An Analysis of the Aspen Housing Market 1996

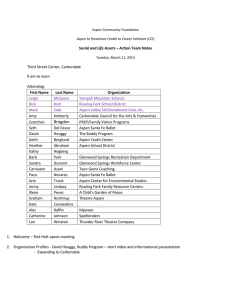

advertisement