The Causal Effects of Credit Supply on Housing Prices Aurel Hizmo

advertisement

The Causal Effects of Credit Supply on Housing Prices

Aurel Hizmo

Edward Kung

September 2, 2013

Abstract

We quantify the separate causal effects of changes in interest rates and changes in

underwriting standards on house prices. The first contribution is to construct a new

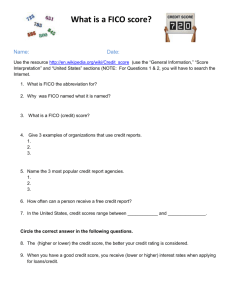

direct measure of underwriting standards based on the maximum DTI ratio a borrower

could obtain conditional on his/her FICO score and on market characteristics. We then

use the dissagregate nature of our underwriting standards measure to construct Bartikstyle instruments for changes in this measure and interest rates. Our IV estimates show

that a one percent change in the average maximum DTI that banks are willing to lend,

increases prices by 2.6%, while a one percent change in interest rates leads to a four

percent drop in house prices. These effects are stronger after the financial crisis and

are stronger in areas where housing supply is less elastic.

1

Introduction

In the wake of the financial and housing crisis of 2008, there has been a push to better understand the role of credit markets in determining house prices. Traditionally, policymakers

have focused most on the role of interest rates. The mechanism that leads from interest rates

to house prices is clear: lower interest rates lead to lower borrowing costs on mortgages and

hence higher demand, ceteris paribus, for owner-occupied housing. Recently, more attention

is also being drawn to the role of underwriting standards (for example, the down payment

required for approval of a loan). The ease or tightness of underwriting standards determines

the degree to which a prospective buyer may leverage the purchase of their home. To the

extent that there are buyers whose access to credit is rationed in equilibrium, a loosening of

underwriting standards would increase the demand for housing and translate to higher house

prices. Which dimension, interest rates or underwriting standards, has a greater marginal

effect on house prices is an empirical question. The answer will depend on the reason that

1

a marginal buyer has not bought a bigger home, or a marginal renter has decided not to

buy. Is it because borrowing costs are too high or is it because they could not get a loan of

the desired size? The goal of this research agenda is to empirically address these questions

in a rigorous and convincing way. It is a question of both academic and practical interest:

academic because it advances our understanding of the interactions between credit markets

and real markets, and practical because it informs policymakers of the relative strengths and

weaknesses of interest rates versus underwriting standards as policy variables. This point has

been emphasized by Geanakoplos (2003, 2010, 1997), who develops the theory of endogenous

collateral requirements and argues that leverage ratios play an especially important role in

times of price collapse and should be monitored closely by policymakers.

The current literature on the role of credit markets in housing has not been able to

satisfactorily address the relative role of interest rates versus underwriting standards. As

noted in Glaeser, Gottlieb, and Gyourko (2010), there are two main challenges to overcome in

order to understand the relative role of mortgage interest rates and underwriting standards.

The first is that there are few direct measures of underwriting standards that accurately

reflect a potential borrower’s true constraints. To understand this problem, consider three

potential measures of underwriting standards: the conforming loan limit, the observed loanto-value ratios of newly originated loans, or the approval rate of loan applications. The

conforming loan limit is problematic as a measure of collateral constraints because there is

little variation in it across time and space, and because for many individuals it does not

accurately reflect the menu of loans that are available to them; many borrowers willingly

take out loans greater than the conforming loan limit in exchange for a higher interest

rate. Observed loan-to-value ratios are problematic because at least a subset of buyers are

borrowing less than they could have, causing observed LTVs to understate true borrowing

limits. Finally, observed approval rates are problematic because the decision of what loan to

apply for is endogenous (potential borrowers are unlikely to apply for loans for which they

are likely to be rejected) and can overstate the true approval rate for any given combination

of borrower and loan characteristics.

The second challenge is the simultaneity between house prices and credit market conditions. Simultaneity arises due to the unique nature of housing as collateral for loans. House

prices, and in particular expectations of house price growth, are important determining factors of interest rates and underwriting standards. Interest rates and underwriting standards

in turn influence demand for housing which affects house prices and house price expectations.

Any study which seeks to estimate the effects of interest rates and underwriting standards

on house prices therefore needs a source of exogenous variation to credit market conditions.

Moreover, in order to separately disentangle the direct effect of interest rates versus the

2

direct effect of underwriting standards, one needs two sources of exogenous variation which

orthogonally impact interest rates and underwriting standards.

The current paper is the first one in the literature to tackle both of these challenges simultaneousy. To overcome the first challenge, we propose a definition of underwriting standards

based on the maximum debt-to-income ratio loan a borrower could obtain conditional on his

or her FICO score and conditional on market level variables such as interest rates and house

prices. The data we use to construct our measures come from the Freddie Mac Single Family

Loan-Level Dataset. This is a dataset that includes the universe of fully amortizing, 30-year

fixed rate single family mortgages purchased or guaranteed by Freddie Mac with origination

dates between 1999Q1 and 2011Q4.1 We construct our measure of underwriting standards

as the answer to an analogous question: “For a given level of credit score (FICO), what is

the highest level of debt-to-income ratio (DTI) that a borrower with that credit score can

obtain?” We shall therefore be thinking of the credit score as an input, the debt-to-income

ratio as an output, and the underwriting standards as the production function. The shape

of the maximum DTI boundary we estimate contains information that supports the idea

that this boundary is determined by credit supply rather than credit demand. First of all,

the boundary is upward sloping. This observation is in line with the idea that banks make

higher DTI loans to people with higher FICO scores. It doesn’t seem plausible that this

slope is driven by demand since it seems unlikely that people with marginally higher FICO

scores would want to spend a higher proportion of their income in housing. One would

either expect FICO score to be uncorrelated with the share of housing expenditure, or to be

negatively correlated with it if FICO is positively correlated with household wealth. In the

latter scenario, higher FICO individuals would tend to be wealthier and would need to lever

themselves less than poorer individuals. This would should lead to a negative slope rather

than the positive slope we observe in the data. Secondly, the boundary we estimate is very

sharp. There is a large amount of data points clustered around the boundary, also indicating

that the boundary is likely to be a constraint rather than result from credit demand.

To overcome the second challenge, we need a source of exogenous variation in local

underwriting standards. We exploit the disaggregated nature of our measure for underwriting

standards by using it to construct instrumental variables for msa-by-year level regressions of

house prices on underwriting standards. The spirit of the instruments we create is closely

1

The dataset is obviously not representative of the mortgage market as a whole. Our constructed measure

therefore cannot be said to representing the minimum underwriting standard that borrowers face, but rather

the underwriting standards they would face on a conforming 30-year fixed rate mortgage. Nevertheless, we

will find that even this measure has explanatory power in the determination of house prices. We plan to

extend this paper in the near future to include data on non-agency mortgages, which would then allow us

to construct underwriting measures that are more representative of the mortgage market as a whole.

3

related to Bartik instruments used in labor economics. The main identification idea is to

use the fact that shocks to the national credit markets are exogenous to the local conditions

in one particular metropolitan area. Additionally, a shock to national credit markets will

have different effects on different metropolitan areas. If, for example, willingness to lend

to subprime borrowers increases nationally, the impact of such change will be greater in

MSA’s where there are a large number of people with low credit scores. Controlling for

what happens to the credit markets as a whole through year fixed effects, we can exploit

the cross-sectional variation in how these shocks affect different locations. More specifically,

to compute the instrument for a particular MSA, we first create a national measure as the

average (across different markets) maximum DTI a borrower with a particular FICO, while

excluding the contribution of the MSA in question. We then construct our instrument by

weighting this national measure according to the FICO distribution of the population in the

MSA in question. This instrument can be interpreted as the part of the local credit supply

shocks that can be attributed to national supply shocks and as such it is uncorrelated with

local conditions. We repeat the same procedure to construct an instrument for local interest

rates, allowing us to identify our parameters of interest.

Using the instrumental variables approach described above we estimate the causal effect

of underwriting standards on local house prices. In our main specification we regress house

prices on the instrumented weighted average maximum DTI, the instrumented weighted

interest rates, on local fundamentals while controlling for year and metro fixed effects. We

find that a one percent change in the population weighted maximum DTI in a MSA leads

to a 2.67 percent change in local house prices holding constant everything else. On the

other hand, one percent change in the level of interest rates will lead to a drop of about

four percent in local house prices. We also conduct a similar analysis for the growth rates

in our variables of interest. In these regressions we find that a one percent change in the

growth rate of the weighted maximum DTI in one particular area will lead to a 0.422 percent

change in the growth rate of local house prices holding constant everything else. Also, a one

percent change in the growth rate of interest rates will lead to a drop of about 0.8 percent

in the growth rate of local house prices. These findings are not only interesting because

they confirm what one would expect, but also because they quantify the separate effects of

underwriting standards and interest rates on house prices. To our knowledge this is the first

paper to do so in the literature.

To test the robustness of our findings, we also confirm that the effects that we identified

are not driven by the financial crisis. We interact our variables of interest with dummy

variables for the crisis and the result stand almost identically. While, as one would expect,

the effects became stronger during the crisis, they were present even in the precrisis period.

4

We also explore the cross-sectional variation in the size of the coefficients. One plausible

hypothesis is that a shock to underwriting standards should have more of a price effect in

areas where housing supply is less elastic than in areas where it is more elastic. To test

this, we interact our variables of interest with a measure that captures how difficult it is to

construct new homes in an area: the Wharton’s index for Land Regulation. The interaction

with the supply elasticity proxy is positive, indicating that a shock to credit condition are

will lead to higher prices in areas where it is more difficult for supply to react. The same

pattern also emerges when we look at the effect of the Weighted Rate: a shock to interest

rates has a higher effect in places where it is difficult to increase the supply of housing.

The rest of the paper is organized as follow: section 2 presents and constructs our new

measure of underwriting standards. Section 3 discusses our estimation strategy and presents

our main estimation results and section 4 concludes.

2

2.1

A new measure of underwriting standards

Methodology

The first goal of this paper is to construct an index that can reasonably be interpreted as

a measure of mortgage underwriting standards, free of demand side factors. To this end,

commonly used proxies for underwriting standards, such as average LTVs, average approval

rates, or subprime shares in a market are inadequate because they reflect both credit supply

and housing demand. Instead of using such population aggregates, our method will draw

from the literature on estimating nonparametric production frontiers, particularly the robust

nonparametric method of Cazals, Florens, and Simar (2002) (henceforth CFS). The frontier

estimation literature is an appropriate place to begin because it is interested in answering the

question: “Given a certain level of inputs, what is the maximum output that is attainable?”

Applied to mortgages, we construct our measure of underwriting standards as the answer to

an analogous question: “For a given level of credit score (FICO), what is the highest level

of debt-to-income ratio (DTI) that a borrower with that credit score can obtain?” We shall

therefore be thinking of the credit score as an input, the debt-to-income ratio as an output,

and the underwriting standards as the production function.

To formalize this idea, suppose that the population of mortgage originations with FICO X

and DTI Y is described by distribution FX,Y (x, y). Our measure of underwriting standards

for credit score x is given by:

Ï (x) = sup {y|P (Y Ø y|X Æ x) > 0}

5

(1)

In words, Ï (x) is the highest y such that a person with a FICO x or lower is observed with

a DTI greater than y, with positive probability. 2 Let us now define

Ïm (x) = E [max {Y1 , . . . , Ym } |X Æ x]

(2)

as the expected maximum of DTI out of m draws, where the draws are conditioned on FICO

less than x. The construction of Ïm (x) is useful because it approaches Ï (x) as m æ Œ,

and because it has an easy-to-compute finite sample analogue. Specifically, suppose we have

n random draws from the population of mortgage originations: {xi , yi }ni=1 . Following CFS,

we construct:

n

1ÿ

I [yi Æ y, xi Æ x]

n i=1

Ŝn (x, y) =

Ŝn (x, y)

Ŝn (x̄, y)

Ŝc,n (y|x) =

(3)

(4)

which respectively are the empirical analogs of P (Y Æ y, X Æ x) and P (Y Æ y|X Æ x) (x̄

is the maximum of the support of X). Noting that:

P (max {Y1 , . . . , Ym } Æ y|X Æ x) = P (Y Æ y|X Æ x)m

(5)

we can express the empirical analogs of Ï (x) and Ïm (x) as:

Ó

Ô

Ï̂n (x) = sup y|Ŝc,n (y|x) > 0

ˆ Ï̂n (x) Ë

Èm

Ï̂m,n (x) = Ï̂n (x) ≠

Ŝc,n (u|x) du

0

(6)

(7)

Equations (3)-(7) tells us how to compute Ï̂m,n (x) non-parametrically from the data. CFS

establish the asymptotic properties of the estimator, but the key point to note is that Ï̂m,n (x)

Ô

is a n-consistent estimator for Ïm (x). Ï̂m,n (x) is therefore a consistent estimator of the

expected maximum DTI available to a borrower with FICO less than x, out of m draws. As

2

One complication in our setting is the possibility that persons with FICO x or lower are not observed

with DTI higher than Ï (x) due to reasons unrelated to credit supply. For example, borrowers with high

FICO’s may not be observed obtaining high DTI’s because they do not want high DTI loans, not because

they are unable to obtain them. This possibility is not typically a concern in production frontier estimation

because free disposal is assumed, and therefore a firm would always produce as much as possible for a given

level of input. Although free disposal cannot be assumed our setting, in the appendix we give conditions

under which we may still interpret Ï (x) as the supply-driven maximum DTI for FICO x. We will also show

be able to show that features of our data appear consistent with those assumptions.

6

m grows large, Ï̂m,n (x) æ Ï̂n (x), which means the estimator approaches the largest DTI

observed out of observations with FICO less than x. The reason to use a finite m is that

choosing a smaller m makes the estimator more robust to outliers, will still maintaining the

interpretation as an expected maximum out of m draws.3

There are a number of advantages to estimating Ïm (x), the expected maximum DTI

that borrowers with FICO less than x could obtain. First, it is readily interpretable as

a credit constraint that borrowers face, imposed upon them by lending standards in the

credit market. In comparison, a measure such as the average DTI that borrowers with

FICO less than x actually obtain is also affected by borrowers’ demand for credit. A second

advantage of using Ïm (x) is that it is a disaggregated measure of underwriting standards. It

therefore allows us to measure borrowing constraints separately for borrowers with different

characteristics. These measures can then be used as inputs into a structural model that allows

for rich heterogeneity in individual agents’ credit constraints. In the current paper, we exploit

the disaggregated nature of our measure by using it to construct Bartik-style instrumental

variables for msa-by-year level regressions of house prices on underwriting standards. We

elaborate more on this point in section 3.

2.2

2.2.1

Construction of the underwriting measure

Estimation of the maximum DTI boundary

The data we use to construct our measures come from the Freddie Mac Single Family LoanLevel Dataset. This is a dataset that includes the universe of fully amortizing, 30-year fixed

rate single family mortgages purchased or guaranteed by Freddie Mac with origination dates

between 1999Q1 and 2011Q4.4 There are a total of about 16 million unique loans in the

dataset. The dataset includes many details about the loan, including the FICO score of the

borrower and the original DTI of the loan. The dataset also includes date of origination

and location of the property, down to 3-digit zip code. We will construct our measures

Ïmjt (x) separately for each MSA j and each year t, with m = 1000, using the method

3

Our exposition of the estimator has focused on estimating a single input, single output production

frontier. The method is easily generalizable to allow multiple inputs and multiple outputs. For example,

a full specification of the underwriting function may include all characteristics of the collateral and of the

borrower as inputs, and all characteristics of the mortgage loan as outputs. However, the resulting frontier

is a higher dimensional object which is more difficult to summarize for use in subsequent analysis. For now,

in this paper, we focus on FICO-DTI frontier.

4

The dataset is obviously not representative of the mortgage market as a whole. Our constructed measure

therefore cannot be said to representing the minimum underwriting standard that borrowers face, but rather

the underwriting standards they would face on a conforming 30-year fixed rate mortgage. Nevertheless, we

will find that even this measure has explanatory power in the determination of house prices. We plan to

extend this paper in the near future to include data on non-agency mortgages, which would then allow us

to construct underwriting measures that are more representative of the mortgage market as a whole.

7

outlined in section 2.1 above. In order to focus on a more homogeneous set of loans in

terms of risk characteristics, we use only loans with original loan-to-value ratio between 60

to 100%. Cutting the sample in this way does not have a significant effect on our estimates

for underwriting standards, because most of the data already lies in this range of LTV.

Because our constructed underwriting measures are two-dimensional objects, it is easier

to show them in pictures than in tables. Figures 1-3 show our constructed measures for three

MSAs: Los Angeles, Phoenix and Dallas, for all the years in our data. Superimposed on

our measures of underwriting standards are scatter plots of the data used to construct the

measures. It is easy to see from the tables how our measure forms an envelope around the

data that can be interpreted as the maximum DTI an individual with a certain FICO could

obtain. Reassuringly, the envelope formed around the data is upward sloping with respect to

FICO, which is consistent with the envelope representing a credit constraint imposed from

the supply side. From these figures, a number of observations bear commenting.

First, the measure assigns a value of 0 to FICO scores in which no originations are

observed. One could interpret this to mean that borrowers with these credit scores were

unable to obtain conforming loans in these time periods. According to this interpretation,

it would appear that underwriting standards for low-FICO borrowers on conforming loans

were loosest in the earliest years of our sample, from 1999 to 2003, and then tightened later

in the sample, with especially sharp tightening occurring in 2009 and 2010. An alternative

interpretation would be that low-FICO borrowers migrated away from conforming loans in

the 2004-2006 period and were increasingly in the market for non-agency loans. Currently,

without additional data from the non-agency side of the market, we are unable to distinguish

between the two interpretations. For this reason, in later sections of the paper we will focus

our analysis on the underwriting measure for higher FICO borrowers. Nevertheless, these

figures demonstrate the importance of extending our analysis to include data on non-agency

loans.

A second important observation about figures 1-3 is that there is little heterogeneity

in the underwriting measure across metros, especially at very low and very high FICOs.

This suggests that underwriting standards, at least for the conforming market, may be

set nationally without regard to local housing market conditions. Despite this, we should

note that nationally set underwriting standards may still affect different cities differently,

depending on the FICO composition of its residents. Moreover, there is substantially more

cross-sectional variation in the changes to the underwriting standard over time, especially

for borrowers with FICO between 600 and 700, than appears from simple visual inspection

of the graphs. This can be more easily seen in the next subsection when we aggregate this

data in a single index for each city.

8

The shape of the maximum DTI boundary in figures 1-3 also contains information that

supports the idea that this boundary is determined by credit supply rather than credit

demand. First of all, notice that the boundary is upward sloping, especially for the lower

to mid range of the FICO scores. This observation is in line with the idea that banks make

higher DTI loans to people with higher FICO scores. It doesn’t seem plausible that this

slope is driven by demand since it seems unlikely that people with marginally higher FICO

scores would want to spend a higher proportion of their income in housing. One would

either expect FICO score to be uncorrelated with the share of housing expenditure, or to

be negatively correlated with it, if FICO is positively correlated with household wealth. In

that scenario higher FICO individuals would tend to be wealthier and would need to lever

themselves less than poorer individuals. This would should lead to a negative slope rather

than the positive slope we observe in the data. Secondly, notice that the boundary is very

sharp. There is a large amount of data points clustered around the boundary, also indicating

that the boundary is likely to be a constraint.

2.2.2

Construction of the measure of the underwriting standards

In the subsection above we show that we can estimate a nonparametric function for the

maximum DTI that a person i in market j at time t with a particular FICO score can get:

DT¯Ijt = Ïjt (F ICO)

There is many ways to create measures of underwriting standards that summarize the information contained in function Ïjt . One way to construct a measure is to take the weighted

average of maximum DTI over the local FICO distribution:

Ujt =

ÿ

F ICO

Ïjt (F ICO) · sjt (F ICO)

where we are weighting the function fjt according to the share of people in market j at

time t that have a particular FICO score sjt (F ICO). Therefore this measure has the clear

interpretation as the weighted average of the maximum DTI that the local population can

get. This calculation allows us to create a time series for each metropolitan area. The result

from such procedure is shown for a few cities in figure 4.

In table (1) we explore how our measure, the population weighed maximum DTI, correlates with local fundamentals and how it is different from a more naive measure of supply,

such as the average DTI. In specification (1) we regress the log weighted max DTI on log

rents, unemployment and wages and also include MSA fixed effects. Here we can see that

9

Figure 1: Underwriting Measures for Los Angeles, 1999-2011

Note: These figures show our constructed underwriting measures from 1999 to 2011, alongside the

scatter plots of the data used to create the measures. The x axis is FICO and the y axis is DTI. The

interpretation of the underwriting measure is the expected maximum DTI that would be observed

for borrowers with FICO less than x, out of 1,000 draws.

10

Figure 2: Underwriting Measures for Dallas, 1999-2011

Note: These figures show our constructed underwriting measures from 1999 to 2011, alongside the

scatter plots of the data used to create the measures. The x axis is FICO and the y axis is DTI. The

interpretation of the underwriting measure is the expected maximum DTI that would be observed

for borrowers with FICO less than x, out of 1,000 draws.

11

Figure 3: Underwriting Measures for Phoenix, 1999-2011

Note: These figures show our constructed underwriting measures from 1999 to 2011, alongside the

scatter plots of the data used to create the measures. The x axis is FICO and the y axis is DTI. The

interpretation of the underwriting measure is the expected maximum DTI that would be observed

for borrowers with FICO less than x, out of 1,000 draws.

12

Figure 4: The Average Maximum DTI Underwriting Standards Index

100

Underwriting Index

110

120

130

140

The Underwriting Index (=100 in year 2000)

2000

2005

year

Dallas, TX

Miami, FL

2010

Los Angeles, CA

Phoenix, AZ

13

Table 1: Explaining Underwriting Measures with Market Fundamentals

Log Weighted Max DTI

Log Average DTI

(1)

(2)

(3)

(4)

0.301***

-0.000319

0.417***

0.329***

(0.0466)

(0.0324)

(0.0336)

(0.0240)

-0.00534

-0.177***

0.00823*

(0.00537)

(0.00674)

(0.00388)

(0.00496)

-0.0193

0.00963

0.0952***

0.0815***

(0.0373)

(0.0284)

(0.0266)

(0.0209)

MSA F.E.

Yes

Yes

Yes

Yes

Year F.E

No

Yes

No

Yes

N

1909

1909

2088

2088

No. MSA

232

232

258

258

R2 within

0.200

0.733

0.649

0.876

R2 between

0.284

0.0993

0.273

0.464

R2 overall

0.200

0.345

0.301

0.574

Log Rent

Log Unemployment -0.0861***

Log Wage

Note - The dependent variable for the first two columns is the logarithm of the average

maximum DTI for a particular MSA. The sample consists of annual data from 1999 to 2011.

The clustered robust standard errors are given in parentheses.

ú

statistical significance at the 90% level

úú

statistical significance at the 95% level

úúú

statistical significance at the 99% level

14

our measure is correlated with rents and negatively correlated with local unemployment.

Similar correlations can be seen in column (3) where the dependend variable is the average

DTI. In specification (2) and (4) we include year fixed effects in order to take out any national trends. From these specifications we can see that once we control for national trends,

our measure is not correlated with market fundamentals anymore, while the average DTI

still is. Comparing the coefficients reveals that the coefficients in in specification (2) are

very economically small and not statistically different from zero, while those in specification

(4) are economically larger and statistically significantly different from zero. This finding is

consistent with the idea that the weighted maximum DTI measure captures credit supply,

which is mostly determined at a national level, while the log average DTI also incorporates

the effects of local credit demand which vary by MSA.5

3

Estimates of the effect of underwriting standards on

house prices

3.1

Model and Identification Strategy

The regression we want to run is:

pjt = –Ujt + —rtj + Xjt “ + dj + dt + Ájt

(8)

where pjt is the log house price in metro j at time t, U is a measure of the underwriting

standards, r is a measure of local log interest rates, and Xjt are additional controls. The

coefficient – here can be interpreted as the percent change in prices for a one percent change

in underwriting standards. Ultimately we want to get a sense for the sizes of the parameters

– and —.

We could also run a similar regression in percent changes:

pjt = – Ujt + — rtj + Xjt “ + dj + dt + Ájt

(9)

Here – can be interpreted as the percent change in the growth rate of prices for a one percent

change in the growth rate of the underwriting standards.

In order to run regression (8) we need a measure for underwriting standards and interest

rates that:

5

Notice that this does not mean that there is no cross-sectional or time-series differences in the weighted

average maximum DTI. Such differences can be seein in Figure (4).

15

1. Captures the supply side of credit rather than the demand side

2. Has exogenous variation, or in our regression is not correlated with Ájt

In the next subsection we describe how we could describe such an instrument. The spirit of

the instruments we create is closely related to Bartik instruments used in labor economics.

The main identification idea is to use the fact that shocks to the national credit markets

are exogenous to the local conditions in one particular metropolitan area. Additionally, a

shock to national credit markets will have different effects on different metropolitan areas.

If, for example, willingness to lend to subprime borrowers increases nationally, the impact

of such change will be greater in MSA’s where there are a large number of people with low

credit scores. Controlling for what happens to the credit markets as a whole through year

fixed effects, we can exploit the cross-sectional variation in how these shocks affect different

locations as exogenous shocks to local credit supply.

3.1.1

Construction of the instrument

We need to construct two instruments: one for the maximum DTI and one for interest rates.

The construction of the index is identically therefore we only discuss the construction of the

maximum DTI index here.

Suppose that we have estimated a nonparametric function for the maximum DTI that a

person i in market j at time t with a particular FICO score can get:

DT¯Ijt = Ïjt (F ICO)

For each MSA i, we can average this function over all the different markets to get a national

measure of underwriting standards while excluding the contribution of the MSA in question:

J

Ë

È

1ÿ

E≠i DT¯ Iit =

Ïjt (F ICO) · 1(i”=j) = gt≠i (F ICO)

J j=1

This function will change over time depending on the credit markets demand for different

credit quality loans. We can interpret this measure as being related to the demand by

investors in capital markets for different credit product types. Any shock to preferences of

investors to hold a particular mortgage type will be reflected in the changes in the shape of

gt≠i ().

A shock to the national credit markets will affect each market differently: if there is an

increase in demand for product types with FICO<700 then the areas with populations with

such FICO scores should benefit the most. We construct our instrument as the local effect

16

that shocks to the national underwriting standards will have. To do this first we compute:

¯ I I = gt≠j (F ICOjt ) · sjt (F ICO) = g I (F ICO)

DT

jt

jt

where gt≠j is the national measure of the credit standards calculated while excluding market

j, and sjt (F ICO) is the share of the population in market j at time t that has a particular

FICO score.

All is left to do now is to aggregate the information in the function fjtI () into one measure

for underwriting standards:

UjtI =

ÿ

I

gjt

(F ICO)

F ICO

Notice that this is a valid instrument for Ujt in regression (8). Since we are including time

specific fixed effects, our estimates are identified from differences from a national trend. Any

shocks to UjtI are orthogonal to what is happening in the particular market j at time t and

should be uncorrelated with the error term in our regression. We construct the instrument

I

for interest rates rjt

similarly using the same procedure.

3.2

Results

In this section we present instrumental variables estimates of equations (8) and (9). Table (2)

presents the results for regressions in log levels for equation (8). The regression is estimated

using data from 1999-2011 for an unbalanced panel of MSA’s. The independent variable in

this regression is the log of house prices. All the independent variables are also in logs. We

instrument for the Weighted Max DTI variable (Ujt ) and for the Weighted Rate (rjt ) by

I

using the proccedure described in the previous subsection (the instruments are UjtI and rjt

respectively). In specification (5) we present our main result. Specification (5) controls for

year and MSA fixed effects as well as for local fundamentals such as the log rent, wages and

unemployment rates. In this regression we find that a one percent change in the weighted

maximum DTI in one particular area will lead to a 2.67 percent change in local house prices

holding everything else constant. On the other hand, one percent change in the level of

interest rates will lead to a drop of about four percent in local house prices. Both of these

estimates are statistically significantly different from zero at the 99% level. We also notice

that the fundamentals included in this regression also enter significantly with the expected

signs.

In specifications (1) to (4) we include first only year fixed effects, then metro fixed effect

17

and then the fundamentals progressively. In all of these cases the magnitude of the coefficients

of interest varies, however it is always of the expected sign and it is statistically different from

zero. In specifications (6)-(8) we include additional variables that are potentially endogenous

to see how our coefficients change. Even when we include variables such as average interest

rates, average DTI and average FICO, our coefficients remain statistically significant and

the magnitude does not change significantly. We take this as evidence for the robustness of

the results.

Table (3) repeats the same excercise as the previous table except that all the variables are

not in growth rates. Our main results are presented in specification (5). This specification

controls for year and MSA fixed effects and also includes as controls the growth rates in

rents, wages and unemployment. In this regression we find that a one percent change in

the growth rate of the weighted maximum DTI in one particular area will lead to a 0.422

percent change in the growth rate of local house prices holding everything else constant. On

the other hand, one percent change in the growth rate of interest rates will lead to a drop

of about 0.8 percent in the growth rate of local house prices. Both of these estimates are

statistically significantly different from zero. We also notice that the fundamentals included

in this regression also enter significantly with the expected signs.

In specifications (1) to (4) of table (3) we include first only year fixed effects, then metro

fixed effect and then the fundamentals progressively. In all of these cases the magnitude

of the coefficients of interest varies, however it is always of the expected sign and it is

statistically different from zero. In specifications (6)-(8) we include additional variables

that are potentially endogenous to see how our coefficients change. Even when we include

variables such as average interest rates, average DTI and average FICO, our coefficients

remain statistically significant and the magnitude does not change significantly.

3.3

Robustness and Alternative Explanations

In this subsection we explore the robustness of our findings. First we explore whether our

results are mainly driven by the financial crisis. Secondly we want to explore cross-sectional

heterogeneity in the magnitude of our coefficients.

Specifications (1) and (2) of Table (4) reproduce our main findings corresponding to

specifications (5) and (8) in table (2). In specification (3) we interact our variables of interest

with indicator variables for the financial crisis. The coefficient on Weighted Max DTI is still

statistically significant and not different from the baseline specification (1). The interaction

with the crisis dummy is positive, indicating that credit condition became more important

during the crisis, although this is not statistically significant. The coefficient on Weighted

18

Table 2: IV Estimates of the Effect of Underwriting Standards on Housing Prices

Weighted Max DTI

Weighted Rate

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

1.697***

7.913***

4.157***

3.186***

2.664***

2.701***

2.911***

2.677***

(0.248)

(1.413)

(0.819)

(0.715)

(0.586)

(0.573)

(0.791)

(0.772)

-4.329*** -8.582*** -5.441*** -4.497*** -4.012***

(0.297)

(1.149)

Rent

-3.971*** -4.197*** -3.212***

(0.725)

(0.645)

(0.541)

(0.547)

(0.748)

(0.829)

1.397***

1.016***

1.137***

1.149***

1.192***

1.237***

(0.204)

(0.171)

(0.145)

(0.148)

(0.175)

(0.182)

1.075***

0.520***

0.507***

0.511***

0.440***

(0.181)

(0.162)

(0.161)

(0.166)

(0.156)

Wage

Unemployment

-0.300***

-0.296*** -0.293*** -0.260***

(0.0357)

(0.0348)

(0.0363)

(0.0338)

-0.781

-0.564

-1.570**

(0.590)

(0.736)

(0.778)

-0.163

-0.355

(0.260)

(0.227)

Avg. Rate

Avg. DTI

Avg. FICO

-4.621***

(1.135)

Metro F.E.

No

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Year F.E

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

N

2043

2029

1895

1895

1895

1895

1895

1895

220

218

218

218

218

218

218

0.379

0.568

0.669

0.665

0.638

0.681

0.154

0.351

0.313

0.327

0.326

0.321

0.336

0.159

0.317

0.295

0.346

0.345

0.334

0.361

No. MSA

R2 within

R2 between

R overall

2

0.386

Note - All the variables in this regression are in logs. The dependent variable is the log of the FHFA house price index. The average

max DTI and weighted interest rates are instrumented with a Bartik type instrument. The sample consists of annual data from 1999 to

2011. The clustered robust standard errors are given in parentheses.

ú

statistical significance at the 90% level

úú

statistical significance at the 95% level

úúú

statistical significance at the 99% level

19

Table 3: IV Estimates of the Effect of Growth in Underwriting Standards on the Growth of Housing Prices

Weighted Max DTI

Weighted Rate

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

0.904***

0.462*

0.339

0.429*

0.422*

0.820***

1.050***

0.916***

(0.348)

(0.281)

(0.272)

(0.235)

(0.234)

(0.256)

(0.310)

(0.304)

-1.391*** -0.931*** -0.775*** -0.908*** -0.800***

(0.335)

(0.264)

Rent

-1.159*** -1.384*** -1.198***

(0.262)

(0.230)

(0.230)

(0.247)

(0.294)

(0.292)

0.421***

0.457***

0.509***

0.446***

0.505***

0.408**

(0.159)

(0.136)

(0.151)

(0.165)

(0.175)

(0.166)

0.877***

0.599***

0.641***

0.634***

0.582***

(0.131)

(0.124)

(0.137)

(0.142)

(0.132)

Wage

Unemployment

-0.186***

-0.147*** -0.145*** -0.141***

(0.0246)

(0.0241)

Avg. FICO

(0.0244)

(0.0238)

-4.134*** -4.465*** -4.927***

(0.519)

Avg. DTI

(0.557)

(0.571)

-0.370*** -0.314***

(0.110)

Avg. Rate

(0.106)

-1.229***

(1.135)

Metro F.E.

No

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Year F.E

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

N

1787

1761

1629

1629

1629

1629

1629

1629

No. MSA

0.441

0.537

0.537

0.567

0.603

0.583

0.530

0.576

R within

0.441

0.537

0.537

0.567

0.603

0.583

0.530

0.576

2

Note - All the variables in this regression are in growth rates. The dependent variable is the growth rate of the FHFA house price index.

The average max DTI and weighted interest rates are instrumented with a Bartik type instrument. The sample consists of annual data

from 1999 to 2011. The clustered robust standard errors are given in parentheses.

ú

statistical significance at the 90% level

úú

statistical significance at the 95% level

úúú

statistical significance at the 99% level

20

Table 4: Exploring the Robustness of the IV Effects of the Underwriting Standards on Housing

Prices

Weighted Max DTI

(1)

(2)

(3)

(4)

(5)

(6)

2.664***

2.677***

2.500***

2.766**

2.311***

2.414***

(0.586)

(0.772)

(0.633)

(1.176)

(0.531)

(0.706)

0.611

1.325*

(0.517)

(0.709)

0.709***

0.737***

(0.116)

(0.132)

◊I (year Ø 2006)

◊RE Supply Elast.

Weighted Rate

-4.012*** -3.212***

(0.541)

(0.829)

◊I (year Ø 2006)

-3.603***

-3.125**

(0.651)

(1.380)

-1.607**

-2.675***

(0.685)

(1.006)

◊RE Supply Elast.

Rent

Wage

Unemployment

-3.862*** -3.146***

(0.502)

(0.792)

-0.119*** -0.132***

(0.0257)

(0.0289)

1.137***

1.237***

0.910***

0.855***

0.984***

1.067***

(0.145)

(0.182)

(0.189)

(0.186)

(0.137)

(0.161)

0.520***

0.440***

(0.162)

(0.156)

-0.300*** -0.260***

-0.274*** -0.206***

-0.274*** -0.231***

(0.0320)

(0.0390)

(0.0340)

(0.0318)

0.514***

0.451***

0.611***

0.551***

(0.0357)

(0.0338)

(0.105)

(0.113)

(0.140)

(0.140)

Other Controls

No

Yes

No

Yes

No

Yes

Metro F.E.

Yes

Yes

Yes

Yes

Yes

Yes

Year F.E

Yes

Yes

Yes

Yes

Yes

Yes

N

1895

1895

1909

1909

1799

1799

R2 within

0.669

0.681

0.667

0.596

0.727

0.730

Note - All the variables in this regression are in logs. The dependent variable is the log of the FHFA house

price index. The average max DTI and weighted interest rates are instrumented with a Bartik type instrument. In

specifications (3) and (4) we interact our variables of interest with a dummy variable for years after the financial

crisis. In specifications (5) and (6) we interact the variables of interest with Wharton’s index for Land Regulation

which is large for places where it is more difficult to build new homes. In specifications (2), (4) and (6) we also control

for average DTI, average interest rates and average FICO scores. The sample consists of annual data from 1999 to

2011. The clustered robust standard errors are given in parentheses.

ú

statistical significance at the 90% level

úú

statistical significance at the 95% level

úúú

statistical significance at the 99% level

21

Table 5: Exploring the Robustness of the IV Effects of the Underwriting Standards on Housing

Prices

Weighted Max DTI

(1)

(2)

(3)

(4)

(5)

(6)

0.422*

0.916***

0.456***

0.492***

0.381*

0.904***

(0.234)

(0.304)

(0.158)

(0.167)

(0.229)

(0.302)

-0.169

0.773

(0.477)

(0.699)

0.244***

0.301***

(0.0540)

(0.0496)

◊I (year Ø 2006)

◊RE Supply Elast.

Weighted Rate

-0.800*** -1.198***

(0.230)

(0.292)

◊I (year Ø 2006)

-0.678*** -0.638***

(0.173)

(0.166)

-0.128

-1.160

(0.506)

(0.723)

◊RE Supply Elast.

Rent

Wage

Unemployment

-0.775*** -1.187***

(0.230)

(0.301)

0.00188

0.0130

(0.0216)

(0.0199)

0.509***

0.408**

0.527***

0.366**

0.425**

0.319*

(0.151)

(0.166)

(0.163)

(0.163)

(0.173)

(0.185)

0.599***

0.582***

(0.124)

(0.132)

-0.186*** -0.141***

-0.187*** -0.143***

-0.191*** -0.149***

(0.0244)

(0.0234)

(0.0248)

(0.0241)

0.591***

0.575***

0.554***

0.543***

(0.0246)

(0.0238)

(0.122)

(0.131)

(0.119)

(0.127)

Other Controls

No

Yes

No

Yes

No

Yes

Metro F.E.

Yes

Yes

Yes

Yes

Yes

Yes

Year F.E

Yes

Yes

Yes

Yes

Yes

Yes

N

1629

1629

1629

1629

1564

1564

R2 within

0.603

0.576

0.607

0.585

0.605

0.576

Note - All the variables in this regression are in growth rates. The dependent variable is the growth rate of the

FHFA house price index. The average max DTI and weighted interest rates are instrumented with a Bartik type

instrument. In specifications (3) and (4) we interact our variables of interest with a dummy variable for years after

the financial crisis. In specifications (5) and (6) we interact the variables of interest with Wharton’s index for Land

Regulation which is large for places where it is more difficult to build new homes. In specifications (2), (4) and (6)

we also control for average DTI, average interest rates and average FICO scores. The sample consists of annual data

from 1999 to 2011. The clustered robust standard errors are given in parentheses.

ú

statistical significance at the 90% level

úú

statistical significance at the 95% level

úúú

statistical significance at the 99% level

22

Interest Rates is also still positive and statistically significantly different from zero. The

interaction with the crisis dummy reveals that changes in the interest rates became more

important during the crisis: a one percent change in interest rates during the crisis led to

an aditional 1.6 percent drop in house prices as compared to the non-crisis period. Similar

results can be also seen in specification (4) when we include additional variables such as

average fico scores, average DTI and average interest rates.

Next we turn to exploring the cross-sectional variation in the size of the coefficients. One

plausible hypothesis is that a shock to underwriting standards should have more of a price

effect in areas where housing supply is less elastic than in areas where it is more elastic. The

idea is that in areas whith elastic supply, relaxing credit would result in more construction

rather in higher house prices. To test this, we interact our variables of interest with a measure

that captures how difficult it is to construct new homes in an area: the Wharton’s index for

Land Regulation. This index is higher in areas where there is a lot of regulation about how

much and where to construct and it is lower in areas with less restrictions. The main results

are presented in specification (5) of table (4). The coefficient on Weighted Max DTI is still

statistically significant and not different from the baseline specification (1). The interaction

with the supply elasticity proxy is positive, indicating that a shock to credit condition are

will lead to higher prices in areas where it is more difficult for supply to react The coefficient

on Weighted Interest Rates is also still positive and statistically significantly different from

zero. The same pattern also emerges when we look at the effect of the Weighted Rate: a

shock to interest rates will have a higher effect in places where it is difficult to increase

the supply of housing. Similar results can be also seen in specification (4) when we include

additional variables such as average fico scores, average DTI and average interest rates.

Similar results can be seen in table (5) where all the variables are in growth rates. We find

that interacting our main variables with a crisis dummy does not qualitatively change our

results indicating that our results are not driven by a particular time period. In specifications

(5) and (6) we also find that changes in the growth of underwriting standards have a higher

impact on price growth in places where it is more difficult for housing construction to readily

react to such shocks.

3.4

Extensions

We would expect that shocks to the underwriting standards for low (high) credit quality

borrowers affect house prices for lower (high) quality homes. To test this hypothesis, our

measure of credit standards can be refined to be the average maximum DTI for a range of

FICO scores. We can create a measures of underwriting standards for different percentiles

23

of the FICO distribution:

Ujt (q) =

b

ÿ

F ICO=a

Ïjt (F ICO) · sjt (F ICO)

where q is the measure of credit standards for a < F ICO < b. From Dataquick we could

construct house price indexes for different percentiles of the house prices so we have pjt (q).

We then can run the following regressions separately for each q:

pjt (q) =

Q

ÿ

–q Ujt (q) + —rtj + Xjt “ + dj + dt + Ájt

(10)

q=1

If we stack the estimated parameters, we would have a matrix of – that is q ◊ q. What we

would expect is that the diagonal of this matrix would have the highest coefficients. The

off the diagonal coefficients would inform us of the spillover effect of underwriting standards

across various segments of the housing market. We could think of things like: suppose we

get a shock to underwriting standards for only the low end, how does that spill over to other

housing segments? This could be quite interesting if the results are precise.

4

Conclusion

Using an instrumental variables approach we estimate the causal effect of underwriting standards on local house prices. In our main specification we regress house prices on the instrumented weighted average maximum DTI, the instrumented weighted interest rates, on local

fundamentals while controlling for year and metro fixed effects. We find that a one percent

change in the population weighted maximum DTI in a MSA leads to a 2.67 percent change in

local house prices holding constant everything else. On the other hand, one percent change

in the level of interest rates will lead to a drop of about four percent in local house prices.

We also conduct a similar analysis for the growth rates in our variables of interest. In these

regressions we find that a one percent change in the growth rate of the weighted maximum

DTI in one particular area will lead to a 0.422 percent change in the growth rate of local

house prices holding constant everything else. Also, a one percent change in the growth rate

of interest rates will lead to a drop of about 0.8 percent in the growth rate of local house

prices. These findings are not only interesting because they confirm what one would expect,

but also because they quantify the separate effects of underwriting standards and interest

rates on house prices. To our knowledge this is the first paper to do so in the literature.

To test the robustness of our findings, we also confirm that the effects that we identified

24

are not driven by the financial crisis. We interact our variables of interest with dummy

variables for the crisis and the result stand almost identically. While, as one would expect,

the effects became stronger during the crisis, they were present even in the precrisis period.

We also explore the cross-sectional variation in the size of the coefficients. One plausible

hypothesis is that a shock to underwriting standards should have more of a price effect in

areas where housing supply is less elastic than in areas where it is more elastic. To test

this, we interact our variables of interest with a measure that captures how difficult it is to

construct new homes in an area: the Wharton’s index for Land Regulation. The interaction

with the supply elasticity proxy is positive, indicating that a shock to credit condition are

will lead to higher prices in areas where it is more difficult for supply to react. The same

pattern also emerges when we look at the effect of the Weighted Rate: a shock to interest

rates has a higher effect in places where it is difficult to increase the supply of housing.

References

Cazals, C., J.-P. Florens, and L. Simar (2002): “Nonparametric frontier estimation:

a robust approach,” Journal of econometrics, 106(1), 1–25.

Geanakoplos, J. (1997): “Promises, Promises,” in The Economy as an Evolving Complex

System, ed. by S. D. W. Arthur, and D. Lane, pp. 285–320.

(2003): “Liquidity, Default, and Crashes: Endogenous Contracts in General Equilibrium,” in Advances in Economics and Econometrics, ed. by L. P. H. Mathias Dewatripont,

and S. J. Turnovsky. Cambridge University Press.

(2010): “The Leverage Cycle,” in NBER Macroeconomics Annual 2009, Volume

24, pp. 1–65. University of Chicago Press.

Glaeser, E. L., J. D. Gottlieb, and J. Gyourko (2010): “Can Cheap Credit Explain

the Housing Boom?,” Working Paper 16230, National Bureau of Economic Research.

25