Title: An Asymmetric Block Dynamic ... model Author: Gregorio A. Vargas III

advertisement

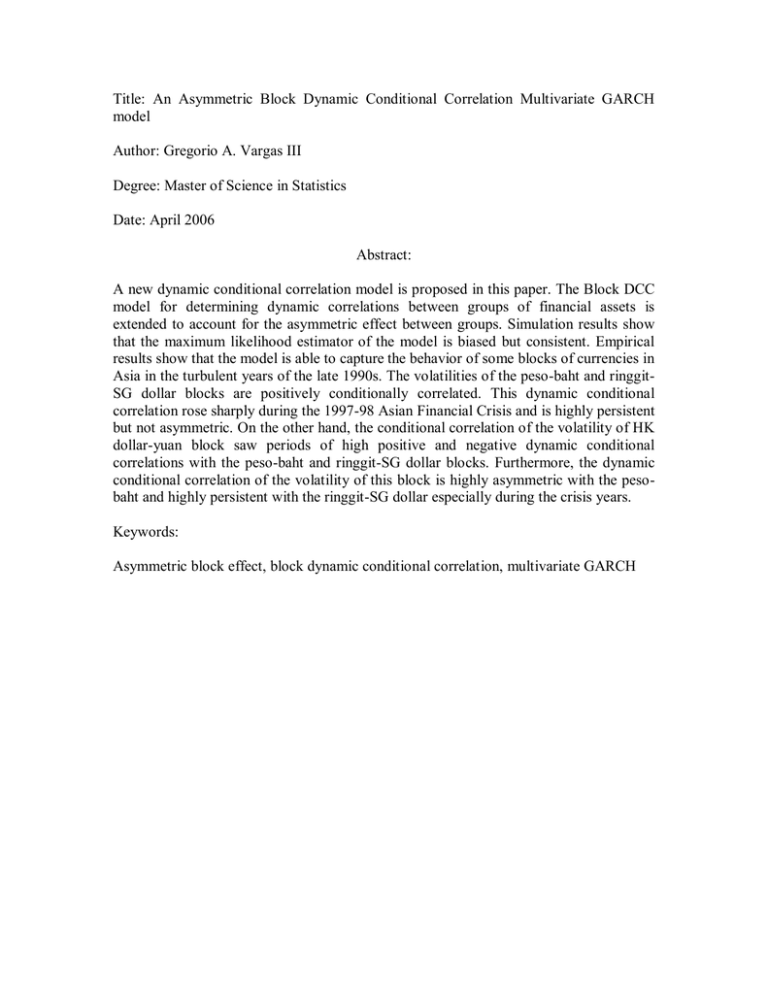

Title: An Asymmetric Block Dynamic Conditional Correlation Multivariate GARCH model Author: Gregorio A. Vargas III Degree: Master of Science in Statistics Date: April 2006 Abstract: A new dynamic conditional correlation model is proposed in this paper. The Block DCC model for determining dynamic correlations between groups of financial assets is extended to account for the asymmetric effect between groups. Simulation results show that the maximum likelihood estimator of the model is biased but consistent. Empirical results show that the model is able to capture the behavior of some blocks of currencies in Asia in the turbulent years of the late 1990s. The volatilities of the peso-baht and ringgitSG dollar blocks are positively conditionally correlated. This dynamic conditional correlation rose sharply during the 1997-98 Asian Financial Crisis and is highly persistent but not asymmetric. On the other hand, the conditional correlation of the volatility of HK dollar-yuan block saw periods of high positive and negative dynamic conditional correlations with the peso-baht and ringgit-SG dollar blocks. Furthermore, the dynamic conditional correlation of the volatility of this block is highly asymmetric with the pesobaht and highly persistent with the ringgit-SG dollar especially during the crisis years. Keywords: Asymmetric block effect, block dynamic conditional correlation, multivariate GARCH