(1979)

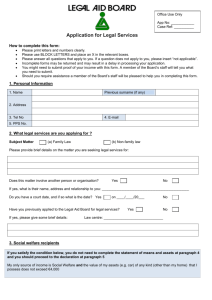

advertisement