Thailand’s competitiveness: Meeting the challenges of globalization and environmental sustainability

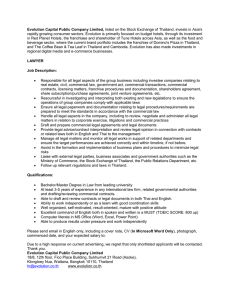

advertisement

Thailand’s competitiveness: Meeting the challenges of globalization and environmental sustainability Dr. Christian H. M. Ketels Institute for Strategy gy and Competitiveness p Harvard Business School Asia Competitiveness Institute Lee Kuan Yew School of Public Policy The Role of Competitiveness Quality of Life (Prosperity) Economic Outcomes (Productivity) Competitiveness Competitiveness is not everything that matters, but without competitiveness everything that matters is much harder to achieve 2 Traditional Views on Achieving Competitiveness • Conceptual research has increasingly focused on endogenous growth-models • Empirical literature has looked at “deep” drivers of prosperity differences; recent work at unsustainable “growth spurts” • The general principles (Washington consensus, etc.) derived from this work provide often insufficient guidance to policy makers • Emerging consensus for policy advice to become more context-, i.e. country-specific • But without a clear framework, the move from general recipes to country-specific approaches opens the door for old-style intervention • The competitiveness framework offers a systematic structure to make evidence-based policy choices in a concrete situation 3 © Christian Ketels, 2009 The Competitiveness Framework Mi Microeconomic i Competitiveness C titi Sophistication of Company Operations and Strategy State of Cluster Development Quality of the National Business Environment Macroeconomic Competitiveness Social Infrastructure and Political Instit tions Institutions Quality of Macroeconomic Policy y Endowments Natural Resources Geographic Location 4 Size Macroeconomic Competitiveness Social Infrastructure and Political Institutions Quality of Macroeconomic Policy Political institutions • Set the context for policy decisions on all dimensions of competitiveness Monetary policy • Ensure the effectiveness of price signals for economic choices Fiscal policy • Keep spending within government’s intertemporal budget constraint • Reduce cyclical fluctuations of the economy Rule of law • Provide fundamental conditions for the functioning of markets Basic human capacity • Provide fundamental capacity for economic activities beyond the subsistence level Financial system management • Avoid the build build-up up of unsustainable internal and external imbalances • Institutions critical in the long long-term term but hard to change in the short-term short term • Macroeconomic policies more amendable to reform but often unsustainable if not matched by policy changes in other areas 5 © Christian Ketels, 2009 Microeconomic Competitiveness Sophistication of Company Operations and Strategy State of Cluster Development Quality of the National Business Environment • Reach the highest level of productivity and innovation possible given the overall environment • Increase the level of productivity and innovation companies can reach for a given business environment • Create the conditions that allow companies to reach a high level of productivity and innovation • Many individual factors and significant systemic interactions among prioritizing g and sequencing q g of actions is a crucial task them; p • Many parts of the economy and society play an important role, including several parts of government, companies, universities, and platforms for collaboration; coordination and allocation of responsibilities ibiliti is i kkey 6 © Christian Ketels, 2009 Microeconomic Foundations of Development Typical Company Weaknesses in Emerging Economies Corporate Direction • Opportunistic pursuit of new businesses, seizing profitable opportunities in whatever area they arise • Strategy driven by government and other g relationships • Conglomerate business groups compete t in i highly hi hl disparate businesses Strategic Positioning • Focus on the local market • Wide product lines serving all local industry segments Activities • Labor intensive parts of the value chain are emphasized • Price is the primary basis of competition • Low investment in machinery, equipment, brands, R&D, and training • Low input costs are primary competitive advantage • Foreign partners provide many inputs, know how, and financing • Emulate foreign best practices • Imitate products and g and services of foreign other domestic competitors 7 Productivity and the Business Environment Context for Firm Strategy and Rivalry z Factor (Input) Conditions z Presence of high quality, specialized inputs available to firms –Human Human resources –Capital resources –Physical infrastructure –Administrative infrastructure –Information infrastructure –Scientific and technological infrastructure –Natural resources z z z z A local context and rules that encourage g investment and sustained upgrading –e.g., Intellectual property Demand protection Conditions Meritocratic incentive systems across all major institutions Open and vigorous competition z Sophisticated and demanding local among locally based rivals customer(s) z Local customer needs that anticipate those elsewhere Related and z Unusual local demand in specialized Supporting segments that can be served Industries nationally and globally Access to capable, locally based suppliers and firms in related fields Presence of clusters instead of isolated industries • Successful economic development is a process of successive economic upgrading, in which the business environment in a nation evolves to support and encourage increasingly sophisticated ways of competing Source: Michael Porter 8 National Export Portfolio Thailand, 1997 to 2007 3.5% Change g In Thailand’s Overall World Export Share: +0.044% Fishing & Fish Products (-2.2%, 6.5%) Information Technology Thailand’s world export ma arket share, 2007 7 3.0% Plastics Motor Driven Products 2.5% Construction Materials 2.0% Entertainment and Reproduction Equipment Jewelry, Precious Metals and Collectibles Sport Agriculture Lighting and Electrical Equipment Building Fixtures and Equipment Analytical Instruments 1.5% F t Footwear (-1.53%) ( 1 53%) Apparel Textiles Leather 1.0% Thailand’s Average World Export Share: 1.08% 0.5% Business Services 0.0% -1.5% Furniture -1.0% Power Generation Communications Equipment Transportation and Logistics Metal, Mining and Manufacturing Medical Devices Oil & TobaccoGas Biopharmaceuticals Communication Services Financial Services -0.5% 0.0% Publishing and Printing Automotive Processed Foods Aerospace Vehicles Chemical Products Construction Services Production Technology Prefabricated Enclosures and Structures Forest Products Heavy Machinery Marine Equipment 0.5% Change in Thailand’s world export market share, 1997 to 2007 Source: Prof. Michael E. Porter, International Cluster Competitiveness Project, Institute for Strategy and Competitiveness, Harvard Business School; Richard Bryden, Project Director. Underlying data drawn from the UN Commodity Trade Statistics Database and the IMF BOP statistics. 9 1.0% 1.5% Exports of US$4.3 Billion = The Thai Automotive Cluster: The Geographic Dimension Pathumthani • Thai Suzuki Motor • and 39 suppliers Chachoengsao • Toyota Motor Thailand • Isuzu Motors (Thailand) Ayudhaya y y • Honda Automobile (Thailand) Samutprakarn • • • • Toyota Motor Thailand Isuzu Motors (Thailand) Siam Nissan Automobile Siam V.M.C. V M C Automobile • Thai Auto Work • International Vehicles • Thai Yamaha Motor • Thai Swedish Assembly • Hino Motors (Thailand) • Thonburi Automotive Assembly Chonburi Bangkok • Bangchan General Assembly • Y.M.C. Assembly • Thai Honda Manufacturing • and 232 suppliers • 55 suppliers Samutsakorn • Thai Rung Union Car Rayong • Auto Alliance (Thailand) • General Motors (Thailand) • BMW Manufacturing (Thailand) • Kawasaki Motors Enterprise (Thailand) • MMC Sittipol • and 41 suppliers Samutprakarn • 158 suppliers Source: Vanichseni: Development of Automotive Industry Master Plan (2002) 10 © Christian Ketels, 2009 The Thai Automotive Cluster: The Activity Dimension A Assemblers bl Steel Plastics Motorcycles Passenger Cars Distribution Pickup Trucks Finance Rubber&Tires Testing Electronics Glass Leather & Fabric Components and Module Makers (1st tier) Engines, Drivetrains, Steering, Suspension, Brake, Wheel, Tire, Bodyworks, Interiors, Electronics and Electrical Systems Specialized Consultants Services Parts (2nd & 3rd tiers) Machinery Stamping, Plastics, Rubber, Machining, Casting, Forging, Function, Electrical, Trimming Globally Competitive Regionally Competitive Tools Nationally Significant Nationally Insignificant Mold&Die G Government t Jig&Fixture Source: Sasin-team analysis, 2003 study Education and T h i l Technical Institutions 11 A Associations i ti Clusters and Competitiveness Static (Leverage) Dynamic (Upgrade) ENHANCE Other Dimensions of Competitiveness Clusters ENABLE • Co-location of companies and other institutions affecting the potential for local value creation within a given economic field through spillovers and linkages • Economic fundamentals that set the productivity level companies can reach within a given geographic location 12 © Christian Ketels, 2009 Clusters Enhancing Competitiveness: Leveraging Existing Assets Productivity Local Externalities • • • • • Common labor markets Specialized suppliers Specialized p infrastructure Knowledge Spillovers Competitive pressure New Business Formation Innovation 13 © Christian Ketels, 2009 Enabling the Emergence of Clusters Location POLICY Existing Clusters Business Environment Natural Resources Entrepreneurs C t t ffor competition Context titi across regions i 14 © Christian Ketels, 2009 Clusters Enhancing Competitiveness: Upgrading Capabilities BETTER (Competitiveness) FINISH MORE (Agglomeration) 15 15 © Christian Ketels, 2009 Target Public Policy at Clusters Business Attraction Education and Workforce Training Science and Technology Infrastructure (e.g., centers, university departments, technology transfer) Export Promotion Clusters Market Information and Disclosure Setting standards Specialized Physical Environmental Stewardship Infrastructure Natural Resource Protection • Clusters provide a framework for organizing the implementation of public policy and public investments towards economic development 16 What are Cluster Initiatives? Cluster initiatives are collaborative activities by a group of companies, public sector entities, and other related institutions with the objective to improve the competitiveness of a group of interlinked economic activities in a specific geographic region • Upgrading of company operations ti and strategies across a group of p companies • Upgrading of clusterspecific ifi business b i environment conditions • Strengthening of networks to enhance spill-overs ill and d other th economic benefits of clusters 17 © Christian Ketels, 2009 Clusters and Structural Change • Cluster policy is most effective if it focuses on existing clusters BUT • For many economies the challenge is to broaden or change the portfolio of clusters they are in Direction of structural change Management of structural change • Natural atu a st structural uctu a change c a ge occu occurs s through growth in fields related to activities already present • Depending epe d g o on ttheir e maturity, atu ty, clusters differ in their likelihood of success and policy needs • Encourage diversification into related clusters • Manage clusters as a portfolio o Existing clusters o Emerging clusters o New clusters 18 © Christian Ketels, 2009 What is Different about Cluster-Based Policy? Broader Set of Industries Public-Private Collaboration Regional Perspective Productivity Focus Demanddriven Approach pp Enhancing Own Strength 19 © Christian Ketels, 2009 Policy Levels Influencing Competitiveness World Economy WTO Broad Economic Areas South-East Asia G Groups off Neighboring Nations Greater G t Mekong M k Region • The business environment at a given location is the cumulative outcome of policy at all levels of geography • Microeconomic competitiveness raises the importance of lower levels of geography Nations Thailand States, Provinces Thai provinces Metropolitan and Rural Areas Bangkok • The allocation of responsibilities across levels of geography is a crucial policy challenge 20 © Christian Ketels, 2009 The Process of Economic Development Shifting g Roles and Responsibilities p Old Model New Model • G Governmentt drives di economic i development through policy decisions and incentives • E Economic i d development l t iis a collaborative process involving government at multiple levels, companies teaching and companies, research institutions, and private sector organizations • Competitiveness p is the result of both top-down p and bottom-up p processes in which many individuals, companies, and institutions take relevant decisions 21 © Christian Ketels, 2009 Observations so Far • Many things matter for prosperity, but there are systematic differences between groups of factors – Macroeconomic strengths create opportunities – Microeconomic strengths translate opportunities into results • The increasing importance of microeconomic factors requires a qualitatively different policy approach – – – – – From identifying right policy targets to sequencing the right policy areas From narrow interventions to integrated g p policies From “horizontal” policies to a mix of general and cluster-specific policies From national policies to leveraging all geographic levels of government From public-sector driven policy to public-private dialogue • Economies need to make progress on all dimensions, but trying to move on all fronts simultaneously often leads to failure – C Crucial role off country analysis to arrive at a context-specific f action strategy without compromising on standard economic logic 22 © Christian Ketels, 2009 From Analysis to Action Prioritization Analysis National Economic Strategy Strengths - + Threats Roll-Out Roll Out Integrated set of activities Internal Weaknesses Integration Opportunities & National Competitiveness Action Agenda Targeted Campaigns: e g Cluster, e.g. Cluster FDI, or SEZ Economywide rollout Institution with cross-cutting authority External National N ti l Competitiveness Council 23 © Christian Ketels, 2009 Defining a National Economic Strategy National Economic Strategy • What can be the unique competitive position of the country/region given its location location, legacy legacy, endowments endowments, and potential strengths? – What is its unique value as a business location? – What role can it play with neighbors? – In I what h t range off clusters l t does d the th nation ti excel? l? Developing Unique Strengths Achieving and Maintaining Parity with Peers • What are the key potential strengths that the country/region must preserve or build? • What weaknesses must be neutralized to achieve parity with peer countries? • A national economic strategy gy p provides strategic g orientation on the type yp of business environment that the country/region aims to provide; it is not a plan that sets production or investment targets • A national economic strategy is only effective, if it reflects a consensus view; it fails, if its implementation is based on government action and incentives/sanctions alone 24 Launching a Targeted Campaign Objectives, Institutions, and Mandates Singapore • Attract foreign investment to create j b jobs • EDB as statutory body with wide-ranging mandate (finance, skills, kill iinfrastructure, f t t rules and regulations Ireland Finland • Turn Ireland into the EU base for US companies • Combination of specialized agencies • Turn Finland into a knowledge-driven economy • Science and Technology Policy Council chaired by y the Prime Minister to coordinate activities across the government • IDA focused on attracting investors • Enterprise Ireland focused on upgrading domestic companies • Forfas F f providing idi policy li support on enhancing the business environment 25 • • • • • Economyy Education Science Regions a ce Finance © Christian Ketels, 2009 Roll-Out of Competitiveness Upgrading Activities and Institutions Costa Rica Latvia • Opportunity to attract investment from Intel • Presidential working group with wide policy p y mandate • Significant foreign investment inflows after independence and EU accession g investors concerned about • Foreign weakness of local institutions driving competitiveness upgrading • No special deals for Intel; all improvements made available to other companies as well • Improvement of electricity supply quality in the Central Valley • Open Sky Sky-policy policy to increase air transport connectivity • Radically increased efficiency of customs procedures • Foreign Investors Council (FICIL) driving general upgrading agenda • Annual High-Level meeting with the entire Latvian cabinet and one-onone with key ministers • Working groups on specific issues (taxes, workforce skills, customs) 26 © Christian Ketels, 2009 From Insight to Action What to do How to get it done • Consensus • Institutional structure • Leadership p • External environment 27 © Christian Ketels, 2009 Where to Start: The Crucial Role of Analysis Equality Productivity y Quality of Life Environmental conditions O t Outcomes g Purchasing Power Labor utilization Entrepreneurship p p I Innovation i Intermediate Indicators FDI flows Knowledge Economy Investment Exports/Imports Competitiveness Corruption Governance Global Competitiveness Report Doing Business 28 Logistical Performance Index © Christian Ketels, 2009 Prosperity Performance PPP-adjusted GDP per Capita 2008 ($USD) Capita, $30,000 Selected Lower and Middle Income Countries Japan ($34,590) $ Greece ($30,650) UAE $ Taiwan ($36,400) Slovenia Israel New Zealand $25 000 $25,000 Bahrain Czech R Republic bli South Korea Cyprus Oman Saudi Arabia Portugal Asian countries Other countries Slovakia Estonia $20,000 Hungary Libya $15,000 Chile y Malaysia Turkey Mexico $10,000 Brazil Thailand Belize Papua New Guinea G i ((-3.15%) 3 15%) Ecuador Latvia Russia Argentina Venezuela V l Uruguay Bulgaria Belarus Romania Kazakhstan South Africa Dominican Republic Colombia Tunisia Bosnia Ukraine Albania Peru Guyana Egypt Jordan Paraguay Sri Lanka El Salvador Bolivia Indonesia Honduras Philippines Nicaragua India Vietnam Pakistan Laos Bangladesh Guatemala $5,000 Algeria Panama Iran Costa Rica Lebanon Li h Lithuania i Trinidad & Tobago Poland Croatia China Georgia Cambodia $0 0% , 2% 4% 6% 8% 10% Growth of Real GDP per Capita (PPP-adjusted), CAGR, 2004 to 2008 29 Source: EIU (2009) authors calculations 12% 14% Comparative Economic Performance Real GDP Growth Rates Over Time Compounded annual growth rate (CAGR) of real GDP 12% 10% Vietnam China Thailand India Malaysia Indonesia Brazil Philippines 8% 6% 4% 2% 0% 1980-1989 Source: EIU (2009), authors calculations 1990-1999 2000-2004 30 2005-08 Income Inequality Gini Index Selected Countries 60 50 40 30 20 10 0 Note: Most recent Gini index data available for each country (1997 – 2007) Source: World Bank, World Development Indicators, 2009 31 Environmental Quality EPI Score, 100 = best value 100 Objectives Policy Categories 80 60 40 Thailand Asia Pacific 4th Income Group 20 0 Source: Yale Environmental Performance Index 2008 32 Decomposing Prosperity Prosperity Domestic g Purchasing Power Per Capita p Income • Consumption taxes • Efficiency of local industries • Level of local market competition Labor Utilization Labor Productivity • Skills • Capital stock • Total factor productivity – Efficiency – Technology 33 • Working hours • Unemployment • Participation rate – Population age profile © Christian Ketels, 2009 Comparative Labor Productivity Selected Countries Real GDP per employee (PPP adjusted US$), 2008 $90,000 USA Ireland $80,000 Hong Kong Asian countries Other countries France UK $70,000 Italy $60,000 Germany Japan Spain Singapore Kuwait Greece Taiwan Australia Saudi Arabia Oman Israel Slovenia $50,000 United Arab Emirates Cyprus New Zealand $40,000 Korea Slovakia Hungary Czech Republic Croatia Poland Lithuania T k Turkey Mexico Chile $30,000 Iran Peru $20,000 $ , Brazil Algeria Syria $10,000 Yemen Cote d’Ivoire $0 -2% 0% South Africa Kenya Kazakhstan Egypt Thailand Ukraine T i i Tunisia Pakistan Senegal Russia Romania Jordan Morocco Cameroon Latvia Malaysia Argentina Philippines Nigeria Ghana 2% Indonesia Bangladesh Sri Lanka (8.1%) China (10.1%) India Cambodia Vietnam Mozambique 4% Growth of real GDP per employee (PPP-adjusted), 2004 to 2008 Source: authors calculation Groningen Growth and Development Centre (2009),34EIU (2009) 6% 8% Understanding Productivity Growth Economy Sector Skill Upgrading, Capital Deepening, and TFP Structural Change Firm Entry, Exit, and Internal Restructuring 35 © Christian Ketels, 2009 Total Factor Productivity Growth Selected Countries High Low Source: EIU (2009) Last 15 years Last 6 years Last 3 years China China China India Hong Kong Hong Kong Singapore Turkey India Thailand India Philippines Vietnam Philippines Turkey South Korea Thailand Malaysia Malaysia Malaysia Indonesia Turkey Indonesia Vietnam Philippines Singapore Thailand Hong Kong Vietnam South Korea Indonesia South Korea Brazil Brazil South Africa Singapore Mexico Brazil Mexico 36 © Christian Ketels, 2009 Labor Force Utilization Labor Force Participation p Rate, 2008 65% Participation Rates, Selected Countries China Kuwait Asian countries Other countries 60% Singapore I l d Iceland United Arab Emirates 50% Brazil 45% 40% Thailand Papua New Guinea 55% Colombia Philippines Sri Lanka (-3.59%) Vietnam Norway Canada Australia Sweden Russia Germany Denmark Latvia New Zealand Japan Hong Kong Ireland Estonia Finland USA UK Cyprus Spain South Korea Slovakia Taiwan Netherlands Lithuania Ukraine Indonesia Slovenia France India Greece Macedonia Poland Chile Austria Bangladesh It Italy l H Hungary Mexico Argentina Malaysia Israel Croatia Moldova Cote d’Ivoire 35% Turkey Albania Bulgaria g Nigeria Iran South Africa Tunisia Egypt Pakistan 30% -2% Source: Economist Intelligence Unit (2009) Syria Saudi Arabia Jordan 25% -3% Libya Yemen -1% 0% 1% 2% Change in Labor Force Participation Rate, 2004 to 2008 37 3% 4% 5% Indicators and Enablers of Competitiveness Productivity Domestic investment Trade FDI Domestic innovation Entrepreneurship Competitive p Environment 38 © Christian Ketels, 2009 Trade Openness Selected Countries Exports/Imports (% of GDP), 2008 +44% +83% -7% 100% 80% 60% % +41% +34% Change in trade as % of GDP since 2003 +21% 0% Exports +36% 36% Imports 40% -23% +17% +17% -8% -1% 1% +8% +19% +1% +11% 20% 0% Source: EIU (2008), authors’ analysis 39 -1% -9% Thailand’s Export Share Trends World Export Market Share (current USD) Processed Goods 2.0% Semi-processed Goods 1.8% Unprocessed Goods Services 1.6% TOTAL 1.4% 1.2% 1.0% 0.8% 0.6% 0.4% 0.2% 0 0% 0.0% 1997 1998 Source: UNComTrade, WTO (2009) 1999 2000 2001 2002 40 2003 2004 2005 2006 2007 Inbound Foreign Investment Performance Stocks and Flows, Selected Countries Inward FDI Stocks as % of GDP, Average 2003 - 2007 80% Netherlands 70% Estonia Singapore (160.1%, 64.7%) Asian countries Other countries Hungary Chile Cyprus Vietnam 60% Switzerland New Zealand Sweden Slovakia C Czech hR Republic bli 50% Denmark Australia 10% 0% -5% Thailand Spain South Africa Syria Norway Slovenia 30% 20% Cambodia UK Portugal 40% Philippines Latvia Canada Egypt Poland Finland Lithuania France Colombia Mexico Laos Austria Brazil Russia y Germany Turkey US Greece Ital South Korea A China y Indonesia Sri Lanka India Japan Iran 0% 5% 10% Iceland (46.7%) Israel Romania UAE Malaysia Saudi Arabia Oman Pakistan 15% 20% 25% 30% FDI Inflows as % of Gross Fixed Capital Formation, Average 2003 - 2007 Source: UNCTAD, World Investment Report (2009) 41 35% 40% Domestic Fixed Investment Rates Selected Countries Gross Fixed Investment as % of GDP, 2008 36% China (40.8%) 32% India Nicaragua Asian countries Other countries Vietnam (44.6%) Romania (11.1%) Bulgaria (12.6%) Qatar Croatia Ghana Jordan Belarus Latvia Estonia 28% Iran Spain Czech Rep. Albania Portugal g Greece 20% Hungary Hong Kong Lebanon Nigeria Taiwan Malaysia Tunisia UAE Canada Denmark Iceland Japan Austria New Zealand Ireland Syria Kazakhstan Bahrain Slovakia Ukraine Sri Lanka Thailand Algeria Oman 24% Singapore Australia Slovenia Korea Turkey Italy Netherlands Malta Germany Israel Indonesia Yemen (8.7%) Lithuania Chile Colombia Argentina Cambodia France Russia Poland Cyprus K Kenya South Africa Norway Finland Pakistan Egypt Saudi Arabia Brazil Kuwait Papua New Guinea Mexico UK 16% Philippines USA 12% -4% -2% 0% 2% 4% Change in Gross Fixed Investment (as % of GDP), 2004 to 2008 Note: Includes inbound FDI Source: EIU, 2009 42 6% 8% Innovative Capacity Innovation Output of Selected Countries Average U.S. patents per 1 million illi population, l ti 2003-2007 2003 2007 9 Slovenia 8 7 6 Hungary 5 4 Malaysia Czech Republic 3 2 1 South Africa Brazil Mexico Argentina Indonesia Thailand 0 Colombia -30% -20% Croatia Estonia Romania Greece Belarus Chile Poland Russia India Egypt Portugal China Saudi Arabia Phili i Philippines -10% 0% 10% 20% CAGR of US-registered patents, 2003 – 2007 Source: USPTO (2008), EIU (2008) 43 30% 50 patents = 40% Thailand’s Competitiveness Profile 2009 Micro (44) Business Environment Quality (48) GCI (55) Company Sophistication (45) Macro (61) Social Infrastructure and Pol. Institutions (68) Demand Conditions (55) Political Institutions (68) Context for Strategy and Rivalry (43) R l off L Rule Law (68) Related and Supporting Industries (40) Human Development (70) Macroeconomic Policy (52) Worse than 65 Factor Input Conditions (40) 60 - 65 50 - 60 Admin (53) Comm. (51) Innov. (49) Capital (35) 45 - 50 Logistic. (33) 44 Better than 45 Governance Indicators Selected Countries Best country i th in the world ld Voice and Accountability Political Stability Government Effectiveness Regulatory Quality Rule of Law Control of Corruption Index of Governance Quality, 2008 Worst country in the world Note: Sorted left to right by decreasing average value across all indicators. The horizontal line corresponds to the median country’s average value across all indicators. 45 Source: World Bank (2009) Factor (Input) Conditions Factor (Input) Conditions Thailand’s Relative Position 2009 Competitive Advantages Relative to GDP per Capita Competitive Disadvantages Relative to GDP per Capita Financial Market Infrastructure Advanced Communications Infrastructure Soundness of banks 18 Personal computers per 100 population 56 Financing through local equity market 19 Internet users per 100 population 52 Ease of access to loans 22 Regulation of securities exchanges 27 Innovation and Skills Financial market sophistication 28 Utility patents per million population 55 Domestic credit to private sector 29 Quality of scientific research institutions 50 Venture capital availability 32 Quality of math and science education 45 Physical Infrastructure Administrative Infrastructure Quality of air transport infrastructure 20 Reliability of the Police Q lit off roads Quality d 24 D Decentralization t li ti off economic i policymaking li ki 52 Quality of port infrastructure 29 (Low) Time required to start a business 52 Quality of electricity supply 30 (Low) Burden of customs procedures 45 Change up/down of more than 5/10 ranks since 2002 Note: Rank versus 74 countries; overall, Thailand ranks 54th in 2008 PPP adjusted GDP per capita and 40th in Global Competitiveness Source: Institute for Strategy and Competitiveness, Harvard University (2009) 46 56 Ease of Doing Business Thailand, 2009 Ranking, 2009 (of 183 countries) Favorable Unfavorable 120 100 80 60 40 20 0 Source: World Bank Report, Doing Business (2009/10) 47 Workforce Skills and Labor Market Needs Time Required to Fill Job Vacancy in Production Educational Attainment, Math, 8th Grade Taiwan Brazil Korea Singapore Hong Kong Thailand Japan Hungary Korea Russia US Slovenia India Australia Unskilled Skilled Sweden Malaysia Russia Israel Thailand T k Turkey Turkey Indonesia Egypt Indonesia Colombia 250 350 450 550 Average Score Source: TIMSS (2007), World Bank (2007) 650 0 48 2 4 6 Number of Weeks 8 10 Context for Firm Strategy and Rivalry Context for Strategy and Rivalry Thailand's Relative Position 2009 Competitive Advantages Relative to GDP per Capita Competitive Disadvantages Relative to GDP per Capita Openness Openness Strength of investor protection 11 (Low) Tariff rate 63 Business impact of rules on FDI 23 Restrictions on capital flows 56 Prevalence of foreign ownership 43 Incentives and flexibility (Low) Rigidity of employment 16 Competition Cooperation in labor-employer relations 21 Efficacy of corporate boards 56 (Low) Impact of taxation on incentives to work and invest 24 Intellectual property protection 53 Regulatory quality 50 Extent of market dominance by business groups 42 Competition Intensity of local competition 27 Quality of competition in the ISP sector 32 Effectiveness of antitrust policy 36 Prevalence of trade barriers 38 Low market disruption from f state-owned enterprises 39 Distortive effect of taxes and subsidies on 40 competition Change up/down of more than 5/10 ranks since 2002 Note: Rank versus 74 countries; overall, Thailand ranks 54th in 2008 PPP adjusted GDP per capita and 40th in Global Competitiveness Source: Institute for Strategy and Competitiveness, Harvard University (2009) 49 Openness to Trade Rank (157 countries) 160 Selected Countries, 2008 140 120 100 80 60 40 20 0 Source: Index of Economic Freedom (2008), Heritage Foundation 50 Related and Supporting Industries Related and Supporting Industries Thailand’s Relative Position 2009 Competitive Advantages Relative to GDP per Capita Competitive Disadvantages Relative to GDP per Capita Extent of cluster policy 21 Local supplier quantity 22 Extent of collaboration in clusters 27 State of cluster development 30 Local availability of process machinery 36 pp q quality y Local supplier 37 Local availability of specialized research and training services 52 Availability of latest technologies 43 Change up/down of more than 5/10 ranks since 2008 Note: Rank versus 74 countries; overall, Thailand ranks 54th in 2008 PPP adjusted GDP per capita and 40th in Global Competitiveness Source: Institute for Strategy and Competitiveness, Harvard University (2009) 51 Share of World Exports by Cluster Thailand, 2007 World Market Share 1.0% -1.5% 1.5% - 2.5% > 2.5 Fishing & Fishing Products Processed Food Hospitality & Tourism Agricultural Products Transportation & Logistics Business Services Financial Services Education & Knowledge Medical Creation Devices Publishing & Printing Building Fixtures, Equipment & Services Forest Products Power Generation Communications Equipment Tobacco Motor Driven Products Heavy Machinery Production Technology Automotive Oil & Gas Apparel Construction Materials Heavy y Construction Services Lightning & Electrical Analytical Instruments Equipment Biopharmaceuticals Chemical Products Textiles Prefabricated Enclosures Furniture Aerospace Vehicles & Information Defense Tech. Distribution Services Jewelry & Precious Metals Entertainment Aerospace Mining & Metal Engines Manufacturing Plastics Leather & Related Products Footwear 52industries) in both directions. Note: Clusters with overlapping borders have at least 20% overlap (by number of Sporting & Recreation Goods Marine Equipment Clusters and Cluster Efforts in Thailand • Clear evidence of significant cluster presence in the Thai economy • Areas of strengths are largely in unrelated areas • Focus on five clusters based on 2003 government decision – Analysis at the time focused on situation in these clusters, not on the selection • Limited progress on mobilizing an effective institutional architecture to move from diagnosis to action – Creation of structures like the Thailand Automotive Institute positive steps, but limited to selected clusters – Organization of government policies around clusters very limited • Limited if any progress of creating mechanisms for translating clustercluster specific competitiveness upgrading into economy-wide benefits • Cluster efforts remain a significant opportunity for Thailand, but a stepchange in the policy approach is needed to achieve real impact 53 © Christian Ketels, 2009 Company Sophistication Relative Position of Thai Companies, 2009 Competitive Advantages Relative to GDP per Capita Competitive Disadvantages Relative to GDP per Capita Organizational Practices Strategy and operations Degree of customer orientation 18 Willingness to delegate authority 56 Value chain breadth 35 Reliance on professional management 46 Company spending on R&D 37 Extent of staff training 42 E t t off marketing Extent k ti 38 E t t off incentive Extent i ti compensation ti 41 Strategy and operations Internationalization Breadth of international markets 23 Production p process sophistication p 51 Prevalence of foreign technology licensing 35 Nature of competitive advantage 46 Capacity for innovation 46 Control of international distribution 37 Firm-level technology absorption 41 E t t off regional Extent i l sales l 37 Extent of incentive compensation 41 Change up/down of more than 5/10 ranks since 2008 Note: Rank versus 74 countries; overall, Thailand ranks 54th in 2008 PPP adjusted GDP per capita and 40th in Global Competitiveness Source: Institute for Strategy and Competitiveness, Harvard University (2009) 54 Subnational Regions in Thailand • Significant differences in prosperity, structure, and competitiveness titi • Duality of locally elected and centrally appointed officials at the local and regional level North 73% of average income Central 102% of average income • Does the current structure provide for an efficient interplay across the different levels of government? – Allocation of responsibilities – Allocation All ti off capabilities biliti Northeast 70% of average income Greater Bangkok 187% of average income South 106% of average income 55 Source: 2007 Household Socio-economic Survey, National Statistical Office of Thailand (accessed Nov. 2009) Thailand’s National Economic and Social Development Plan • Sets out objectives and principles The 10th National Economic and Social Development Plan (2007-2011) • Provides the foundation for government investments and legislative action The 9th National Economic and Social Development Plan • Does the Plan define competitive strengths to be achieved? • Is the private sector sufficiently involved in the design and execution? The 8th National Economic and Social Development Plan The 7th National Economic and Social Development Plan 56 © Christian Ketels, 2009 Competitiveness Rankings Over Time New GCI Methodology Rank (Stable (Stab e sa sample peo of countries) 15 Malaysia a ays a 25 China 35 Thailand 45 I d Indonesia i India 55 Vietnam 65 2001 2002 2003 2004 2005 2006 Source: Unpublished data from the Institute for Strategy and Competitiveness, 57 Harvard University (2009) 2007 2008 2009 Thailand’s Competitiveness Agenda Priority Action Areas • Strengthen the robustness and efficiency of public institutions • Address the mismatch between existing and required workforce skills • Tackle remaining weaknesses in business rules and regulations • Remove remaining g barriers to foreign g competition p and strengthen g the legal framework to enable more effective domestic rivalry • Activate clusters as an effective mechanism to deliver government policies • Clarify the roles and responsibilities across different levels of government • Mobilize public-private collaboration at the level of clusters, regions, and the national economy • Launch a discussion on the dimensions of national value proposition for Thailand 58 © Christian Ketels, 2009 Thailand Approaching a Critical Junction Creating competitive advantages Prosperity Thailand Argentina S Korea Exploiting comparative advantages Time 59 © Christian Ketels, 2009 Themes • The concept of competitiveness • Thailand’s Competitiveness: From Assessment to Action • Competitiveness and the New Global Economy • Competitiveness C ii and dE Environmental i lS Sustainability i bili 60 Impact of the Global Economic Crisis China Sweden Financial SectorOriented Singapore Exportp Driven Mexico Vietnam Thailand UK US Ireland Russia Iceland Hungary Estonia Reall EstateR E t t Driven Brazil Venezuela Ukraine External H Hungary FinanceUkraine Dependent Spain Latvia Argentina T k Turkey 61 © Christian Ketels, 2009 Prosperity and Competitiveness Economic Sustainability of Current Prosperity High THAILAND Philippines Indonesia Malaysia Vietnam L Low Source: Global Competitiveness Report 2009 62 © Christian Ketels, 2009 Competitiveness and the Crisis Economic Sustainability of Current Prosperity High Moderate Low • High short term impact given high openness • Short term impact depends on openness • Short term impact depends on openness • Quick recovery possible • Recovery likely to be prolonged • Recovery only with reforms • R Remain i on course • B Balance l crisis i i management with upgrading • U Use th the crisis i i as a promoter of change 63 © Christian Ketels, 2009 Thailand and the Global Economic Crisis • When the global financial crisis translated into a dramatic slowdown of global trade, Thailand was hard hit due to its export-orientation – Thailand’s financial system was relatively resilient after the fundamental changes in the wake of the Asian Financial crisis • Recovery is now relatively swift because of the balance between Thailand’s competitiveness and prosperity • The challenge is to remain focused on upgrading Thailand’s competitiveness while the improving economic situation reduces the pressure to act 64 © Christian Ketels, 2009 A Changing Economic Environment After the Crisis • Unsustainable trade imbalances in the global economy will adjust over time – There is some risk of increasing protectionism in key export markets – Adjustment in response to changes in exchange rates and capital flows seems more likely • While Thailand’s trade has become more ASEAN/Asia-focused over time, the ultimate market for many exports so far remains in the US or Western Europe global economy y is g growing, g a process • The relative share of Asia in the g that has been accelerated by the global economic crisis 65 © Christian Ketels, 2009 The New Global Economy Implications for Thailand • Competitiveness will only increase in importance • A robust economic strategy needs to take a balanced view of different segments of the economy – Export-oriented activities will remain important: support the market-driven reorientation towards Asian markets – Domestic consumption will gradually gain in importance, especially for jobs: ensure the upgrading of activities serving the domestic market • Regional collaboration will gain in importance – Strengthening the potential of markets in neighboring countries – Leverage the potential for cluster collaboration in regional cluster networks • Th The ability bili to d deall with i h externall shocks h k is i b becoming i more crucial; i l avoiding shocks through less openness and specialization is not viable – Skill level of the workforce – Flexibility of the economy – Social security mechanisms 66 © Christian Ketels, 2009 Themes • The concept of competitiveness • Thailand’s Competitiveness: From Assessment to Action • Competitiveness and the New Global Economy • Competitiveness C ii and d Environmental E i l Sustainability S i bili 67 Competitiveness and Ecological Sustainability • Ecological sustainability is conceptually fully consistent with the overall objective of competitiveness, i.e. creating an environment where p productivity y supports pp a high g standard of living g • The Porter hypothesis identified the synergistic relationship of the two – Tough environmental regulations can lead companies to become more productive – Tough environmental regulations can trigger innovations that provide companies with competitive advantages BUT • Short-term trade-offs can exist through the costs of ecological activities, especially for activities exposed to global competition • Competitiveness and ecological sustainability have many overlaps but are two separate objectives 68 © Christian Ketels, 2009 Economic Policy towards Environmental Sustainability Context for Firm Strategy and Rivalry z Factor F t (Input) Conditions z Research grants with an environmental focus z Targeted workforce skill upgrading z Financing facilities for relevant public and private investments z Upgrading g g programs g for companies, especially SMEs Demand Conditions Environmental taxes, subsidies, and process standards Related and Supporting Industries z Creation of specialized research institutions z Cluster working groups on environmental sustainability z Demanding domestic product standards, including early adoption of demanding international standards z Environmental E i t l ttaxes or subsidies • Achieving higher levels of environmental sustainability requires innovation • Innovation will only occur, if complementary changes are made across different dimensions the business environment • The policy challenge is to set the pace and mix of these policies in ways that balances environmental and economic goals in the short-term 69 Ecological Sustainability of Clusters • Th The market k t environment i t will ill create t iincreasing i opportunities t iti ffor environmental products and services o Relative prices for energy, natural resources, and pollution o Government G policies (taxes, ( subsidies, regulations)) o Consumer preferences • The market for the products of specific clusters is likely to grew significantly, e.g. renewable energy technologies g • The demand for products, services and processes that services, are environmentally sound is going to increase across all clusters • Competition in these markets is going to be intense;; onlyy the most productive clusters will succeed • Environmental issues will affect competition on all markets;; no cluster will be successful unless it actively addresses them 70 © Christian Ketels, 2009 The New Sustainable Economy Implications for Thailand • Competitiveness and sustainability have to be pursued in tandem • Thailand’s Thailand s environmental track track-record record is relatively solid solid, but more a reflection of its overall profile than of explicit policies in the past – Issues in areas like air quality and the pollution in industrialized zones have growing g over time been g • The national strategy for environmental sustainability needs to integrate policies across different business environment dimensions – A narrow focus on branding Thailand will not be sufficient; the global competition in this space is becoming relentless • Cluster policy needs to be an important tool for achieving environmental sustainability – Pursue environmental issues within existing clusters – Encourage the development of new clusters that target emerging g environmental markets and relate to areas of current Thai strengths 71 © Christian Ketels, 2009 Why Should Business Leaders Worry About Clusters and National Competitiveness? External Internal • Competitive advantage resides id solely l l inside i id a company or in its industry • Competitive advantage (or di d disadvantage) t ) resides id partly in the locations at which a company’s business units are based • Competitive success depends primarily on company choices h i • Cluster participation is an important contributor to competitiveness titi Source: Michael Porter 72 Thailand: Looking Ahead ISSUES Thailand has all opportunities to meet the challenges of the future… Domestic • The Middle Income Trap • Policy Implementation … if Thais across all segments of society and economy collaborate. • Political Volatility Global Competitiveness Competitiveness has is a t national to b be a national ti lnot goal, goal, al notpolitical a political oneone • New N global l b l economy • Climate Change 73 © Christian Ketels, 2009