EVALUATING LYNN'S SOUTH by A

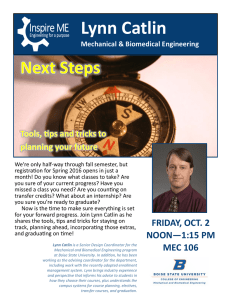

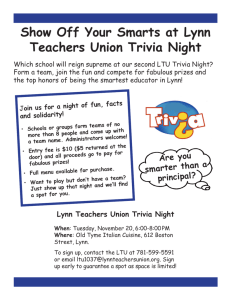

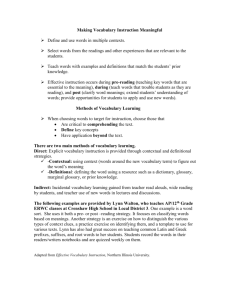

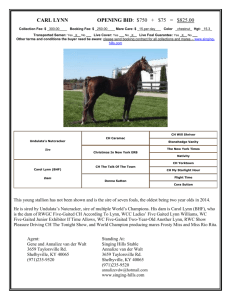

advertisement