– Welcome to a safe visit to GKN Filton and Western Approach

Welcome to a safe visit to GKN –

Filton and Western Approach

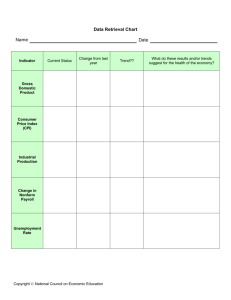

Safety Conditions

There are numerous chemicals and processes that could pose a hazard to unprotected individual’s.

Please follow all signs and instructions given by your host whilst on site.

To minimise your exposure to hazards you are requested to abide by the following guidelines:

Be aware of your environment at all times

Stay with your host at all times, always ask for permission before approaching or touching equipment or products

Never enter an area that contains warning signs or is cordoned off

Follow all safety announcements and instructions that you receive

Notify your host if you have an implanted medical device that could be affected by electromagnetic field

1

[21 st May 2012 Investor Briefing]

GKN plc Overview

Nick Waters

CFO GKN Aerospace

May 21 st 2012

Strategic Goals

Building a portfolio of market leaders with: leading market shares in chosen segments above market growth in each division margin expanding through the target ranges technology leadership – engineering for the future

2011 - Sales by division 2011 - Sales by region

£1,003m

£885m

£2,795m £2,232m

£1,481m

£2,877m

£845m

Total 2011 Sales

£6,112m

3

[21 st May 2012 Investor Briefing]

Global Positioning

44,000 Employees in over 30 Countries

4

[21 st May 2012 Investor Briefing]

GKN Driveline

From driveshaft to driveline – repositioned globally

2011 sales by region Unrivalled capability

– global no 1

Asia

31%

Americas

29%

Europe

40%

2011 sales by customer

5

[21 st May 2012 Investor Briefing]

GKN Powder Metallurgy

2011 sales by region

0%

Sinter - Rest of world

7%

Hoeganaes

17%

Sinter

Americas

38%

Sinter

Europe

38%

2011 sales by customer

6

[21 st May 2012 Investor Briefing]

Land Systems

2011 sales by market

2011 sales by customer

Market Leading

Positions

7

[21 st May 2012 Investor Briefing]

GKN Aerospace

Market

Business

Mix

Sector

Customer Base

8

[21 st May 2012 Investor Briefing]

GKN Aerospace – key growth events:

St Louis-2002

Secure military position

Major Boeing Military relationship

Pilkington Aerospace-2004

Secure Military Transparency leadership

Stellex-2005

Complimentary to St. Louis

Boeing Commercial position on B787

Teleflex-2007

Extend to engine hot section

Secure major GE relationship

Rolls-Royce Composite Fan Blade JV-2008

Positioning for Next Gen Single Aisle

Strategic Partnership with RR

Filton -2009

Major capability expansion and A350 position

Strategic position with Airbus

9

[21 st May 2012 Investor Briefing]

9

GKN Aerospace – strong sales and margin delivery

10

[21 st May 2012 Investor Briefing]

10

GKN Aerospace

$2.5B International Aerospace Enterprise

29 sites - 9,000 people

Aerospace

North America

Kevin Cummings

Aerospace

Europe

Phil Swash

GKN Aerospace

Marcus Bryson

11

[21 st May 2012 Investor Briefing]

Aerospace North America

Aerospace Europe & Special Products Group

GKN Aerospace – World Class Product Portfolio

Airframe

Subassemblies

Composite

Structures

Metallic

Structures

Engine

Products

Nacelles

Canopies and

Transparencies

Fuel & Flotation

Systems

Hondajet Fuselage

Assembly

A400M Composite

Wing Spar

F/A-22 Titanium

Aft Boom

Exhaust Systems

Gulfstream

G100/G150/

Dassault Falcon

50EX Military

Canopies and

Windshields

Fan Modules

Airbus Fixed

Trailing Edge

GEnx Composite

Fan Case

Main Landing

Gear Beam

Assembly

A330 Trent 700

Fan Cowl Door

B787 Passenger

Windows

B787 Section 41

Floor Assembly

F-135 Fan Inlet

Case

F-35 JSF

Titanium

Bulkhead

Fan Blades

Bombardier Dash

8 - 400

12

[21 st May 2012 Investor Briefing]

Fuel Systems

Aircraft Flotation

Devices

Seals & Gaskets

GKN Aerospace – Well Positioned for the Future

*

*

*

*

*

*

*

*

*

Ship set values $m

*

Life of Programme Significant proportion of life of programme

*

13

[21 st May 2012 Investor Briefing]

Changing Shape of the Business

Sales by Market

2011

Customer Sales

2011

Military 42%

Civil 58%

14

[21 st May 2012 Investor Briefing]

GKN Aerospace Filton

Overview

Charles Paterson

VP Business Development and Strategy – Europe and Special Products

GKN Aerostructures Metals / Assembly Sites

St. Louis

Advanced Machining & Assemblies

1,000,000 SF

Monitor

Complex Metal Machining

243,000 SF

Premac

Metal Machining & Assemblies

242,000 SF

Bandy

Hinges and Machining

48,000 SF

Mexicali

Low Cost Machining & Tooling

155,000 SF

Filton

Advanced Machining & Assemblies

Floor Space 800,000 SF

Yeovil

Fabrications & Assembly

Floor Space 290,000 SF

Filton

Engineering Design Center

Bandy

Mexicali

Premac

St. Louis

Monitor

Filton

Filton

Yeovil

16

[21 st May 2012 Investor Briefing]

Design Center

Manufacturing Facility

GKN Filton

World leading capabilities in the design, build & systems integration of major wing assemblies

£400M turnover

1500 people

Floor space 74,000m²

Room for Expansion

25,000 parts shipped per week

Procured BOM 11,000 part #’s

17

[21 st May 2012 Investor Briefing]

GKN Filton – Key Capabilities

Components

Machining;

Large structural and complex parts – max 4m x 2m

Hard and soft metal capability

Advanced Systems

Full system capability – hydraulic, pneumatic, fuel, anti-ice, electrics

Electron beam welding, automated robotic welding and assembly

Assembly

Major structural assembly

Metallic and Composite

Automated and robotic assembly

Supporting capabilities:

Design - build capability

Independent quality approvals

Tool design and manufacture

Metrology and conformance engineering

Additional capabilities through GKN network

18

[21 st May 2012 Investor Briefing]

GKN Filton – Wing Products

A330/340

Outer wingbox

Wingbox ribs

Complex ducts, welded assemblies, pipes

SA Flap Track levers

Hard

Metal

A330/340 - A400M

Leading Edge Assembly

LR Trailing Edge Hinge

Ribs

SA Pylon Brk

LR APU

Brks

LR Inboard LE Track Ribs

SA OB Tank

Access Doors

SA Catcher

Brks

SA Crown Fitting

A330/340 - A380 - A400M

Trailing Edge Assembly

LR False rear

Spar

LR Fixed shroud

A380, A330/340

Gear rib

19

[21 st May 2012 Investor Briefing]

SA Dry Bay Doors

LR & SA Pintle Pin

A380 Pintle fitting

GKN Filton – Integration Update

Acquisition was successfully completed 5 th Jan 2009, post acquisition 100 day plan was concluded successfully and GKN controls environment installed

Full stand-alone capability is established

– IT systems, Quality Approvals

Operational performance is excellent; delivery performance consistently running well above the customer target quality initiatives delivering measurable improvements customer working relationship is very good

Value generation projects are delivering; GKN Lean Enterprise approach installed - significant reductions in white collar headcount and inventory have been achieved

Design-build capability is in place – Filton Engineering Centre has been launched

Customer portfolio is being diversified

– two new customer contracts in implementation in 2011

Delivered three years of strong financial performance

Culture change

– transformation from cost centre to stand-alone competitive business

20

[21 st May 2012 Investor Briefing]

GKN Aerospace Western Approach

Overview

Charles Paterson

VP Business Development and Strategy – Europe and Special Products

Increased Use of Composites in Aerospace

Rapid growth since introduction in the 1970’s

Next generation Single Aisle - up to 60% composite

Military platform growth into UAV’s – up to 70% composite

22

[21 st May 2012 Investor Briefing]

GKN Leadership in Composites

First application of RFI in commercial aircraft – A380

World’s first large wing composite spars - A400M – automated lay up process

GEnX filament wound composite fan case – a first for large commercial engines

F35 (JSF) F135 engine fan inlet – first composite structural front end to a military engine – proprietary

RTM process

B787 first electronic wing ice protection product

1 st RTM Structure on wing (Boeing) as well as 1 st Class 1 RTM

Structure (LHM)

Future Composite fan blade high volume, automated

RTM process development programme in 2 nd year

A400M

Composite

Wing Spar

GEnx

Composite

Fan Case

F135 Fan

Inlet Case

23

[21 st May 2012 Investor Briefing]

GKN Aerostructures Composites/Assembly Sites

St. Louis

Advanced Composites &

Assemblies

700,000 SF

Cromwell

Advanced Composite Structures

30,000 SF

Tallassee

Composite Details & Assemblies

380,000 SF

Munich

Western Approach

Advanced Composites & Assembly

330,000 SF

Munich

ATL Composites

325,000 SF

Cowes

Research, Composites, Assemblies

420,000 SF

Luton

Ice Protection, Composites

250,000 SF

Cowes

Engineering Design Centre

Mexicali

St. Louis

Tallassee

Cromwell

UK Composites Centre

Western Approach

Luton

East Cowes Design Centre

Manufacturing Facility

Future Capability

24

[21 st May 2012 Investor Briefing]

Facility Development – Western Approach

25

[21 st May 2012 Investor Briefing]

Facility Development – Western Approach

26

[21 st May 2012 Investor Briefing]

27

[21 st May 2012 Investor Briefing]

28

[21 st May 2012 Investor Briefing]

29

[21 st May 2012 Investor Briefing]

30

[21 st May 2012 Investor Briefing]

31

[21 st May 2012 Investor Briefing]

A350 XWB Variants

+5 frames +6 frames

-4 frames -1 frame -5 frames

-1000: 343 pax

EIS: 2016

-900: 315 pax

EIS: 2013

-800: 274 pax

EIS: 2017

32

[21 st May 2012 Investor Briefing]

A350 Key Programme Facts

Single largest programme investment by GKNA

£172m Programme including:

£70m Engineering Spar Design, Development programme & tooling

£84m Spar manufacturing & Automated Assembly capabilities

£18m Land, Buildings & Facilitisation

Advancing GKN Capabilities

First Inner Rear Spar in Composite – largest composite part in

GKN

First use of AFP on this scale - First Advanced Fibre Placement spar manufacture

First FTE automated moving assembly system

Fully integrated product teams working closely with customer and supply chain

Creation of GKN Centre of Excellence for composite spars

(Western Approach)

A400M Leading Edge & Trailing Edge manufacture transferred from

Cowes to Western Approach in 2011

33

[21 st May 2012 Investor Briefing]

Fixed Trailing Edge (FTE) Work Package Overview

Fixed Trailing Edge is the main structural sub assembly that forms the critical aft section of the wing

Most complex area of the wing with critical interfaces with root joint, landing gear, high lift system, wing covers. Most highly loaded section of the wing.

Outer Spar & Assy

Mid Spar & Assy

Inner Spar & Assy

FTE work package comprises

3 Spars total over 27m in length with an accuracy of +/- 0.3mm

Total weight of spar carbon is 1132kg/aircraft. GKN package target weight is 1658kg

The FTE is 7% of total wing weight and supports 10x its own weight

34

[21 st May 2012 Investor Briefing]

Spar Process Flow

Goods In

Mandrel

Preparation

Advanced

Fibre

Placement

Hot

De-Bulk

Transfer to

Cure Tool

Autoclave

Cure Router

Non Destructive

Testing Paint

Rib-Post Assy

To

Assembly

35

[21 st May 2012 Investor Briefing]

Advanced Fibre Placement (AFP)

36

[21 st May 2012 Investor Briefing]

Assembly Process Flow

Spar and

Details

Load to Jig

IRS 5 Axis Drill

MRS & ORS Robot

Drill

Move

Bolt & Assemble

Digital Scan Joint

Spar

[21 st May 2012 Investor Briefing]

Robotic drill &

Integrate

Despatch

A400M SPARS

38

[21 st May 2012 Investor Briefing]

Spar Manufacture

39

[21 st May 2012 Investor Briefing]

Spars

One of the eight spars that we produce for the A400M:

Vertical stiffeners

Deflectors

Rib posts

Horizontal stiffeners

Throat plates

40

[21 st May 2012 Investor Briefing]

Summary

Summary – GKN Aerospace

Proven track record of growth and margin progression into 11% - 13% range

Strong position on existing programmes with increasing build rates

New programmes now set to ramp-up production

Technology development remains a focus and is positioning GKN for future programmes

Filton acquisition and integration very successful and A350 capabilities now being proven

Airbus relationship is hugely important and continues to strengthen

Thank you for your attention

42

[21 st May 2012 Investor Briefing]