FINANCING CONTINUING ALTERNATIVES TAPLIN (1982)

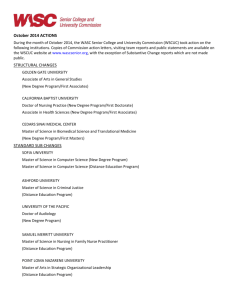

advertisement