BUDGET COMMUNICATION 2008 / 09 COMMONWEALTH OF THE BAHAMAS

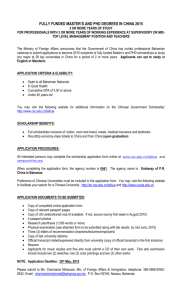

advertisement