Omaha World-Herald Potential growth tops estimates for U.S. cropland agriculture are attractive

advertisement

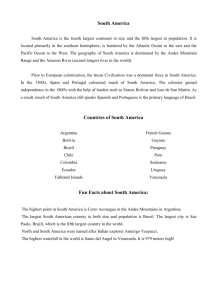

Omaha World-Herald March 7, 2006 Tuesday Iowa; Metro; Midlands; Nebraska; Sunrise BUSINESS; Pg. 01D Potential growth tops estimates for U.S. cropland Midlanders investing in Brazil Low land cost, vast potential for agriculture are attractive Joe Ruff, WORLD-HERALD STAFF WRITER Some farmers and ranchers in Nebraska and Iowa are investing in farmland in Brazil, drawn by the emerging agricultural giant's inexpensive land, vast natural resources and weather that is friendly to crops and cattle. "I was really awestruck by the potential they've got," said Korley Sears of Ainsworth, Neb., who toured Brazil about five years ago and is a member of the board of directors of Brazil Iowa Farms, LLC, in Royal, Iowa. Brazil already is among the world's leaders in sugar, coffee, beef, soybeans and poultry production, and a great deal of untapped potential remains. For example, Brazil's high plains, or cerrado region, is nearly three times the size of Texas, and huge tracts of it are undeveloped. Three years ago, the U.S. Department of Agriculture's Foreign Agricultural Service reported that potential farmland expansion in Brazil, without additional deforestation in the Amazon River basin, is equal to or greater than all of the cropland in the United States. "Brazil is a monster," said Philip Warnken, president and founder of AgBrazil Inc. in Columbia, Mo. "It's the coming agricultural superpower." Warnken, who has a Ph.D. in agricultural economics from Michigan State University, had lived in Brazil for many years and now helps investors find and purchase land in that country. Warnken said that he is working with clients in Belgium, the United States, Canada, Italy, India and Portugal. Brazil welcomes foreign investment because capital is short, constraining agricultural growth and development, Warnken said. "If Brazil had the capital markets of the West, its frontier would have been opened years ago," Warnken said. Brazil also requires that 20 percent of each land purchase be set aside for conservation. The Nebraska Department of Agriculture does not have information on the level of investment Nebraskans might be making in Brazilian farmland because investors do not work through the department, said spokeswoman Christin Kamm. However, Brazil Iowa Farms is selling a small part of its holdings, 3,247 acres, through Omaha-based farm management company Farmers National Co., which is marketing the land. It is Farmers National's first international listing of land. "It very much fits with how we look at things for the long term," said Farmers National President and Chief Executive Jim Farrell. "Land is what we're into. We understand farmland, we know how to sell it, take care of it, appraise it." Brazil Iowa Farms wants to use money from the sale to help fund its operations. Farmers National and Brazil Iowa Farms also could work together on more land sales in Brazil. Farmers National would market the property and help make farm management decisions while Brazil Iowa would offer to work the land for the owner. There are risks to consider before investing in Brazilian farmland, those involved say. People need to have plenty of investment capital lined up, because Brazil's high interest rates make obtaining loans in that country expensive. And the exchange rate between the dollar and the Brazilian real fluctuates, sometimes favorably for U.S. investors and sometimes not. Changes in the economy or politics in Brazil also could be disruptive. Other concerns include potential changes in Brazilian land values and the cost of transportation in that country compared with relatively inexpensive shipping in the United States. "There are a lot of opportunities in Brazil, but at the same time there are a lot of risks," said Kelvin Leibold, extension farm management specialist at Iowa State University. Reasons to invest in Brazil include opportunity for growth, diversification of investments and the ability to operate profitably without the level of government subsidies received by U.S. producers, said investors with Brazil Iowa Farms. "We are concerned over the sustainability of current U.S. farmland values, which have been capitalized by government subsidies," the group says on its Web site. "Should these subsidies be reduced or eliminated, many farmers would be unable to continue." David Kruse, president and chief executive of Brazil Iowa Farms, said the high cost of capital in Brazil can be an advantage to U.S. investors, because they can borrow money at relatively low interest rates in the United States and buy land in Brazil for $600 to $800 an acre. Comparable land in Iowa sells for more than $4,000 an acre, Kruse said. Brazil Iowa Farms raised $26 million in the last two years from more than 300 investors who each contributed a minimum of $25,000. It has purchased 23,000 acres and a cotton gin in the western area of Bahia and is growing soybeans and cotton. Based on lower cost of land, lower costs of production and equal or higher yields, Brazil Iowa Farms expects over time to obtain about a 15 percent rate of return on its investment, versus 4 percent to 5 percent return on an average U.S. farm, Kruse said. The group plans to increasingly turn to cotton, which grows well in the region and is a good cash crop, Kruse said. An investment group based in Harlan, Iowa, Fazenda Parceiros, Portuguese for Farm Partners, is purchasing 17,000 acres for about $4 million in northwestern Bahia. The group of about 10 initial investors is clearing the land and will prepare it for cotton by planting it in soybeans for two years and then one year of corn. After the first year of cotton production, the group plans to sell the land to someone who will continue operating it as a cotton farm, said one of the partners and the group's president, Ron Beach.