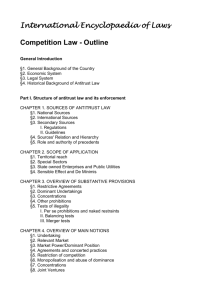

Antitrust, Legal Standards and Investment

advertisement