by (1980) Wellesley College

advertisement

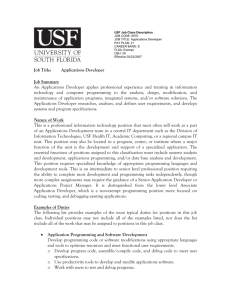

INCENTIVES FOR DEVELOPERS IN NEW YORK CITY TO PROVIDE AFFORDABLE HOMEOWNERSHIP OPPORTUNITIES by DRINA A. HOLDEN Bachelor of Arts, Economics Wellesley College (1980) Submitted to the School of Architecture in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development at the Massachusetts Institute of Technology September 1987 Copyright ( Drina A. Holden 1987 The author hereby grants to MIT permission to reproduce and to distribute copies of this thesis document in whole or in part. K.1 Signature of Author_ _ _ _ _ _ _ _ _ Drina A. Holden Department of Architecture July 31,1987 Certified by Denise DPasquale Visiting Assistant Professor Department of Urban Studies and Planning Thesis Advisor Accepted by Michael Wheeler Chairman Interdepartmental Degree Program in Real Estate Development Rotch INST TECH, AU6 3 1 191 s, INCENTIVES FOR DEVELOPERS IN NEW YORK CITY TO PROVIDE AFFORDABLE HOMEOWNERSHIP OPPORTUNITIES by DRINA ARCHER HOLDEN Submitted to the Center for Real Estate Development on July 31,1987 in partial fulfillment of the requirements for The Degree of Master of Science in Real Estate Development ABSTRACT This thesis examines the incentives which exist for developers in New York City to provide affordable homeownership opportunities. Due to the housing crisis occurring in the New York City market, there is a scarcity of affordable units. Moreover, homeownership is declining on a national level and in the City. The implications of the lack of affordable housing and declining homeownership have far reaching effects, from neighborhood stability to the labor force. Federal, State and municipal programs have attempted to address these issues through the development of programs to encourage participation on the part of the private sector. To some extent, the programs have been successful, however, production is not nearly meeting the demand. Through the examination of three actual development projects in New York City, the incentives provided for developers through these programs will be discussed. Although the use of development subsidies have mitigated some of the risks to developers, the overall process and the prospect of limited profits are impediments to increased production. Thesis Supervisor: Denise DiPasquale Title: Visiting Assistant Professor -2- TABLE OF CONTENTS PAGE LIST OF EXHIBITS . S . 0 0 0 - . . . . 0 - . .0 . . I. Affordable Housing: An Overview . . 0 INTRODUCTION - - - 0 . . . . . 5 0 0 0 0 7 . . 16 0 30 . 39 4 CHAPTER II. III. IV. V. Federal, State and Municipal Programs Developer Incentives - 0 . 0 0 . Case Studies: Flatbush Condominiums CONCLUSIONS - . . . . . Woodhaven Estates . . . . . . 46 Columbia Terrace . . . 0 . 53 - - - -3- - - . 0 0 0 . 0 . 59 LIST OF EXHIBITS PAGE FLATBUSH CONDOMINIUMS 42 WOODHAVEN ESTATES COLUMBIA TERRACE . . . . . -4- . . . . . . . . . 51 . 57 INTRODUCTION Historically, families homeownership as a result of recent years, however, earning power. were to achieve normal increases in income. housing prices The ensuing result must wait longer able have In outstripped is the young family which to purchase their first home or by default have their choice of tenure as rental. In many cities across the York nation, specifically development is expensive in New due to the rising cost increased construction costs, which to the Hence, there affordable housing stock. In economic terms, This the highest and best appears to use as exclude is an acute of land and affordable scarcity of land is going determined by housing. crisis is especially acute in New York City. crisis has the capacity housing are ultimately passed on consumer. to City, the market. The housing This particular to jeopardize the long-term economic health of the entire city. Both the to address private and the public the problem developers are sector have attempted of affordable housing. in business to produce Real estate a profitable product, in this case housing. Affordable housing by definition would require the developer to sell his product at -5- a below market rate. Without government intervention profitable venture for the developer. this would not be a Hence, the production incentive would be removed. The purpose of existing this thesis is to examine incentives for developers in New the issue of York provide affordable homeownership opportunities. the thesis market, gives an explores overview the the New York homeownership. In Chapter Federal, State and municipal the housing need II, there are descriptions programs created affordable homes. the mechanics of the These descriptions outline programs, and identify of the risks of to encourage the incentives for developers that are provided under each program. discusses some for as well as the importance of production of III to Chapter I of City arguments surrounding affordable housing in the City, City inherent in real Chapter estate development and the incentives for a developer to assume that risk. Chapter IV analyzes the described programs through actual homeownership development, impact of the previously case studies of affordable including project specific data. In the conclusion, there is a summary of the effectiveness of these incentives and recommendations for improvements. -6- CHAPTER I AFFORDABLE HOUSING: AN OVERVIEW To be meet the able to afford expense without serious affordable housing acquired for a this is clean and thesis is either in will a buyer's decent housing that decision focus which of a is on the can be buyer's income. the form owning homeownership, the topic must be "is to consequences."1 Generally, reasonable percentage Housing occupancy While something by definition, or renting. affordability of evaluated in the context of the cost of homeownership relative to the cost of renting. There are two general statistical trends which describe the problem the level income. of affordable housing. of homeownership Second, is First, is the costs relative the trend in the to trend in household level of homeownership costs relative to the costs of renting. On a national level, the cost has increased from approximately 10.64% of in 1979 to approximately 30.22% the most recent year data expected, homeownership rates younger age burden of homeownership groups. Since -7- household income of household income in 1985, is available.2 As might be are declining, particularly in 1980, homeownership as a percentage of the total population has fallen every year, for a total drop from 65.6 to 64.1 percent.3 While this overall decline appears minor (a 1.5 percent decline over a five year period), a more significant statistic, is homeownership for younger households. 25-29 age segment the decline of For households in the there was a 4 percent decline, from 41.7% in 1981 to 37.7% in 1985.4 The cost of homeownership renting bears examination. median burden rent relative Over (rent in the cost plus heating during the index same period (from 10% households overall growth which payments as a (basically financing over three times in 1979 to 34% in 1983).6 influenced the overall growth in rent. in households households that rent period, the from 27% in 1980 versus home related expenditures) of This disparity in costs has total of increase.5 This compares to an increase of homeownership charges plus the cost the 1980-1983 percentage of household income) rose 29% in 1983, a 7.4 % to Between 1980 was 6 percent. has increased from 34.4% to The 1983 the share of to 35.3% over the same time period. 7 "The current cost of owning a home is largely determined by the purchase rate, which price of the home and together determine monthly -8- the mortgage interest mortgage payments." 8 As a result, purchase a the proportionate home and service Housing prices on average are in part, prices payments turn but Moreover, in recent vulnerable to mortgages. Because have risen mortgage has to not only downpayments on years buyers interest rate than increased. Higher house higher have been volatility household mortgage houses as well. particularly in home prices and mortgage faster to higher across the country, due contribute higher a income needed construction costs . to increases in in share of residential interest rates income, they have exacerbated the affordability issue.9 Income eligibility is a measurement used whether or not a household ratio represents household will qualify for a mortgage. monthly income. Income housing representing total gross taxes, and costs reflecting mortgage mortgage principal, mortgage insurance. institutions have mortgages. household by percent of combined, have a their income higher Savings -9- & Loan income before payment and on of and Loan of residential institutions devoting more than 30 to debt, risk of are based Savings been the primary providers The monthly property taxes Historically, Data gathered to monthly interest, suggest that statistically, households to 35 expenses eligibility ratios income housing to determine all types mortgage default. of debt These findings have become an industry quasi-public agencies, such as Association (FANNIE MAE), conservative standards. repackages and most to standard, adopted even more stringent and Fannie that led the Federal National Mortgage Mae, sells mortgages for the cases requires and have which purchases, secondary market, in monthly housing expenses do not exceed 28 percent of income. 1 1 With a people, the population of slightly more New York City housing market housing affordability trends. Times article, the Northeast region family devotes 28% conventional percent, $50,000 average is reflects national According to a recent New York price of a slightly above new house in 30 year mortgage, at purchase into a an interest rate of income of In New the a and obtains a a family house. the $120,000. 12Assuming of their income to housing this translates to than seven million 10 roughly York City metropolitan area, the average price of a previously occupied house is $140,000 13, approximately 17 % higher than average prices for new homes in the Northeast region. Only 8 percent of the families in the metropolitan region have incomes over $50,000, with incomes statistics leaving 92% coupled with an residents of New York City, below average income $50,000. These of $26,000 for suggests that a large portion of the population is excluded from owner occupied housing. 1 4 -10- A general contributing homeownership costs Rising tend to usually signal hence, higher incomes or put lead to the housing prices. inflation and Households must onerous for in larger downpayments forth larger downpayments to homeownership are rise mortgage credit. higher levels of eligibility requirements of lenders. of to is the availability of interest rates because they factor have higher meet the income Consequently, the costs many households and they decide not to purchase. 1 5 The increase was in in the response to which was use of adjustable the affordability problem caused by higher mortgages in the These mortgages, by providing interest rates help homebuyers due lower of homebuyers levels of interest rates early 1970's and early 1980's. lower initial rate mortgages monthly payments to qualify for resulting from lower interest rates. 1 6 Because of high construction costs, developers tend to build luxury rental units where there is potential to command the highest York market rents. City according utilities). wide range of This to The median contract rent a 1984 relatively low survey median rent rents in the city and is -11- is $330 in New (including reflects the indicative of a very fragmented market. The highest rents in the in Manhattan, south of 96th $476, and asking rents in public housing Street, where the median rent is are estimated well, the median rent city are found at above projects. The median rent perception of New York City as city. the of apartments vacancy rate. rent as does measured The net vacancy City apartments was 1981. median not in the city was 29.3 percent these a high rent indicate by the the prevailing rate, in 1984, for 2.04 percent, down from Despite the low median in account, in part, for the disparity in the availability As figure includes the 177,282 apartments dwellings is $160.18 These figures However, $1,000. New York 2.13 percent in rent, the rent to income ratio as of 1984, an increase from 28 percent in 1981.19 In addition, primarily rent control and rent responsible for the relatively because they keep rents below stabilization are low median the market rate. rent, Rent control applies to residential buildings constructed before February 1947 in municipalities that have not declared an post-war rental under rent continuously control housing emergency. control, the tenant since apartment stabilized or is before is vacated completely -12- For an apartment must have been July end to the to be living there 1st, 1971. When a rent it becomes rent either removed from regulation. Buildings between are under rent stabilization February 1947 apartments economy. have and January increases tied 1974. to Rent Control limits the if they Rent were built stabilized fluctuations in the rent a landlord may charge for apartments and restricts the right of a landlord to evict tenants. A developer must either wait for tenants of rent controlled buildings to move or buy them out. By contrast, a developer to wait of commercial property only has until existing leases expire. 2 0 High housing construction and contribute to the developer prices, increases depressed The low the high production contrast, cost of to rent cost of land, provide of substantial production control factors in incentives for end of the market. truly new of housing a previously mentioned developers to supply the high is due the decision regarding what type provides. addition to rents in The result affordable housing in the luxury end and by of the market. Homeownership is stability and community. is a determining factor evidence Moreover, of homeownership transformation of deteriorating the purchase economic is investment a key neighborhoods. of solidly constructed, but -13- in neighborhood in factor a in For example, deteriorated homes in neglected areas, and considered gentrification. the transformation of a subsequent rehabilitation, By definition economic development has ceased. The opportunities in and investment provision these impact, to spur economic gentrification is deteriorated neighborhood. contains many distressed neighborhoods. of is New York For various reasons, in some of affordable neighborhoods would these areas homeownership have a dual investment and promote neighborhood stability. The need goes beyond for affordable homeownership the issue of neighborhood in urban areas such as New York City. arguments for affordable homeownership homebuyers. A more critical affordable housing for stability, especially On a national level, focus on first time issue to the economic viability of urban areas, particularly, New of opportunities York City, is the question middle/moderate income Families in the $25,000-$48,000 workers. income range, whether or not they are first time homebuyers, are the backbone of the labor force, because they supply support services to businesses. In a recent New York Times article, a leading accounting firm announced its the city. could no intentions to The reason cited move its operations was that the longer find affordable housing commute.21 Usually the decision -14- outside of company's workers within a reasonable to relocate outside of the city is due to rising commercial rents. This segment of the labor force is being disenfranchised from the housing market, particularly if their choice of tenure is to own. provision of affordable Hence, the homeownership opportunities at lower costs to middle/moderate income groups is important in order to encourage this segment of the labor force to remain in the City. Aside from the importance of homeownership to neighborhood stability and labor force access, there are also the social benefits Homeownership is such it success. implied by a central has become Americans a homeownership to part of valued expect to the American symbol of consider. dream, as independence work hard and and through normal and expected increases in income be able to achieve the goal of "For owning their own home. represents financial security, to adapt a them, homeownership comfort, privacy, the freedom dwelling to individual and family needs, and the intangible sense of belonging to a community." 2 2 -15- CHAPTER II FEDERAL, STATE AND MUNICIPAL PROGRAMS The following is a description available on the Federal, of some of the programs State and Municipal level to provide affordable homeownership opportunities: THE NEW HOMES PROGRAM UNDER THE NEW YORK CITY PARTNERSHIP The New Homes City Partnership, New York City Development. is a private Program is administered by The New York with municipal assistance provided Department of Housing by The Preservation and The New York City Partnership (The Partnership) organization, composed of business and civic leaders concerned with pertinent issues affecting the City as a whole. The intent of the New Homes Program is to "Provide homeownership opportunities for moderate- and middle- income families in the $25,000 - $48,000 income range, who have been priced out of the New current program, York City housing market." 2 3 Under the approximately 1200 homes have been completed.24 Basically, the developer enters The Partnership Consequently, to act he agrees as to the into an agreement with builder build, design -16- of the units. and finance the now builder agrees price. affordable sales limit his profit costs, less less to any guaranteed subsidies represents public 10 percent of public subsidies the total development contingency and the agrees to the developer Moreover, overruns are the sole Hence, any cost for a the project to build cost, which maximum The developer, risk this entails. assume the project, and costs. responsibility of the developer and can potentially reduce his profit. 2 5 The majority City-owned City to of the Partnership projects land. The The New Company,Inc., (The potential site York City Fund), are built on is conveyed Housing from the Development a non-profit entity. Fund The Fund is in direct contract with the developer to build and market the project. Because of Article XI the The Fund's corporation), developer the from paying non-profit status structure of the mortgage (as an deal exempts recording tax on the construction loan, sales tax on construction materials, state property transfer New York unit. the tax and capital gains transfer City transfer tax is The State property transfer sales price construction 1% of the sales of the materials building materials. dwelling is equal unit. to 8% The as 1 % of the face amount of the mortgage. The price of the tax is equal to .04% of sales tax of the The mortgage recording tax -17- tax. hard on cost is computed The capital gains transfer tax is usually computed as 10% of the developer's profit on a single family home or condominium unit. 2 6 The developer does not own or hold title The Fund, as the actual owner interest in the site to to the site. of the site, mortgages its fee the lender on behalf of the developer, so that the developer can obtain financing without title. The City conducts an site to determine the value independent appraisal of the parcel. At of the this point, The Partnership assigns a value to the site, of $500 per unit constructed on the site. Based on the number of units built on the site, this becomes the developers assigned acquisition costs. The lowered acquisition cost favor of the developer. value of the site is in fact a subsidy in The difference between the appraised and the developer's acquisition becomes a lien on the property assumed by the homebuyer. lien is over a fifteen The year period and diminishes 1/15th for every year the unit is held. out of resale cost The lien is repaid by the buyer proceeds at the time the unit is sold. These factors work in conjunction not only to lower the sales price of the homes to the eligible buyers but to lower the acquisition cost to the developer. 2 7 Two sources of public funds to provide Federal monies are available in subsidies for this program. the form are combined of Urban Development -18- Action Grants (UDAG's) up to also available from cannot exceed These funds are Partnership. a limit 40 sources for Subsidy contributions from $15,000. percent of administered the and City Assistance funds of $10,000 Affordable Housing York State the New Corporation (AHC) up to AHC Funds are private investment capital. be $3 of there must of UDAG funds in the project For every $1 $15,000 per unit. per unit. total project disbursed cost. through the are also available up to Total subsidies projects participating in the from public New Homes Program cannot exceed $25,000 per unit.28 Lenders familiar with the program, provide construction financing, typically developer for requiring personal guarantees construction completion. lenders will accept the public participation from put forth lower project. More importantly, subsidies as proxy for equity the developer. Hence, the developer can amounts of equity capital than However, from the the developer in a regular continues to be "at risk" for the entire amount of the construction loan and subject to interest rate fluctuations.29 The obligation for the passed onto the property. bearing. The homebuyer lien is If owner occupancy repayment of these subsidies is in the form of non-amortizing a and lien on the non-interest exceeds fifteen years, the lien -19- is removed and the loan is forgiven. Otherwise, the loan is repaid from 50 percent on the gain on the property at resale. The homeowner is required to have the unit as his principal residence. If the home is resold within three years the next buyer must meet the income eligibility an income under the $48,000 limit. period, any buyer can purchase guidelines of having After the three year the home whether or not their annual income is below $48,000. However, liens are repayable by meet the subsequent buyers, if they guidelines the lien is assumed by owner has an income above income eligibility the new owner. $48,000 the lien is If the new repayable at the time of the resale. 3 0 The proceeds from construction loan borrowed funds. monies owed for the which sale of has the the first The developer and The non-subsidized units repay position of the any Partnership are paid development costs. The developer can then deduct the limited profit which may or may not equal 10 percent of the project costs City Assistance funds, UDAG funds less subsidies. and AHC funds are paid, in that order. 3 1 In assistance Program. addition, the to developers Partnership who participate Technical assistance funds -20- offers in the technical New Homes are available through a cooperative agreement between the Department of Urban Development (HUD), and The Partnership. $25,000 are available to developers surveys and preliminary design for schematics. Housing and Funds of up to soils analysis, As well, The New York State Division of Housing and Community Renewal provides seed loan for up money to developers participating in the program such as architectural and legal fees. front costs , This loan is a zero- interest loan that is given prior to the construction commitment construction loan. , with All funds repayment expected are administered from the through The Partnership. 32 SECTION 235 PROGRAM Section 235, began in 1980 as the original component of the City's in all of homeownership program. Projects have boroughs except Staten Island. the 235 Program is the been built A critical component Mortgage Subsidy Program, administered through HUD, which enables families with incomes under $35,000 purchase limited , homes. by the who otherwise Sales prices program would be of section guidelines to ineligible, 235 homes $57,000 for three-bedroom home and $66,000 for a four- bedroom home. Section 235 Program is currently Federal cutbacks. To date, -21- the being phased program out due has to are a The to produced approximately 1100 homes. 3 3 Section 235 Developers parcels. Proposal(RFP) complete are homes are on which Request a developer is chosen to the acquisition cost was $500 per unit built on the parcel. For projects the acquisition the after appraised value program the projects begun For before 1986, begun For owned City a selected through process, by a project. constructed 1986, of the parcel. Similar to cost is the Partnership difference between the acquisition cost and the appraised value is payable by the individual purchaser at the closing of his income eligible designs, builds home or assumed as purchasers. and loan from a private 235 homes are built for a the sales price caps from the City The finances through a a lien designated construction of the fixed sales price, not up case of developer construction lender. described above. providing in the homes Section to exceed Subsidies are awarded to $15,000 per unit in City Assistance, and for homes built after 1986, up to $13,500 per unit in combined UDAG or AHC units equal to lien is the the the amount of the resold. program are available a A lien is placed on the construction subsidy. responsibility of the homebuyer to home is owning funds. home which Houses built under translates into -22- be paid when the Section to anyone able to afford families The 235 the costs of which are approved for a mortgage by a conventional lender. The single requirement is that the units remain owner occupied. 3 4 BRONX NEW HOMES PROGRAM The Bronx New Program, aims to provide moderate income produced over Bronx. The homes, in Homes Program, similar to homeownership opportunities target market. three hundred project is At present, units in designed for single units are targeted for sale for a the program has several sites the $70,000-$80,000 price range. percent of the the New Homes in the family attached At least ninety to families with incomes below $48,000.35 Developers Proposal process. builder, and is are selected through responsible for allocated in for design, construction The acquisition cost of $500 per unit built on the parcel. available, Request for The selected developer acts as the financing the project. are the $15,000 payments during per and the land is City Assistance subsidies unit. The the construction subsidy phase. is Upon completion and sale of the homes to purchasers, the remainder of the land price is Assistance funds payable. The subsidy derived from City convert into liens on the property similar to those described under The New Homes Program. 3 6 -23- Several mortgages are presenthomes 421b tax State of New York available built under abatement. for New the program The tax abatement initially pay property taxes on years, taxes on the house are homeowner Mortgage Agency will pay Homes units. are entitled At to the allows homeowners to the land alone. phased in. approximately (SONYMA) half After three At five years, the the fully assessed property taxes with the full assessment paid after the eighth year.37 NEHEMIAH The Nehemiah Program is East Brooklyn administered by a coalition of Churches known as the Nehemiah Plan. The program was founded in 1982 to build single-family row houses in the Brownsville and East The objective is to provide the moderate income units various are sold phases of sales prices of New for of Brooklyn. affordable housing for people in bracket. Both two $43,500. Roughly production and three 2,000 bedroom homes are in under the program. The are attributable to several factors. The City York has made dwelling unit. New York sections large acreage available for In addition, low $1.00 per City Assistance is available in the amount of $10,000 per dwelling unit. -24- The City has agreed to complete street paving and other infrastructure work in the public right of way.38 Nehemiah further which is used by benefits from the developer as a large private grant an interest-free loan during the construction phase. Because these are very large sites, development costs and in turn purchase prices, can be reduced significantly by economies of scale. 3 9 The Nehemiah development process process in the other Coalition of for a programs in license to build on City - owned in by the the $43,500. After City. amount completion, the subsidy the sale with the city land. Construction from the coalition members. Site preparation, including demolition completed The a private interest free revolving fund obtained from contributions available several respects. East Brooklyn Churches contracts financing is provided from is is different from the City of and removal of rubble Assistance $10,000 per serves to reduce the of the units the funds unit. are Upon sales price to City Assistance subsidy becomes a permanent lien on the property .40 Neither Nehemiah homes. State nor Federal Subsidies All units have Authority (SONYMA) set-aside are utilized in a State of New York Mortgage which guarantees all purchasers -25- mortgages at SONYMA Nehemiah units are "Under this the rates, currently 9.2%. entitled to a twenty In year tax abatement. abatement, homeowners are obligated pre-existing occupancy. land tax After the for tenth gradually until the exemption ends the first year, taxes phased in and the addition, to pay only ten on years the home 20th year, at which property is taxed at of are time the its fully assessed value." 41 OTHER SOURCES OF PUBLIC SUBSIDIES DEPARTMENT OF HOUSING AND URBAN RENEWAL Federal cutbacks have clearly affordable housing programs which been evident came under the auspices of The Department of Housing and Urban Development (HUD). the advent have been Urban of these cutbacks, HUD's curtailed. Development subsidies for Partnership and However, HUD Action affordable Grants Development, HUD grants are for technical . Since previous contributions is still the (UDAG's) homeownership. the Department in of Housing source for which Through provide the NYC Preservation and available to designated projects assistance, 42 -26- such as site feasibility URBAN DEVELOPMENT ACTION GRANTS As previously mentioned, Grants are available to Urban Development partially finance development costs. A maximum of $15,000 per unit is provided by HUD. be at least $3 of funds in private investment the project. The funds are There must for every $1 of UDAG disbursed as work is completed, based on a predetermined leverage ratio. are derived from subordinate UDAGs financing, Action in the which form is of Benefits zero-interest attractive to both the developer and to the conventional lender in the project. The benefit to the end user is in a reduced purchase price due to the subsidies. 4 3 AFFORDABLE HOMEOWNERSHIP PROGRAM During the established a 1985 session, the State subsidiary corporation of the Legislature Housing Finance Agency (HFA), the Affordable Housing Corporation (AHC). administers Program. Program is moderate the "The Affordable purpose to promote income. AHC Home of the Ownership Affordable homeownership by provides Development Home persons of financial AHC, Ownership low and assistance, in conjunction with other private and public investment, for the acquisition, construction and -27- rehabilitation and improvement of owner occupied housing. By reducing rehabilitation costs, the assistance development and provided is expected to make homeownership affordable to families and individuals for whom there are no other reasonable ownership alternatives in the development connection blighted in affordable home the private market. Additionally, and rehabilitation activities undertaken in with this program are neighborhoods, blighted. and It is or expected to those in danger also expected to create communities throughout the help improve State. of becoming jobs and stability Eligible applicants under the program are municipalities, housing development fund companies charitable or any organization not-for-profit which has as corporation one of its or primary purposes the improvement of housing." 44 Funds Affordable are available funds exist, in that there to partially State finance must be $3 of private Again, work is completed, based predetermined leverage ratio. awards cannot York AHC funds in the project. disbursed again as funds can be New Guidelines similar to those applicable to investment for every $1 of funds are from the Housing Corporation,(AHC), development costs. UDAG also No more than 50% of the grant used in a single municipality. exceed $15,000 per unit or project cost, whichever is less. -28- 45 on a As well, grant 40% of the total STATE OF NEW YORK MORTGAGE AGENCY The State public of New benefit affordable offers corporation housing for below York Mortgage market tax-exempt revenue New bonds. formed York rate the mission provide New State residents. SONYMA mortgages through opportunities. Affordable The Housing the sale from the sale of of these mortgages originated by a network of the Yorkers 1970 is a provide of participating lenders statewide. Cuomo, in (SONYMA) to Proceeds bonds are used to purchase Agency In 1983, under Governor agency was with better mortgage Program, loan changed in order to affordable housing program, began to center renamed on the "forward commitments" made by the agency to purchase new, below market rate mortgages from purchasing seasoned lenders instead mortgages. of the Hence, old method creating a immediate secondary market for residential mortgages. mortgages are available to purchasers of constructed homes at a years with a minimum 5% program must fixed rate for down payment. be first-time economically distressed homeowner requirement is waived). 46 -29- more SONYMA existing and newly a maximum of thirty Beneficiaries of this homebuyers, except neighborhoods of (where in targeted, the first-time CHAPTER III DEVELOPER INCENTIVES The role of the developer in any real estate project is analogous to that the pivot for of a producer of a motion all the absence of the components of picture. the project. developer or the producer there He is In the is no vision of what the end product can be, moreover there is no strategy to realize that vision. coordination and The developer is responsible for the negotiation responsibilities include site of the project. These identification and feasibility analysis, acquisition, financing, construction, marketing and sales. The skills involved draw from a wide range of disciplines, from engineering and architecture to finance and law. The organizer. developer He has is to the consummate rely on the tradesmen to complete his project. desires the developer to the objectively and One of must team members. realistically members, and ensure project. capabilities of and other There is a great deal of For team work to be productive and cost - teamwork involved. effective, negotiator be able He to communicate must be able to the abilities that they can fulfill his the keys to business is project management. must be adequately addressed. -30- success in of the his assess team vision of the the real estate Every detail of the project At every point in the development process there is some element of risk. interrelated. risks, The risks There which all project. A and Success control of the magnitudes of profitability of decision is the amount of risk he the risks often times developer's depends on the ability construction risk, inherent in the subsidy provided by to the burden of some a to is willing to to identify, assess a project. There financing risk and absorption result of shift types and the potential part undertake a project, assume. project are are different impact large of a risk. is The homeownership programs is of these risks from the increase the developer. The intent production of available to the use of mitigate a of the affordable programs housing the target market. subsidies. portion of the The program. thus, When the to and make the achieved by to the project. price of the units to the part risks in product subsidy is developer's risk in satisfying the The intent is effect of Moreover, the subsidies reduce the homebuyer, is of a project the intent of are diminished, the an incentive exists for the developer to consider going forward with result, the production project. of The affordable should housing, -31- then be meeting the increased original obj ective. Subsidies are applied to of the development financing. similar, The available subsidize in the the case and buildable applications. usually process, acquisition, construction, and structure and mechanics of they demonstrated the most risk sensitive areas risks of studies, sites are the programs are the project. acquisition As costs lowered through of subsidy In unsubsidized development, acquisition costs equal the appraised value of the property. The subsidy defers a portion of the cost of the land by attaching a lien on the property which defers payment of the remainder of the appraised value until the unit is resold. Subsidies are also directly applied to costs during the construction phase. These subsidies non-interest bearing contribution to the Repayment of resale of this subsidy the contribution to unit are in the form construction loan. comes from profits by the these costs, buyer. the of a realized from Aside primary from their benefit of the subsidy is that lenders will accept it as proxy for equity in construction financing. As a result, in the case studies relatively little equity was put forth by the developers. In addition, during the construction -32- phase there is always must the risk of construction demonstrate project, prior the cost overuns. capacity to designation. to build Developers and All of the finance the developers have development experience, however every project must be managed individually schedule. to control Those confident that who costs participate based on their capacity to control costs. key to affordable and deliver in the project these experience, on programs are they have the In this instance, cost control is housing developer's profit is limited. construction because the Therefore, cost overuns would have a negative impact as deductions from their profits. The structure of the program also allows for the waiver of certain municipal and state "taxes" because title is never passed directly to the builder. This structure exempts the builder from mortgage recording tax on the construction loan, state property transfer tax, tax on construction building materials, and the capital gains transfer tax. Due to the developer product has time factor the additional is completed, the rates are below his original to command the alleviated involved in prices risk market is by the soft. If time his absorption projections, he may not be able he had by participation that development, the anticipated. in affordable -33- This risk is housing programs where historically there has been a waiting list of potential applicants that example, a exceeds the number of recent project Partnership has families.47 The by New York 594 apartments and A captive market units available. City Housing a waiting list exists For of 5,000 where demand exceeds supply. Developers also participate in the program in order to gain experience and establish credibility. risks involved mitigated as conventional an incentive for the in the program. to in refine and As discussed, the development have been developers to participate Herein lies an opportunity for the developer practice his craft in a somewhat sheltered environment. Participation in the program also allows a developer to establish contacts and City approvals familiarity in and permitting working through process. the developer in all likelihood In the future projects will negotiate with the same politicians and city bureaucrats. Knowing how to expedite a project through this process is a cost savings because of the construction loan interest the developer is accruing. As innovative construction costs methods to rise reduce -34- developers these costs. seek new Attempting and to lower costs with prototypes has the prefabricated modules become an construction appropriate of backdrop and simpler design builders. Again, alternative for affordable for the housing builder provides to an test design fraught with risks. Again, prototypes, in an effort to control costs. Real estate development is the objective of affordable housing programs the production of such Although the developer, developer. lower accepting trade-off For the risk. housing by private sector developers. program endeavors to the a there is these types housing project the is mitigate the risk limited limited profit, However is to increase of profit to the for the the developer obtains another opportunity cost to projects. For every developer accepts with the affordable promise of a limited profit he forgoes other projects. The build opportunity cost and develop development is for a affordable inherently real estate homes is a high risk developer to high. Real business. estate For a developer to undertake risk, reward must be the trade-off. A balance is struck between the subsequent reward which undertaking that risk. subsidy programs amount of risk assumed and the compensates Developers the developer who participate in public to provide affordable housing -35- for must usually limit their profit to some extent. Homes program the total development costs. higher than will In the case of developers profit If total is limited Conversely developer to deliver there is to 10% development costs originally projected then the be less. the New of are developers profit no incentive for the project below cost the since profit is limited to 10%, he cannot realize any cost savings. The amount of risk the developer must limited profit may be the same in a project programs as the amount of risk assumed where the profit is not described in this thesis portion of the developer's risk, still responsible for undertake for a limited. attempt Although the to mitigate a in essence the developer is construction loans and subject to interest rate fluctuations during the time period the loan is outstanding. The developer acts as the does not hold title to clever and complex the land. structure of great deal of risk. -36- builder, however he The developer, despite the these programs, assumes a CHAPTER IV CASE STUDIES As has been suggested, sector production in order to must offer of affordable housing programs to the developers. concrete and quantifiable incentives programs described developers promote private incentives for have attempted to provide through direct and The indirect subsidies. Direct subsidies as applied, lower the acquisition and construction costs. are waiver Indirect subsidies of municipal taxes on construction materials. affordable units by derived in form of costs, specifically a land and The programs promote the building of attempting builder is exposed to the to mitigate the risks the during the normal development process. Diminished or controlled risk is the incentive for developers presented by the realizes a profit, programs. In addition, limited to 10 percent the developer of the development costs less any subsidies and contingency costs. The following section describes how selected programs in the New York City market have achieved the desired results, stimulating the private sector to provide affordable housing. Moreover, contribution the analysis and impact of attempts to the subsidies programs. -37- determine the provided by the Both the Condominiums Program, last phase between fall under administered Partnership. Area. Woodhaven Project of housing in the builder Assistance by Preservation Funds. The New the York The Columbia Street developed under The New and New City Homes Housing Columbia Terrace Project is the is being and of auspices the Phase V of the This project Housing the proposed Flatbush and the York an agreement City Department Development, initial phases Urban Renewal utilizing of the of City project were completed under the Section 235 Program before its demise. -38- FLATBUSH CONDOMINIUMS The Project The located project of 72 Brooklyn, consists form condominium of buildings. The project and under sponsored by The the units Bushwick developed in is being of in the three twenty-four in section new construction story conjunction Catholic Charities of Brooklyn & auspices of The New Homes New York City Partnership. Church has contributed the remaining the units of with The Holy Cross Church, Queens, in 90% of the site to 10% coming from held by the Partnership, the the City. Program The Holy Cross the project, with Title to the land "right" to build is conveyed to the developer who then becomes a contract builder. 4 8 Development Objectives The New Homes of distressed Program specifically targets utilization sites, economically feasible. which otherwise would not be To achieve this goal, use of the site in the program and subsequent development of the site must be profitable for the developer. The builder/ developer sought to realize a reasonable return, partnership developing which is -39- (10% was satisfactory). this site includes The a builder/contractor. One of the objectives of the builder is to test design prototypes that might prove cost efficient for the Because projects. future includes partnership an experienced contractor, as developers they are confident they can This costs. control of profitability the project decision to Any cost over runs are addition, project in this the is the New Homes An underlying reason for their participation in the Program. program In profits. partnership's first development the the developer/builder and consequently the responsibility of potential to critical their and participate in the New Homes Program. erode is point was working with to gain experience and develop expertise city agencies through the in development process. This type of experience is invaluable in terms of familiarity with the city approval process and contacts within the were determined by the per bureaucratic system. 4 9 Project Summary Prices for the 72 units square foot development costs before the subsidy was applied. This method enabled the developer to basically determine the sales price for the units. two - The bedroom apartments and 48 determining the per square projected unit mix is for 24 three-bedroom units. foot costs -40- and After the number of in each square feet price. base unit type, the public subsidy The This price. amenities, for base on a per unit basis was of each unit for a subsidized subtracted from the base price sales at a developer arrived price was adjusted example, parking spaces and for various direct access to the unit. 5 0 The developer's price estimates for the units are in the following chart: TYPE First Fl. Two BR Second Fl. Third Fl. UNITS $84,400 $82,500 13 Two BR(P) 87,400 85,500 11 Three BR 95,000 93,500 91,000 25 ThreeBR(P 98,000 96,500 94,000 23 TOTAL $8,015,300 Analysis of Pro Forma Total revenues from the sale of the units are projected at $8,015,300.(refer to costs of components the project are of the Exhibit 1) The total development estimated at $7,436,383. total development -41- costs The key are land FLATBUSH CONDOMINIUMS DEVELOPMENT PRO FORMA - PERCENT OF TOTAL TOTAL COST PER SQ. FT. PER UNIT LAND COSTS $207,500 230,400 115,200 2.797 3.10Z 1.55 $2.85 3.17 1.58 $2,882 553,100 7.44% 7.61 7,682 3.787 19.36Z 3.207 5.307. 4.947 1.557. 13.167 6.6371 3.86 11.09 19.81 3.27 5.42 5.05 1.58 13.46 6.78 3),900 11,200 20,000 5,112,736 68.75Z 70.33 71,010 175,000 90,000 95,000 150,000 7,500 1,047,775 2.357 1.21% 1.287. 2.02% 0.10% 14.09% 2.41 1.24 1.31 2.06 0.10 14.41 2,431 1,250 1,319 2,083 104 14,552 Sub Total/Soft Costs MISCELLANEOUS CONTINGENCY 1,565,275 21. 05. 21.53 21,740 205,272 2.767 2.82 2,851 TOTAL DEVELOPMENT COST 7,436,383 102.29 103,283 Land Aquisition Site Costs Excavation/Fill Sub Total 3,200 1,600 CONSTRUCTION COSTS Foundation Masonry Carpentry Electrical HVAC Plumbing Roofing Other Costs General Cond. Sub Total/Hard Costs 280,800 806,400 1,440,000 237,600 10.84Z 394, 200 367,200 115,200 978,336 493,000 3,300 5,475 5,100 1,600 13,588 6,847 DEVELOPMENT COSTS Arch./Eng. Legal/Acct. Sales/Mktg. Insurance Taxes Misc. PROFITABILITY Total Revenues From Sellout Public Subsidy 100. 007.1 $6,550,605 $1,464,500 $8,015,105 Less Total Development Costs Developer's Fee Subsidy Percentage Contribution $7,436,383 578,722 19.697 Source: Author's calculations per figures provided by developer of Flatbush Condominiums, Alan Bell and Nick Lembo, June 19,1987 -42- acquisition, hard preliminary (construction) costs, fees such This reflects as architecture land acquisition total development costs). (68.75%), and and soft costs for and legal expenses. costs of $207,500,(2.79% of Construction costs were $5,112,736 soft costs were $1,565,275, reflecting 21.05% of total development costs. 5 1 The subsidies in this project lowered acquisition costs and the cost of construction. the structure of The New of the land lowered. from The As City described in on the land By virtue of Homes Program, the acquisition cost of New York was substantially the Program description was conveyed to the developer for built the parcel, amounting the land the price of $500 per unit to $3,000. The difference between the appraised value of the parcel and the amount paid ($24,500) becomes a non-amortizing, non-interest bearing lien on the property distributed over the total number of units in the project. defer As well, The a portion of the Holy Cross Church has land acquisition $155,000 , to be repaid from units. The effect of acquisition cost of appears be to $1,440,000 was construction costs. subsidy 2.79 percent applied payment equalling the proceeds of the sale of the this relatively agreed to of the low. to The total cost public infrastructure The application -43- is reflected in the which subsidy and of the subsidy of hard to the construction costs had a substantial impact because construction costs made up 68.75% of total development costs. In addition there is an implied subsidy derived from the tax waiver. from the savings The New York City transfer tax is 1% of the sales price of the unit. The State transfer tax is equal to 4/10ths of 1 % of the sales price of the dwelling unit. The sales tax on building materials is equal to 8% of the hard cost building materials. is computed as 1 % of the face amount capital gains transfer tax is developer's unit. profit on These costs are benefit The mortgage recording tax to the of the mortgage. The usually computed as 10% of the a single family home or condominium quantifiable and constitute a subsidy developer. Because the developer does not hold title to the site under the New Homes Program, he is not subject to these taxes. As mentioned fee of $578,722 in the previous chapter, is calculated as 10 development costs minus subsidies the developers percent of the total and contingency costs, and in this case, is less the $155,000 of Church owned land. The significant impact of the subsidy is considered development cost. as In the case subsidy contribution as the subsidies are evident if a percentage of of the Flatbush a percentage is @ -44- the total Project the 20 percent. This constitutes a substantial contribution to of the deal. Without the subsidies available this project would program feasible. -45- not have the profitability been through this economically WOODHAVEN ESTATES The Project Woodhaven homes Estates consists located on a Woodhaven section January 1985. the project. previously of Queens. owned parcel The project was The units of @ 1,144 sq.ft. in the completed in each, are intended with an income generating rental Rental units are common in this area of Queens, moreover, "as of right" The owner occupied zoning permitted this configuration. unit has a small gives it additional space. the New Homes City two-family detached All ten homes were sold prior to completion of for single family occupancy tenant unit. of 10 unfinished cellar which This project was initiated under Program in conjunction with The New York City Partnership. 52 Eligible purchasers, the program, $48,000. could not have The homes required downpayment year term, and income than generated market payment as per the from a were the income a family income sold for of 10%. A a piece with mortgage at 10%, with a 30 comparables, enabled the would of $48,000. the rental when buyer unit, to have require a However, estimated applied to -46- which exceeded $125,000 10% downpayment limit guidelines of the a the higher income as $600 monthly using housing lower income.53 The market value of the homes was estimated by the developer to be $175,000. The designated developer builder/contractor, originally for Woodhaven Estates is an by architect a training. Initially, the parcel was offered for sale through an auction conducted by the Department of Real Estate of the City of New York. The minimum bid for the parcel started at $60,000 with no takers at this price. The Woodhaven area is primarily an owner-occupied residential neighborhood. of a bid as site was an indicator, the not Citing the absence developer deduced "economically feasible" for that this conventional development and therefore an excellent candidate for the New Homes Program.54 The low bid was indicative of reluctance on the part of builders to undertake the risk of the project. The risk being that development of the parcel would not yield substantial After two returns, despite years of the surrounding lengthy negotiation, released to the New York City the neighborhood. parcel was Partnership for use in the New Homes Program. Project Summary The derived prices for as a the homes in Woodhaven Estates function of the cost of development. -47- were Total development costs on $159,000 prior to subsidy was applied a per unit any public of sales price of $125,000. high. This fact is to each The month time frame. closed A due to the public subsidized configuration of the homes per home, entitling the developer Actual unit, as opposed completed during a fifteen construction was completed in nine of 1985, a list of to further per unit The subsidy in this project appears project was By January approximately resulting in subsidy consideration for each home. months. subsidy. $35,000 , which allows for two units to separate basis were applicants. potential buyers was Within a three month time period the project was completely sold. 5 5 Developer Objectives The developer of Woodhaven Estates is primarily a developer of luxury homes and condominiums in the Long Island area. Woodhaven Estates developer's career, track record as was which aided in the a developer. Bushwick section of is projects. As a developer of development of portfolio in the of his experience 1986 he will develop 39 units Brooklyn. incentive project establishment of his As a result with the Woodhaven project, in in the an earlier balance In this relative to instance his his other luxury units in Long Island the affordable housing is a -48- stark contrast. The market for luxury construction is is vulnerable experienced controlled units builder, and he the precarious, to interest feels project be well volatility. confident will as costs delivered the As an can be on time. However, the market for luxury units is subject to absorption rate changes. Absorption rates may differ from the outset of the project to the end the demand experience for affordable with replicated in of the project. the housing sellout Bushtick, the affordable units in the for affordable housing. of As previously cited, is strong. Woodhaven capacity for the Estates his is absorption of market will demonstrate The If the demand structure of the projects under the New Homes program offer the developer a profit limited to 10% if cost over runs "core crew" of the able to need for luxury units is soft. addition, his in the event The developer projects accordingly, anticipating he do luxury workers on In laborers are assured employment market for scheduled his can be controlled. building and both these projects are additional contingency cost labor, they of the project. has will be affordable housing. The the same, if there is a are The hired out of the subsidies he received as the designated developer were accepted by his construction lender as his share of equity in the project. 5 6 -49- Pro Forma Analysis Total development costs for the project were $1,488,070, which included land acquisition and site costs of $321,320, representing 21.59% construction $198,450 costs of (13.34%).(refer cost of the acquisition cost of total development $847,500 (56.95%) to costs for the project were total of Exhibit 2) this particular Homes Program. As Total costs of acquisition $77,000 representing 5.18% of the project. Relative to a 2.79% of total development Flatbush project, this figure is high. of and Soft costs, parcel were previously subsidized costs in the The acquisition costs not subsidized stated, prior by the New to 1985, the guidelines for the program stated that land acquisition costs were carried Funds at appraised value. in the amount of to infrastructure applied substantially incurred, higher bringing $70,000 However, or $7,000 costs. Land/Site the City Assistance per unit, Without costs percentage to this were subsidy would have 26.30% of been total development costs . The effect of the subsidy is reflected in the lower 21.59% of total development costs. Hard construction costs for homes constituted 56.95% the development of the ten of total -50- development costs. The THE WOODHAVEN PROJECT DEVELOPMENT PRO FORMA PER SQ. FT. PERCENT OF TOTAL TOTAL COST PER UNIT LAND COSTS $77,070 114,250 130,000 5.18 7.681 B.74Z $3.37 $4.99 $5.68 $7,707 $11,425 $13,000 321,320 21.591 $14.04 $32,132 5.71Z 4.70Z 5.04Z 3.161 2.69Z 5.38Z 1.681 25.91Z 2.691 $3.72 $3.06 $3.28 $2.05 $1.75 $3.50 $1.09 $16.85 $1.75 $8,500 Roofing Other Costs General Cond. 85,000 70,000 75,000 47,000 40,000 80,000 25,000 385,500 40,000 $7,500 $4,700 $4,000 $8,000 $2,500 $38,550 $4,000 Sub Total/Hard Costs 847,500 56.951 $37.04 $84,750 13,000 12,000 10,000 5,000 3,000 155,450 0.87Z 0.812 0.671 0.34% 0.20Z 10.451 $0.57 $0.52 $0.44 $0.22 $0.13 $6.79 $1,300 $1,200 $1,000 $500 $300 $15,545 Sub Total/Soft Costs 198,450 13. 34Z $8.67 $19,845 MISCELLANEOUS CONTINGENCY 319,250 120,800 8.121 $5.28 $12,080 1,488,070 100.00-1 $65.04 $148,807 Land Aquisition Site Costs Excavation/Fill Sub Total CONSTRUCTION COSTS Foundation Masonry Carpentry Electrical HVAC Pluabing $7,000 DEVELOPMENT COSTS Arch./Eng. Legal/Acct. Sales/Mktg. Insurance Taxes Misc. TOTAL DEVELOPMENT COST PROFITABILITY Total Revenues From Sellout Public Subsidy $1,250,000 $350,000 $1,600,000 Less Total Development Costs Developer's Fee Subsidy Percentage Contribution $1,48S,070 111,930 23. 52i Source: Author's calculations per figures provided by developer Leslie J.Lerner, Woodhaven Estates, June 23,1987 -51- bulk of the costs. public subsidy Total soft costs. The was applied costs were effect of 13.34% of the waiver sales taxes, is demonstrated to these building total development of specific property and by taxes contributing less than a third of one percent to total costs. Total revenues constituted sold at $125,000 each. $1,250,000 The developers fee for ten homes of $101,700, was calculated as 10 percent of the total development costs minus the subsidies and the contingencies. the subsidy on The the project is recognized subsidy percentage contribution to total overall effect of by calculating the development costs. Almost a quarter, 23.52%, of the total development costs were paid for by the the subsidy. homes might In this case, have been able to without the subsidy command a market price igher than the per unit cost of production, depending on the faith of the potential purchasers neighborhood. However, not be affordable income bracket. it is in the attributes clear that these to families within the The subsidy of the homes would $25,000 to $48,000 therefore, actually lowered the purchase price of the home for the target market. -52- COLUMBIA TERRACE The Project Columbia Terrace is a 180 unit residential condominium project located in Carroll project is Gardens section of Brooklyn. built on a site originally owned by The New York, and developed under it was phased out. The The City of the Section 235 program before developer of the project was designated through the Request for Proposal process, to build a mix of affordable and market rate residential condominiums. The site was zoned for residential and commercial use and the ensuing development initial three phases, immediately. was constructed "as completed These first three by 1984, for the for both types of moderate rate units exceed $48,000. Phase out period. sold out The almost 60% market rate units. units, buyers qualified if total family income IV of the project, market rate units is in the right". phases had approximately 40% moderate/affordable units and roughly There were buyers of did not comprised of only midst of a normal six-month sell Phase V, which is the focus of this case study, is currently being negotiated. The figures used in this case study are discussion hypothetical in the figures prepared as negotiation process, and do reflect the ultimate outcome of the process. 5 7 -53- a basis for not at all Project Summary The terms development of negotiation. for the structure Phase V of of the agreement Columbia Terrace for the are under The proposed structure of the deal is not final and will in all likelihood included in these case undergo extensive changes. It is studies for purposes of illustration. For a project of this large a scale it is not unusual for the development and Phasing used when is whether or project construction there not the project were developed early 1986, some of demise of is be will sell. in segments. as Prior phases Section 235 the guidelines Section phased market uncertainty under the revised before Section 235 the to of the program. under the negotiating solely Preservation and Development with the , The developer Department for subsidies In program were was phased out altogether. 235 to Since has of been Housing from the City Assistance Fund. 5 8 Under the revised Section parcels appraised developed value. under As program guidelines, at of units in the City will share the 235 program, after 1986, all program were described in a previous least 40 percent of project have to sold under their the the total number be affordable in the profits derived from the -54- at units. The sale of the market rate negotiating units. The the projected City and market profits from which they will share. the developer are price of the units, any The actual amount of the subsidy payment from the city is also being negotiated. 5 9 Development Objective At the time developer it was this project was the largest project he undertaken by the had ever developed. As well it provided the opportunity to develop a large parcel at what the developer felt, Subsidies were was an acceptable level of risk. being provided during the construction phase such that the developer had to put forth a relatively minimal amount of equity. the Moreover, the construction lender accepted subsidy payment construction loan. as an equity contribution The developer personal guarantees towards the as standard procedure gave for the project. The developer was and continues to be an active developer in the Brooklyn area. saw an commonly opportunity to develop available) established. The in an a large site, (which area developer was where was familiar with the felt confident that the project would sell. 6 0 -55- he He are not already area and Analysis of Pro Forma Total Revenues revenues are derived are estimated from the to sale of be the $3,928,000. units at the following prices: 6 1 TYPE PRICE Efficiency $69,000 2 $138,000 One BR 89,000 6 $534,000 Two BR 109,000 8 $872,000 Two BR/Market 149,000 16 $2,384,000 32 $3,928,000 UNIT TOTAL Total estimated development costs at development include $163,000,(3.74%) total soft costs for $4,361,473.(refer costs TOTAL the to the Exhibit land representing $480,883(11.02%). price for the 3) Construction costs total development allowed under make up a portion of these The at, The $163,000 purchase value of the the program subsidies from the construction costs. -56- total (65.13%) and are estimated at approximately costs. are Land acquisition land reflects the full appraised which is The acquisition hard costs of $2840,800 costs constitute 3.74% of total costs. property, entire project guidelines. 65.13% of City will Soft costs COLUMBIA TERRACE DEVELOPMENT PRO FORMA HHHHHHHH+Hf*~~ff~H*HHHffHH H HH H HH+H TOTAL COST HH PERCENT OF TOTAL H *f* H ff**** HHH*HfffffffffffffHf* PER SO. FT. HHI PER UNIT LAND COSTS 3.74% 7.867 5.73 $163,000 342,750 250,000 Land Aquisition Site Costs Excavation/Fill Sub Total $5.09 $10.71 $7.81 $5,094 $10,711 $7,813 $23,617 755,750 17.33% $23.62 140,400 403,200 720, 000 115,300 192,100 184,100 75,100 485,163 525,437 3.221 9.24% 16.51% 2.64% 4.40Z 4.22% 1.727.% 11.121 12.05% $4.39 $12.60 $22.50 $3.60 $6.00 $5.75 $2.35 $15.16 $16.42 $22,500 $3,603 $6,003 $5,753 $2,347 $15, 161 $16,420 65. 137 $88.78 $88,775 $5.86 $1.50 $5.00 $1.72 $0.20 $0.75 $5,859 $1,500 $5,000 $1,719 $197 $752 CONSTRUCTION COSTS Foundation Masonry Carpentry Electrical HVAC Plumbing Roofing Other Costs General Cond. 2,840,800 Sub Total/Hard Costs $4,388 $12,600 DEVELOPMENT COSTS Arch. /Eng. Legal/Acct. Sales/Mkta. Insurance Taxes Misc. 187,493 48,000 160,000 55,000 6,300 24,050 4.30% 1.10% 3.67% 1.267 0.14% 0.557 Sub Total/Soft Costs 480,843 11.02% MISCELLANEOUS CONTINGENCY 765,300 284,080 17.55-7 6.51% TOTAL DEVELOPMENT COST $15,026 100.00% 4,361,473 Public Subsidy $23,916 $8,878 $136.30 $136,296 SUBSIDIZED Total Revenues Public Subsidy PROFITABILITY Total Revenues From Sellout $8.88 $23.92 $3,928,000 $472,000 $4,400,000 Less Total Development Costs Developer's Fee Subsidy Percentage Contribution $2,016,000 $472,000 $2,488,000 Development Costs (Subsidized Units) $4,361,473 38,527 10.82% Developer's Profit Subsidy Percentage Contribution Source: Author's calculations per preliminary figures provided by developer, Frederick W. Hilles of Columbia Terrace,June18,1987 -57- $2,180,737 $307,263 23.411 are 11.02 % of total development costs. In this case study the developer's fee is not limited to 10 percent of the total development costs, represent the developer's fee therefore total developer's profit. on the However, these figures revenues less costs Under this scenario the subsidized units would be $307,263. are used to illustrate the effect of the subsidy. Actual impact against the portion subsidy contribution portion of the these terms of the subsidy should of the project that is project. 23.41% of the If the project the contribution of the only be evaluated is subsidized. affordable The income is negotiated under subsidy is substantial. According to the developer the subsidy figures are also being negotiated. -58- CHAPTER V CONCLUSIONS The objective of homeownership programs is to increase production of affordable housing by the private sector, for a targeted population. affordable is lower the The implication of making homeownership that it must be subsidized in some purchase price for the buyer. An manner to implication of increased production is that some incentive is being provided for developers the former subsidies these to produce issue, these for homebuyers programs are comparable units. programs such that substantially With regard to studies sited in this by the private this type of sector. housing. have Regarding provided ample purchase prices under below market prices for the latter issue, the case thesis provides evidence of production Whether this level of production is sufficient to meet demand is an unanswered question. The affordable homeownership programs have provided clean, decent of affordable under these and affordable units. homeownership opportunities has programs because subsidy to the portion in New York City of the More importantly, risk inherent in the subsidy -59- been possible contribution of projects and program's ability of the Provision to mitigate a the development also lowers the the cost process. of the home to the purchaser. studies, the pro forma made at least projects. a 20 Without served as evidenced in percent contribution the subsidy to the case each of contribution it have been undertaken. the lower acquisition equity each of analysis indicates that the subsidies that the projects would contributed to As in construction is doubtful The subsidies costs of the loans. the land and Basically, the application of subsidies helped to mitigate some of the risks of the project. In the Flatbush Condominium project the subsidy contribution was 19.69%. to the overall project. For Woodhaven Estates, the subsidy contributed 23.52% towards the project. Moreover, the subsidies in these two projects help to decrease the purchase price to the homebuyer. features of the programs made the provision These three of affordable homeownership opportunities possible. Despite examination the attributes indicates that appeal to developers. in the This decision making developer considers also consider of their the programs, structure has a further limited illustrates the opportunity cost process of an affordable each developer. As the housing project, he must the projects he forgoes. He weighs financial risk he must assume in the project versus the profit he earns which compensates him for taking issues which must be resolved before a -60- that risk. These are the developer is willing to undertake developer an will affordable housing go forward with compensates him for the risk. affordable housing project. a Hence, project if the the profit Since the profit scheme under programs are limited the developer will often opt for a more lucrative project. While there the housing developers attempts are limited programs, who fall in to mitigate exchange for programs in benefits to addition, a select some of the risks development construction loan, a and building attributes, additional Flatbush the developer's Condominiums In of the in experience to otherwise not establishing their 235 program develop a Aside be careers these tend to -61- first In the case of from participation of land To programs offer the and the opportunity tract entering have Estates project there was available. themselves or from these projects represent large includes the product, participate of Columbia Terrace, aside the Section The which qualify as equity large undertaking for the development entity. the developer project in opportunity which the Woodhaven these program limited profit. experience. who entice The strong market for and development motives. programs category. lowered acquisition costs, subsidies in the the the developer accepting a provide a participation in that developers a and would who different phase experience, a are of forum in which to test design ideas development community. and establish contacts in the Consequently, as a developer's career progresses these motivations become less important. There are these programs. existing several approaches to broaden First, change or programs. increase the project. Existing This change of the is the limited developer must assume. developer must perhaps larger provide a greater Moreover, the weakness profit relative to in a profit to of these the risk the A better balance between the risk the undertake potential profit be modified sector developer through the sale market rate units. programs can units and market units would motivation for the private modify the features of the programs mix of affordable the appeal of under would be an added scale these programs incentive. projects could be and the In addition, encouraged where possible,to provide the developer some economies of scale and therefore increase cost savings. the number of units greater profit potential. structure of hence, Larger scale produced as well as also provide These modifications would make the these programs increasing projects would more attractive production opportunities. -62- of affordable to developers, homeownership SOURCES Appel, Willa."Facing the Urban Housing Crisis."Real Estate Finance Journal, vol.2,n.s.3 (1987): 37-43. Bell, Alan R., and Nicholas Lembo, of Flatbush Condominiums. Interview by the author, 19 June 1987, Brooklyn, New York. Brown, James H. and Yinger, John.Homeownership and Housing Affordability in the United States: 1963-1985 Cambridge M.A.: The 1986 Report, Joint Center for Housing Studies The Massachusetts Institute of Technology and Harva University, 1986. DePalma, Anthony. "Rental Apartments Are Getting Harder to Find."New York Times, 12 April 1987, Section 8, page 1. "In Northeast, Prices Rising Faster Than Family Incomes."New York Times,8 February 1987, section 4, page 6. Downs, Anthony.The Revolution in Real Estate Washington D.C.:The Brooking Institute, 1985. Haar, Finance. Charles M. ed."New York City's J-51 Program: A Redefinition of Housing Objectives".Lincoln Institute of Land Policy Roundtable, Policy Analysis Series. Cambridge: Lincoln Institute of Land Policy, 1983. Hilles, Frederick W., of Columbia Terrace. Interview by the author, 18 June 1987, Brooklyn, New York. Kayden, Jerold S.Incentive Zoning in New York City: A CostBenefit Analysis. Cambridge: Lincoln Institute of Land Policy, 1978. Klebaner, Benjamin J.New York City's Changing Economic Base. New York :Pica Press, 1981. Lerner, Leslie J.,of Woodhaven Estates. Interview by the author, 23 June 1987, Long Island, New York. The New York City Department of Housing Preservation and Development.Homeownership Programs New York: The New York City Department of Housing Preservation and Development.:1986. New York City Housing Partnership.New Homes Program: Invitation to Builders New York: The New York City Housi Partnership.: 1986. -63- New York State Division of Housing and Community Renewal. Consolidated Report on Community Development Programs 1986 Bronx, New York.:1987. New York State Division of Housing and Renewal.Housing Programs of New York State Bronx, New York.: 1986. Community Robbins, I.D. "Affordable Single Family Housing Grows Brooklyn".Real Estate Finance Journal, vol.2,n.s.3 in (1987) :49-55. Rosen, Kenneth T.Affordable Housing: New Policies for the Housing and Mortgage Markets. Cambridge: Ballinger Publishing Company, 1984. Sinnreich, Masha.New York: World City Cambridge: Oelgeschlager,Gunn & Hain, Publishers,Inc., 1980. Sunneborg, Karen. The New York City Partnership. Interview by the author, 23 June 1987, New York, N.Y. Stegman, Michael A., with Hillstrom, Douglas.Housing in New York: Study of a City. New York: Study for The City of N York, 1984. Viola, Thomas.Housing New York: Progress and CommitmentNew York: New York State Division of Housing and Community Renewal, Annual Report, 1985-1986. U.S. Department of Housing and Urban Development: Office of Policy Development and Research Affordable Housing: A Selected Resource Guide. Germantown,MD.: February,1985. -64- ENDNOTES 1 The Random House Dictionary,1980 ed., based on The RandomHouse Dictionary of the English Language-The Unabridged Edition, s.v."afford",page 15. 2 H.James Brown and John Yinger,Homeownership and Housing Affordability in the United States: 1963-1985 (Cambridge, M.A.: The 1986 Report, Joint Center for Housing Stusies of the Massachusetts Institute of Technology and Harvard University, 1986),appendix II, page 18. 3 Ibid.,page 7 4 Ibid. 5 Ibid. 6 Ibid. 7 Ibid.,page 24 8 Kenneth T. Rosen,Affordable Housing: New Policies for the Housing and Mortgage Markets (Cambridge M.A.: Ballinger Publishing Company, 1984), page 31. 9 Brown, "Homeownership and Housing Affordability," page 8. 1 0 Anthony DownsThe Revolution in Real Estate Finance (Washington D.C.: The Brookings Institute,1985), page 119. 11 Ibid.,page 117 12 Anthony DePalma, "In Northeast, Prices Rising Faster Than Family Incomes,"New York Times,8 February 1987, section 4, page 6. 13 14 Ibid. Ibid. 1 5 Downs,The Revolution in Real Estate Finance, page 126. 16 Ibid. 17 Michael A. Stegman with Douglas Hillstrom,Housing in New York: Study of a City,1984, (New York: The City of New -65- Department of Housing Preservation and Development, February 1985) 1 8 Anthony DePalma, "Rental Apartments Are Getting Harder to Find,"New York Times, 12 April 1987, Section 8, page 1. 1 9 StegmanHousing in New York: Study of a City, 1984,page 5 2 0 Assistant Commissioner Thomas Viola,New York State Division of Housing and Community Renewal, Annual Report 1985-1986, Housing New York: Progress and Commitment, (New York: Division of Housing and Community Renewal, 1986), page 36 21 "Deloitte, Haskins & Sells Announces Decision Relocate,New York Times, 19 June 1987, Section A, page to 1. 2 2 Willa Appel, "Facing the Urban Housing Crisis,"The Real Estate Finance Journal(Winter 1987),page 37 2 3 New York City Housing Partnership,New Homes Program: Invitation to Builders (New York: The New York City Housing Partnership, 1986). 24 Karen Sunneborg, The New York City Partnership, interview by the author, 23 June 1987, New York, N.Y. 2 5 The New York City Housing Partnership,New Homes, page 3. 26 Ibid. 2 7 The New York City Department of Housing Preservation and Development, Homeownership Programs (New York: The New York City Department of Housing Preservation and Development,1986). 2 8 The New York City Housing Partnership, New Homes,page 4. 29 Ibid. 30 Ibid. 31 Ibid. 3 2 Karen Sunneborg, The -66- New York City Partnership, interview by the author, 23 June 1987, New York, N.Y. 3 3 The New York City Housing Partnership, New Homes,page 5. 34 Ibid. 3 5 Ibid. 3 6 Ibid.,page 37 4. Ibid. 3 8 Ibid.,page 6. 3 9 Ibid. 4 0 Ibid. 4 1 Ibid. 42 New York State Division of Housing and Community Renewal.Housing Programs of New York State (1986), page 12. 4 3 The New York City Housing Partnership, New Homes, page 5. 4New York State Division of Housing and Community Renewal.Housing Programs of New York State (1986), page 15 45 Ibid. 4 6Ibid., page 18 4 7 Karen Sunneborg, The New York City Partnership, interview by the author, 23 June 1987, New York, N.Y. 48 Alan R. Bell ard Condominiums, interview by Brooklyn, New York. 49 Ibid. 50 Ibid. Nicholas Lembo the author, 19 of Flatbush June 1987, 51 Author's Calculations 52 Leslie J. Lerner of Woodhaven Estates, interview by the author, 23 June 1987, Brooklyn, New York. -67- 5 3 Under the New York City Partnership guidelines, normally income eligible buyer's could not have incomes which exceeded $48,000. Due to the unique configuration of the 2-family homes available in Woodhaven Estates, one owner-occuppied unit and one rental unit, the guidelines were relaxed. The Partnership agreed to accept up to 75% of the annual rental income generated by the unit as an addition to the homebuyers income. This modification allows the buyer to afford the higher priced house. 54 Ibid. 55 Ibid. 56 Ibid. 57 Frederick W. Hilles of Columbia Terrace, interview by the author, 18 June 1987, Brooklyn, New York. 58 Ibid. 59 Ibid. 60 61 Ibid. Ibid. -68-