Con E 221

advertisement

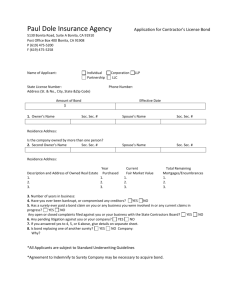

Con E 221 Review graded exams on Monday Review presentation guideline for term papers Finalize presentation schedule on Monday 1 Construction Engineering 221 Contract Surety Bonds 2 RPQ 1. A surety bond is a type of insurance. A. True B. False 2. Approximately ___________ of all construction firms in operation today will be out of business in seven years. A. One-third B. One-half C. Two-thirds 3. Surety bonds are required by law on public as well as private construction jobs. A. True B. False 3 RPQ #1 1. A surety bond is a type of insurance. A. True B. False Correct Answer is: B. False 4 RPQ #2 2. Approximately ___________ of all construction firms in operation today will be out of business in seven years. A. One-third B. One-half C. Two-thirds Correct Answer is: B. One-half 5 RPQ #3 3. Surety bonds are required by law on public as well as private construction jobs. A. True B. False Correct Answer is: B. False 6 What is a Surety? 7 What is a Surety? Surety – a party that assumes liability for the debt, default or failure in duty of another. Surety Bond – a contract that outlines the conditions of the assumed liability by a Surety. 8 Surety Bond Remember – A surety bond is not an insurance policy Insurance – protects from risk of loss Surety Bond – guarantees the performance of a defined contractual duty. Surety Bond – an extension of credit that serves as an endorsement to a contractual relationship 9 Parties to a Surety Bond Obligee – Owner Principle – Prime Contractor – Gen. Contractor Surety – entity providing the surety bond Lending Institution – organization that provides financial loan to obligee for construction and long term (mortgage) 10 Surety Bonds – More Definition Contract Surety Bonds = Surety Bonds = Contract Bonds = Construction Contract Bonds Surety agrees to indemnify the Obligee (Owner), against any default or failure in duty of the Principle (Gen. Contractor) 11 What does “indemnify” mean? To secure against hurt, loss, or damage To make compensation to for incurred hurt, loss, or damage (hold harmless) 12 Failure in Duty Failure in duty = breach of contract i.e. Non-payment of labor (wages, benefits, payroll taxes), stops work through no fault of the owner, non-payment of subcontractors and suppliers after being paid by the owner 13 Surety Bonds – More Definition Contact Bond Three-party agreement Guarantees Work completed in accordance with contract documents (plans, specifications) All construction costs will be paid Labor, benefits, payroll taxes Materials Subcontractors 14 Surety Coverage? Regardless of the reason, if the prime contractor fails to fulfill its contractual obligations, the surety must assume the obligations of the contractor and see that the contract is completed, paying all costs up to the face amount of the bond. (in the book) Not just provide money to get the project completed but actually responsible for finishing the contract. 15 Why Surety? Approximately one half of all construction contracting firms in operation today will not be in business seven years from now. Why Surety? Because construction is a very risky business. A risk that some owners are not prepared or able to assume. 16 Other Info Bond can not be invoked until the contractor is in formal breach of the contract Contract bonds are always written documents Obligations of the bond = provisions of the contract Required on public projects by law Not required by law on private projects – owner’s call The dollar amount in which the bond is written for is called the “penalty amount” 17 Prime Contractor’s Three Principle Responsibilities What are they? 18 Prime Contractor’s Three Principle Responsibilities Prime Contractor’s three principle responsibilities Honor its bid and sign all contract documents if awarded the contract To perform the objectives of the contract Pay all cost associated with the work 19 Con E 221 – Revised Schedule Monday, Nov. 4th Change for presentations: Must use Power Point Presentation Surety Bonds (continued) Tuesday, Nov. 5th Return EXAM 3 Presentation Schedule Power Point Presentation guidelines and tips Wednesday, Nov. 6th Construction Insurance Thursday, Nov. 7th Term Papers are due at beginning of class at 11:00 AM Construction Insurance Monday, Nov. 11th First day of term paper presentations Split classes 11 AM and 4 PM 20 Three Types of Bonds A Surety covers these responsibilities through Bid Bond Performance Bond Payment Bond Public – separate bonds Private – sometimes Performance & Payment bond are combined into one contract bond 21 Bid Bond Guarantees the owner that the contractor will honor it bid and will sign all contract documents if awarded the contact. Owner is the Obligee Obligee may sue principal (prime contractor) and surety to enforce the bond What happens if principal refuses to honor its bid? 22 Contractor Does Not Honor Their Bid Principal and surety are liable on the bond for any additional costs the owner incurs in reletting the contract. This usually is the difference in dollar amount between the low bid and the second low bid. The penalty sum of a bid bond often is ten to twenty percent of the bid amount. 23 Performance Bond Guarantees: Contract performed Owner receives its structure Build in accordance with contract Covers warranty period (normally one year) Premium includes warranty period coverage If the principal defaults what are the options for the surety? 24 Three Choices If principal defaults, or is terminated for default by the owner the surety has three choices: Complete the contract itself through a completion contractor Select a new contractor to contract directly with the owner Allow the owner to complete the work with the surety paying the costs 25 Payment Bond Protection of third parties to contract Guarantees payment of labor and materials used or supplied in the performance of construction Not required on privately financed work – few state statutes Protects against “liens” What are liens? 26 What are “liens”? Right created by law to secure payment for work performed and material furnished in the improvement of land A lien is recorded (with county recorders office) against the title or deed for a property (land and/or building) A Title to your new car will have a “lien holder”, your bank, if you have a car loan 27 Statutory vs Common Law Bonds Payment Bonds are either statutory or commonlaw Public – statutory (prescribed by law) Private – common law (the bond instrument) Bond Forms Public – standard by federal government written in accordance with Miller Act Private – AIA form 28 The Miller Act Enacted in 1935 All federal projects greater than $25,000 – performance and payment bond required 100 percent of the contract amount Protects first and second tier subcontractors only Cannot sue on the payment bond until 90 days after the last day labor was performed on job 29 Bond Premiums To compute contract bond premiums construction contracts are divided up into four classifications: (see pg 183) A-1 A B Miscellaneous More than one classification – high premium rate controls 30 The Surety Subject to public regulation – same as insurance industry Approved by the U.S. Treasury Department for government projects A. M. Best Insurance Reports – financial ratings for insurance and surety companies Owners can require a minimum Best Rating for the surety 31 A. M. Best’s Ratings of Surety http://www.ambest.com/ Secure Best’s Ratings Vulnerable Best’s Ratings A++ and A+ (Superior) A and A- (Excellent) B++ and B+ (Very Good) B and B- (Fair) C++ and C+ (Marginal) C and C- (Weak) D (Poor) E (Under Regulatory Supervision) F (In Liquidation) S (Rating Suspended) The rating symbols "A++", "A+", "A", "A-", "B++", and "B+" are registered certification marks of the A.M. Best Company, Inc. 32 The Surety Owners may name the surety company for the contractor to use – NOT RECOMMENDED PRACTICE, but is LEGAL for private work Contractor typically have one surety (bonding company) that has pre-approved contractor Surety pre-approval takes time and involves a review of audited financial statements and other records Co-sureties – large project – one surety does not have the financial capacity for large risks 33 Indemnity of Surety Surety indemnifies the owner against default by the contractor Contractor indemnifies the surety against claims and damages due to contractor’s failure to perform Surety is not legally obligated to provide payment and performance bond if they provided bid bond – but always do 34 Bonding Capacity Maximum dollar value of uncompleted work the surety will allow the contractor to have on going Based on contractor’s net worth and cash liquidity Surety may also limit dollar value of one project Example: total bonding capacity of $5 million maximum project bond of $1 million 35 Surety Agent Local representative for surety Many agents are independent and sell contract bonds by multiple surety companies In reality, Bid Bonds cost the contractor nothing – no cost, as a professional courtesy If contractor is the low bidder the surety agent wants the opportunity to sell the contract bonds 36 Subcontractor Bonds Contract bond that covers the performance of subcontractors Common on private projects Requested by and paid by owner Cost: 0.5 to 1% for excellent subcontractors 1 to 2% for good subcontractors >2% for average to marginal subs (cost is a percentage of subcontract value) 37 Miscellaneous Surety Bonds Bonds to Release Retainage Bonds to Discharge Liens or Claims Commonly called “bonding over a lien” Bonds to Indemnify Owner Against Liens License Bonds Self-Insurers’ Workers’ Compensation Bond Union Wage Bond 38