SIECA 2000 Contents Central American Report

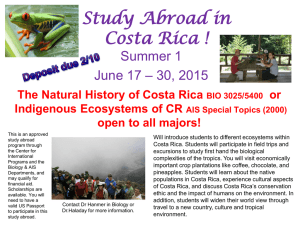

advertisement