Europe doubling down Risk management research

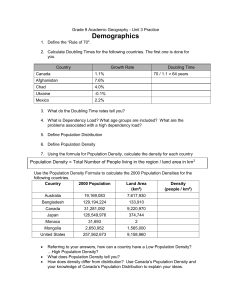

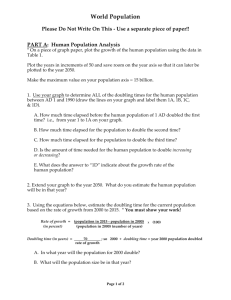

advertisement