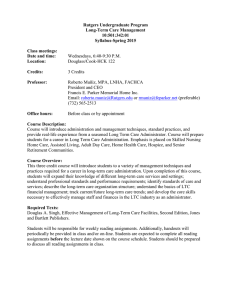

Long Term Care / Disability Income Claim Consultant Springfield, MA Company Information:

advertisement

Long Term Care / Disability Income Claim Consultant Springfield, MA Company Information: In the world of financial services, it’s all about working with an established, highly respected company based on demonstrated indications of quality and performance. Who you choose to work with matters. Consider Massachusetts Mutual Life Insurance Company. Founded in 1851, Massachusetts Mutual Life Insurance Company is the center of the MassMutual Financial Group, a diversified financial services organization. Key subsidiaries include OppenheimerFunds, a leading mutual fund family; Babson Capital Management, a provider of investor services; and Cornerstone Real Estate Advisers, which offers real estate equities. MassMutual has a broad portfolio of products and services including life insurance, mutual funds, money management, trust services, retirement planning products, worksite, annuities, disability insurance and long-term care insurance. MassMutual products are distributed through a nationwide network of trusted and knowledgeable financial professionals who think in terms of longterm commitment to meeting individual client’s needs. Since 1851, MassMutual has made business decisions based on customer needs. Our mutual structure, along with our long-term business approach, has helped keep us strong. This strength means we will be here when our customers need us most. Together, we help people secure their futures and protect the ones they love. MassMutual has maintained some of the highest financial strength ratings in any industry, and is committed to maintaining a position of preeminent financial strength by achieving consistent, long-term profitable growth. In total, MassMutual's worldwide insurance in-force was $ 579 Billion at the end of 2014, and assets under management were $651 billion up 2% and reached its highest point in history. MassMutual is ranked 96 on the 2014 Fortune 500 list and was again honored by Working Mother magazine as one of its “100 Best Companies”. DiversityInc for the fourth consecutive year, names MassMutual one of its “25 Noteworthy Companies” and for the first time as one of it “Top 10 Companies for LGBT Employees”. Job Summary: Associates at this level have acquired the advanced skills necessary to expertly adjudicate LTC/disability income and life waiver of premium claims of high complexity. An extensive knowledge of disability income policy and rider provisions as well as life waiver of premium riders has been demonstrated. With a high degree of autonomy and discretion, incumbents independently identify core claim issues, develop and execute investigative action plans to obtain essential information, and analyze claim information with the assistance of appropriate subject matter experts (medical, vocational, financial, legal, etc). Independent field investigative work may be performed. After considering claim facts and policy coverage, incumbents make or recommend initial and ongoing liability determinations on disability income and life waiver of premium claims and authorize benefit payments as appropriate within specified authority limits. Partners with counsel in representing company at arbitrations, mediations and trials. Exceptional customer service through oral and written communications is required in accordance with internal and regulatory standards. Mentoring, providing second approvals and other department monitoring functions may be assigned to these associates. Will participate in and also lead projects. Role Characteristics: • Handles projects or work with defined scope in own discipline and typically has a short-term focus • Works with guidance on small-scale team/unit projects • Solves problems in own specialty area • Makes worthwhile improvements to existing programs, and procedures • Makes practical suggestions for improving work processes in own area • Works for consensus and contributes to achievement of work group goals • Individual typically has at least 2-5 years of related experience Responsibilities: • Properly adjudicate LTC/Disability Income and Life Waiver of premium claims • Identify core claim issues, develop and execute investigative action plans to obtain essential information, and analyze claim information with the assistance of appropriate subject matter experts (medical, vocational, financial, legal, etc) • Recommend initial and ongoing liability determinations on LTC/Disability Income and Life Waiver of premium claims, and authorize benefit payments as appropriate within specified authority limits • Ability to interpret and apply policy language • Use experience gained from handling of LTC cases to identify and recommend system and procedural enhancements designed to improve the level of service provided to LTC customers thereby reducing both justified and unjustified complaints • Individual will be required to mentor and coach individuals on LTC processes/procedures and industry practices • Drive and support continuous improvement throughout the Claim Dept. Improve processes to provide a better customer experience Basic Qualifications: • 3+ years of LTC experience with the ability to demonstrate solid knowledge of LTC claims processes and industry practices • 4+ years of customer service experience with the ability to demonstrate exceptional customer service skills through oral and written communication skills, in accordance with internal and regulatory standards • 4 year college degree or equivalent of work experience • Qualified candidates must be authorized to work in the US for any employer, without requiring Visa sponsorship • Must be flexible, able to work independently and be self-driven Qualified applicants can send resumes directly to Kristine Baptiste – Sr. Recruiter at kbaptiste@massmutual.com