Welcome Back Cadets… LTC

advertisement

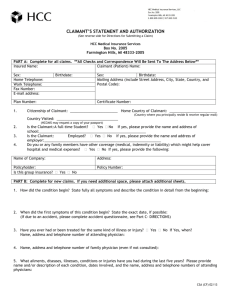

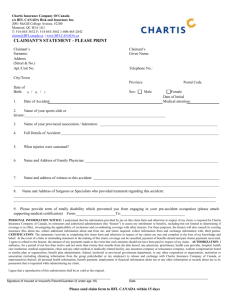

Welcome Back Cadets… LTC Brian Landry Claims Bureau Robert Russ Prudential Karen Smyth Prudential Nolan Tully Drinker Biddle & Reath LLP 1 Welcome to Training Roll Call • Your Instructors (LTC Police Officers) • Goals for training Examine real life case studies 3 perspectives: claims, SIU/Investigation, legal Identify red flags, surveillance tactics, and legal hazards associated with LTC claims 2 First Case Study . . . Background • Female 73 year old former mechanical engineer residing in Los Angeles, CA area • • • • Cash Indemnity Policy (not expense reimbursement) $120 Daily Maximum Benefit with a Lifetime Maximum of 3 years Claimant called to initiate her own claim; requested her own physician perform the Face to Face Assessment Claimant's physician is well-known to us Face to Face Assessment performed: conditions include fibromyalgia, diabetes, neuropathy, retinopathy, osteoarthritis and bilateral rotator cuff tears Cognitive problems alleged based on prior incidents 3 First Case Study . . . Background (cont.) • Rx includes Aricept and Namenda • Living with her son and his wife • Certified as a Chronically Ill Individual; benefits initiated • Obtain medical records from a different physician; records reveal she had been driving as recently as 3 months prior 4 A Home Away From Home Investigation • Conducted activities check - Claimant does not reside with son; living 2 miles away in an apartment and she continues to drive • Attempted unannounced visit - Claimant's son got involved; visit and interview conducted at his home; he answered all questions; Claimant appears incapacitated • Attempted second unannounced visit and surveillance at claimant's "real" residence. She answered the door. Surveillance showed claimant attempting to use a cane 5 A Home Away From Home Investigation (cont.) • Third visit initiated; sent investigators to both properties simultaneously • • Son stated claimant is sleeping; requested we return later Daughter-in-law leaves residence and drives to claimant's apartment; picks up claimant and returns with her to the house Investigator returns to son's house; claimant is inside dressed in nightgown with a walker Administered Activities Questionnaire; son refused to sign after reading fraud warning 6 Legal Considerations • If you were the attorney, what would your recommendation be? Need more information Independent Assessment – what does that reveal? Maybe IME Does additional information corroborate investigation? 7 Legal Considerations • • Independent medical evaluations corroborate investigation. What is your recommendation now? Deny claim and seek to rescind the policy File declaratory judgment action Refer case to state authorities for consideration 8 Case Study #2 Background • Male in his 60s, retired VP of a bank Claim for benefits based on a brain injury as a result of a MVA 9 months prior to claim submission Insured claimed the need for hands on assistance 24 hours per day; seven days per week due to inability to perform ADLs Approved for benefits after in-home assessment was conducted; insured presented as lethargic and incoherent Claims handler found the insured and his wife were associated with a ranch and Alpacas through an online review No SIU in place within carrier; case was referred for investigation directly from the claims department to the outside vendor 9 Best in Show, Worst in Fraud Investigation • • Prior to utilizing surveillance, alternative methods of investigation were used in order to gather information that would lead to constructing a productive game plan for surveillance Background investigation results: Insured and his wife were in the process of moving from their home to a new 20 acre ranch in WA Insured and his wife obtained a business license for their ranch and are involved in local associations Social media indicated the insured loved the outdoors, hiking, skiing, sailing, camping, starting an adventure raising Alpacas and building greenhouses 10 Best in Show, Worst in Fraud Investigation (cont.) • Structuring a productive surveillance Conducted a day of surveillance prior to the show and the two days of the show Additional surveillance conducted around an assessment Conclusion of investigation 11 Best in Show, Worst in Fraud 12 Legal Considerations • Based on the facts learned in its investigation, the company has denied the claim • Shortly after denying claim, company receives strongly worded letter from claimant’s attorney • Letter seeks to appeal decision to deny the claim Letter threatens litigation against company 13 Legal Considerations • You are the Attorney, what is your Recommendation? Company should strongly consider resuming payment because insured has retained counsel and has threatened litigation Company should engage in discussions with insured’s attorney and should render decision on appeal based on all information available. Company should file declaratory judgment action seeking declaration as to eligibility for benefits Company should deny appeal outright because of overwhelming evidence of fraud 14 Legal Considerations • You are the Attorney, what is your Recommendation? Company should strongly consider resuming payment because insured has retained counsel and threatened litigation (Probably not) Company should engage in discussions with insured’s attorney and should render decision on appeal based on all information available. (Probably) Company should file declaratory judgment action seeking declaration as to eligibility for benefits (Possibly – conservative approach) Company should deny appeal outright because of overwhelming evidence of fraud? (Possibly – aggressive approach) 15 Case Study #3 Background • Female 64 year old former dentist residing in Los Angeles, CA • • Claimant initiated claim because of carpal tunnel syndrome and diabetic neuropathy Face to Face Assessment performed • Cash Indemnity Policy (not expense reimbursement) $145 Daily Maximum Benefit with an Unlimited Lifetime Maximum Symptoms alleged to be so severe that she was unable to write a sentence as required by cognitive portion of the assessment Claimant's physician is well-known to us 16 Case Study #3 Background (cont.) • Certified as a Chronically Ill Individual; benefits initiated • Diagnoses seemed inconsistent with Plan of Care • Opened an investigation with SIU 17 Power Washers and Claims Investigations Investigation • Sent Daily Activities Questionnaire • Conducted Activities Check • Claimant indicated she needs assistance because of severe back, neck, shoulder and arm pain, but continues to drive May have some care in place Personally visited Claimant She was in front of her home operating a power washer Upon identification, she became "dizzy" and went indoors 18 Power Washers and Claims Investigations Investigation (cont.) • Interviewed claimant alone • Interviewed husband alone • • She reported she has two caregivers in addition to her husband Needs help bathing and dressing. Can sometimes go out on her own. He said one of the "caregivers" was a housekeeper He never heard of the other caregiver. At a later date, attempted to conduct surveillance; results unsuccessful/inconclusive Claimant has moved into a large high-rise apartment/condo building 19 Power Washers and Claims Investigations Investigation (cont.) • High rise condo building inaccessible. • Do we have enough information to make a determination on the claim now? • Need more information – but how do we get it? 20 Legal Considerations • You are the Attorney, what is your Recommendation? Deny claim and either seek to rescind policy or seek declaratory judgment Continue to pay claim based on evidence that insured is still benefit eligible; continue to gather information at periodic intervals and monitor recovery Continue to pay claim under Reservation of Rights while diligently seeking additional information 21 Legal Considerations • You are the Attorney, what is your Recommendation? Deny claim and either seek to rescind policy or seek declaratory judgment (Probably not) Continue to pay claim based on evidence that insured is still benefit eligible; continue to gather information at periodic intervals and monitor recovery (Possibly – More conservative approach) Continue to pay claim under Reservation of Rights while diligently seeking additional information (Possibly – Less conservative approach) 22 Legal Considerations • • Difficult situation to evaluate Maintain objectivity • Ok to protect the company’s rights/interests, but do so thoughtfully • No arbitrary decisions No inaccurate or misleading communications What would a jury do? “When all else fails, read the directions” • Not every “suspicious” case is a fraud Legal focus shifts from considering fraud, to making correct and defensible decision under the policy What does the policy say? What do your SOPs say? Pitfall: Seeing all claims in black and white 23 Case Study #4 Background • Male 71 year old former used car salesman residing in Iowa • • Claimant initiated claim stating he needed help with bathing and dressing because of a tremor in his head and arm Face to Face Assessment performed • • • Cash Indemnity Policy (not expense reimbursement) $100 Daily Maximum Benefit with and Unlimited Lifetime Maximum Symptoms alleged to be so severe that he has lost the entire use of his left arm Physician certifications we obtained confirmed he needed ADL assistance due to tremors Certified as a Chronically Ill Individual; benefits initiated Upon reassessment, we learned he is still driving and that he owned a used car lot 24 Never Trust a Used Car Salesmen Investigation • Conducted Activities Check • Found to be actively working at the used car lot as the sole employee Observed rolling a tire into his garage with one hand Surveillance Initiated Retrieved garbage cans from the street, drove to used car lot, worked at car lot -- including bending, stooping, squatting, donning/doffing clothing and spray-painting with the arm he claimed to have no use of 25 Never Trust a Used Car Salesmen • We have some footage of the claimant: 26 Never Trust a Used Car Salesmen • • We still need more information Scheduled IME Examined the insured and watched our surveillance video Abilities exhibited during the video were completely inconsistent with how the insured presented at the office Determination made that claimant is not Chronically Ill 27 Legal Considerations • What should the company do now? • Do you have enough evidence to terminate benefits? • Let’s assume that the company terminates benefits – what next? 28 Legal Considerations • Should the company: Seek to rescind the policy? File civil suit for fraud to recover benefits paid? Refer case to state authorities for consideration? 29 Legal Considerations • Rescission • Contestable period Policy language State law Voluntary rescission Return of premium No apparent problem with “contract formation” Pitfall: Attempts to “unilaterally” unwind Policy 30 Legal Considerations • File suit for fraud to recover benefits paid • State law “it’s not what we know, it’s what you can prove” Amount in controversy Damages unrecoverable Send message to the marketplace Open door for counterclaims? Possible media exposure/industry perception Potential Pitfall: Expense 31 Legal Considerations • Refer case to state authorities for consideration • State law – mandatory fraud reporting requirement? What does the evidence show Send message to marketplace Restitution order possible (but probably unlikely) Industry/marketplace perception Utilize in-house/outside counsel Possible pitfall: privilege considerations; possibility that authorities do nothing. 32