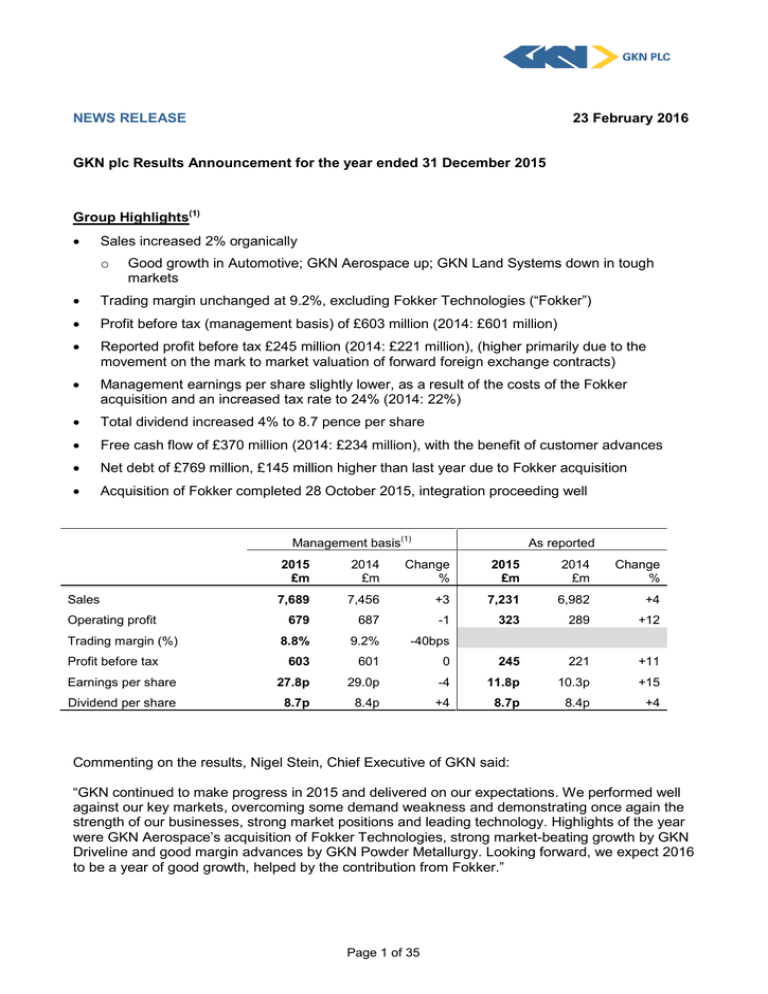

Document 10698122

advertisement