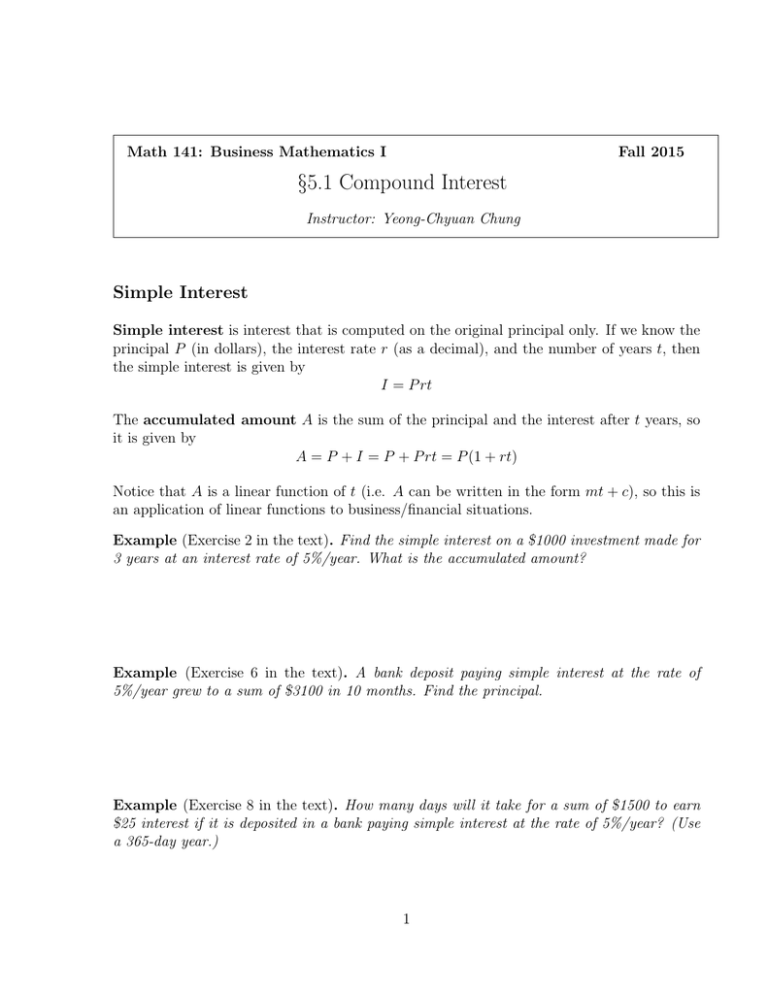

§5.1 Compound Interest Simple Interest

advertisement

Math 141: Business Mathematics I Fall 2015 §5.1 Compound Interest Instructor: Yeong-Chyuan Chung Simple Interest Simple interest is interest that is computed on the original principal only. If we know the principal P (in dollars), the interest rate r (as a decimal), and the number of years t, then the simple interest is given by I = P rt The accumulated amount A is the sum of the principal and the interest after t years, so it is given by A = P + I = P + P rt = P (1 + rt) Notice that A is a linear function of t (i.e. A can be written in the form mt + c), so this is an application of linear functions to business/financial situations. Example (Exercise 2 in the text). Find the simple interest on a $1000 investment made for 3 years at an interest rate of 5%/year. What is the accumulated amount? Example (Exercise 6 in the text). A bank deposit paying simple interest at the rate of 5%/year grew to a sum of $3100 in 10 months. Find the principal. Example (Exercise 8 in the text). How many days will it take for a sum of $1500 to earn $25 interest if it is deposited in a bank paying simple interest at the rate of 5%/year? (Use a 365-day year.) 1 2 §5.1 Compound Interest Compound Interest Compound interest is interest that is periodically added to the principal and thereafter itself earns interest at the same rate. For example, if $1000 is deposited in a bank, and the interest rate is 5%/year compounded annually, then after 1 year, we will have 1000 + 1000(.05) = $1050. After 2 years, we will have 1050 + 1050(.05) = $1102.50. After 3 years, we will have 1102.50 + 1102.50(.05) = $1157.63. The computation for the first year is exactly the same as the computation for simple interest, and we could have written it as 1000(1 + .05). Observe that the computation for the second year can be rewritten as 1050(1+.05) = 1000(1+.05)(1+.05) = 1000(1+.05)2 . Similarly, the computation for the third year can be rewritten as 1102.50(1+.05) = 1000(1+.05)2 (1+.05) = 1000(1 + .05)3 . This observation leads us to the formula for computing compound interest. If P is the principal, r is the nominal interest rate per year (as a decimal), m is the number of conversion/compounding periods per year, and t is the number of years, then the accumulated amount A is given by r A = P (1 + )mt m In the example above, we took P = 1000, r = .05, m = 1, and t was 1, 2, or 3. If the interest is compounded monthly instead of annually, then m will be 12 since there are 12 months in a year. If the interest is compounded quarterly, then m will be 4. Example (Exercise 20 in the text). Find the accumulated amount A after 4 years if $200,000 is invested at an interest rate of 8% per year compounded daily. Continuous Compounding of Interest Intuitively, the more often interest is compounded, the larger the accumulated amount will be. A question then arises as to whether the accumulated amount keeps growing without bound, or whether it approaches a particular number when the interest is compounded more and more frequently over a fixed period of time. It turns out that the latter case is what happens. §5.1 Compound Interest 3 If P is the principal, r is the interest rate compounded continuously (as a decimal), and t is the number of years, then the accumulated amount A is given by A = P ert Example (Exercise 64 in the text). Leonard’s current annual salary is $65,000. Ten years from now, how much will he need to earn to retain his present purchasing power if the rate of inflation over that period is 3%/year compounded continuously? Effective Rate of Interest The effective rate of interest is the interest rate if compounding is done annually (instead of more than once a year). It allows us to compare different interest rates with different compounding frequencies. The effective rate of interest is sometimes also called the annual percentage yield. We will use the Eff command in the Finance menu to compute effective rates of interest. The Finance menu can be accessed by pressing APPS. (If you are using a plain TI-83, then you need to press 2nd x−1 to access the Finance menu.) The syntax is as follows: Eff(annual interest rate as a percentage, the number of compounding periods per year) Example (Exercise 56 in the text). Fleet Street Savings Bank pays interest at the rate of 4.25%/year compounded weekly in a savings account, whereas Washington Bank pays interest at the rate of 4.125%/year compounded daily (assume a 365-day year.) Which bank offers a better rate of interest? Present Value Recall the compound interest formula A = P (1 + mr )mt . The principal P is often referred to as the present value, and the accumulated amount A is called the future value. In certain instances, an investor might want to know how much money he/she should invest §5.1 Compound Interest 4 now, at a given rate of interest, so that he/she will accumulate a certain sum at some future date. We can get a formula by rewriting the compound interest formula to get P in terms of A. However, we will just use the TVM Solver in the calculator for such computations. It can be used to compute the future value if the present value is given, or to compute the present value if the future value is given. The TVM Solver can be found in the Finance menu, and the required inputs are as follows: N - the total number of compounding periods I% - interest rate (as a percentage) P V - present value (principal). Entered as a negative number if invested, and a positive number if borrowed. P M T - payment amount (0 if no payments are involved) F V - future value (accumulated amount) P/Y = C/Y - the number of compounding periods per year Make sure that END is highlighted at the bottom of the screen. This means that payments are received at the end of each period. Move the cursor to the value you are solving for, and press ALPHA and ENTER. Example. How much money will be in an account after 10 years if $1000 is invested at an interest rate of 2.4%/year compounded (a) annually? (b) quarterly? (c) daily? §5.1 Compound Interest 5 Example (Exercise 54 in the text). Anthony invested a sum of money 5 years ago in a savings account that has since paid interest at the rate of 4%/year compounded quarterly. His investment is now worth $22,289.22. How much did he originally invest? Example (Exercise 80 in the text). How long will it take $12,000 to grow to $15,000 if the investment earns interest at the rate of 4%/year compounded monthly?