Public FTAA.sme/inf/164 December 2, 2003

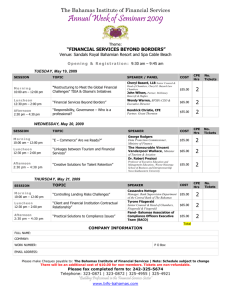

advertisement