Mixed-Use Development: A Development Case Study

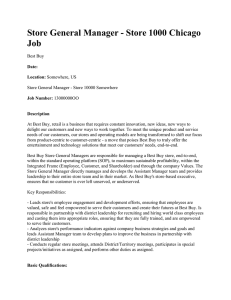

advertisement