Document 10698728

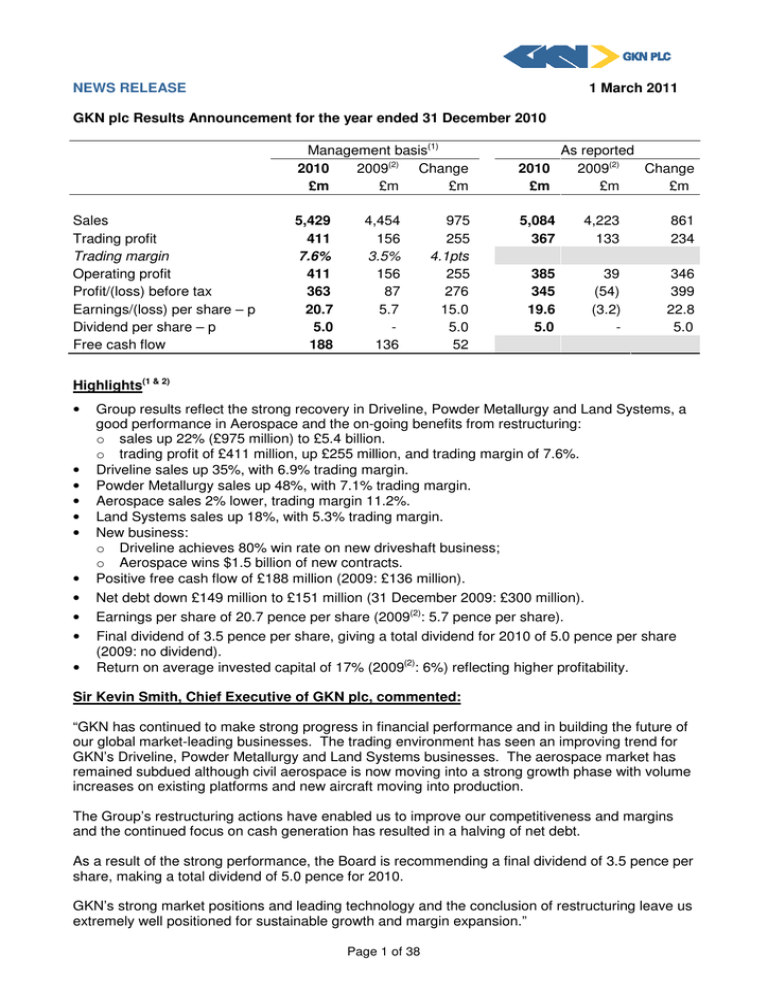

advertisement