Private v. Public Subsidies: 774

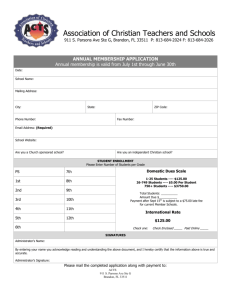

advertisement

Private v. Public Subsidies:

An Analysis of Chapter 774 Subsidies For The Production of

Low and Moderate Income Rental Housing

by

David Searson Carter

Bachelor of Science

Bates College

1982

SUBMITTED TO THE DEPARTMENT OF ARCHITECTURE

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS OF THE DEGREE

MASTER OF SCIENCE IN REAL ESTATE DEVELOPMENT AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

SEPTEMBER,

1988

David Searson Carter 1988

The author hereby grants to M.I.T.

permission to reproduce and to distribute publicly copies

of this thesis document in whole or in part.

Signature of the Author

I

-vd

c-ar on Ca rte r

Department of

Architecture

August 8, 1988

Certified by_

Michael Wheeler

Visiting Professor of Urban Studies and Planning

Thesis Supervisor

Accepted by

_-

-Michael Wheeler

Chairman

Interdepartmental Degree Program in Real Estate Development

1

MASSACIUSGE-TS INSTIilE

OFTENLG

SEP 20 1988

LIBRARIES

MfI

Libraries

Document Services

Room 14-0551

77 Massachusetts Avenue

Cambridge, MA 02139

Ph: 617.253.2800

Email: docs@mit.edu

http://libraries.mit.edu/docs

DISCLAIMER OF QUALITY

Due to the condition of the original material, there are unavoidable

flaws in this reproduction. We have made every effort possible to

provide you with the best copy available. If you are dissatisfied with

this product and find it unusable, please contact Document Services as

soon as possible.

Thank you.

The Appendix section of this thesis contains

text that is illegible.

Private v. Public Subsidies:

An Analysis of Chapter 774 Subsidies For The Production of

Low and Moderate Income Rental Housing

by

David Searson Carter

SUBMITTED TO THE DEPARTMENT OF ARCHITECTURE

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS OF THE DEGREE

MASTER OF SCIENCE IN REAL ESTATE DEVELOPMENT AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

ABSTRACT

Massachusetts

"anti-snob

zoning

law"

-

Chapter

774

-

allows

qualifying developers of affordable housing to overcome local

regulating barriers by expediting the permitting process and

over-riding exclusionary zoning.

As presently interpreted, the

law applies only to developers receiving a "state or federal

subsidy. "

This study questions the appropriateness of that requirement.

It introduces the concept of a private subsidy as a possible

alternative to the state and federal programs.

A financial

analysis of the subsidy programs that currently qualify under

Chapter 774 to create low and moderate income rental housing

is used to determine the "economic value" of each.

The

programs are compared and contrasted to a private subsidy

alternative through a discounted cash flow method of analysis.

The results of the study indicate that a private subsidy would,

under certain conditions, be a valuable addition to the current

programs.

TABLE OF CONTENTS

CHAPTER 1 -----------------------------------------------INTRODUCTION

4

Chapter 774; An Overview

CHAPTER 2 ---------------------------------------------

9

Chapter 774; Standards and Process

CHAPTER 3

--------------------------------------------STATE HOUSING ASSISTANCE FOR RENTAL

PRODUCTION

Outline of (SHARP) Program

SHARP Point System

SHARP Analysis

16

CHAPTER 4 ---------------------------------------------

29

TAX EXEMPT LOCAL LOANS TO ENCOURAGE

RENTAL HOUSING

Outline of (TELLER) Program

TELLER Analysis

CHAPTER 5 ---------------------------------------------

32

LOW INCOME HOUSING TAX CREDIT

Outline of (TRA '86) Tax Credit Program

Selection Criteria

TRA '86 Analysis

CHAPTER 6 --------------------------------------------PRIVATE SUBSIDY PROGRAM - (Outline)

38

Qualifying Criteria

Private Subsidy Analysis

CHAPTER 7 ---------------------------------------------

45

COMPARATIVE ANALYSIS

Summary

Conclusion

BIBLIOGRAPHY ------------------------------------------

59

APPENDIX -----------------------------------------------

61

CHAPTER 1 - INTRODUCTION

In

Chapter

1969,

774

the Commonwealth

the

of

of

the production

to

incentives

income

benefits:

1)

exclude

single

This

housing.1

application

to

low

build

yields

able

higher

to

2)

the approval process;

expediting

disregard

local

zoning

- densities typically

densities

is

a

eligible

enables

which

process

by offering

incentive

primary

process

encourage

to

and

important

two

developers are allowed to by-pass virtually

thus

sometimes

a

Laws

established

housing

income

The

permitting

submit

moderate

boards,

moderate

developers.

to

developers

Massachusetts General

low and

"comprehensive"

of Massachusetts

all local

developers

ordinances

are

which

required to produce

low and moderate income housing.

The

legislative

for

authorities

goal

attempt

increasing

Specifically,

of

of

passage

it

to

to

Chapter

implement

the stock

was

of

aimed

thwart

establishing "a

low

at

housing

774

limiting

moderate

decent home and

Chapter 774 is now

Massachusetts General Laws.

Chapter

of

Though

production.

housing.

income

the power

state's

incentives

governmental

other

and

one

represents

local

zoning

a national

a suitable environment

40B,

sec.

20-23

of

the

for every

American

Housing

Chapter

Act

of

774,

family"

1949,

the

2

had been

twenty

country and

set forth

years

the

before

in

the

the

commonwealth

Federal

passage

had

of

not come

close to achieving this fundamental objective.

Local

zoning

increasingly

housing.

been

The

and

related

invoked

United

272

communities

but,

was

365

power

land

-

it

use

control

a parochialism

municipalities

would

even

(most

though

Affordable

in

they

ban

in

land

notably,

low

were

clearly

housing

became

a

and

Ambler

controlling

Much

seen

needed

NIMBY

growth

and

on

impact of

predictability-

locally,

the case

Specifically,

costly or

moderate

income

a

Realty

local

towns.

as

the

gave

of the

and

exercised

cities and

uses

v.

had

affordable

upheld

thereby

planning

was

of

Court

Euclid

and

fostered

also prompted

undesirable

Supreme

(1926),

regulations

siting

use of private property.

positive

because

use

the

in Village of

significant

restricting the

Euclid

U.S.

block

States

constitutionality of zoning

Company,

to

land

socially

housing),

regional

level.

(not-in-my-backyard)

problem.

As

to

a consequence,

exclusionary zoning

Jersey and

other

constitutional

have

states.

been

and

brought

For example,

in

in

statutory

the

challenges

courts of New

Southern

Burlington

2 Report of the U.S.

National Advisory commission of

Civil Disorders (Washington, D.C.:

U.S. Government Printing

Office, 1968) usually referred to as the Kerner Report, p. 467.

5

County

(1975),

N.A.A.C.P.

v.

Township

of Mount

Laurel,

336 A2d 713

the New Jersey Supreme Court held that:

a developing municipality may not, by a system of land use

regulation, make it physically and economically impossible to

provide low and moderate income housing in the municipality

for various categories of persons who need and want it.

The

court

New

Jersey

housing

Mount

ordered

Laurel

municipalities)

opportunities.

(and

to

by

provide

Unfortunately,

all

implication

and

create

other

expanded

implementation

of this

principle has proven slow and sometimes contradictory. 3

In

largely

Massachusetts

legislative.

intrusion

to build

low and

Upon

innovative

production

seven

of

the

and

have

one

Chapter

has

served

moderate

sustained

hundred

fifty

been

significant

developers

using a comprehensive

at

the

as

an

denials

a

has

by allowing

774 was

income

six

snob-zoning

represents

housing

breakthrough

years

low

authorities

of

income

enactment,

the

774

on

autonomy

local

moderate

legislative

throughout

attack

Chapter

into traditional

permit.4

state

the

recognized

state

by local

cases

an

level

and

for

the

impetus

housing.

as

Since

ZBA's

appealed.

1978

in only

These

3 Michael Wheeler,

"Resolving Local Regulatory Disputes

M.I.T. Housing

and Building Consensus for Affordable Housing,"

Policy Project. Working Paper #9, 1988.

4 In theory, Chapter 774 is only binding in Massachusetts

communities that have not reached a designated level of low

and moderate income housinq, but very few had met the

standard.

statistics are a clear indication of the impact of the law.

Even

that

a

so,

many

major

government

facet

developers

of

subsidies,

comprehensive

developers

of

the

limits

That

is,

unless developers

state

or

federal

comprehensive

getting

subsidy,

permitting

approval

low

process

can

and

apply

they

the

advocates

required

effectiveness.

process

"subsidized"

housing

program,

its

permitting

and

only

and

cannot

be

for greater densities,

use

invoked

income

receive

of

the

by

housing.

a recognized

avail themselves

and zoning

argue

By statute,

moderate

for

5

of the

over-ride.

Without

the developers,

in turn,

cannot produce less costly housing.

Though

the

affordability,

Specifically,

applying

the

could

subsidies

allege

contend

benefit

argue

financing

of

governmental

economic

critics

critics

they

for

use

that

if

this

that

are

the

increase

intended

to

insure

always

the

case.

not

administrative

actually

supposed

they were

actually

is

programs

they

was

spared

to

chew

up

provide.

this

cost

of

much

of

These

delay,

private

the

production

of

major

programs

which

low

and

moderate income housing.

This

paper

evaluates three

satisfy

the subsidy requirement under Chapter 774:

5 Cynthia Lacasse, "The Anti-Snob

Effectiveness of Chapter 774 in Getting

Built," M.I.T. 1982.

Zoning Law:

The

Affordable Housing

*

State

Housing Assistance for

Rental

Production

program

(SHARP)

*

Tax-Exempt

Local

Loans

to

Encourage

Rental

housing

(TELLER)

* Low Income Tax Credit program (TRA '86)

Specifically,

it

programs

compares

private

place.

and

subsidizing

Each

effectiveness

income

examines

the

net

economic

value offered

alternative

achieving

housing.

demonstrates

the

program

in

the

is

in

each

presently available

evaluated

with

the goal of creating

Perhaps

value

most

feasibility of

income housing without state or federal subsidies.

in

to a

the market

low and

low

these

program

respect

important,

developing

of

to

its

moderate

the

analysis

and

moderate

CHAPTER 2 - 774 STANDARDS AND PROCESS

Under

developers

a single

An

774's

to the

local zoning

permit

which

encompasses

Developers

by-pass

conservation

board,

"over-ride"

to reverse

comprehensive

apply

approvals.

planning

Chapter

adverse ZBA

board of

all

other

appeals

necessary

local

boards

and

commission,

clause written

permitting

into Chapter

process

(ZBA)

for

sub-division

including the

board

of health.6

774 allows

rulings which the state deems

the

State

unjustified

and/or exclusionary.

Chapter

774

The

receiving

a completed

application for

The

must

a decision

hearings

are

approved

(as

decision

render

closed.

under

defined

must hold

a timetable

process.

ZBA

ZBA

specifies

in

to the

If

Chapter

State

the

a hearing within thirty

the

conditions

for

within

application

Housing

the

days.

The

HAC

must

hold

twenty

days.

The

HAC

must then

forty

is

days

either

the project

applicant

Appeals

twenty

days after

a comprehensive

rendering

774),

approval

the

the

denied

or

appeal

the

(HAC)

within

hearing

within

a decision

within

initial

render

after

"uneconomic"

may

Committee

permit.

6 However, conservation commission approval is required

pursuant to the State Wetlands Act if applicable; and a

building permit is required subsequent to comprehensive permit

approval.

7

thirty days after its last hearing.

An

applicant

filing

for

a comprehensive

permit

under

Chapter 774 must meet four basic criteria; namely,

1)

The

developer

developer

profit

must be

is defined

developer,

dividend

"qualified."

under Chapter

a public

corporation

(as

A

qualified

774 as a non-

agency,

or

a limited

defined by the particular

subsidizing agency involved).

2)

The

development

income

must

housing.

include

The

low or

definition

moderate

income

housing

quantities

required

are

and

similarly

moderate

of

the

low

or

minimum

defined

by the

particular subsidizing agency involved.

3)

The

applicant

control

over

must

the

have

some

property

form

for

of

site

which

the

comprehensive permit is being requested.

4)

The applicant must have a letter of

qualified

federal

or

state

intent from a

agency

indicating

potential eligibility for subsidized funding. 8

7 Chapter 774 fails to provide specific limits with

respect to the cumulative time span of ZBA and HAC hearings;

consequently, the permitting time table is not absolutely

finite.

8 Massachusetts Housing Partnership "Questions and

Answers about the Comprehensive Permit Process" prepared by

Stockard and Engler, Inc.

It

must

the

be emphasized that the first

subsidizing

providing

agencies

funds.

a

and second

much

Specifically,

larger

they

provisions give

role

than

simply

guarantee that the

project

really will advance State housing policy.

Developers

provide

the

meeting

following

each

of

additional

the

above

information

criteria

as

part

of

must

the

comprehensive permit application.

1)

Primary

site

development

plans

showing

the

locations

and outlines of proposed buildings.

2)

A

report

of

existing

site

conditions

including

street elevations, traffic patterns, and buildings.

3)

Preliminary

architectural

drawings

including

floor

plans, elevations, and sections.

4)

A

list of

size of

proposed

units,

building types

number

including

of bedrooms,

floor

the

areas,

parking availabilities, and open spaces.

5)

A

preliminary

sub-division

plan

where

the

sub-

division of land is involved.

6)

A

preliminary

utilities

plan

including

sewage,

water, and drainage conditions.

7)

A

list of

requested exceptions to

ordinances including zoning by-laws. 9

9 Ibid.

local codes

and

A

the

qualified

local

permit

ZBA

for

developer

their

process.

The

ZBA

would

safety

of the community.

Chapter

the

serious

774 to approve

project

subject

submits

consideration

which

have

then

may

under

deny

adverse

the

the application.

reasonable

information

to

the comprehensive

a permit

impacts

Otherwise,

to

this

on

for

the

ZBA

a project

health

and

is compelled

The ZBA

conditions

may

by

approve

concerning

the

physical and economic characteristics of the project.

If the

with

conditions

developer

Any

project is

may

denied

render

that

by the local ZBA,

the

appeal the decision

developer

seeking an

project

to the

appeal must

or

is approved

"uneconomic,"

Commonwealth's

comply with

the

HAC.

the following

three Geographic Allocating Standards.

1)

The application

with

an

must be made

existing

in

low or moderate

a city or town

income

housing

stock of less than 10%.10

2)

The

low

total

or

amount

moderate

of

land

income

currently

housing

in

occupied

the

by

subject

community must comprise less than 1.5% of the

total

land

commercial,

in

the

community

and industrial

use,

zoned

for

(excluding

residential,

publicly owned

land).

10 Of the 351 municipalities in the Commonwealth,

23

currently exceed the 10% requirement with an additional 39 in

the 7% - 10% range.

3)

The

total

land

developed

the

as

land

in

the

low and moderate

current

total

area

year,

area

must

in

the

be

community

income

housing,

less than

community

being

or

in

.3%

of the

10

acres,

whichever is larger. 1 1

A

qualified

standards

that

may

renders

established

oversee

for

the

appeal

the

a mechanism

decisions of

board.

town

Chairman

selectman,

within

The

Governor

the

of the HAC)

complies

with

Chapter

ZBAs

in

HAC

is

appoints

remaining

The

774 to

regard

three

approval

HAC

regulate

was

and

to applications

comprised

of a five-

one city counselor

three members

are appointed

these

or a conditional

"uneconomic."

the local

permits.

The

who

either a denial

project

comprehensive

member

one

as

developer

(including

by the Commissioner

and

the

of the

Massachusetts Department of Community Affairs.

Chapter 774 defines low or moderate income housing as:

Any housing unit subsidized by the Federal or State

Government under any program to assist the construction of

low or moderate income housing as defined in the applicable

Federal or State Statute, whether built or operated by any

public agency or any nonprofit or limited dividend

organization.

The

State Attorney

has

concluded

from

General,

this

in an

advisory non-binding

language that

a project

must

opinion,

have

a

11 Metropolitan Area Planning Commission "Chapter 774:

An Interpretive Analysis for Cities and Towns"

(Boston:

Metropolitan Area Planning Commission, 1969), p. 4

13

state

or

federal

Accordingly,

of

low

subsidy

private

qualify

under

subsidies structured

and moderate

a comprehensive

to

income

permit.

units

To

will

date,

to

Chapter

buy-down

774.

the cost

not qualify a project for

this

opinion

has

not

been

challenged or interpreted in court.

The

Attorney

influenced

the

provides

federal

of

fe deral

Urban

Chapter

77 4.

But

Ho using

programs

this

as

h ave

void b y

sources

0

Opportu ni

Encourage

Assistance

on

with

the

the

housing.

now,

Tax

adminis tered

with

These

Program

HOP)

Rental

'86

ing

Housing

The HOP

program,

as

or

substantial

the

as

Since

a su bsidy

of the

(TRA

programs

Tax

TELLER),

(SHARP).

each

Low

the federal

V

has filled

hich qualify

Homeowners hip

L ocal

and

of

under

Federal

'86),

include:

Ex empt

1969,

De partment

three program s

SHAR P and

program,

a gency which

The Commonweal Lh

implementing

Ho

by

the exception

prog ram

demonstrate

housing.

qualified

discontinued.

Commonwealth's

TRA

income

has

an

c onstruction

moderate

subsidy.

Rental

For

the

"subsidized"

to

state subsidies to

Credit

been

of

developers

Development

recently

f

or

programs

ar d

interpretation

require

for

low or

Housing

Income

to

subsidizes

rehabilitati on

several

HAC

for

qualificatio i

General's

State

Loans

to

Housi ng

This paper will focus

TELLER

programs,

deals exclusively with

o n the other hand,

facilitate homeownership, and thus i s not really comparable.

along

rental

is designed to

Developers

either

non-profit,

This

paper

dividend

dividend

This

exclusively

developer.

It

therefore,

investment,

non-profit

or

all

be

the

understood

assumes that

other

private-sector

an appropriate

primarily by

as

that

return

on

limited

the

limited

investment.

limited dividend developers

appropriate,

things

are categorized

and limited dividend developers.

with

must

developer expects

analysis,

for subsidies

public agency,

deals

are motivated

on

who qualify

if

being

not excessive,

equal.

public agency developers

may

(By

returns

contrast,

have broader,

a

non-

financial objectives.)

This

rental

subsidy

hypothetical

in

each

paper

will

programs

private

chapter

chapter to follow.

begin

will

with

currently

an

introduction

in

subsidy alternative.

then

be

compared

existence

to the three

followed

by a

The financial analysis

and

contrasted

in

the

CHAPTER 3 - STATE HOUSING ASSISTANCE FOR RENTAL PRODUCTION

State

was

Housing

signed

development

program

which

is

Assistance for

into

law

of

rental

designed

the

private

in

Rental

December

housing

in

to "encourage

sector

of

could

Production

1983

the

to

stimulate

Commonwealth.

types of housing

not

(SHARP)

accomplish

the

The

development

without

some

form of government aid". 12

Under

Finance

the

Agency

SHARP

(MHFA)

financing through

most

recent

addition,

cover

the

funds"

to note that

must

be

fifteen

or

in

SHARP

(EOCD)

some

Massachusetts

construction

cases,

issue

was

provides an

shortfalls.

by the Executive

and accrue

SHARP

time

bond

program

operating

repaid.

year

the

and

Housing

permanent

the sale of tax-exempt or taxable bonds.

are provided

Development

provides

tax-exempt

projected

program,

funds are

at

annual

These

at 5%.

It

not grants,

is

and

loans

are

set up on

frame,

after

which

the

loan

continue

the

"SHARP

Communities

SHARP

to

In

cash subsidy to

Most

renewed

8.5%.

so-called

Office of

interest

loans,

sold

The

important

as

such,

a maximum

is either

project

and

as

repaid,

low or

moderate income housing.

12 Executive Office of Communities and Development

"Program

Guidelines, State Housing Assistance for Rental

Production (SHARP).

July 1987, p 1.

16

The

"minimum

intent

amount

economically

debt

as

(over

ultimately,

SHARP

that is,

Fundamental

that

constant

the

program

of subsidy necessary"

feasible;

service.

theory

of

market

time),

are

cover all

to

provide

rents

rise

operating

and

SHARP

out of project

the

sustain the project as

expenses

to the viability of the program

the required

repaid

to

is

debt

service

and

is the

remains

subsidies decrease,

cash flow.

and

However,

the

SHARP subsidy:

shall not exceed in any one year , on a per unit basis, the

difference between the amount determined by EOCD to be

necessary to pay debt service on a typical, newly constructed

rental housing project at prevailing interest rates on bonds

whose interest is tax exempt from federal or state taxation,

and t

amount necessary to pay such service at 5% per

annum.

All SHARP

the

The

units

set

as.ide

low-income

households

developments must

in

units,

holding

perpetuity

in

Section

most

8 or

have a minimum

for

low-income

of 25% of

households.

cases,

will

be

marketed

Chapter

707

rental

to

assistance

certificates.

SHARP

"equity",

currently

where equity

allows

a 6% return

is defined

as

the

on

sum

the developer's

of the following

three categories:

1.

land

A developer's

allowance

13 lbid p. 4-5.

fee of 20% of project cost exclusive of

(appraised

value

of

the

land)

plus

developer's

overhead

of

5% of project costs

exclusive of

land allowance.

2.

A

"standard"

approximate

investment at closing,

2% of the mortgage

explicitly stated

cash

cash

in the program

investment

by

the

receive a 6% return,

developer

were

investment

would

to

if

amount.

is

attainable.

pay

cash

be counted

Although

guidelines,

developer

the

as equity,

to

not

any additional

also

For

for

expected

eligible to

example,

if

the

land,

this

for

purposes

cash

of

calculating the developer's permitted annual 6% dividend.

3.

A

over

construction

letter of

into an operating

period

credit

of 4%,

which

letter of credit.

purpose of the analysis to follow,

rolls

For the

this 4% letter of credit

is assumed to cost 1%of the total letter of credit. 14

SHARP

MHFA

funds

competitions

funds.

Projects

against

minimum

(covered

in

are awarded

developers

are awarded

the

two ways.

compete

for

First,

a

limited

funds on the basis of:

standards;

following

in

2)

A

merit-based

pages);

and

3)

funds

are

awarded

through

pool

of

1) a review

point

the total

system

amount

of

available funding.

Secondly,

Massachusetts

SHARP

SHARP

Housing

funds to

14 Ibid p. 3-4.

Partnership

proposals

which

(MHP) .

The

through

MHP

the

awards

have the support of the Local

Partnership.

Local

Commonwealth

by

Partnerships

MHP

moderate

income

MHP

consideration

for

as

housing

a

are established

way

of

encouraging

development.

must

also

throughout

Projects

meet

the

the

low

and

submitted

minimum

to

standards

estimated within the merit-based point system discussed below.

SHARP POINT SYSTEM

SHARP

on

a maximum

proposals

of

130

are evaluated

points.

on

Points

a point

are

system

earned

based

through

the

following three categories:

1)

Development

Quality Goals-

50 possible points.

which

30

carries

points

in

There

10 points.

Design-

The

has

a total of

are five sub-categories

Applicants must

this category

points in each sub-category.

A)

This category

and

receive

each of

score a total of

a minimum of 4

The five sub-categories are:

overall

quality

of

the

design

is

evaluated.

B)

Development

Team-

The

track

record

of

the

development team is evaluated.

C)

Site-

The

suitability

of

the

site,

availability of

utilities, zoning, and site control are evaluated.

D)

Management-

The quality of the

management

plan

is

evaluated.

E)

Marketability-

The feasibility of the

proposed

rent

schedule is taken into account.

2)

Overall

Impact Goals-

There

are a total of 50 points

in

this category allocated between four sub-categories:

A)

Housing

Needs-

evaluated

meets

on

the

(10

points)

the merits

local

of the

housing

need for three bedroom

Standards

The proposed

degree to which

needs;

units

for this category

project is

v.

for

example,

two bedroom

vary somewhat

it

the

units.

by

location.

B)

Community

positive

Impact-

community

(15

points)

impacts

are

Projects

more

with

favorably

reviewed.

C)

Affirmative

housing

Action-

and

job

(10

points)

opportunities

The

for

degree

of

minorities

is

ranked in this section.

E)

Readiness

will

to

Construct-

be given to those

(15

points)

Consideration

proposals that are

ready to

move quickly to construction.

3)

Affordability-Valuethis

takes

category.

into

separately

There

While

account

allocated

the

three

to

is

a maximum

of 30 points

affordability

criteria,

the

value

points

each

but

rather

Point Count-

The

unit

in

ranking

are

cumulated

not

as

indicated below:

A)

The

Unit

derived based on the following table;

point

count

is

TYPE OF UNIT

NUMBER OF POINTS

Low-income with a minimum of

10 points

25% in perpetuity

Low-income, 30 year term

8 points

Low-income, 15 year term

6 points

Moderate-income, 30 year term

5 points

15 year term

3 points

Moderate-income,

Market rental, 15 year term

2 points

Market rental, 7.5 year term

1 point

B)

The

Bedroom

larger

unit

Adjustment

size,

an

Factor-

adjustment

number of units

derived.

The

multiplied

by the appropriate

calculate the corresponding

factor table is as follows;

in

To

encourage

has

factor

each

category

is

factor

to

adjustment

points.

been

The adjustment

SIZE OF UNIT

ADJUSTMENT FACTOR

0 to 1 bedroom--------------------------0.60

2 bedrooms-------------------------1--1.00

3 bedrooms---------------------------1.40

4 bedrooms---------------------------1.70

C)

The

Assessment

determined

requested.

Cost

of

based

on

to the

the

Commonwealth-

initial

SHARP

This

is

amount

15

SHARP ANALYSIS

For

purposes

programs,

of

a hypothetical

The project

is

accommodate

located on

is seeking

applicable percentage of

25%,

to be rented

to

be

or 25

to

15 lbid p. 10-15.

(1/2)

low

units.

or

current

income

The

remaining

units.

$16,000

units

per

Land

unit.

subsidy

is

used.

of land located

zoning,

acre lots.

all

development

the

Under

approval for 100 residential

as market-rate

$1,600,000,

housing

across

a twenty acre tract

forty one-half

the developer

analysis

100-unit

According

MetroWest.

is set at

financial

in the

in

tract

can

Chapter

774,

units.

The

SHARP

section

75 units are assumed

acquisition is

Hard

assumed

costs

total

$6,432,500 (approximately

allocated

to

in

respect

to

rental

replacement

land

$59

development.

income

reserve,

per

and

per

sq.ft.),

of which

Operating

unit

operating

assumptions

type,

expenses

$500,000

with

laundry

income,

are

constant

held

and are listed in the first table of each section of analysis.

This

project

has

been

evaluated

under

four

different

SHARP financing alternatives:

1.

The first alternative

financing

MHFA

at

bond

a rate

issue.

assumes

of 8.5%,

For

the

as

use of

per

tax exempt

the most

complete analysis,

recent

see SHARP-4A

(Appendix A).

2.

The

financing

second alternative

at a rate of

10%.

assumes

the

use

For complete

of taxable

analysis,

see

SHARP-4B (Appendix B).

3.

The third alternative assumes the

financing

tax

at a rate of

credit of 4%.

For

use of tax exempt

8.5% combined

complete

with

analysis,

a low

income

see SHARP-4C

(Appendix C).

4.

The

combined

fourth

alternative assumes

with a 9% low

income tax

10% taxable

credit.

financing

For complete

analysis, see SHARP-4D (Appendix D).

A discount rate of

minimum

multi-unit

after-tax

housing

17.5% has

return-on-equity

projects

(see

been

used,

expected

discussion

representing the

by developers

below).

Finally,

of

a

holding

period

of ten

The

methodology

discounted

permits

employed

cash

flow

alternatives

subsidy programs

considered

to

to

as

developers

various

programs

the

money.

DCF

developers and

of the

is

in the table below:

each

to

in

by

of

by

is,

the

because

value

DCF

time

it

among

of

addresses

value

of

sophisticated

industry.

alternatives

the

to other

unique flows

numerous

real estate

is

methodology

technique

That

principle

and

DCF

differences

benefits over time.

of the four SHARP

considered

methodology

other

the

are characterized

used

is

alternative

each

most appropriate

currently

it

This

Theoretically,

investors in the

analysis

as

analysis of income properties.

evaluate

quantify the

which

used,

methodology.

investment

fundamental

been

be compared

well.

to

investment costs and

to

(DCF)

be the

enables

has

for financial

industry standard

the

is

years

are

The results

summarized

SEE

APPENDIX

FINANCIAL

VALUE

(NPV)

PROGRAM DESCRIPTION

523,000

D

SHARP - With a market rate loan

and a 9% tax credit.

C

SHARP - With tax-exempt financing

and a 4% tax credit.

349,000

A

SHARP - With tax-exempt financing

without a tax credit.

82,000

B

SHARP - Market rate financing

without tax credits.

(83,000)

The

the

defined

by

would

SHARP)

4% tax

loan

under the

time

is

comparisons

scenarios,

can

the

credit that

with

be

could

guidelines.

SHARP

associated

developer

(as

($349,000-$82,000)

$267,000

require

For

in

at the onset of a development to be induced

present value terms

to forgo the

dividend

variations of

value."

"financial

its

limited

maximizing

profit

a

example,

indicative of

is

program

SHARP

of the four

each

associated with

NPV

securing

analysis

in

This

report

this

assumes

the tax credit.

between

drawn

supplement

this

and

is only

a tax-exempt

no

additional

While

isolated

other

project

accurate for our

hypothetical (yet realistic) 100-unit development proposal.

of

the

A close

examination

SHARP

development

sensitivity to assumed

of

the financial

proposals

Revenue Growth

25

sensitivity analysis

illustrates

Factors.

their

hyper-

Specifically,

a

five

percent

units

is

(5%)

used

Revenue

as

per

SHARP

Guidelines.

(6%)

used for

is

variable

subsidy

is

Growth

the maximum

A

illustrated

in

"Sensitivity

Analysis:

Changes

in

Growth

Revenue

average NPV

For

example,

the

and

a 5% re venue growth

yet

using

represents

a

significant.

Aggressive

the market

the

amount

proposal

difference

rate

units

of

SHARP

units,

induce

which

to

may

require

It's

clear

on

the

percent

Unit

Land

market

NPV

respective

sensitivity is

After-Tax

NPV due to

Cost

Assumptions.

unit land cost

rate units,

falls

is $258,000;

to $-254,000.

$5 12,000,

which

the profitability

make

ap plied

than

set

is

for)

fund

for t he growth

is

This

arguably

unrealistically

-

rate of

(which

affects

a development

attainable.

rate

SHAR P program

additional

of

actually

rat e ass umptions

growth

MHFA

of

fun ds

to the

applications

over-aggressive

may

can

is

standardization

some

the

six

in the

assu mption s regarding the growth

greater

appear

for

ass uming a $16,000

rate for

rate,

a 3% growth

of

analyzes this

Effects

and

subsidized

The sensitivity of this

appendix

The chart which

entitled,

the

Factor

rate units.

each

for

allowance set fourth

Revenue Growth

the market

program.

Factor

of

may

Until

market

fall

rate

victim to

assumptions

which

aggressive projects

(unanticipated)

funding

in

the

future.

market

state.

growth

One

that

rates

over-aggressive

are

criticism of

extending

the

SHARP

assumptions

the

risk

program

concerning

horizon

that

for

should

the

be

raised

is

definition

the

SHARP

program

equity,

where

developers

allows

of

a developer

permitted

developer's

that a developer

for a total

housing

exclusive of

costs

is

developer

project

or $20.

cost,

withdrawn

be

"hard"

and

with

if

upon

under SHARP,

to

have

Under

the

6%

$25

level

of

limited

to

into the

20% of total

election,

funding

a limited

of the

an

not

permanent

dividend developer

equity

"phantom"

dividend

investing

costs are

overhead

be entitled to a maximum

dividend

developer's

and

rental

and "soft"

back

investing

earning

such

of

a limited

SHARP,

at the

allowed

would

includes

Furthermore,

the development

Therefore,

mortgage.

developer

from

(this

fee equal

($5),

a

to

a unit

development

fee

land).

used to raise a

produce

earning

credited

5% overhead

additional

project.

be

can

developer

would

with

credited

of

(exclusive

can

Under

land).

a hypothetical

project

the

cost of $100

a

An example may help.

consistent with non-subsidized programs.

Assume

on

20% and

fee of

distribution

cash

annual

a 6% return

"gimmicks"

The developers fee and overhead are

The

developer.

earn

project costs

of 5% of

overhead

to

a developers

includes

equity

dividend

limited

in

restriction,

the

the

cash

dividend

equity,

in turn,

$1.50

per year.

Unfortunately,

creates

"phantom"

developments

the creation of "phantom"

Specifically,

regulation.

typically employ

less

than

because

SHARP

cash

equity,

10% ($10)

even

the developer who

$100

project

annual

($1.50/$10)

be

that

noted

From

at

is,

on

SHARP

is

cash

developments

are

project

remain

even

is

the developer's

of

equity

project

in

Return

a project is

the

"affordability

arguably

the

developer's

has

on

Equity

index"

;

level

limited

leaving the

through

inefficient

SHARP

allocation

to

will

dividend

developers.

equity

in

a

fee and overhead

effect

as the actual

amount

this

limited

equity

in

Consequently,

which

should

a diminishing

(ROE)

increased.

It

15%

debt financed.

largely

induces developers

minimum

publicly financed

the

relationship

This

"gimmick"

to

investment.

that

a

receive

amount of cash

the actual

if

increased,

constant.

on

dividend

this means

to

usually not even a binding constraint on

However,

SHARP

permitted

the

dividend

a policy perspective,

"gimmick"

will

a minimum,

into the

of cash

is willing to invest $10

limit

score

points

on

a

the

balance of the project to be

subsidies.

of

public

subsidies are drained into over-funded projects.

The

funds,

result is

as

an

limited

CHAPTER 4 - TAX EXEMPT LOCAL LOANS TO ENCOURAGE

Tax

Exempt

(TELLER)

income

local

was

rental

Local

created

housing

housing

in

tax-exempt

housing

projects

bonds

in

Laws,

financed

There

of

are

the

two

as

a

way

level.

to finance

their

Constitution

a portion

1984

Encourage

by

units

low

section

TELLER

reserved

programs

to

and

through

of

(with

income

the

the

bonds

low

program,

EOCD

moderate

26(m)

low

which

this

Pursuant

tax-exempt

for

Housing

encourage

issuing

community.

and

Rental

Under

have the option of

Massachusetts

projects

to

at the local

authorities

approval)

Loans

RENTAL HOUSING

income

to

the

General

must have

households.

project can

16

meet

this criteria:

1)

The development

income

made

units.

may

set

aside 20% of the units

Under this

available to

program,

households

the

earning

units

less

than

as

low

must

be

50% of

the area median income.

2)

The

development

units

this

in

the

program,

households

may choose

development

the

earning

units

less

as

to

low

must

than

set

aside

income

be

units.

made

60% of

40% of

the

Under

available

area

the

to

median

income.

16 Executive Office of Communities and Development, "Tax

Exempt Local Loans to Encourage Rental Housing, TELLER

Program", Department of Community Affairs, 1985.

29

In

either

case,

the units

households for

a minimum

actual

of

amount

attractiveness

"lock-in"

the subsidy to

of

the

must

be

rented to

low

income

period of fifteen years.

the developer depends

tax-exempt

bond

financing

The

on

the

relative

to

taxable financing alternatives.

TELLER ANALYSIS

Under

are

limited

program,

the TELLER

to

is

a 10%

program,

on

return

limited

equity.

defined as the difference

dividend

Equity,

between

developers

under

this

the amount of the

loan awarded to the project and the total cost of the project.

The

100

unit

based

TELLER

project

program

described

is evaluated

in

using the

Chapter 2.

TELLER

the latest bond issue of 8.5% and

on

hypothetical

financing

is separated

is

into the

following two categories:

1.

Tax-exempt TELLER financing at 8.5%. Appendix E.

2.

Tax-exempt

TELLER

financing

with

a 4% low income

tax credit. Appendix F.

In

assumed

and

both

TELLER

scenarios,

to be affordable.

F reflect

the

limited

20% of the

The financial

dividends

and

have been

units

analyses in Appendix

unit

mix

as

E

required

under

the Teller

program.

The financial

value (NPV)

of the of

the two TELLER scenarios are shown below:

FINANCIAL

VALUE

(NPV)

SEE

APPENDIX

PROGRAM DESCRIPTION

F

TELLER - With a 4% tax credit.

709,000

E

TELLER - Without tax credit.

488,000

Sensitivity analysis indicates that the TELLER

also hyper-sensitive to market rate growth

a land

4%

cost of $16,000 per

tax

credit

$355,000 used for

alternative

and

about

the

a 5% growth

half that when

the market

drops

unit,

units.

-$276,000

3% for the market rate units is assumed.

alternative with

produces

an

a 6% revenue growth

The financial

drastically to

rate assumptions.

TELLER

rate

program

is

At

a

NPV

of

rate

is

value of this TELLER

when

a growth

rate of

CHAPTER 5 - LOW INCOME HOUSING TAX CREDIT

Although

potential

(e.g. ,

construction

period

Tax

for

of

broken

into three

10

low

years

construction

Second,

other

rehabilitation

categories.

is

low

and

for

of

for

did establish the

Low

rehabilitation,

and

income

new

tax

credits

are

a credit of 9% per year

projects

that

qualifying

low

projects

subsidies to

housing

deductions

The

available for

federal

it

First,

income-sheltering

low-income

depreciation

housing.

rehabilitation

of

induce

construction,

available

a 4% credit

bonds or

to

the

income

is

or

used

most of the

interest and taxes),

Credit

out

removed

accelerated

acquisition

for

'86

formerly

development

Income

TRA

involve

the

income

units.

using tax

exempt

finance the construction or

units.

Finally,

a credit of 4% is

available for the acquisition of existing low income units.

The credits

low

income

project

To

be received

units on a straight

must

calculate

remain

the

"qualified"

low

years

have

low-income

dollar

credit percentage

will

may

is

owner s "qualified

units.

a present

basis"

on

of

qualified

line basis for ten years,

for

amount of

multiplied

income

by the owners

a period

credit

by the

value

(at

"qualified"

of fifteen

for

each

"qualified

A 9% credit

5%)

low

but the

year,

basis"

received

equal

to

income

years.

the

of the

over ten

70% of the

units.

The

4% credit

qualified

will

have

Credit percentages

basis.

Treasury,

val ue

a present

to

the

maintain

70%

(at

5%)

equal

are adjusted

and

to 30% of

monthly by the

30% present

values,

respectively.

States are

per

with

resident.

bond

this

program

financing,

financing.

is

based

national

population

country

could

current

population

be

$7,277,500 per year.

low

income

as

on

its

as

high

to credits

opposed

Much

of 250

sheer

million,

as

to

of the

equal

used

in

using

$312.5 million.

tax-

surrounding

Based

magnitude.

annual

to $1.25

conjunction

projects

excitement

the

in Massachusetts,

on

a

credit

for

the

Based

on

the

17

the credit would

amount

to

18

All projects,

for

low-income tax credits

This limit applies

"taxable"

exempt

allocated

tax

tax-exempt

as

well as

credits

must

meet

"taxable",

the

applying

following

three

criteria:

1)

The

project must

meet one

of the following

two

resident

targeting criteria:

a)

At

least 20% of the

be

rented

to households

rental

with

units

incomes

in

the project must

no higher than

50%

17 Richard S. Goldstein and Charles L. Edson, The Tax

Credit for Low Income Housing, Real Estate Review, Spring 1987

pp 54.

18 Low Income Housing Tax Credit

Office of Communities and Development, 1988.

Guidelines,

Executive

of the area median income; or

b)

At

least 40% of the

be

rented to

households

rental

with

units

in

incomes

t he

project must

no higher than 60%

of the area median income.

2)

The

"rent

than

higher

restricted"

30% of

units

must

set the

the

relevant

income

be

retained

as

gross

rents

li mitations

no

cited

above.

3)

project

The

minimur n of

must

fifteen

proportio nally.

years

or

the

rental

credit

housing

wil I be

for

a

pro-rated

19

SELECTION CRITERIA

Pursuant to

Order

No.

271

administrative

the

EOCD.

for

those

any

TRA

on

duties

'86,

Governor Dukakis

February

of the

low

With this assignment,

projects

project

not

subject to the

using

tax

12,

1987

tax

income

EOCD

signed

Executive

assigning

credit

program

to

set up a list of criteria

tax credit allocation;

exempt

the

bond

financing

or

that

is,

federal

subsidies.

First,

the

projects

must meet the

following

set of five

"threshold criteria":

1)

The

project must

19 Ibid.

p. 2

demonstrate

financial

feasibility and the

ability to

receive firm

receiving

of

expected

a tax

to

financial

commitments

within

credit commitment.

close financing

within

90

60 days of

Projects

days

of

are

then

receiving

the

tax credit commitment.

2)

The

development

team

must

demonstrate

the

ability

to

complete the project as proposed.

3) The project must be ready to move to construction.

4)

The

project

must

fit

within

the

goals

of the

tax

credit

program and the housing goals of the Commonwealth.

5)

The

project

Affirmative

must

Action

goals

opportunities to minorities.

Projects

permitted

Projects

associated

which

to move

are

meet

by

the

Commonwealth's

providing

housing

and

job

criteria"

are

20

meet

to the

allocated

with

help

these

"threshold

next stage of

tax

credits

the competitive

"competitive

based

on

a

criteria."

point

system

There are a total

criteria.

of

100 possible points allocated as follows:

A)

Housing

Need.

This

category

has

a total

of 40

points

allocated to three separate sub-categories.

1)

The degree

maximum

income

benefit

and

the tax credit will

to which

in

terms

affordable

of creation

units.

This

of

leverage the

additional

sub-category

low

has

a

total of 20 possible points.

2)

The

degree to which

20 Ibid. p. 6

the

low

income

units will

meet

the

needs of the community

and

the

region.

This

sub-

category has a total of 10 points.

3)

The

income

degree

to

and market

community

and

which

rate

region.

the entire

units)

This

will

project

meet

(both

low

the needs of the

sub-category has a total of 5

points.

4)

The

readiness

to

move to

construction.

This

sub-

category has a total of 5 points.

B)

Impact.

This category

has a total of 30 points

which

are

allocated through three sub-categories.

1)

The

positive impact that the

community

in which

it

is

project will

located.

have on the

This sub-category

has

a total of 15 points.

2)

The

degree to which

allocate other

the

project

state resources.

diverts

This

the

need to

sub-category

has

a

total of 10 points.

3)

The

degree

opportunities

for

to

which

the

minorities.

project

This

will

broaden

sub-category

has

a

total of 5 points.

C)

Quality.

This

category

has

a total

of 30 possible

points

allocated equally to three sub-categories.

1)

The qualifications of the development

team for a total

of 10 possible points.

2)

The

quality and suitability of the site for a total of

10 possible points.

3)

The

quality

of

the

design,

manageability,

compatibility for a total of 10 possible points. 2 1

TRA '86 ANALYSIS

Again,

the

hypothetical

100-unit

development

used

is

a 9% low-income tax

this

analysis.

Under

this

scenario,

and

a market

interest

rate

of 10% are

assumed.

See

in

credit

Appendix

G.

This

at the

value

scenario

standard

drops

of 3% (for

TELLER,

is

to

the

a financial

market unit growth

$249,000 at

market

5% and

units).

Ibid. p. 6-7.

value

equal to

$558,000

rate assumption of 6%.

-$236,000

This

hyper-sensitive to market

assumptions.

21

shows

proposal,

unit

at a growth

like SHARP

revenue growth

This

rate

and

rate

CHAPTER 6 - PRIVATE SUBSIDY PROPOSAL

Although

programs

the

differ

in

TELLER,

many

and TRA

regards,

they

the approval

Specifically,

similarities.

SHARP,

do

but also weighs

readiness

density,

design,

projects

throughout

the

become

a

focus

central

Consequently,

agencies

from

wield

of

required

subsidy,

These

the

significant

action

objectives,

allocation

of proposed

ancillary

factors

subsidizing

perspective the

a development

power.

important

program

affirmative

state.

Credit

process for each

and the geographic

to construct,

Tax

have

not only the dollars and cents of the

considers

'86

For

example,

have

agencies.

subsidizing

rather

than

defining "limited dividend developer", Chapter 774 provides that:

Determination whether an applicant for

permit to construct low or moderate

qualifies

as

a

limited

dividend

organization,...,

provides

determining

the

fate

agency,

subsidizing

subsidizing

the

of

the

agency

developer

process

a

properly

strong

applicants.

would

is

agency from which

left to the appropriate state or federal

applicant is required to obtain funding.

This

a comprehensive

income housing

lack

role

Absent

assurances

in

the

that

development proposals would serve their intended purpose.

If,

finance

low

in

fact,

and

a private subsidy

moderate

income

program

housing,

an

could efficiently

effective

review

process

would

consistency

required,

projects

of

be necessary

the

to monitor the

developments.

developers

could

If

mechanism

financing

used

private

is

this

review

needed

regardless

subsidy

program

would

clearly be

which

of

moderate

method

income

these

unacceptable,

not

some type of

the

ignored

were

permit to build

Accordingly,

to subsidize the low and

considerations

performance and

use a comprehensive

injurious to the public good.

policing

Any

still

and

of

units.

ancillary

inconsistent

with the central focus of Chapter 774.

Even

solved,

if

the

the

problems

requirement

Eliminating

the

of monitoring

to use state or federal

required

of

public

achieved through

three mechanisms.

First,

level,

could

a decision

program.

Second,

use

be sought

legislation

requirement.

Finally,

designed

works within

which

efficient

approach

could

the

be

at the

compared

be

a private subsidy

confines

could

of the

appears to

to

be

State judicial

program

subsidy program

when

could

passed changing

subsidy"

present

can

subsidies remains.

subsidies

in favor of

a "token

The development of a token

most

developments

the

this

be

law.

be the

judicial

and

legislative alternatives.

I

organized

propose

to

a system

by

which

a modest

provide a token subsidy for

and moderate income housing developments.

fund

would

privately financed

be

low

QUALIFYING CRITERIA FOR PRIVATE SUBSIDY PROGRAM

I suggest the MHFA

MHFA

the

presently

subsidy granting

background,

needed

Also,

issues

to

the

financial

and

obtain

level

administer this

site approval

process

in

new program.

letters

SHARP,

as an

it

The

a state-funded

subsidy would

feasibly)

project

could

review

initial step

has the

organization.

of

additional

(at

least

be understandably

Since

necessary

process

be

in

time

eliminated.

with

respect

to

lessened

because

no

state funds would at risk.

Prior

to

awarding

a site approval

letter,

MHFA

would

evaluate the project based on the following set of criteria:

1.

Quality of

architecture

the

would

Development

be evaluated

-

to

The

site

plan

insure that

it

and

is

in

keeping with local community character and standards.

2.

Development

Team

required to demonstrate

total

development

the financial

for the

demonstrated

institution.

The development team would

its ability to:

cost as

strength

balance

-

cash

equity;

a letter

The

raise 10% of the

and

necessary to qualify for

of the project.

by

1)

This

of commitment

development

team

be

2)

exhibit

financing

ability would

from

would

be

a lending

also

be

required

to have

secured a threshold

participation on

the

part of minorities of perhaps 10%.

3.

Affordability

match

the

The

project

affordability guidelines

existing qualified

minimum

-

would

be

of

least one other

at

This would

subsidizing agency.

of

percentages

required

as

units

affordable

to

include

well

as

would

be

income and rent level criteria.

4.

Tenant

required

in

units

Selection

to offer

All

-

a minimum

developments

of 20% of the

the project to qualified

that the

project is

income

In the event

minorities.

under-subscribed

low

by such

minorities,

the units may then be offered to other needy individuals.

In

the local

pending approval

view of the fact that projects

ZBA

are

moderate

income

exercised

when

issuing

failed to

developers

be

program)

would

approved

projects,

performance

in

housing

bond

initiate approved

To

applicants

equal

to

letters.

approval

damaged.

projects,

insure

would

five

care

community,

a

site

level of

the threshold

counted toward

percent

low and

would

be

Clearly

if

the process

(and

the construction

required

be

before

of

to

total

post

of

a

estimated

project costs.

The

in the

site

following

of public funds,

approval

manner.

letter issued

If the

by MHFA

project

the letter would be used

requires

would

be

used

the assistance

in its current capacity

as a pre-requisite to programs

project

letter

was

financially

could be

MHFA.

This

development

approval

and

be

feasible

SHARP.