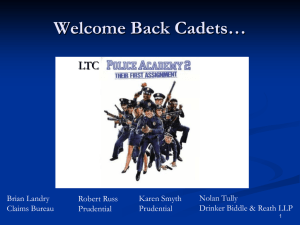

You have been accepted to … LTC Michael Rafalko Robert Russ

advertisement

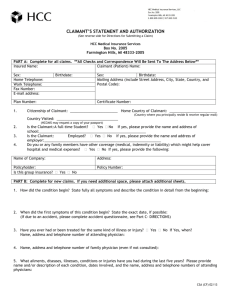

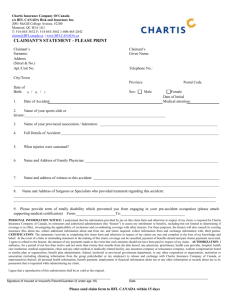

You have been accepted to … LTC Dr. Stephen Holland Univita Robert Russ Prudential Michael Rafalko Drinker Biddle & Reath LLP Welcome to Training Roll Call ● Your Instructors (LTC Police Officers) ● Goals for training - Examine real life case studies - 3 perspectives: claims, SIU, legal - Identify red flags, surveillance tactics, and legal hazards associated with LTC claims ● Promotion from cadet to officer - Prizes for completion of examinations ● Promotion to Commandant for one lucky cadet 1 First Case Study . . . • Mr. Everett, 70 year old retired plumber – LTCI policy effective date June 15, 1995 – Cash benefit: $130/day, TQ, comprehensive coverage, 30 day EP Claimed for benefits in June 2007 describing significant dementia • In-person assessment: MMSE 15/30, lethargic, mumbling incoherently in a foreign language • Approved for benefits on June 25, 2007, cash benefits begin after EP • Subsequent assessments showed claimant to be disoriented and confused, very lethargic, MMSE always less than 15/30, noted to be 2-4 ADL dependent • 2 First Case Study . . . At 24 months, inconsistent marital status on claim renewal form identified, further investigation into careplan noted that claimant was being cared for my his daughter, who is confined to wheelchair • APS ordered – very little corroboration of a significant cognitive impairment or ADL deficits • A meeting is held • 3 A Plumber, a Cash Policy and Dementia SIU involvement is requested – first step, Activity Check •Activity check revealed home phone number is for an active plumbing business – Confirmed with Better Business Bureau – Business re-bonded while claimant in payment – Called business number and claimant answered phone and identified himself by name •Escalated to surveillance – Plumbing services requested by SIU – Videotaped responding to service call 4 • 2 days later SIU arranged for in home interview with claimant and caretaker - Claimant found bedridden, starring at ceiling mumbling in foreign language - Daughter stated that he was semi-comatose 85% of the time, needing constant care, unable to drive or care for himself • Claimant informed of videotaping and driving to service call • Claimant immediately became cognizant and attentive 55 • You are the Attorney, what is your Recommendation? Deny claim; seek to rescind the policy. Deny claim; file civil suit for fraud to recover benefits paid. Deny claim; refer case to state authorities for consideration. 6 • You are the Attorney, what is your Recommendation? Deny claim; seek to rescind the policy. (Probably Not) Deny claim; file civil suit for fraud to recover benefits paid. (Possibly Yes) Deny claim; refer case to state authorities for consideration (Probably Yes) 7 Legal Considerations (Case Study # 1) • • The answer is almost always “it depends” Recession • Contestable period Policy language State law Voluntary recession Return of premium No apparent problem with “contract formation” Pitfall: Attempts to “unilaterally” unwind Policy 8 Legal Considerations (cont.) (Case Study # 1) • File suit for fraud to recover benefits paid • State law “it’s not what we know, it’s what you can prove” Amount in controversy Damages unrecoverable Send message to the marketplace Open door for counterclaims? Possible media exposure/industry perception Potential Pitfall: “The game isn’t worth the candle.” 9 Legal Considerations (cont.) (Case Study # 1) • Refer case to state authorities for consideration • • State law – mandatory fraud reporting requirement? What does the evidence show Send message to marketplace Restitution order possible (but probably unlikely) Industry/marketplace perception Utilize in-house/outside counsel Possible pitfall: not having your ducks row; privilege considerations Note: This is not an exhaustive list of options; each case is unique 10 Case Study #2 • Ms. P.N. Tush, 75 year old, retired school teacher • • • • • • LTCI policy effective date 2003 Cash benefit: $120/day, TQ, comprehensive coverage, 60 day EP Claimed for benefits based with diagnosis of frozen shoulder s/p bilateral rotator cuff reconstruction complicated by fibromyalgia In-person assessment showed insured to be 4 ADL dependent needing assistance with bathing, dressing, toileting and transferring, walked with shuffling gait, very lethargic. Assessing nurse stated that she will likely need help for the “rest of her life”. Approved for benefits on April 15, 2006, cash benefits begin after EP Subsequent assessments by different assessor documented no improvement, though assessor noted movement or lack of movement to be very exaggerated APS obtained – very little to corroborate level of disability and dependency; no evidence of past rotator cuff repairs in records A meeting is held 11 A Teacher, a Cash Policy and Frozen Shoulders SIU begins investigation – surveillance and an in-person nursing assessment •Surveillance initiated around the in-person nursing assessment •The day before assessment claimant documented: Driving, walking without an aide, hesitation or equipment, shopping Good ambulation and upper extremity range of motion and strength •On the day of assessment she is not observed outside •The assessment report documented : Claimant in severe pain, confined to chair, needing caregiver (friend) to help her transfer and ambulate, described severe limitations with dependencies in all IADLs as well as bathing, dressing and toileting Stated that she pays friend to help her with ADLs every day, friend agrees 12 • The day after the nursing assessment the claimant is again documented talking on cell phone and smoking while driving, ambulating and shopping at several stores without an aide or assistance , carrying packages • Claim was denied and payments stopped • Appeal made via an attorney • Case summary and surveillance video sent to attorney 13 13 • You are the Attorney, what is your Recommendation? Company should strongly consider resuming payment because insured has retained counsel and is “lawyered up.” Company should file declaratory judgment action seeking declaration as to eligibility for benefits. Company should engage in discussions with insured’s attorney and should render decision on appeal based on all information available. Company should deny appeal outright because of overwhelming evidence of fraud. 14 • You are the Attorney, what is your Recommendation? Company should strongly consider resuming payment because insured has retained counsel and is “lawyered up.” (Probably not) Company should file declaratory judgment action seeking declaration as to eligibility for benefits (Possibly – conservative approach) Company should engage in discussions with insured’s attorney and should render decision on appeal based on all information available. (Probably) Company should deny appeal outright because of overwhelming evidence of fraud? (Possibly – aggressive approach) 15 Legal Considerations (cont.) Case Study # 2 • Facts not a “slam dunk” as in case study #1 • • Probably not a strong case to file civil suit for damages Be wary of attorney involvement • Assessments say insured is eligible for benefits Video suggests insured is not eligible for benefits Insured will claim she has good days and bad days Goal to appropriately deny claim without being sued What state are we in? If breach of contract, then bad faith Communicate carefully and diligently Pitfall: Failing to position company favorably in case of legal action 16 Case Study #3 • • • • • • Ms. Simpson, 69 year old retired policewoman LTCI policy effective date 1997 Indemnity, reimbursement, $150/day, TQ, comprehensive, 90 day EP Found by daughter at Christmas Confused, disoriented, depressed, 5/6 ADL dependencies, unsafe house MD Evaluation: Dementia, unspecified, depression, MMSE 15/30 Begun on Aricept, Namenda and antidepressant Admitted to a locked dementia unit Approved for benefits, deductable begin At 30 days, ADL independent, begins to socialize At 45 days, transferred to the ALF from dementia unit, only on antidepressant At 90 days, stopped all medications, socializes with residence and staff, needs to be cued for meals, bathing and dressing, mostly stays close to room, never leaves facility, all medications stopped, diagnosis of dementia and depression remain on ALF chart 17 A Cop, a TQ Policy and Dementia • • • • APS obtained at one year anniversary Dementia diagnosis remains on chart, noted to be oriented to person only “No need for medication at this time”, noted to be living comfortably in ALF No mention of need for continual supervision, “depression lifting” Onsite assessment Clamant found to be alert and oriented to person and place (not time) Affable, talkative, scored a 25/30 on MMSE (Masters level of education) No medication, easily distracted, talking at length about her career Incomplete care notes at nursing station; RN supervisor maintains that claimant is unable to live alone independently and that her house was sold MD Letter advocates for claimant stating that she has moderate dementia, that she should be in an ALF and that she requires intermittent supervision 18 A meeting is held A Cop, a TQ Policy and Dementia • • SIU Investigation consisted of staff and facility caregiver interviews – corroborate onsite assessment Staff notes that she could leave if she wanted to but that she doesn’t leave, staff disagrees over whether she could manage her own medications Staff interviews indicate claimant at times cares for herself and at other times chooses not too A case conference is held 19 • You are the Attorney, what is your Recommendation? Deny claim based on evidence that insured has recovered Continue to pay claim based on evidence that insured is still benefit eligible; continue to gather information at periodic intervals and monitor recovery Continue to pay claim under Reservation of Rights while diligently seeking additional information 20 • You are the Attorney, what is your Recommendation? Deny claim based on evidence that insured has recovered (Probably not) Continue to pay claim based on evidence that insured is still benefit eligible; continue to gather information at periodic intervals and monitor recovery (Possibly – More conservative approach) Continue to pay claim under Reservation of Rights while diligently seeking additional information (Possibly – Less conservative approach) 21 Legal Considerations (Case Study # 3) • • Difficult situation to evaluate Maintain objectivity • Ok to protect the company’s rights/interests, but do so thoughtfully • No arbitrary decisions No inaccurate or misleading communications What would a jury do? “When all else fails, read the directions” • Not every “suspicious” case is a fraud Legal focus shifts from considering fraud, to making correct and defensible decision under the policy What does the policy say? What do your SOPs say? Pitfall: Seeing all claims in black and white 22