4 1 2 3 2008 4 1 2 3 RPM2009 ASM 4 Fuel Price Dollar per Gallon milage Flown Transition of ASM-RPM- Fuel Price vs Years 4000