Donor Governance and Financial Management in Prominent U.S. Art Museums

advertisement

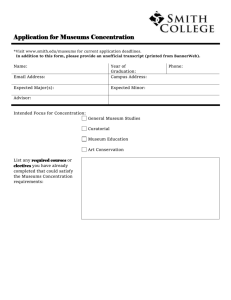

Donor Governance and Financial Management in Prominent U.S. Art Museums David Yermack Department of Finance, NYU Stern School of Business and National Bureau of Economic Research dyermack@stern.nyu.edu This draft: September 12, 2015 Abstract I study “donor governance,” which occurs when contributors to non-profit firms place restrictions on their gifts to limit the discretion of managers. In a study of U.S. art museums, I find that this practice has grown significantly in recent years, and it represents the largest source of permanent capital in the industry. When donor restrictions are strong, museums shift their cost structures away from administration and toward program services, and they exhibit very high savings rates, retaining in their endowments 45 cents of each incremental dollar donated. Retention rates are near zero for cash generated from other activities. Restricted donations appear to stabilize nonprofits and significantly influence their activities, but they reduce management flexibility and may contribute to lower profit margins. Rising donor governance in U.S. art museums may represent a reaction by contributors to the industry’s high rates of financial distress, weak boards of trustees, and large private benefits of control enjoyed by managers. I am grateful to Tumi Adebiyi and Siddharth Vij for excellent research assistance, and I thank Jianping Mei, Michael Moses, and Ashley Newton for graciously sharing their data with me. I appreciate helpful comments from Tumi Adebiyi, David Lesmond, Ashley Newton, Michael O’Hare, John Page, Johann Reindl, Gudrun Rolle, Siddharth Vij, Leonard Wolk, seminar participants at the University of Adelaide, Baruch College, BI Norwegian Business School, University of Edinburgh, Erasmus University Rotterdam, Free University of Amsterdam, IESEG Paris, Melbourne University, Tulane University, the University of Western Australia, and students in my NYU doctoral seminar on corporate distress and restructuring. Part of this paper was completed while I was a visiting professor at Erasmus University Rotterdam. Donor Governance and Financial Management in Prominent U.S. Art Museums I. Introduction This paper studies the role of restricted donations in financing major U.S. art museums. Charitable gifts play a critical role in supporting museums and other non-profit corporations, and accumulated restricted donations represent a significant and growing amount of the capital invested in the museum industry. When donors place restrictions on these contributions, the funds resemble equity investments with restrictive covenants, a source of financing unknown in the for-profit sector. Restricted donations permit benefactors to influence a non-profit organization for decades, even after the donors may have severed all connections or died. While restricted gifts provide stability and probably encourage a greater rate of contributions, they also limit operating flexibility in a way that could compromise an organization’s efficiency. Restricted donations represent a form of corporate governance, because they constrain the opportunities for non-profit managers to expropriate resources. I call this practice “donor governance.” The rationale for this type of donor control increases when other forms of governance are weak and information asymmetry between donors and managers is high. These conditions seem to characterize art museums, which have oversized, ceremonial boards of trustees and are managed by professional curators with specialized education from elite universities. For the curatorial staff, art museums offer potentially large private benefits of 1 control, since their positions provide exquisite working conditions and offer entree into the high society of museum patrons and donors. Although a minority of U.S. art museums have implicit financial protection due to government or university ownership, the vast majority are public charities overseen by selfperpetuating boards of trustees, and I focus my analysis on these independent museums. These organizations raise their own financial resources, make decisions about balance sheet leverage and undertake long-term capital investments. The potential agency problems in these art museums provide an interesting reason for examining their financial structure, and a further rationale comes from museums’ recurring encounters with financial distress. While museums enjoy a variety of government subsidies such as tax deductible donations, discounted utilities, and millage taxes, they remain exposed to considerable market risk, and sometimes things go very wrong. Art museums’ financial problems seem more than ironic, because many of them rank among the very wealthiest businesses in the economy, with vast collections of sought-after assets that appreciate in value and draw crowds of paying customers.1 Among many recent examples of museums facing financial crises, the Los Angeles Museum of Contemporary Art experienced a massive restructuring between 2008-13 that included a failed merger attempt with a cross-town competitor; the New York based American Folk Art Museum defaulted on a bond issue in 2011 and vacated its headquarters for a far smaller location; and the Detroit Institute of Art became ensnared in that city’s 2013 bankruptcy when 1 A former assistant curator at the Metropolitan Museum of Art in New York estimated its collection’s fair market value at more than $100 billion in 2008, as recounted in Gross (2009). O’Hare (2015) reports an estimate of $26 billion to $43 billion for the collection of the Art Institute of Chicago. 2 Detroit’s creditors pursued the museum’s art collection to satisfy the municipality’s debts. 2 Studying a panel dataset of prominent U.S. art museums between 1999 and 2013, I find that donor governance in the form of restricted donations has greatly increased in recent years and significantly impacts museums’ balance sheets and cost structures, in ways that both help and hurt their overall financial performance. Museums with high amounts of restricted donor capital tend to spend more on programming and less on administration, which suggests that donors successfully limit the appropriation of resources by management. These museums also exhibit more stability in year-to-year operating margins. However, their margins are lower compared to museums who receive gifts with fewer restrictions, implying that the loss of operating flexibility that accompanies donor governance can be costly. Figure 1 shows the total capital reported on the balance sheets of the 129 major art museums that form the sample for this study, as described more fully below. The figure shows an unmistakable trend over the 1999-2012 period of a reduction in unrestricted assets in favor of assets whose uses are temporarily or permanently restricted. More debt has also entered museum’s capital structures at the same time. As a result, museums have far less financial flexibility and operating discretion than before. The figure also shows clearly that restricted donations are the most important source of permanent capital in the art museum industry, even though widely recognized ethical guidelines state that museums should seek unrestricted gifts 2 Detroit’s flagship art museum was founded by the city in 1885 but spun off decades ago into a self-governing independent entity. However, the city retained title to the art collection in order to improve its position as a borrower in the municipal bond markets. The collection was appraised as high as $8 billion during the bankruptcy proceedings before a negotiated settlement extricated the art from the case. As discussed below, a handful of other museums have similar situations, with their art collections wholly or partly owned by the municipalities where they are located. 3 “whenever possible.”3 The figure is also misleading, because museums do not capitalize the value of their collections as assets on their balance sheets; when a museum purchases artworks for cash, the cost is expensed immediately rather than capitalized, and when art is donated (the much more common method of acquisition), no value is added to the organization’s balance sheet even though appraisals are often procured by donors to justify personal income tax deductions. Donated art can be subject to restrictions just like cash contributions, so it is unclear whether including the fair market value of a museum’s collection as a balance sheet asset would alter the message conveyed by Figure 1 of donor restrictions increasing dramatically over time. Certain costs and benefits of restricted donations can be observed by studying the inflows and outflows of funds from museums’ endowment funds. A recent expansion in disclosure requirements permits me to examine a four-year history of savings and spending from museums’ endowments. Analyzing the sensitivities between various revenue sources and changes in the organizations’ endowments, I find that museums add about 45 cents of each donated dollar to their endowments, an extraordinarily high savings rate that must surely occur as a byproduct of donor restrictions, which may affect the rate of spending either directly (by imposing time restrictions) or indirectly (by stipulating a restrictive set of uses for the curator). In contrast, museums’ endowment savings rates for operating surpluses and other sources of cash are virtually zero. When faced with operating shortfalls, museums draw down their endowments to cover operating deficits, but only at a lower rate of 13 cents per dollar decline in income, which 3 Principle 17 of the Professional Practices in Art Museums promulgated by the Association of Art Museum Directors states that “Gifts and bequests should be unrestricted whenever possible. No work of art should be accepted or acquired with conditions that restrict or otherwise interfere with the museum’s obligation to apply the most reliable scholarly and scientific information available to questions of attribution, dating, iconography, provenance, conservation, and related matters.” See https://aamd.org/sites/default/files/document/2011ProfessionalPracitiesinArtMuseums.pdf. 4 is likely also limited by donor restrictions on the uses of prior gifts. Museums’ constraints against using endowment funds as a buffer against operating losses force managers to make difficult choices about reducing operations when business turns down, which is likely the intention of their donors. Related restrictions against the “deaccessioning” or sale of artwork, discussed in more detail below, play a similar role in forcing museum curators to balance their budgets. Art museums offer an interesting opportunity to test Merton’s (1993) hypothesis that nonprofits should invest their endowments to hedge the value of other assets they own. Testing this hypothesis is difficult when studying non-profit organizations such as universities, but museums offer a much cleaner setting since their principal assets, fine art, comprise an investable asset class whose rates of return have historically provided a hedge against the returns on stocks, bonds, and other securities held in endowments, as shown by Mei and Moses (2002). However, I find no significant evidence that museums take account of rates of return in the art market when investing their financial endowments. This research extends our knowledge of the governance of major non-profit institutions, which dominate important, highly visible industries in the U.S. economy including the arts, education, healthcare, and religion. My focus on donor governance identifies a channel for control of non-profits and complements other recent papers on aspects of non-profit governance. For example, Newton (2015) shows the importance of effective board oversight for impacting operating results in the non-profit sector, while Hallock (2002) and Eldenburg et al. (2004) illustrate the role of executive incentives and the threat of dismissal in motivating non-profit managers to perform. 5 The remainder of this paper is organized as follows. Section II discusses the organization and economics of the art museum industry in the U.S. Section III describes the data set used in this study and presents descriptive statistics about restricted donations and other aspects of museums’ financing. Section IV contains the main analysis of museums’ endowment funds, cost structures, and financial performance. Section V concludes the paper. II. Organization and Economics of Major U.S. Art Museums Most museums have a timeless mission, exhibiting fine art masterpieces for public viewing in a format that has not changed in centuries. Because of the iconic nature of their collections, leading museums are relatively invulnerable to shifts in tastes or consumer technology, and they can rely on a more or less permanent clientele of visitors. Therefore, the economics of the industry are quite stable, as described in papers on the creation and early history of U.S. art museums by Smolensky (1986) and Temin (1991). On the cost side, museums have extreme operating leverage, with nearly all of their costs fixed except in the very long run. The marginal cost of accommodating an additional visitor is almost zero, and museums use a variety of strategies such as a heavy reliance on volunteer docents in order to align their operations with short-term changes in visitor demand. Frey and Meier (2006) provide a detailed survey of the sizeable number of published papers studying various aspects of museums’ business operations. Museums obtain most of their revenue from donations, with a minority coming from admission charges, membership subscriptions, and other user fees. In recent years, for-profit affiliated operations such as restaurants and gift shops have also subsidized some museums’ operations, especially in larger cities with high tourist traffic. While some donors make 6 unrestricted gifts to support all aspects of museum operations, Temin (1991) describes the longstanding preference of donors to restrict gifts for expansion of facilities, acquisitions of new art, or preservation of a museum’s collection. 4 Donations are tied to cycles in the economy and can vary considerably from year to year due to fluctuations in the stock market, as shown by Blanchett (2014). However, museum attendance tends to behave counter-cyclically according to Skinner, Ekelund and Jackson (2009), which should somewhat offset the instability of the donation stream (I find no evidence of such a pattern in my sample). Additions of art objects to museum collections usually occur as bequests whose timing is almost entirely idiosyncratic. Although a buoyant collectors’ market exists for the buying and selling of art masterpieces, museums do not participate in this market on a large scale. Total 2012 spending on art acquisitions by all 129 museums in my sample was just $256 million, about 80 percent of it by the top 10 museums. In contrast, the size of the worldwide art market is about $60 billion per year.5 Museum sales of art from their collections are severely constrained by codes of ethics that generally prohibit the deaccessioning of museum pieces except under very narrow circumstances.6 In principle, the ability to sell off surplus art could serve as a safety valve to 4 Many types of restrictions appear in charitable gifts, such as requiring an institution to use the funds to construct a building, to pay the salary for a particular position, or to award a traveling fellowship to a researcher in a specific field. Over time, purposes of a gift can become obsolete or peripheral to the mission of an organization, and both private and public lawsuits occasionally occur to enforce gift restrictions or permit their relaxation. Opposing views of the merits of donor restrictions, as well as abundant examples, appear in Feld, O’Hare and Schuster (1983) and Lotkin (1999). A good account of recent art museum controversies over donor restrictions can be found at http://www.nytimes.com/2013/02/05/arts/design/museums-grapple-with-onerous-restrictions-on-donations.html. 5 See http://www.artnet.com/magazineus/news/artnetnews/china-the-worlds-top-art-and-antique-market.asp. 6 In one prominent recent example, the Albright-Knox Art Gallery in Buffalo, NY, in 2007 raised $28.6 million by auctioning a bronze sculpture from its collection. It complied with standard ethical guidelines by earmarking the proceeds for an acquisitions endowment fund, essentially exchanging one piece of art for the resources with which to purchase others and rebalance the span of the overall collection. However, the transaction caused considerable controversy in the city and in the museum industry. 7 generate revenue when museums’ other funding dries up, but to the extent that these sales of art actually occur, museums use extreme discretion to avoid negative publicity. For example, some museums evade the restrictions against deaccessioning by immediately selling newly donated art without ever formally accepting it into their collections, and others have reportedly scrubbed evidence of prior ownership from historical records when selling off pieces of art. Temin (1991) explains that donor restrictions on gifts and the ethical rules against deaccessioning arose as forms of bonding between donors and a museum’s trained curators, who achieved operational control of most museums in the first part of the 20 th century. These restrictions prevented the museum’s professional staff from consuming the value of its collections through excessive compensation or fringe benefits. Numerous other contractual restrictions, such as governments’ limits on the use of tax-exempt bond proceeds that museums are permitted to issue, play a similar role in limiting agency costs. However, constraining managers’ perquisite consumption represents a chronic governance issue for museums, because the private benefits of control enjoyed by museum directors can be large. Some museum directors live rent-free on the premises, which are often located in the most desirable districts of cities, and international travel for research or consultation with the staff of other museums occurs frequently. The work environment for managers of museums is sublime, with careful climate control, high security, great attention to order and cleanliness, and, of course, exquisite decor. Curators also exercise power as social gatekeepers for rich donors, who seek entry to an elite network that receives invitations to private museum receptions, gallery openings, and fundraising luncheons. Fama and Jensen’s (1983) landmark work on organizational design recognizes the 8 inherent risk of agency problems in non-profit enterprises, since unlike other organizations, nonprofits have no residual claimants who would have incentives to monitor the professional staff. As predicted by Fama and Jensen, museum governance is overseen by independent boards of directors that are typically comprised exclusively of outsiders, many of them current or prospective donors. However, most museum boards are too oversized to operate effectively (Aggarwal, Evans, and Nanda, 2012), with a mean of 32.6 directors in my sample. Therefore, they tend to play ceremonial roles with considerable free-riding. Actual monitoring responsibility, to the extent it is exercised at all, is generally delegated to various subcommittees such as an executive committee or an audit committee. Until recently, the lack of public disclosure about the composition and qualification of non-profit boards limited the scope of academic research into their effectiveness. Capitalizing on new data provided by a major 2008 disclosure reform, Newton (2015) uses 16 variables to create a governance index for non-profits, finding that better governed organizations succeed in constraining the compensation and benefits of managers, leading to better operating performance. The leading prior paper studying art museum governance is Oster and Goetzmann (2003), which examines variables such as the date of a museum’s founding and whether its ownership structure is government, private, or academic. The authors find that a museum’s choice of mission depends on its ownership structure, among other variables. Donor restrictions, the focus of this study, represent a channel of governance that has received relatively little attention in academic studies. In the finance literature, Mensah and Werner (2003) study a sample of universities and find that cost efficiency declines when more of the organization’s net assets are unrestricted. Li, McDowell, and Hu (2012) find that an 9 organization’s intake of new donations increases when it permits donors to place restrictions upon the use of their gifts. In accounting research, Yetman and Yetman (2012) and Ling and Roberts (2014) have found improvements in the quality of financial reporting when a larger fraction of an organization’s reserves are restricted, suggesting that major donors act as effective monitors and demand better disclosure. Wolk (2014) is the most ambitious study of donor restrictions to date, using a large panel dataset of thousands of United Kingdom charities between 2007-2011. In a wide-ranging investigation, the author finds that donor restrictions appear to hurt the profitability of low-performing charities but have the opposite effect on well-performing ones. The results of Wolk’s research are not directly comparable to the investigation of art museums that I undertake in this paper, partly because the presentation of data differs in significant ways for U.S. and U.K. non-profits, and also because the typical charity in his allindustry sample is much smaller (less than £1 million in assets) and has vastly more unrestricted funds (a median of 91.7 percent) than the 129 top-shelf art museums in my sample, for which the median values are $47 million of total assets and 52.0 percent of unrestricted funds. III. Sample Selection and Data Description The sample for this paper is drawn from the 242 museums that belong to the Association of Art Museum Directors (AAMD), an organization founded in 1916 to establish professional standards and advocate for the interests of the museum industry in the United States. Virtually every culturally significant fine arts institution in the U.S. belongs to the AAMD, including a handful that do not have permanent collections because they operate as fine arts academies or host only traveling exhibitions. I exclude these non-collecting institutions and also drop 10 museums that are owned by or affiliated with universities, and museums that are entities of federal, state, or municipal government. For many of these excluded museums, separate financial disclosures are not available, and for all of them the issues of financial risk are fundamentally different than those faced by the independent museums that I analyze below. These exclusions narrow the sample to 136 museums, and I must exclude a further seven because they are legally organized as private foundations rather than public charitable trusts. 7 Private foundations file an abbreviated Form 990-PF rather than the more complete Form 990 with the U.S. Internal Revenue Service, so that the financial data required for the analysis below is generally not available for them. I obtain a final sample of 129 museums, including nearly every well-known independent museum in the U.S. such as the Metropolitan Museum of Art in New York, the Museum of Fine Arts in Boston, the Art Institute of Chicago, and so forth. I use the database of Guidestar.org to obtain Form 990 financial data for the 129 museums in the sample, and for most institutions I have 14 annual observations for the period 1999-2013 and up to 1,789 museum-year observations for the sample overall. Missing values in the dataset are typically caused when museums do not complete all the required fields in the Form 990. Table 1 presents summary statistics for basic financial information for the museums in the sample. The data indicate that museums are largely financed by donations, which I define as the sum of charitable contributions plus government grants. The mean value of donations per museum-year is about four times larger than the mean value of program service revenue, which is 7 Unfortunately the small group of excluded private foundation museums includes two of the best capitalized, the Getty Museum in Los Angeles, CA, and the Crystal Bridges Museum of American Art in Bentonville, AR. 11 comprised of admission charges, memberships, and related fees paid by the customers of a museum. The disparity between contributions and user fee income would be much greater if the value of donations of artwork were included, but under accounting rules such gifts typically do not appear on museums’ financial statements due to the difficulty of determining their fair market value. In addition, the relationship between donations and program service revenue is completely different for art museums compared to the overall U.S. non-profit sector. Aggregate statistics indicate that 73% of all non-profit revenue came from program services in 2012, with 21% obtained from donations, almost the mirror image of the composition of revenue for art museums.8 Data in Table 1 also suggest the difficulty faced by museums in balancing their budgets, as the mean value of total expenses exceeds the sum total of the mean values of revenue from donations and program services. The difference must be made up from investment income and drawing down financial reserves. The asset base of museums as shown on their balance sheets is comprised mostly of financial investments, which are usually held in endowment funds. Almost half of the assets of a museum are restricted by donors, in the sub categories of temporarily restricted (21% of total assets, on average) and permanently restricted (26% of total assets, on average). The distinction between the two categories arises over whether a donor’s condition is perpetual or expires after a finite period. During the 1999-2013 sample period, museums appear to have embarked on a borrowing and building spree. The average leverage of a museum in the sample, calculated as total liabilities over total assets, rose during this period from about 8% to 15% of total assets, while 8 See http://nccs.urban.org/statistics/quickfacts.cfm. 12 fixed assets as a fraction of total assets rose by about a third, from 24% to 32%. During this time the number of museums with tax-exempt bonds outstanding to public investors increased from 13 to 36. Figure 1 provides insight into the time trend of museums’ capital structures during the sample period. The figure shows the aggregate capital invested in the 129 museums in the sample, with the sum of each category divided by the sum of total assets for the industry as a whole. In addition to the steady increase in debt finance, the amount of permanently restricted and temporarily restricted assets has grown as well, increasing far faster than unrestricted assets. Unrestricted assets available to management have declined by about one-third, from about 45% of capital in 1999 to about 30% in 2013. If restricted assets are considered a form of pseudodebt, since they cannot be used for general obligations of the organization, then museums are extremely leveraged. Issuing risky debt makes museums’ art collections vulnerable to foreclosure in the event that the organization cannot make its payments and defaults, although placing the art into a trust fund protected from creditors can circumvent this risk. In my sample, only four museums out of 129 appear to have taken this step, based on disclosures in their loan documents, and only one of these four currently has bonds outstanding.9 In six cases, museum collections appear to be at risk to the finances of their host city, as the municipality retains title to all or part of the collection, which could potentially be seized by city creditors in the event of a bankruptcy filing such as Detroit’s. 9 A number of museums appear to rely implicitly for protection from creditors upon the concept of a cultural trust, which asserts that creditors cannot seize assets that are held for the benefit of the public. See Tam (2012). This position was taken by the attorney general of the state of Michigan during the bankruptcy of Detroit. The U.S. bankruptcy judge did not appear to agree with this doctrine, as he oversaw a negotiated settlement in which donors to the Detroit Institute of Arts and the museum itself agreed to pay hundreds of millions of dollars to the city’s creditors in order to remove any encumbrance upon the museum’s collections. 13 Perhaps the most surprising omission in museums’ risk management policies is the nearuniversal choice not to insure their collections against theft or casualty loss. The total spent on insurance for all the museums in the sample in 2012 was just $33.2 million, far less than the cost of one top-shelf painting in today’s art auction market. According to a recent report by a national magazine, the worldwide market for fine art insurance is somewhere between $500 million and $1 billion in premiums per year, meaning that “there’s a lot of uninsured art out there.” 10 A number of recent famous art thefts, such as the 1990 heist of a Rembrandt and other pieces from the Isabella Stewart Gardner Museum in Boston, MA, have been followed by revelations that the pieces were not insured. Nicita and Rizzolli (2009) argue that the failure of museums to carry insurance represents a strategic decision, rather than an example of reckless risk management. According to their argument, the availability of insurance could tempt art thieves into stealing paintings to extract ransom from the insurer, so that not carrying insurance represents a commitment device whereby museums credibly pledge not to negotiate with thieves. A similar argument by these authors rationalizes the light security in place at most museums not as a costsaving strategy, but rather as an attempt to avoid calling attention to the value of the art. Table 2 presents data about the growth rate and riskiness of various museum revenue streams during my sample period. While overall museum revenue rose at a modest rate of 2.0% per year, the striking data appear in the third column, which shows the standard deviation of the annual growth rates in each sub-category of revenue. With the exception of endowment investment returns, each of the four major revenue streams of program services, donations, government grants, and other revenue are subject to large year-to-year swings in growth rates, 10 See http://www.forbes.com/sites/kathryntully/2012/10/31/should-your-art-be-insured/. 14 much larger than the estimates for arts organizations reported by Blanchett (2014). For example, the standard deviation of the growth rate in donations is about 70% per year, so that a museum’s use of its brand as the basis of a fundraising franchise yields returns that are about two to three times more volatile than a typical publicly traded stock. A correlation matrix on the right side of Table 2 shows that these revenue streams exhibit almost zero association with one another, suggesting that museums must compartmentalize the management of fundraising, exhibits, grant writing, and ancillary business units and hope that not all of them go bad at the same time. Museums’ vulnerability to financial and other risks may occur as a strategic choice or as a consequence of market incompleteness. For instance, the market for art insurance may be too small or prohibitively expensive for museums to cover their masterpieces. Or museums may self-insure because they have an overabundance of art, far too much to display, so that if a work is damaged or stolen, it can be replaced with one held in inventory. Museums may wish to seem vulnerable in order to attract benefactors or to position themselves for government bailouts or subsidies. These hypotheses seem intriguing, but data necessary to test them is not readily available. IV Analysis This section analyzes the impact of donor restrictions upon museums’ financial policies and performance. I begin by examining when museums contribute to and withdraw funds from their endowments in regression analysis shown in the first three columns of Table 3. For non-profit corporations, endowment funds provide a form of risk reduction since they contain reserves that can cover the organization’s debts. If the endowment is large enough, it can 15 provide an income stream enabling the organization to rely less on user fees and donations. While a fairly large literature such as Lerner, Schoar, and Wang (2008) has studied the investment performance and asset allocation of endowment funds, far fewer papers have examined the conditions under which non-profits add to or withdraw capital from them. Most of the literature on this topic, such as Brown, Dimmock, Kang, and Weisbenner (2012) and Cejnek, Franz, Randall and Stoughton (2013), uses self-reported survey data,11 and to my knowledge this paper is the first to analyze organizations’ disclosures of annual endowment inflows and outflows as reported in Schedule D, Part V of Form 990. Out of the 129 museums in the sample, 120 report endowment data on this section of the form, most of them beginning in the year 2008 when these disclosures were first required. Descriptive statistics about endowment sizes, contributions, distribution rates, and investment returns appear in the lower half of Table 1. The first three columns of Table 3 show the incremental effect upon endowment contributions and withdrawals of increases in different sources of cash, in a framework analogous to the “cash flow sensitivity of cash” studied by Almeida, Campello and Weisbach (2004). The analysis takes advantage of the financial reporting rules that require non-profits to disaggregate their revenue streams into programming, gifts, grants, and ancillary sources, a decomposition that provides insight that is generally not available when analyzing the net sales revenue of publicly traded firms. The table presents estimates from least squares regressions with the dollar value of endowment contributions as the dependent variable in the first column, 11 Nearly all prior endowment research uses survey data from the higher education industry compiled by the National Association of College and University Business Officers (NACUBO). While the completeness of this data has improved over time, it has been subject to survey self-selection effects, changing variable definitions, and a reliance on self-reporting by those universities that cooperate. A comprehensive evaluation of the NACUBO data’s quality appears in Brown, Garlappi, and Tiu (2010). 16 the dollar value of endowment withdrawals as the dependent variable in the second column, and the net of contributions minus withdrawals in the third column. The main explanatory variables are the dollar value of cash donations received, the operating surplus of program service revenue less program service expense, the dollar value of earnings within the endowment itself, the dollar value of new debt issued in the form of loans, notes, or bonds, the dollar value of government grants received, and the dollar value of cash on the balance sheet at the start of the fiscal year. All models include fixed effects for museums and for individual fiscal years, since the market investment climate will obviously affect decisions about how to manage the endowment. The most striking result in Table 3 appears in the top left cell, which shows that for each dollar in gifts received, 45 cents is typically added to a museum’s endowment. This is an extremely large savings rate, and it appears even more surprising when compared to the coefficient on operating profits in the cell immediately below. That estimate is virtually zero, implying that museums save almost half of their donations but none of their profits. Since money is fungible, it is not clear why these coefficients should differ so markedly, if at all, and it seems likely that the explanation comes from donor restrictions forcing museums to save gifts and spend them gradually over time. A related alternative explanation is that many gifts are solicited for the express purpose of building an organization’s endowment fund. Unfortunately little research exists into the frequency, scale, and use of proceeds of non-profit firms’ capital campaigns, which appear to play a role quite similar to rights issues by public corporations. The first column of Table 3 also shows a strongly negative relation between new grant income received and endowment contributions. Intuitively, an increase in cash from grants should free up other resources and perhaps cause an increase in endowment contributions. The 17 negative association likely occurs because government grants often require organizations to raise or provide a matching amount of money to support the project being funded. I do not find a significant association between new debt issues and increases in endowment funds. This provides evidence against the hypothesis of “endowment arbitrage,” which conjectures that wealthy non-profits issue debt at low interest rates, often due to income tax subsidies for the lenders, and then invest the proceeds to earn a higher return in the stock market via their endowments. See Congressional Budget Office (2010) for a study of this endowment arbitrage pattern in the higher education industry. The second column of Table 3, studying endowment withdrawals, contains one notable result, a negative estimate of -0.13 for the variable measuring operating profits. The estimate implies that when a deficit occurs in museum operations, only a fraction is covered by funds taken from the endowment. The third column of the table consolidates the results shown in the first two columns and shows the impact of different changes in cash upon the net inflow of funds to or from an endowment. In principle, the coefficients on the six variables should not vary greatly from one another due to the fungibility of cash, but the analysis confirms the result that museums save a very large proportion of their gifts, a modest (though insignificant) fraction of their operating surpluses, and reduce the endowment to support projects that are funded by government grants. The coefficient on the donations variable is far larger than any of the other effects, suggesting the large influence of donor governance. I find little evidence in Table 3 that the performance of the endowment fund itself affects additions by or distributions to the organization. Estimates for the variable measuring annual 18 endowment performance are virtually zero and not significant, except for a marginal result of small magnitude in the first column. These findings are not consistent with Brown et al. (2012), who find that university endowments reduce payout rates following negative investment shocks, but do not raise them following positive shocks, consistent with a hoarding or accumulation management strategy. In the right two columns of Table 3, I study the impact of various sources of cash flow upon museums’ cash balances and their investments in fixed assets, akin to property, plant and equipment. Estimates in the top row indicate that about 14 cents of every dollar donated is held on the balance sheet as cash, while 11 cents per dollar of donations is spent on increasing the size of the museum facility. Strikingly, when museums earn operating profits, about 50 cents per dollar is spent on new bricks-and-mortar expansions of the museum. Table 4 investigates the impact of donor restrictions upon the investment performance of museums’ endowments. The main hypothesis is that restrictions reduce the expected investment return, since assets earmarked for a specific use might be invested either in cash or risk-free bonds. The first column of the table provides a benchmark, showing the results from a standard Fama-French four factor model in which the annual endowment return is regressed against the excess return on the stock market as well as the factors for growth stocks, small stocks, and momentum. Standard errors are clustered by museum within the sample of 490 annual observations. The key estimate in the table is the coefficient of 0.52 on the market return, a relatively low value suggesting that museum endowments are conservatively managed with close to half of their assets earning the risk-free rate. I introduce the Mei-Moses art index as an additional risk factor in the middle column. 19 Based on the research methods described in Mei and Moses (2002), this index uses auction data to track the semi-annual performance of the art market as an alternative investment asset class. For the minority of museums whose reporting periods do not end in June or December, I take a weighted average of the returns on the Mei-Moses index during the months contained in each fiscal year. According to Merton’s (1993) theory paper on endowment management, an organization should invest its endowment in assets whose returns are uncorrelated or negatively correlated with changes in the values of the organization’s own assets. An alternative hypothesis cuts in the other direction: if endowment assets are held partly to finance future purchases of fine art, one might over-weight the portfolio with securities that exhibit a positive correlation, rather than a negative one, with the market values of art on the open market. Testing whether endowment funds are used to hedge the value of an organization’s other assets is difficult for most non-profits given the breadth of their asset bases, 12 but art museums are an exception, since most of their wealth is held in fine art, and the appreciation of the art should track indexes of art market investment returns. I find inconclusive evidence that any such hedging occurs in museum endowments. When the Mei-Moses index is included as an additional risk factor in the Fama-French model, it has an estimate of virtually zero, as shown in the second column of Table 4. This indicates that the art market has no explanatory power for the investment returns earned by art museums in their endowment funds; museums do not invest in stocks that are correlated with art returns. This conclusion is basically unchanged if I drop the stock market return from the model in the second column and use only the Mei-Moses index 12 The closest paper to running such a test appears to be Dimmock (2012), which establishes that the standard deviation of endowment returns for a sample of universities is inverse to the standard deviation of the non-investment revenue streams, so that the most stable universities tend to have the riskiest endowment investment policies and vice versa. 20 instead; in that model, the index has an insignificant estimate of +0.04. The third column of Table 4 tests whether endowment returns are lower due to more conservative asset allocation by those museums that have high amounts of restricted assets. I multiply the stock market index by the ratio of restricted assets over net assets; this quotient represents the fraction of a museum’s assets, excluding those financed by debt, that are encumbered by donor restrictions. My hypothesis is that this interaction term should have a negative sign, reducing the overall portfolio association with the stock market, if restricted assets are invested conservatively. However, as shown by the positive and significant estimate of +0.036, this hypothesis is not supported by the data. While it continues to appear that museums manage their endowments conservatively, this conclusion does not strengthen based upon the presence of donor restrictions. I study the impact of donor restrictions upon museums’ operations in Tables 5 and 6. The first analysis in Table 5 uses regression analysis in a panel data setting to study three dependent variables: the ratios of administrative expenses over total expenses, program service expenses over total expenses, and fundraising expenses over total expenses. Independent variables include the ratios of temporarily restricted assets over total assets and permanently restricted assets over total assets. Other control variables include the size of the museum, measured as the log of program service revenue, fixed asset intensity, leverage, and fixed effects for individual museums and fiscal year periods. Estimates for the coefficient of permanently restricted assets indicate that donor restrictions impart large and significant impact upon museums’ cost structures. Estimates for this variable in the first two columns indicate a shift of the cost structure, taking resources out of 21 administration and placing them into programming when donor restrictions are high. The interpretation is that these museums spend less on administrative overhead and more on exhibitions and other programming directly in line with their missions, surely a goal that most donors would share. The costs of managerial compensation and various private benefits, while not transparently shown in the financial statements, would appear in various sub-categories of administration, so donor restrictions appear to be successful in reducing curators’ private benefits of control. For the variable measuring temporarily restricted asset intensity, the two models have coefficient estimates with the expected signs, but they are smaller in magnitude compared to those for permanently restricted assets and are not statistically significant. The results reported in Table 5 are probably the most important in this study, although they would also be consistent with an alternative hypothesis that firms manipulate their financial accounting by reclassifying expenses from one category to another when donors impose spending restrictions. Even if the results occur as a result of the more benign hypothesis, that donor governance imposes a strong influence upon museums’ spending priorities, they do not illuminate whether donor restrictions improve the overall efficiency of a museum. I study that question in Table 6, where I look at the level and volatility of a museum’s profitability in regression analysis identical to that used in Table 5. The first two columns of Table 6 have measures of return on assets as the dependent variables. In the first column, the “museum ROA” variable equals all non-investment revenue, minus non-investment expense, divided by the book value of assets that are not listed as investment securities or other investments. In the second column, the “investment ROA” equals the net change in investment assets during the year divided by investment securities plus other investments at the start of the year. In the third and 22 fourth columns, I use the squared values of these two variables as the dependent variables, in order to study whether the riskiness of an organization’s performance has a significant relation to donor governance via restricted gifts. As in Table 5, the permanently restricted gift ratio has a strong and significant estimate in all four columns of Table 6, while the temporarily restricted gift ratio has insignificant and generally smaller estimates. Firms with fractions of permanently restricted assets exhibit lower operating performance, though the result is not statistically significant, and sharply, significantly lower investment performance. This result is inconsistent with the findings in the right column of Table 4, but the analysis in that table was based only on assets designated as part of museum endowments. Some restricted assets may be held outside the endowment portfolio, in the form of cash or time deposits that the organization treats as an investment for reporting purposes. If these accounts earned little or no interest it would be consistent with the finding of lower investment returns in Table 6. Finally, estimates in the right two columns indicate that museums exhibit significantly less volatile operating and financial returns when their restricted gift ratios are high. This seems to be an important result, given the risk management problems of many museums that are documented above. In addition to affecting museums’ cost structures, donor restrictions appear to push museums toward more financial stability, albeit at a cost of less flexibility that may undermine profitability. V. Conclusions This paper studies the role of donor governance, which takes the form of restrictions 23 placed upon charitable gifts to non-profit corporations. For an organization, receiving a donation with strings attached is analogous to an increase in permanent equity capital with restrictive covenants that are more commonly associated with debt capital. Evidence from a panel data set of leading U.S. art museums indicates that when donors place restrictions upon the use of new capital, these constraints appear to reduce agency problems by shifting the museum’s spending away from administration and into programming. This redistribution of costs might reduce agency costs by limiting perquisite consumption and asset substitution, among other problems. I find that museums have less variable performance when they receive large amounts of permanently restricted gifts, and this result seems closely associated with an additional finding, that a large fraction of incoming gifts are placed into museums’ endowments. However, these financial benefits come at the cost of reduced operating flexibility, and as a result museums’ profit margins are lower when restricted gifts are sizeable. Donor governance represents an important channel through which the financial backers of nonprofit firms influence the behavior of management, but we know relatively little about its details. For instance, what types of restrictions are used in practice? What is their typical duration? How successfully do managers limit or contract around them? Does any competition among potential contributors enable the firm to raise donations with reduced restrictions, just as firms sometimes succeed in issuing “covenant lite” debt? Future research into these and other questions has the potential to illuminate our understanding of what may be the most significant source of capital for the non-profit sector. 24 References Aggarwal, Rajesh K., Mark E. Evans, and Dhananjay Nanda, 2012, “Nonprofit boards: Size, performance, and managerial incentives,” Journal of Accounting and Economics 53, 466-487. Almeida, Heitor, Murillo Campello, and Michael S. Weisbach, 2004, “The cash flow sensitivity of cash,” Journal of Finance 59, 1777-1804. Blanchett, David, 2014, “Donation risk and optimal endowment portfolio allocations,” Journal of Portfolio Management 41:1, 109-120. Brown, Jeffrey, Stephen G. Dimmock, Jun-Koo Kang, and Scott Weisbenner, 2012, “How university endowments respond to financial market shocks: Evidence and implications,” American Economic Review 104, 931-962. Brown, Keith C., Lorenzo Garlappi, and Cristian Tiu, 2010, “Asset allocation and portfolio performance: Evidence from university endowment funds,” Journal of Financial Markets 13, 268-294. Cejnek, Georg, Richard Franz, Otto Randl, and Neal Stoughton, 2013, “A survey of university endowment management research,” working paper, available at ssrn.com/abstract=2205207. Congressional Budget Office, 2010, “Tax arbitrage by colleges and universities,” available at http://www.cbo.gov/sites/default/files/04-30-taxarbitrage.pdf. Dimmock, Stephen G., 2012, “Background risk and university endowment funds,” Review of Economics and Statistics 94, 789-799. Eldenburg, Leslie, Benjamin E. Hermalin, Michael S. Weisbach, and Marta Wosinska, 2004, “Governance, performance objectives and organizational form: Evidence from hospitals,” Journal of Corporate Finance 10, 527-548. Fama, Eugene F., and Michael C. Jensen, 1983, “Separation of ownership and control,” Journal of Law and Economics 26, 301-325. Feld, Alan L., Michael O’Hare, and J. Mark Davidson Schuster, 1983, Patrons Despite Themselves: Taxpayers and Arts Policy (New York University Press). Frey, Bruno, and Stephan Meier, 2006, “The economics of museums” in Victor A. Ginsburg and David Throsby eds., Handbook of the Economics of Art and Culture (Elsevier), 1017-1047. Gross, Michael, 2009, Rogues’ Gallery (New York: Broadway Books). Hallock, Kevin F., 2002, “Managerial pay and governance in American nonprofits,” Industrial 25 Relations 41, 377-406. Lerner, Josh, Antoinette Schoar, and Jialan Wang, 2008, “Secrets of the academy: The drivers of university endowment success,” Journal of Economic Perspectives 22, 207-222. Li, Wei, Evelyn McDowell, and Michael Hu, 2012, “Effects of financial efficiency and choice to restrict contributions on individual donations,” Accounting Horizons 26, 111-123. Ling, Qianhua, and Andrea Alston Roberts, 2014, “The effect of governance on nonprofit reporting quality when misreporting is subtle,” unpublished manuscript, available at ssrn.com/abstract=2425980. Lotkin, Lisa, 1999, “Protecting the charitable investor: A rationale for donor enforcement of restricted gifts,” Boston University Public Interest Law Journal 8, 361-386. Mei, Jianping, and Michael Moses, 2002, “Art as an investment and the underperformance of masterpieces,” American Economic Review 92, 1656-1668. Mensah, Yaw M., and Robert Werner, 2003, “Cost efficiency and financial flexibility in institutions of higher education,” Journal of Accounting and Public Policy 22, 293-323. Merton, Robert C., 1993, “Optimal investment strategies for university endowment funds” in Charles T. Clotfelter and Michael Rotschild eds., Studies of Supply and Demand in Higher Education (University of Chicago Press). Newton, Ashley N., 2015, “Executive compensation, organizational performance, and governance quality in the absence of owners,” Journal of Corporate Finance 30, 195-222. Nicita, Antonio, and Matteo Rizzolli, 2009, “The economics of art thefts: Too much screaming over Munch’s The Scream?” Economic Papers 28, 291-303. O’Hare, Michael, 2015, “Museums can change - will they?” Democracy: A Journal of Ideas 36. Oster, Sharon, and William N. Goetzmann, 2003, “Does governance matter? The case of art museums” in Edward L. Glaeser ed., The Governance of Not-for-Profit Organizations (University of Chicago Press), 71-99. Skinner, Sarah J., Robert B. Ekelund Jr., and John D. Jackson, 2009, “Art museum attendance, public funding, and the business cycle,” American Journal of Economics and Sociology 68, 491516. Smolensky, Eugene, 1986, “Municipal financing of the U.S. fine arts museum: A historical rationale,” Journal of Economic History 46, 757-768. 26 Tam, Sara, 2012, “In museums we trust: Analyzing the mission of museums, deaccessioning policies, and the public trust,” Fordham Urban Law Journal 39, 849-901. Temin, Peter, 1991, “An economic history of American art museums” in Martin Feldstein ed., The Economics of Art Museums (University of Chicago Press), 179-194. Wolk, Leonard, 2014, “Authority and delegation in charities: Evidence from the United Kingdom,” unpublished manuscript, Colby College. Yetman, Michelle H., and Robert J. Yetman, 2012, “Do donors discount low-quality accounting information?” Accounting Review 88, 1041-1067. 27 Table 1 Descriptive statistics The table shows descriptive statistics for financial data for a sample of 129 U.S. art museums between 1999 and 2013. The lower part of the table shows data for a subsample of 120 museums for which endowment data is available between 2008 and 2013. Leverage equals total liabilities over total assets. Days payables is calculated based on program service expense. The endowment spending rate equals distributions divided by the value of the endowment at the start of the year. The endowment investment return equals endowment earnings divided by the sum of the value of the endowment at the start of the year plus one-half the value of endowment additions during the year. All dollar values are in millions. All balance sheet data is recorded at the start of the year. Data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. Variable Total assets Leverage Days payables Program service revenue Cash donations + Government grants Program service expense Total expense Cash and equivalents / total assets Temporarily restricted assets / total assets Permanently restricted assets / total assets Fixed assets / total assets Endowment assets Endowment additions Endowment spending Endowment spending rate Endowment investment return Obs. 1,769 1,763 1,765 1,764 1,762 1,768 1,789 1,763 1,763 1,763 1,758 Mean 149.1 0.13 64 3.6 14.5 15.2 19.6 0.091 0.210 0.260 0.269 Median 47.0 0.06 44 0.7 5.3 4.4 6.8 0.043 0.144 0.236 0.239 Std.Dev. 331.6 0.18 70 12.5 28.2 34.2 40.5 0.140 0.204 0.221 0.214 Min. 0 0 0 0 0 0 0 -0.024 0 0 0 Max. 3,552.2 1.89 990 214.4 518.8 404.2 462.6 0.932 1.532 0.935 0.996 491 491 491 490 491 102.5 3.1 5.8 5.8% 3.1% 27.7 0.4 1.5 4.7% 2.0% 237.8 9.1 15.5 11.1% 13.1% 0.2 -2.5 -3.4 -10.0% -33.3% 2,313.1 133.8 153.9 189.5% 55.0% 28 Table 2 Growth, volatility, and correlation of museums’ revenue sources The table shows the annual growth rates, standard deviations of the growth rates, and correlations among different museum revenue sources. Program service revenue includes admission charges, memberships, and related costs. Other museum revenue includes parking, restaurants, and gift shops. The growth rate for endowment investment income equals the annual investment return on the endowment fund. All growth rates are compounded continuously to reduce the importance of outliers. The sample includes 1,789 annual observations for 129 museums. Data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. Correlation with Obs. Mean growth rate Standard deviation Program service revenue Other museum revenue Cash donations Government grants Program service revenue Other museum revenue Cash donations Government grants Endowment investment income 1,561 1,355 1,610 1,309 491 4.7% - 8.5% 3.4% 1.8% 2.3% 52.0% 104.3% 70.0% 99.0% 13.6% 0.01 -0.02 -0.03 -0.13 -0.01 0.03 0.32 0.01 0.07 0.02 Total revenue 1,596 2.0% 61.4% 29 Table 3 Additions and withdrawals from art museum endowments The table shows fixed effects regression estimates of the amounts of cash contributed to and removed from art museum endowments, as a function of six potential sources of cash for the museum. The operating surplus equals program service revenue minus program service expenses. New debt issued equals the year-over-year difference in bonds, loans, and notes outstanding. Government grants received equals cash from newly awarded grants minus changes in grants receivable. The analysis includes 490 observations for 120 museums during the 2008-12 period. Data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. 30 Dependent variable: Endowment additions Endowment distributions Net additions to endowment Change in cash balance Change in fixed assets Cash donations 0.45 *** (0.03) -0.01 (0.02) 0.46 *** (0.04) 0.14 *** (0.02) 0.11 *** (0.03) Operating surplus - 0.001 (0.07) - 0.13 *** (0.04) 0.14 (0.08) 0.10 ** (0.04) 0.50 *** (0.08) Endowment earnings - 0.01 * (0.006) 0.001 (0.004) 0.01 (0.01) -0.003 (0.004) -0.03 *** (0.01) Net change in long-term debt - 0.02 (0.03) - 0.04 *** (0.02) 0.02 (0.03) 0.15 *** (0.02) 0.15 *** (0.03) Government grants received - 0.23 *** (0.03) 0.01 (0.02) - 0.24 *** (0.04) 0.01 (0.02) 0.17 *** (0.04) 0.03 (0.04) 0.06 ** (0.03) - 0.03 (0.05) -0.67 *** (0.03) 0.50 *** (0.05) 490 Yes Yes 0.72 490 Yes Yes 0.97 490 Yes Yes 0.85 490 Yes Yes 0.78 490 Yes Yes 0.69 Cash on balance sheet, start of year Museum-year observations Museum fixed effects Fiscal year fixed effects R2 Standard errors appear in parentheses. Significant at 1% (***), 5% (**) and 10% (*) levels. 31 Table 4 Investment performance of art museum endowment funds The table shows Fama-French four-factor estimates of the annual performance of art museum endowment funds for a panel of 120 museums during the 2008-2012 period. Standard errors clustered at the firm level appear in parentheses below each coefficient estimate. The Mei-Moses (2002) index reflects changes in the market value of fine art as measured semi-annually in the private auction market. Endowment data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. Stock market data are obtained from Prof. Kenenth French’s website, and value for the Mei-Moses index were kindly provided by Profs. Jianping Mei and Michael Moses. Dependent variable: Endowment return Endowment return Endowment return Intercept - 0.007 ** (0.003) - 0.007* (0.004) - 0.007 * (0.004) Market excess return 0.520 *** (0.030) 0.520 *** (0.030) 0.503 *** (0.030) 0.036 * (0.019) Market excess return x (Restricted assets / net assets) Mei-Moses index 0.002 (0.024) 0.001 (0.024) Small - large excess return 0.092 * (0.046) 0.093 * (0.047) 0.096 ** (0.047) High - low excess return 0.044 (0.036) 0.042 (0.038) 0.041 (0.038) Up - down excess return 0.128 *** (0.037) 0.122 ** (0.060) 0.119 ** (0.060) 490 0.76 490 0.76 490 0.76 Museum-year observations R2 Standard errors appear in parentheses. Significant at 1% (***), 5% (**) and 10% (*) levels. 32 Table 5 Impact of asset restrictions on cost components The table shows fixed effects regression estimates of the cost structure of art museums as a function of asset composition and size. The sample includes 129 private U.S. art museums between 1999-2013. Data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. Dependent variable: Administration / total exp. Program services / total exp. Fundraising / total exp. Temporarily restricted assets / total assets - 0.026 (0.017) 0.009 (0.018) 0.005 *** (0.002) Permanently restricted assets / total assets - 0.091 *** (0.021) 0.085 *** (0.022) - 0.001 (0.002) Museum size (log of program service revenue) - 0.012 *** (0.004) 0.018 *** (0.004) - 0.0007 * (0.0004) Fixed assets / total assets - 0.015 (0.018) 0.047 ** (0.019) 0.005 *** (0.002) Leverage -0.003 (0.020) -0.001 (0.021) -0.001 (0.002) 1,705 Yes Yes 0.51 1,705 Yes Yes 0.56 1,705 Yes Yes 0.20 Museum-year observations Museum fixed effects Fiscal year fixed effects R2 Standard errors appear in parentheses. Significant at 1% (***), 5% (**) and 10% (*) levels. 33 Table 6 Impact of asset restrictions on profitability and risk The table shows fixed effects regression estimates of the profitability of art museums as a function of asset composition and size. The sample includes 129 private U.S. art museums between 1999-2013. The museum return on assets (ROA) equals all non-investing revenue, minus all non-investing expenses, divided by non-investment assets. The investing ROA equals the net increase in investment assets divided by the sum of investment securities plus other investments. Both ROA variables are compounded continuously to reduce the importance of extreme values. Data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. Return measures Risk measures Dependent variable: Museum ROA Investing ROA Museum ROA squared Investing ROA squared Temporarily restricted assets / total assets 0.121 (0.084) 0.013 (0.148) - 0.295 (0.286) - 2.653 (1.596) Permanently restricted assets / total assets - 0.121 (0.105) - 0.500 *** (0.171) - 0.877 ** (0.360) - 12.309 *** (1.834) Museum size (log of program service revenue) - 0.012 (0.019) - 0.114 *** (0.031) - 0.048 (0.066) - 0.745 ** (0.337) - 0.307 *** (0.089) 0.504 *** (0.156) - 1.032 *** (0.303) 2.663 (1.677) 0.024 (0.098) -0.076 (0.187) -0.462 (0.332) -2.250 (2.007) 1,657 Yes Yes 0.29 1,504 Yes Yes 0.49 1,657 Yes Yes 0.21 1,504 Yes Yes 0.22 Fixed assets / total assets Leverage Museum-year observations Museum fixed effects Fiscal year fixed effects R2 Standard errors appear in parentheses. Significant at 1% (***), 5% (**) and 10% (*) levels. 34 100% 90% Percent of invested capital 80% 70% Unrestricted Temporarily restricted Permanently restricted Liabilities 60% 50% 40% 30% 20% 10% 0% 1999 2001 2000 2003 2002 2005 2004 2007 2006 2009 2008 2011 2010 2013 2012 Figure 1 Total capital invested in the art museum industry, by type The figure shows the aggregate amount of capital invested in the 129 museums in the sample for each year between 1999 and 2013. The data are displayed in four categories that sum up to 100% of the total assets of the museums. Data are obtained from museums’ U.S. Internal Revenue Service Form 990 filings. 35