2003/04 BUDGET COMMUNICATION The Hon. Perry G. Christie, Minister of Finance

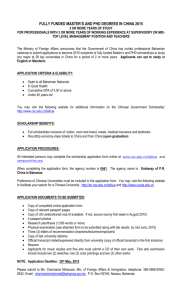

advertisement